Breathing Room in a Tight Budget

There’s an odd clarity in the moment you can finally exhale. Years ago, it came as a small, unexpected tax refund. Not a windfall—just enough for me to pay down a stubborn bill and fill my gas tank without holding my breath at checkout. I remember sitting in my car afterward, hands wrapped around a warm coffee, feeling a flicker of ease. It was a fleeting patch of blue sky in a long stretch of overcast months, and for a few days, my worry about bounced payments and interest ticks stopped nipping at my heels. That simple “breathing room”—however temporary—felt like a gift. Yet the bigger lesson, I’d later realize, wasn’t just the pause, but how to make those pauses count for more than a passing sigh.

Why Budgets Feel So Tight in 2025

If life seems more expensive than ever, it’s not just a feeling—it’s a statistical reality in 2025. The average U.S. household now carries nearly $1.21 trillion in credit card debt, with total household debt close to $18.4 trillion. Credit card interest rates hover at historic highs, and real wages struggle to keep pace with the cost of everyday essentials. Grocery prices alone are up nearly 39% for vegetables (the steepest summer jump since World War II), while new car buyers face sticker prices that, for many, are simply out of reach.

A record 57% of Americans report living paycheck to paycheck—rising even higher in some surveys. In places where student loans have resumed and health, insurance, and rent absorb a greater share of income, many families find themselves laser-focused on the next bill, not the next year. Nearly 1 out of every 4 households now spends more than it earns, and only 44% say paying their bills is “not at all difficult”—a steep decline from just a few years ago. Anxiety is the common state: this year, 63% say they’re stressed about money, and over a third couldn’t cover a $2,000 emergency without borrowing or selling something.

Drowning in credit card interest?

These top 0% intro APR cards can give you up to 21 months with no interest—so every dollar goes toward paying off your balance, not your bank’s profits.

No gimmicks. Just smart credit.

The Emotional Weight of No Margin

Budget pressure is about more than numbers. When there’s no wiggle room, life itself feels narrower. Psychologists often describe the “bandwidth tax”: constant money stress can erode our patience, our confidence, and sometimes even the trust between partners. It’s harder to plan, to rest, to say “yes” to a friend’s invitation, when every unplanned expense is a threat. As debt attorney Leslie Tayne put it recently: “It’s not just about math—prolonged scarcity erodes our sense of stability. That uncertainty can undermine hope and relationships over time.”

Turning a Pause Into a Strategy

For most of us, relief doesn’t arrive as a lump sum or a lottery win. It’s the occasional tax refund, a short-term 0% APR credit card offer, or that rare month when a bill gets deferred just long enough to catch up. The common mistake? Treating these as only a pause, not a chance to re-anchor for the future.

What if, instead, we viewed every “breathing room” moment as fuel for a deeper change?

Here’s the formula I now use—simple, yet quietly powerful:

Relief × Action = Long-Term Gain

Relief is the small windfall—a refund, bonus, or saved payment. Action is what’s done with it: paying down high-interest debt, building an emergency buffer, even pre-paying a stressful bill. The result isn’t just a single lighter month—it’s establishing a habit that slowly widens your margin for years to come.

