A Smarter Way to Build Extra Income in Retirement

The Moment I Realized Retirement Isn’t Just About One Social Security Check

When I first started thinking seriously about retirement, I assumed Social Security would cover the essentials. After all, wasn’t that the “guaranteed” income that most retirees depended on? It sounded simple and reassuring. But as I sat down with my parents a few years ago, helping them sort out bills and healthcare costs amid rising inflation, the picture became a lot more complex. Watching their concerns grow as they scrutinized every expense, I saw clearly that relying solely on one check—no matter how steady it seemed—was fraught with risk.

This personal moment sparked a deeper dive into retirement finances that many Americans, myself included, face today: Stretching a single source of income to cover all the costs of living is increasingly challenging. And the solution is not just for the affluent; it's for anyone willing to plan carefully and take advantage of smart strategies.

Why Relying on One Income Stream in Retirement Is Risky

The truth is, the financial landscape in retirement has shifted dramatically over the past few decades. Rising costs, persistent inflation, and taxes chip away at what Social Security can realistically cover. Add healthcare—perhaps the single biggest expense in retirement—and it becomes clear that the so-called “guaranteed” income is often not enough.

Rising healthcare costs: According to recent data, the average retired couple can expect to spend over $300,000 on healthcare costs throughout retirement. Medicare covers a portion, but premiums, copays, and uncovered services add up quickly.

Inflation: Inflation averaged around 3% annually over the last decade, but recently it’s been even more volatile. This erodes the purchasing power of a fixed Social Security check, leaving many retirees struggling to maintain their standard of living.

Taxes: Social Security benefits themselves can be taxable, depending on your other income streams. Many retirees find themselves paying unexpected taxes, reducing their net income further.

All of these factors make depending on a single paycheck a precarious proposition. It’s a lesson that emerged not from abstract theory, but from lived experience and hard numbers—as I discovered gathering data and talking with families just like mine.

The Numbers Tell the Story: Gaps, Dependence, and Costs

Understanding the “retirement income gap” is crucial here. Simply put, the gap is the difference between the expenses retirees face and the guaranteed income they receive.

Retirement Income Gap = Expenses − Guaranteed Income

Let’s break that down with some national averages:

- Median monthly expenses for retirees: about $4,000

- Average monthly Social Security benefit: about $1,800

- Average other guaranteed income (pensions, annuities): varies significantly, but only about 15% of Americans receive a pension

- Healthcare expenses alone: roughly $1,200 per month per couple

That leaves a sizable gap many need to cover from savings or other income sources—often $1,000 to $2,000 monthly or more.

Here’s another eye-opening statistic: Nearly 60% of American retirees rely solely on Social Security for their income, according to the Social Security Administration. For many, that single paycheck simply doesn’t suffice to cover rising everyday costs.

Why 408(m) Accounts Could Be Your Retirement Game-Changer

Most Americans have never even heard of it. Yet the wealthy use it to shield gains, avoid penalties and stay fully invested—while everyone else sits exposed.

This isn't a theory. It’s a legal, IRS-approved strategy that can put a second, tax-free paycheck in your pocket—no cash conversion, no red tape, no catching penalties.

Grab your FREE 408(m) Guide now

Stay protected when the next crash hits.

P.S. Wall Street won’t tell you about 408(m). The insiders move first. Claim your guide (and bonus gold coin) before everyone else wakes up.

If you’re an independent consultant, small-business owner, or transition from employment soon, consider exploring the 408(m) retirement plan options—powerful, lesser-known tools that let you grow your nest egg with tax advantages while keeping flexibility. A 408(m) account can be a second paycheck source, tapping into avenues unavailable to typical 401(k) or IRA plans.

Learn more about how 408(m) plans can boost your retirement income, help diversify your portfolio, and keep you comfortably covered, even if Social Security feels like your only safety net.

