Cash vs. Crypto: What’s Really at Stake

One morning, while scrolling through the news with my coffee, a headline caught my eye: “Trump pushes back against U.S. Central Bank Digital Currency plans.” My first thought wasn’t politics, it was personal. What does this mean for my wallet? For the money I carry in my pocket, the money I spend every day? Suddenly, this abstract debate about digital currencies felt a lot more immediate—and confusing.

If you’re like me, hearing about Central Bank Digital Currencies (CBDCs), crypto, and cash in the same breath raises questions: What are the real differences? How could these changes affect how I earn, spend, or protect my money? And importantly, how do I keep control in a world that seems to be moving faster and more digital by the day?

What Are CBDCs — And Why Are They on the Table?

To begin, here’s a quick primer. Central Bank Digital Currencies (CBDCs) are a new form of government-issued money—but unlike paper bills or coins, these exist purely in digital form. Think of a CBDC as the electronic cousin of physical cash, created and backed by the country’s central bank (like the U.S. Federal Reserve).

Why propose a CBDC at all? Several reasons drive these efforts:

- Efficiency: Digital money can make payments faster and cheaper, especially domestic and cross-border transactions.

- Financial Inclusion: CBDCs could grant easier access to digital payments for people without bank accounts.

- Countering Crypto: Central banks want to offer a stable alternative to volatile cryptocurrencies.

- Control and Transparency: Governments and regulators see CBDCs as tools for better monitoring and managing the financial system.

But CBDCs differ widely from both cash and cryptocurrencies. Cash is anonymous and tangible—no bank or tech company tracks every dime you spend. Cryptocurrencies like Bitcoin promise decentralization and privacy (although that’s nuanced), operating independently of governments.

CBDCs, meanwhile, could integrate features like transaction traceability, programmable money, and immediate settlements. This raises concerns about privacy, surveillance, and who truly controls your money.

🚨 Trump Just Signed the Crypto Order of the Decade

In a fiery executive order, Trump slammed the door on surveillance coins — and opened the gates to decentralized, real-world assets.

So now the question is:

If CBDC is dead… what crypto wins?

Bryce Paul — host of the #1 Crypto Podcast (17M+ streams) — says the answer is simple:

🪙 One tiny coin at the center of a massive blockchain pivot by J.P. Morgan, BlackRock, and Singapore.

This isn’t hype. This isn’t a meme. It’s infrastructure.

And it could make you 10x, 50x, even 150x gains — if you get in now.

⏳ But timing is everything. The big boys are already buying in.

👉 Bryce’s full report reveals the coin, the catalyst, and exactly how to buy — for just $3.

P.S. Trump just cleared the way for real crypto to thrive — and this coin is built for the new regime.

Don’t be the guy who heard about it too late.

Get the $3 coin report now »

Putting the Numbers in Perspective: What’s Happening Now?

To really grasp what’s at stake, let’s look at some key recent data:

- Global CBDC pilots are multiplying: According to the Bank for International Settlements (BIS), over 100 countries worldwide are exploring CBDCs, with at least 10 already testing pilot programs as of mid-2025.

- U.S. debate remains cautious: The Federal Reserve is conducting research and consultation but has no concrete launch timeline. Surveys show 60% of Americans remain wary or confused about CBDCs.

- Crypto adoption keeps growing: Despite volatility, about 30 million Americans say they own some form of cryptocurrency, showing a growing comfort with digital assets among everyday people.

- Payment systems shifting: Digital payments now account for over 70% of retail transactions in the U.S., far surpassing cash, though cash remains preferred for small, everyday uses by older demographics.

These numbers tell us that money is evolving—but how, and on whose terms, remains an open question.

