A Legal Shelter Hidden in the U.S. Tax Code

For years, I believed my retirement accounts—the 401(k), IRA, and the like—were safe havens. Like many Americans, I assumed these vehicles came with built-in protections, shields from market ups and downs, and a kind of financial “auto-pilot” toward security.

That belief softened when local bank branches started closing, headlines reported rising national debt, and markets jittered unexpectedly. Suddenly, those “safe” accounts felt more fragile. The tether to Wall Street’s mood swings seemed longer and thinner than ever. I came to see that safety is never automatic—and that protecting what you've worked hard to save requires more than hope.

The Problem: Fragile Nest Eggs in a Shaking World

The reality for many retirees and pre-retirees today is sobering:

- Banks are tightening up physical access.

- Consumer and national debts are rising.

- Market volatility, inflation, and geopolitical tensions create uncertainty.

Your retirement funds, mostly invested in stocks and bonds, are directly tied to market moods. The old assumption that your 401(k) or IRA is "protected" in all scenarios is far from true.

Many people believe they’re immune because of tax shelters or diversification—but hidden risks lurk beneath. A sharp downturn, banking crisis, or systemic shock can still buffet your nest egg hard and fast, potentially wiping out years of growth in months.

Banks are closing. Debt is spiraling. Markets are shaking. Your nest egg is exposed.

There’s a hidden lifeline in the U.S.

Tax Code 408(m).

It lets you shift part of your 401(k), IRA, TSP or 403(b) with zero penalties, zero cash conversion and total shelter from the coming storm.

Wall Street won’t mention it. The wealthy are already on board.

The Overlooked Solution: Tax Code Section 408(m)

Amid this climate, there’s a little-known tax code provision quietly offering Americans a way to diversify—and safeguard—retirement savings with more stability.

Section 408(m) allows certain qualified transfers of retirement funds into alternative assets, including physical precious metals and other tangible stores of value, without triggering penalties or forced cash-out.

This isn’t a loophole in the sense of bending rules—it’s fully IRS-compliant and was actually protected and clarified under recent tax reforms championed in part by Trump’s administration. Historically, wealthy investors have leveraged 408(m) to insulate their portfolios during crises—using assets less correlated with traditional markets.

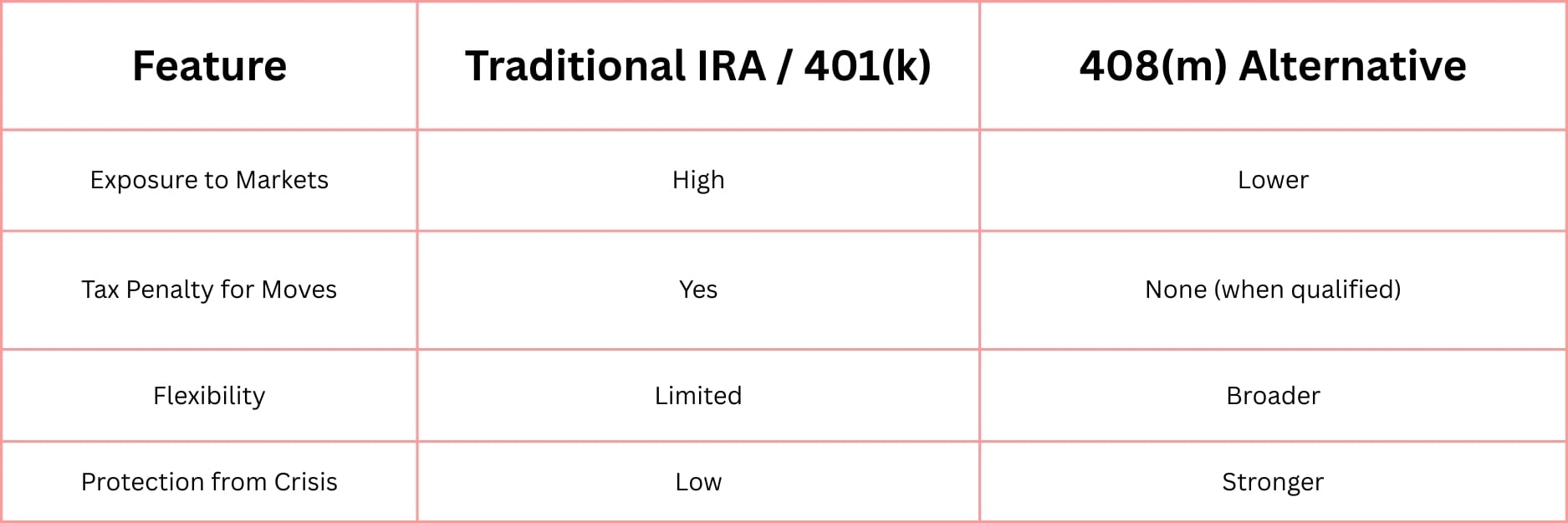

Mini-Table: Traditional Accounts vs. 408(m) Alternative

This table clarifies how 408(m) offers a distinct risk management option, complementing rather than replacing your existing accounts.

Why You Haven’t Heard of It

There’s a reason this option isn’t splashed across financial news or mainstream advisors: Wall Street profits when money stays tied to stocks and bonds. The broader financial industry rarely promotes alternatives that could diminish those revenues or encourage sidestepping market dependency.

But behind the scenes, many high-net-worth individuals quietly maintain 408(m) allocations as a backup—a hedge to balance uncertainty and maintain control.

Checklist: What To Do Next

- Learn if your account qualifies (401(k), IRA, TSP, 403(b), among others).

- Understand transfer rules (ensure moves are penalty-free under 408(m) guidelines).

- Explore diversification options suitable for your goals—not putting all eggs in one basket.

- Request the free 408(m) Guide for clear, step-by-step information tailored to everyday savers.

I’m not saying you should abandon traditional retirement vehicles altogether. They remain invaluable tools. But I am suggesting you need to know your options fully—especially those coded in the tax laws meant to protect your choices.

Section 408(m) isn’t marketing hype. It’s a real, IRS-recognized line in the tax code, quietly serving as a financial lifeline in uncertain times.

When certainty feels rare, knowledge is your best protection. By embracing this hidden tool, you reclaim more control and build a retirement plan better suited for today’s world—and tomorrow’s unknowns.

[Claim yours before it’s too late] presented by Allegiance Gold

Claire West