Beyond Nvidia: Where the Next AI Wave Could Hit

I still remember the first time I saw Nvidia’s graphics chips in action. It was the early 2010s, and I was mesmerized by how a gaming computer could deliver powerful, immersive experiences thanks to these tiny pieces of silicon. Back then, Nvidia was a respected tech firm carving its niche in graphics processing for video games and professional visualization.

Fast forward to 2025. Nvidia’s market capitalization has soared beyond $4 trillion, a number that stuns even seasoned investors. The catalyst? Its leadership in AI hardware. As AI exploded from theory into practically every industry—from language processing to image recognition—Nvidia’s GPUs became the backbone powering that revolution.

Watching this feels historic. But it also feels like arriving late to a party that started years ago. The question, as an investor, is: where does the next wave hit? How do you stay ahead when one titan already dominates headlines?

The Nvidia Lesson: Dominance Comes at a Cost

Nvidia’s story is one of brilliant timing, technical innovation, and relentless execution. By building GPUs that excelled at parallel computing and embracing AI workloads early, the company positioned itself as the gatekeeper to the future of computing.

This dominance fueled a valuation growth on an almost unprecedented scale. Yet such sky-high valuations come with their own risks. When you buy a stock trading at hundreds of times expected forward earnings, you are not just paying for what the company is today—you’re betting on near-flawless execution and continued market leadership far into the future.

This creates a fragile scenario: any stumble in earnings growth, market share, or competition can lead to sharp price corrections. Simply put, paying for perfection increases risk.

The Question Investors Should Ask:

Where’s the Next Opportunity?

History teaches us that tech cycles often function like waves crashing ashore—when one dominates the shoreline, the next builds quietly offshore before roaring in.

While Nvidia blazed its trail visibly, there are usually technologies and companies developing in the background, preparing the stage for what’s next. The world isn’t just one company or one chip; it's a complex ecosystem of innovation.

So, where is the next AI wave forming? Where might investors find meaningful growth before the mainstream spotlight hits?

The Musk Angle: Betting Beyond the Obvious

Elon Musk is famous for his bets—many outside conventional narratives. When most eyes are fixed on public tech giants, Musk often invests in stealth projects, strategic ventures, or emerging tech far from the limelight.

There’s growing chatter in investor circles about a Musk-aligned stealth AI play. This entity is reportedly focused on new AI applications rather than the underlying core infrastructure Nvidia dominates. Backed by hedge funds and insiders, it represents a speculative but potentially transformative opportunity.

It’s the classic contrarian angle—investing where broader markets may not yet see the full story.

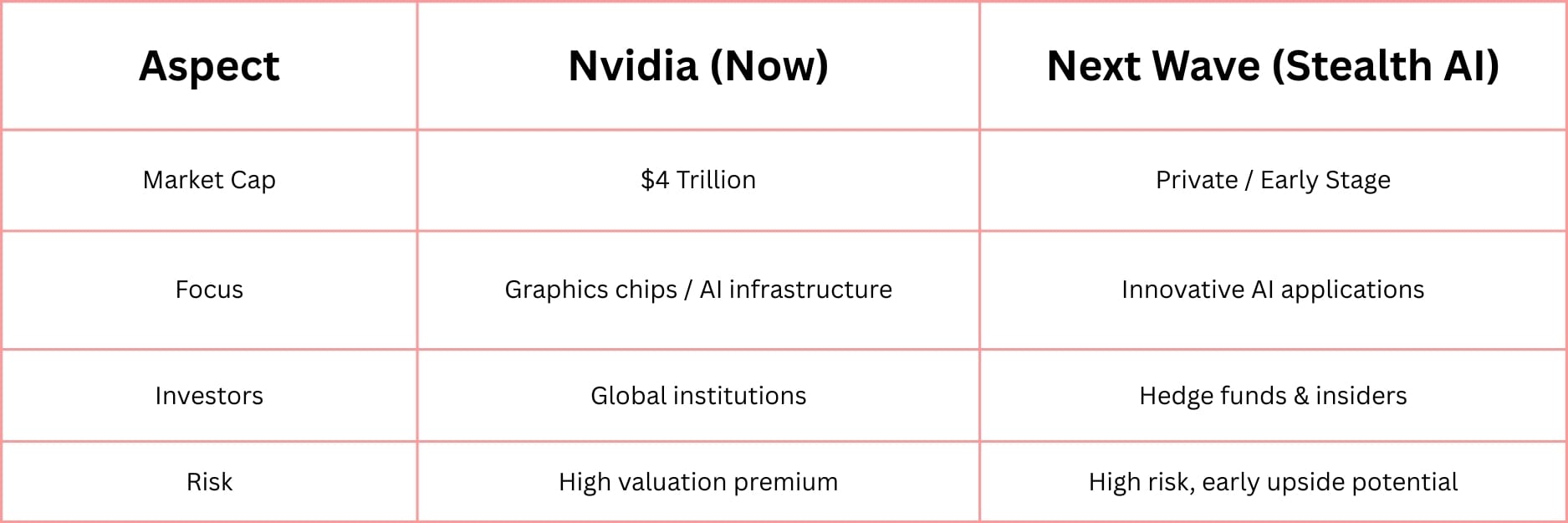

Big AI vs. Stealth AI

Nvidia just made history — a $4 trillion valuation driven entirely by AI dominance.

But here’s what the headlines don’t tell you: Elon Musk’s real play isn’t in graphics chips — it’s in stealth AI tech nobody’s talking about yet.

We have uncovered a potential Musk-aligned company that's positioned to ride the post‑Nvidia wave — AI + scale + hedge-fund backing.

How to Approach the AI Boom Wisely: A Practical Checklist

- Avoid chasing companies after their meteoric 1,000%+ runs. Being first often pays more than being late.

- Focus on early-stage narratives backed by credible investors. This lends greater probability of long-term success.

- Diversify across AI infrastructure (chips), applications (software), and stealth opportunities. Spread exposure to balance risk and reward.

- Treat smaller speculative bets as venture capital slices. Only allocate money you can afford to risk for the long haul.

Every tech cycle has its icons—those companies that shape narratives and capture headlines. But the real wealth often lies in spotting the shifts just beyond the horizon, before the mainstream crowd follows.

Nvidia’s rise is a powerful lesson in innovation and timing. Yet today, those looking for breakthrough AI investment opportunities might find fertile ground in emerging stealth plays—where technology, vision, and smart capital combine quietly, waiting to become the next chapter.

Being calm, curious, and analytical is your best guide in navigating this evolving AI landscape.

👉 Explore the Musk-aligned stealth AI opportunity now

(Behind The Markets)

—

Claire West