Bitcoin at New Highs — But The Real Story May Be Elsewhere

I still vividly remember the first time I saw Bitcoin (BTC) hit an all-time high—whether it was the frenzy back in late 2017, when BTC approached $20,000, or the record-breaking run in 2021 soaring to nearly $69,000. Everywhere I looked, there was an unmistakable buzz: social feeds flooded with FOMO (fear of missing out), friends and strangers alike jumped into the conversation, and headlines screamed about the “next gold.”

Fast forward to August 2025. Bitcoin is once again pushing new highs, reviving those memories—and that familiar feeling of excitement is stirring in many investors. But as history tends to remind us, with every surge in Bitcoin, there’s often more happening quietly beneath the surface.

The Pattern: When Altcoins Follow Bitcoin’s Lead

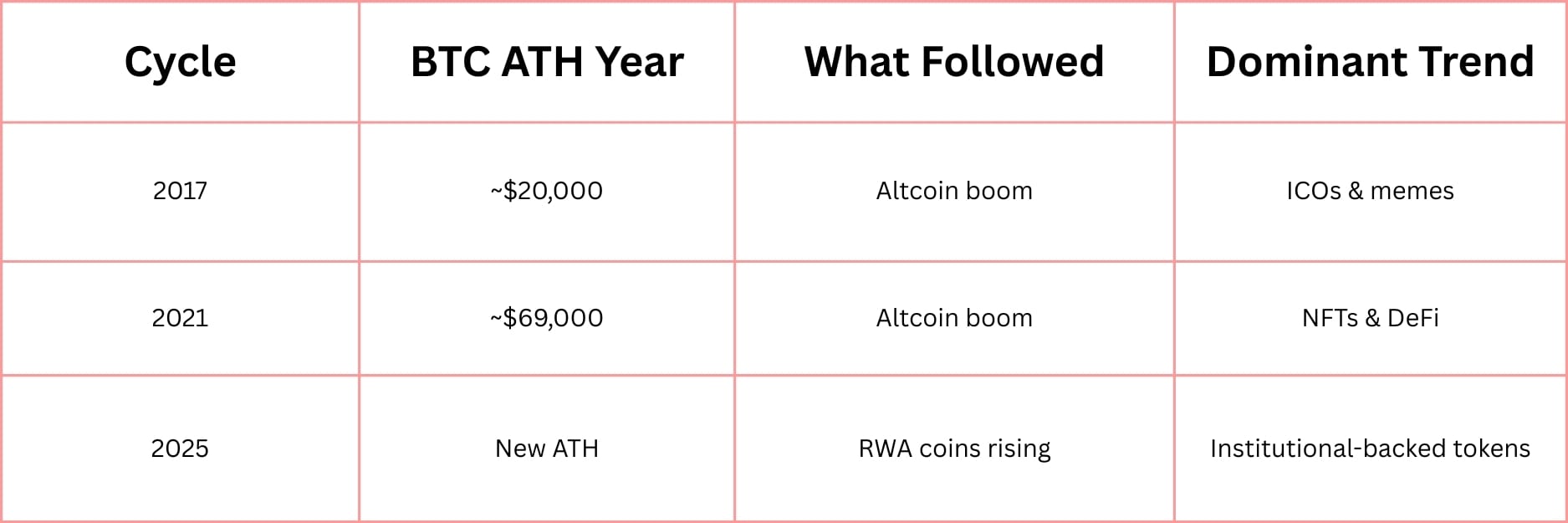

If you’ve tracked crypto through the years, you’ve probably noticed a recurring pattern: Bitcoin breaks through its previous all-time highs, and soon after, altcoins surge. We saw this vividly in 2017 and again in 2021.

In 2017, Bitcoin’s landmark peak set off a frenzy of altcoins riding the wave—many were ICOs (Initial Coin Offerings) or meme projects fueled by hype and speculation.

In 2021, after Bitcoin smashed the previous ceiling, we witnessed an altcoin boom driven largely by NFTs (non-fungible tokens) and decentralized finance (DeFi) platforms, marking a new chapter of crypto use cases beyond just digital gold.

These cycles show a rhythm to the market: Bitcoin leads, altcoins follow—but each cycle has its own story and dominant themes.

This Cycle’s Twist: Real-World Asset (RWA) Coins

Here’s where 2025 differs. Instead of just a repeat of meme coins or NFT hype, this cycle introduces a game-changer: RWA coins, or Real-World Asset tokens.

In simple terms, RWAs are cryptocurrencies backed by tangible assets outside the blockchain. Think of projects supported by giants like BlackRock, JP Morgan, or trials launched in Singapore—tokens tied directly to things like real estate, loans, or commodities.

Why is this so important? Because it moves crypto beyond speculation or purely digital playgrounds into tangible, utility-backed territory. Institutional players are participating in ways that link blockchain to everyday finance, adding layers of legitimacy and stability.

🚀 Bitcoin Just Hit a New All-Time High

And just like clockwork... altcoins are waking up.

Historically, every time BTC rips through an ATH, altcoins go absolutely vertical.

We saw it in 2017.

We saw it in 2021.

And now — it’s starting again.

But this cycle has a new twist:

The next wave isn’t meme coins. It’s real-world asset (RWA) coins — backed by BlackRock, J.P. Morgan, and even countries like Singapore.

Bryce Paul just named the one tiny altcoin that could dominate this new RWA supercycle.

🪙 Limited supply. Massive institutional demand. Real-world utility.

And it just made history with the first on-chain real-world loan.

⚠️ This is the kind of setup that turns $3 into a portfolio move.

Click here to see the #1 Coin for August 2025 (Just $3) >>

Mini-Table: Crypto Cycles Past and Present

This new chapter may offer an evolution, not just a repeat.

Spotlight Opportunity: A Small RWA Coin Making History

Recently, crypto analyst Bryce Paul highlighted a fascinating RWA coin that just hit an exciting milestone: the first-ever real-world loan fully issued and tracked on-chain. This isn’t just techno-spectacle—it’s a clear test of how blockchain can power traditional financial services with transparency and security.

What makes it notable? It has:

- A limited, carefully managed token supply, avoiding inflation risks.

- Strong institutional demand, signaling confidence from big investors.

- Direct real-world utility, not just speculative buzz.

It’s the kind of thoughtful innovation that could quietly shape the future of crypto finance.

Actionable Checklist for Readers

- Don’t chase Bitcoin’s green candles at all-time highs. Remember the history behind those surges.

- Learn about Real-World Asset (RWA) tokens. They represent a link between the digital and tangible worlds—often backed by institutions or governments.

- Start small with emerging trends. Use careful allocations to test waters without overexposure.

- Do your homework before buying. Look for clear partnerships, proven utility, and avoid hype-driven projects.

As I watch the markets evolve, I’m reminded that crypto cycles often rhyme but never exactly repeat. The playful, speculative spirit of meme coins gave early flair to the space, NFTs opened new frontiers, but now, we might be entering the era where assets that truly tie the digital to the real take center stage.

(by Crypto101)

Click here to see the #1 RWA Coin for August 2025 — trading at just $3

This shift isn’t flashy but promises quiet resilience.

—

Claire West