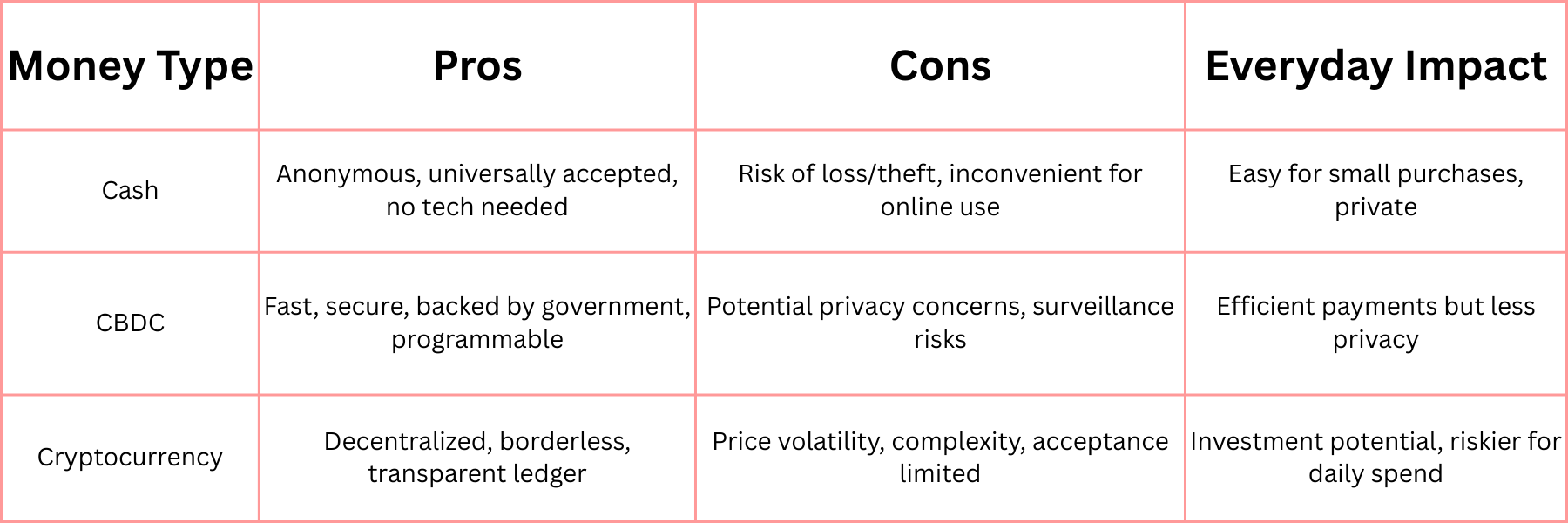

Understanding the Trade-offs: Cash vs. CBDCs vs. Crypto

Here’s a simple comparison to clarify how these forms of money stack up:

Taking Control Over Your Household Money

In a world where money takes many forms, basic control and education make all the difference. Here are some steps to help you navigate this changing landscape:

Diversify your money holding methods. Keep a mix of cash, bank accounts, and if comfortable, small crypto positions. Diversification reduces risk.

Understand digital payment methods. Familiarize yourself with how cards, mobile wallets, and digital currencies work, including fees and security issues.

Track privacy risks. Be aware that digital payments can leave data trails. Use cash where privacy is important, and choose payment providers carefully.

Keep savings options open. Don’t crowd your savings into a single asset class. Use traditional accounts, IRAs, and, if appropriate, low-risk crypto assets.

Monitor fees and inflation. Remember this simple formula for money control:

Household Money Control = Income − Expenses − Fees − Inflation Losses

Every dollar lost to fees or inflation is money you can’t use.

Stay informed about policy changes. Government regulations around CBDCs and crypto will impact how we all use money. Follow trusted sources.

The Shape of Money, But Not the Power to You

Money’s form may change—from paper to digital tokens to blockchain entries—but the heart of your financial well-being remains constant: control, knowledge, and planning. Whether you hold cash, dip your toes into crypto, or prepare for a potential CBDC future, the key is staying grounded in your own goals and values.

As we navigate these shifts, don’t lose sight of what matters. Your money is more than numbers—it reflects your effort, your security, and your freedom.

Keep learning, keep adapting, and keep in control.

—

Claire West