Early Signals vs. Late Reactions — Why Rare Public Flashes Say More Than They Seem

Night in Times Square. Neon pulses, crowds flow like rivers — tourists with phones, office workers with backpacks, street performers under synthesizer beats. I walk through this chaos, accustomed to it like the city's breath.

But tonight something catches my eye. One screen on Bryant Street — not standard Coca-Cola or Broadway advertising. It's brighter, sharper, with text that stands out from the general noise: a name I've only seen in private chats, and numbers that seem too specific for public display.

The moment feels strange — like an internal conversation breaking out. Sometimes major events break into public view too early. And that's always a sign. Not of celebration. But of warning.

The Nature of Public Signals

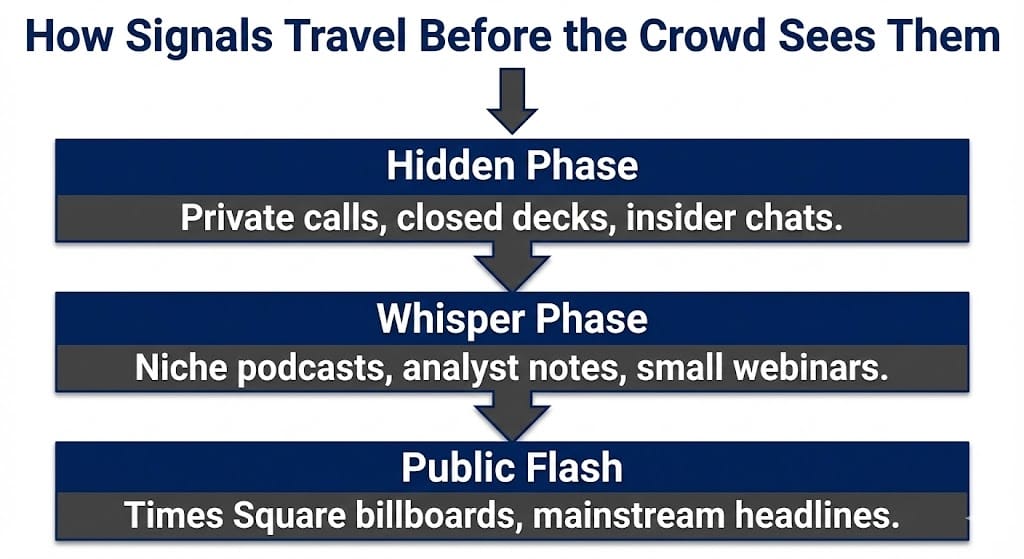

Real market movements never start where everyone can see. They begin quietly — in private calls, in analyst notes, in closed rooms where those who understand structure act before it becomes news.

But sometimes a breakthrough happens. Sudden public appearance — that's when the hidden becomes visible. Not for everyone, of course. For most it's just another bright screen among thousands. But for those watching signals, it's like a lighthouse flash in fog.

I've seen this before. When private processes go public ahead of schedule, there's always architecture behind it — money already raised, intentions already formalized. Publicity becomes not the end, but the start of counting.

It’s not just a billboard in Times Square.

It’s a signal — and insiders didn’t expect it to go public yet.

