Banking Crisis 2.0: What It Means for Everyday Savers

I still remember the night the 2008 financial crisis truly hit home—a sense of shock that swept the nation in sweeping waves. Banks that once seemed unshakable faltered, and trust broke apart almost overnight. For everyday savers like me, it was a moment filled with uncertainty, when the foundations beneath our money suddenly felt unstable.

Now, in 2025, headlines have started to echo that fear—whispers of “Banking Crisis 2.0” are reemerging. The landscape is different, but the unease feels familiar. It’s a reminder that financial stability is never a given, especially when the very institutions meant to safeguard our savings face new strains.

The Hidden Cracks Beneath the Surface

Banks continue to assure us all is well. Yet, the signs tell a quieter story:

- Deposits are shrinking as some customers move money elsewhere.

- Liquidity is tightening, making it harder for banks to meet sudden demands.

- Behind closed doors, quiet government interventions and bailouts take place without broad public knowledge.

But what does all this mean for you and me—the everyday saver?

First, it signals that the traditional banking system may be more fragile than it appears. When liquidity tightens, banks become reluctant to lend, which slows economic growth and affects interest rates on savings accounts. Deposit shrinkage means less buffer against shocks, increasing the risk of failures.

If you keep most of your cash in a single institution or a handful of savings products tied closely to the banking system, you’re exposed. The recent turmoil should inspire caution and a reassessment of where and how your money is stored.

The CBDC Connection: Why Some Experts Are Watching Closely

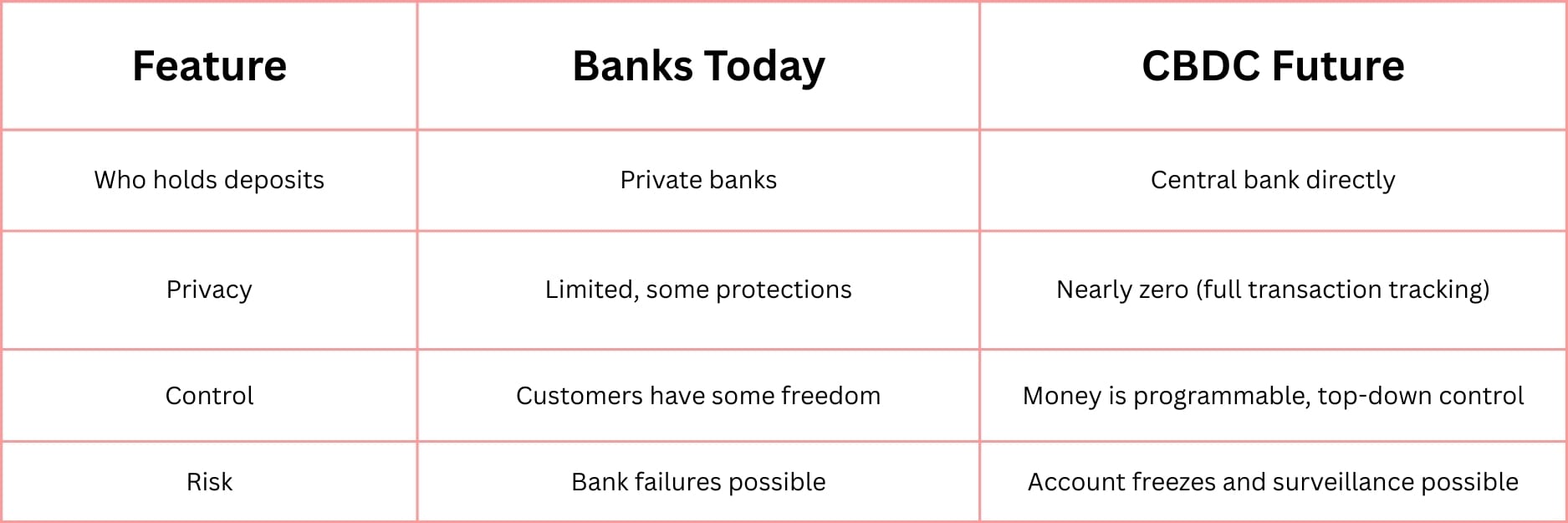

As the banking sector navigates these stresses, another trend is gaining attention: the push for Central Bank Digital Currencies, or CBDCs.

In simple terms, a CBDC is a digital form of a country’s currency issued and controlled directly by the central bank—in the U.S., this would be the Federal Reserve. Unlike cryptocurrencies like Bitcoin, CBDCs are centralized, government-issued money running on digital platforms.

The promise? Instant transactions, increased efficiency, easier cross-border payments, and potentially better financial inclusion. But with this power come risks:

- CBDCs could allow near-total surveillance of every financial transaction.

- Funds can become programmable money, enabling authorities to impose spending limits or freeze accounts instantly.

- The shift moves money control from private banks to a centralized authority with top-down power.

Some analysts believe that the current strains on banks are being used to accelerate this transition—pressuring institutions while pushing for a digital currency that would ultimately reshape our financial systems.

Banking Today vs. CBDC Future

Understanding this landscape helps piece together why banking crises today have implications beyond just failed institutions—they mark possible turning points toward a more controlled financial future.

Banking Crisis 2.0 Is Already Exploding

They told you everything was fine. They lied.

Behind the scenes, the U.S. banking system is cracking — and you’re not supposed to know why.

The real reason? The government is pushing ahead with a Central Bank Digital Currency (CBDC) — and banks are the first casualty.

- Deposits are vanishing

- Liquidity is drying up

- Quiet bailouts are already happening

This isn’t a theory — it’s the beginning of a financial reset.

And once CBDC replaces your cash, it’s game over:

- They’ll track every transaction

- They’ll decide where you can spend

- They’ll shut down your account instantly if you step out of line

This is the new financial surveillance state.

Checklist: How to Prepare Your Finances Today

- ✅ Keep emergency funds accessible outside traditional banks, such as in physical cash or secure liquid options.

- ✅ Diversify your stores of value, including tangible assets like precious metals or diversified portfolios beyond bank deposits.

- ✅ Stay informed on CBDC and financial policy developments to anticipate changes.

- ✅ Review how your retirement and investment accounts are exposed to the banking sector, assessing risks and diversification.

We may never fully control the financial system or political decisions driving it. But we can control our preparedness.

The fragility revealed by banking crises reminds us that trust is precious and easily shaken. The best defense isn’t panic—it’s clarity, steady action, and thoughtful diversification.

Prepare not out of fear but from a calm commitment to protect what matters most.

For a detailed roadmap, repeat the link here to download the FREE Presidential Transition Guide.

What the "resistance" doesn't want you to know

SPONSORED by Amercan Alternative Assets

—

Claire West