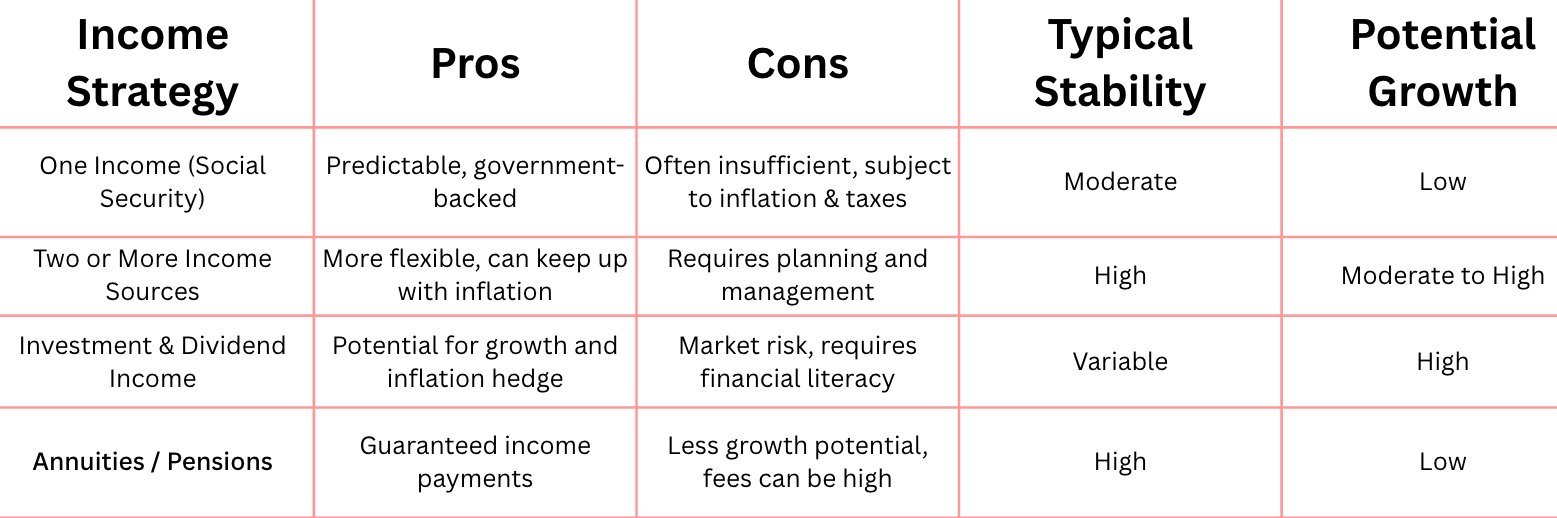

One Income Stream vs. Diversified Sources: A Comparison

A diversified income mix reduces risk, improves stability, and helps cover gaps. This chart shows why a “second paycheck” isn’t just about more money—it’s about resilience.

Practical Checklist: How to Build Your Second Paycheck

Here’s a roadmap based on lessons I’ve gathered over the years—practical, actionable steps you can take now:

- Diversify Your Income Streams

Don’t rely solely on Social Security and savings withdrawals. Include dividends, rental income, or part-time work to build resilience against inflation and market fluctuations. - Maximize Tax-Advantaged Accounts

Contribute to IRAs, Roth IRAs, or 408(m) plans if you qualify. These accounts offer tax relief and growth opportunities that stretch your retirement dollars further. - Understand Withdrawal Timing and Rules

Coordinate withdrawals from taxable, tax-deferred, and tax-free accounts to minimize taxes and penalties. A well-planned strategy might delay Social Security or allow your investments to grow longer. - Avoid Early Withdrawal Penalties

Know the rules around age 59½ and Required Minimum Distributions (RMDs). Penalties can eat into your savings if you withdraw too early or don’t take RMDs once required. - Seek Safe Income “Shelters”

Consider guaranteed income products, like immediate or deferred annuities, but be mindful of fees. Safe options help secure a baseline income you can count on no matter what markets do. - Review and Adjust Regularly

Retirement planning isn’t “set it and forget it.” Review your income sources and expenses yearly to adapt to inflation, healthcare changes, and personal circumstances.

Final Reflection: Wealth Isn’t About Luck—It’s About Playing the Game Smart

Wealth isn’t about how much you start with or getting lucky on the market. It’s about understanding the rules—tax laws, investments, income streams—and using them to your advantage.

A second paycheck in retirement isn’t just a luxury for the ultra-wealthy. It’s an achievable goal for hardworking Americans willing to plan thoughtfully and embrace diverse income strategies.

For many, the second paycheck begins as a seed—a small dividend here, a part-time project there—that grows into a steady, reliable monthly income stream, easing anxiety and enhancing independence.

If you’ve ever felt the sting of “not enough” in retirement fears, remember this: The second paycheck is closer than you think. And it might just make all the difference.

—

Claire West