Convenience vs. Control: The New Currency Dilemma

It was a Tuesday morning when I sent money to a friend using an app on my phone—a quick “just paid you” message, a tap, and the transfer was done. Seconds later, a confirmation popped up: “Payment received.” No cash exchanged hands. No waiting for banks to open. No worries about lost checks or ATM lines. It was seamless, effortless, the ultimate in convenience.

Yet, as I sat back with my coffee, a thought struck me: What happens if that freedom suddenly disappears? If this ease—this instant access to money—was taken away or restricted? We trade convenience every day, but what about the long-term cost? The growing ease of digital payments brings a quiet but pressing dilemma: convenience vs. control.

The Rise of Instant Payment Systems

The United States has seen a rapid shift from cash and checks to digital payments. Enter FedNow, a new instant payment rail launched by the Federal Reserve, enabling real-time bank transfers 24/7/365. Whether it’s a paycheck, rent, or splitting the dinner bill, the transfer happens instantly—no delays, no business hour restrictions. Apps like Venmo and Zelle exemplify closed-loop and open-loop systems that make instant payments the norm.

Governments and banks hail these innovations as progress—modernizing finance, driving efficiency, and fostering inclusion. The promise is undeniable: faster transactions mean better cash flow, fewer late payments, and a more connected economy.

What We Trade for Convenience

But this transition carries potential trade-offs—not just for individuals but for society’s financial fabric. Privacy risks increase as digital transactions create detailed spending footprints that can be monitored. Access to payment systems might tighten as governments or institutions wield new digital controls. And crucially, long-term financial independence could erode if alternative money forms like cash phase out.

Donald Trump just did it again.

He confirmed his Rebate Stimulus Plan — but it’s not just about sending out checks.

This isn’t just a “bonus” — it’s a chance to shield your savings from what’s coming.

Get your FREE 2025 Gold Protection Guide now.

Understanding the Data

Digital payments are here to stay. Nearly half of Americans—about 45%—now rely on digital payment systems regularly, and the market is booming, projected to reach over $42 billion in 2025 alone. Meanwhile, the national backdrop is sobering: U.S. national debt nears $37.4 trillion, inflation holds near 3%, and the Federal Reserve maintains interest rates around 4.25% to 4.50%, signaling ongoing economic pressures.

Globally, China is aggressively piloting its digital yuan, creating an international operations center to expand its reach and reduce dependence on traditional currencies. The European Union advances its digital euro, with extensive research ensuring accessibility and privacy protections.

Balancing Benefits and Risks

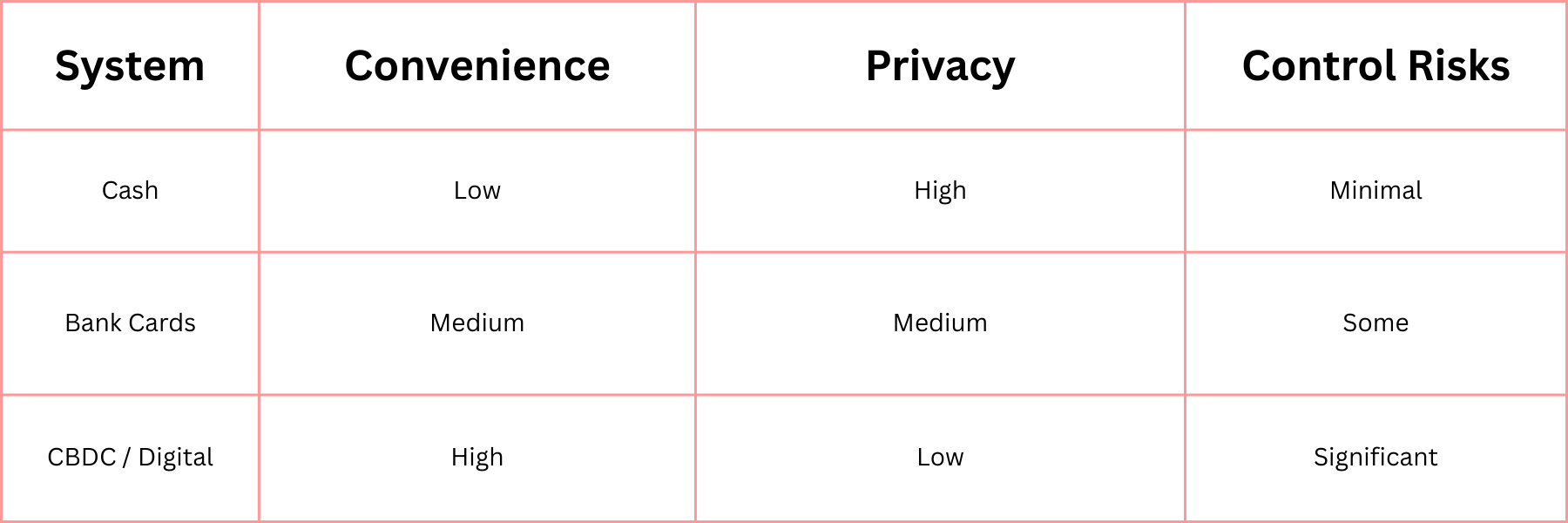

The benefits of digital currency systems are clear: speed, convenience, and operational efficiency. But the risks are significant. Digitally issued central bank currencies (CBDCs) may enable unprecedented surveillance and control over personal finances. Restrictions could be embedded in digital contracts that condition access to funds, potentially limiting freedoms.

This brings us to a simple but vital formula for financial freedom:

Financial Freedom = Access − Restrictions − Surveillance

This equation reminds us that true independence depends not just on having money but on how freely one can use it, without unnecessary invasion or limitation.

Convenience vs. Control: A Comparison

If you’re concerned about what comes next, here’s one option people are looking at…

Practical Checklist for Navigating the New Currency Landscape

- Keep some assets liquid outside the traditional banking system to maintain access regardless of digital restrictions.

- Diversify retirement accounts using defensive strategies that protect against inflation and policy shifts.

- Stay informed on Federal Reserve and Treasury announcements regarding digital currency and payment regulation.

- Balance the convenience of digital payments with alternative stores of value, such as precious metals or cash reserves.

- Build an emergency fund that remains accessible even if digital channels become temporarily restricted.

Preparation Over Prediction

This new currency dilemma—between convenience and control—won’t be solved overnight. In many ways, it’s the financial challenge of our time. While we embrace digital speed and ease, safeguarding financial independence means recognizing the value of access beyond convenience.

The technology that made sending money as easy as a phone tap could also limit our freedom if control overs money tightens too much. Preparation, not prediction, is the shield against uncertainty. Understanding the trade-offs and maintaining diversified financial strategies will be the quiet power that preserves your security.

Convenience simplifies life, but real security lies in control—true access to your money, with minimal restrictions or surveillance. Protecting your savings today may be the strongest move you make for your financial freedom tomorrow.

—

Claire West