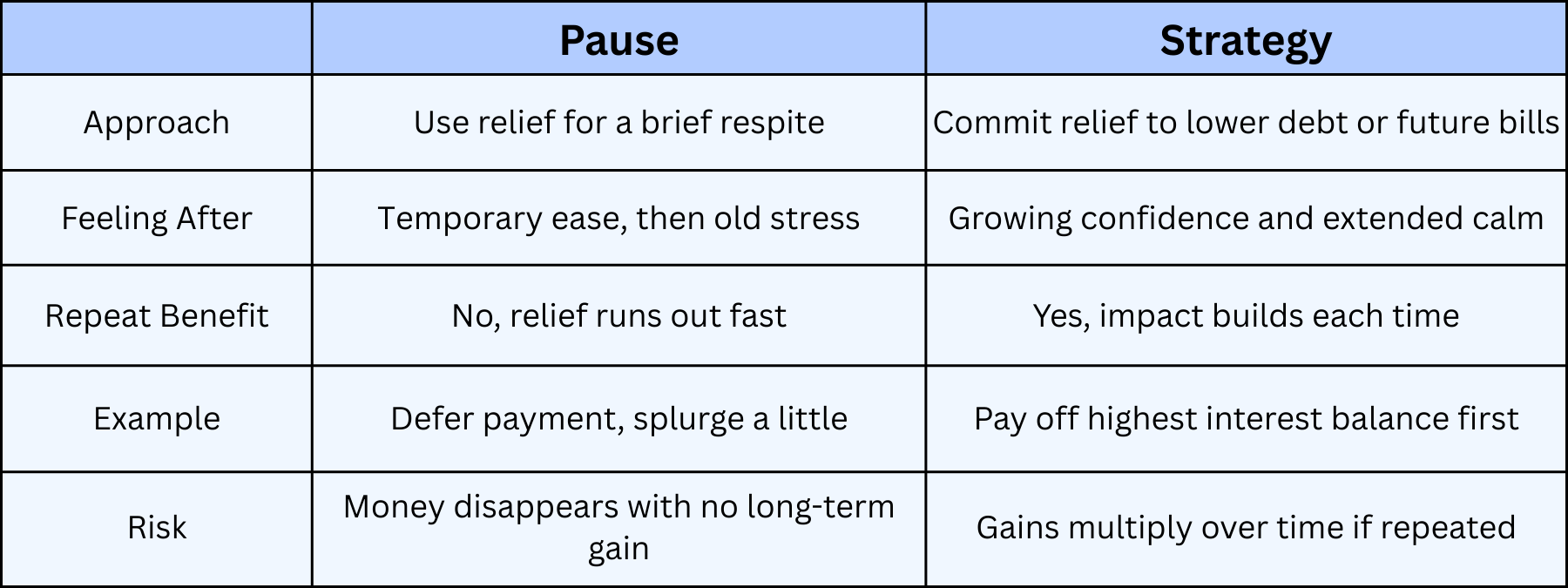

Breathing Room as Pause vs. Breathing Room as Strategy

Checklist for Families

Breathing room is precious—and short-lived. These quiet steps make it count:

- Pause and inventory the extra margin (tax refund, payment holiday, etc.).

- Apply relief first to overdue or highest-interest bills.

- Use a spending tracker (paper, app, or spreadsheet) to capture where the extra went.

- Build or top off a small emergency fund—even $200 can prevent a crisis.

- Communicate with family; set one “comfort” bill to prepay (utilities, rent).

- Review the calendar for upcoming bills; set reminders to avoid late fees.

Risks and Preparation

Breathing space rarely lasts. Most 0% APRs have a hard deadline; tax refunds can dry up with a job change or a tax code tweak. Payment holidays are temporary—when they end, debts reassert themselves with more vigor. The key is not to mistake a brief relief for a solution.

Here’s how to prepare as 2025’s economic winds keep shifting:

- Assume forgiveness periods will end; plan repayments two months in advance.

- If a windfall comes, divide—pay down debt, hold a slice for emergencies, and forecast next quarter’s “pain points.”

- Track your progress monthly—not just the debt declining but the days when stress is lowest.

- If using 0% APR cards, pay them off fully before the rate resets, or transfer with care to minimize new fees.

- Know that resilience itself, not perfection, is the long-term gain.

A Hopeful Glance Forward

The Federal Reserve’s recent rate cut may nudge interest burdens a little lower by 2026, and some forecasts predict inflation cooling closer to 2%—good news for families who stretch every dime. Yet wage growth remains uncertain, and core expenses from groceries to insurance likely won’t shrink overnight. If there’s one forecast to hold, it’s this: breathing room will remain a moving target, best managed by discipline and realistic hope, not by waiting for rescue.

Resilience Isn’t Luxury—It’s Power in Motion

Breathing room isn’t a luxury reserved for the lucky. It’s resilience in action—a kind of everyday power. The relief from a tax refund, a payment holiday, or an unexpected grace period isn’t about escape; it’s about steadying oneself to face another month, a pile of bills, a world that’s never entirely predictable.

As I learned in that quiet coffee moment, what matters most isn’t the size of the pause, but how many steps forward you take before breath becomes tension again. Every bit of margin is an invitation to act, and, with practice, to transform short-term mercy into longer-term peace.

—

Claire West