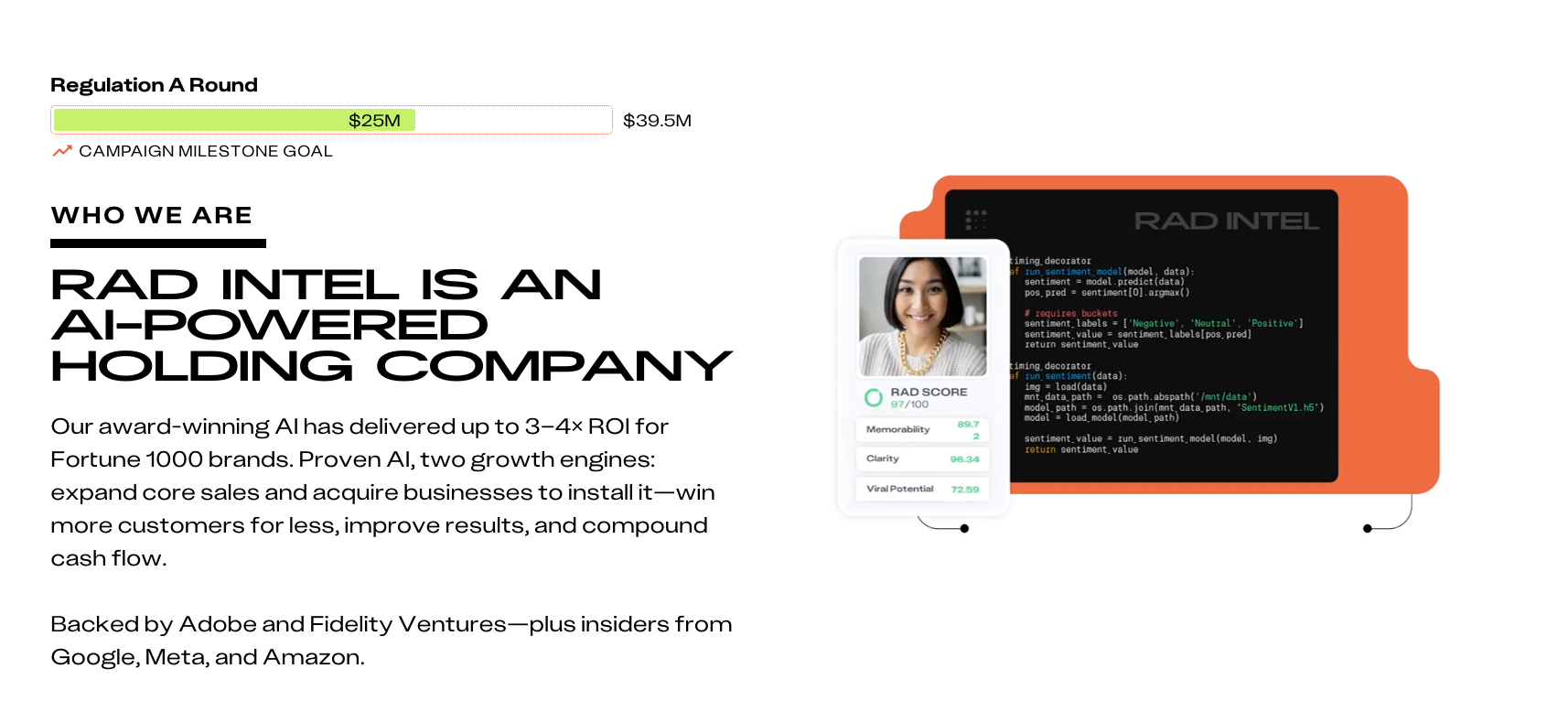

$40M raised.

7,000 early participants.

Nasdaq ticker reserved as $RADI.

And then — suddenly — the billboard lit up.

This was meant for the inner circle…

until it wasn’t.

You still have a window.

But windows close.

This early-stage Reg A+ offering won’t sit at $0.85 for long.

Why These Moments Matter

When internal movements suddenly become public, it's never accidental. Market history is full of such breakthroughs — moments when private architecture comes to light, signaling phase change.

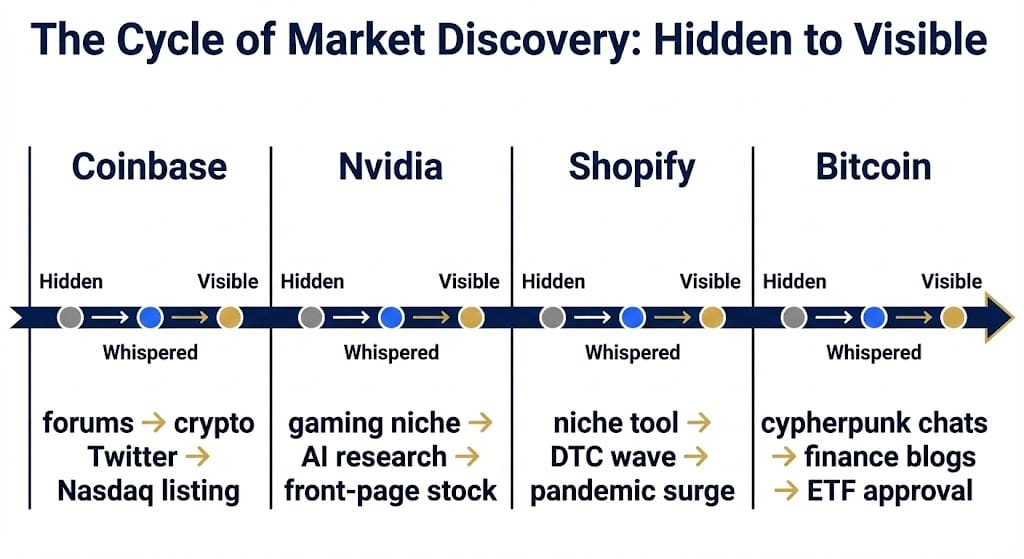

Remember how Coinbase quietly accumulated users in 2017, while its 2021 public listing became not discovery, but confirmation. Or how Nvidia existed for decades in shadow before AI made it visible to all. These flashes — not beginnings. They're the point after which it's too late to react.

These moments matter because they show structure. Money already raised. Participants onboard. Ticker reserved. Publicity — not advertising. It's the transition from whisper to voice.

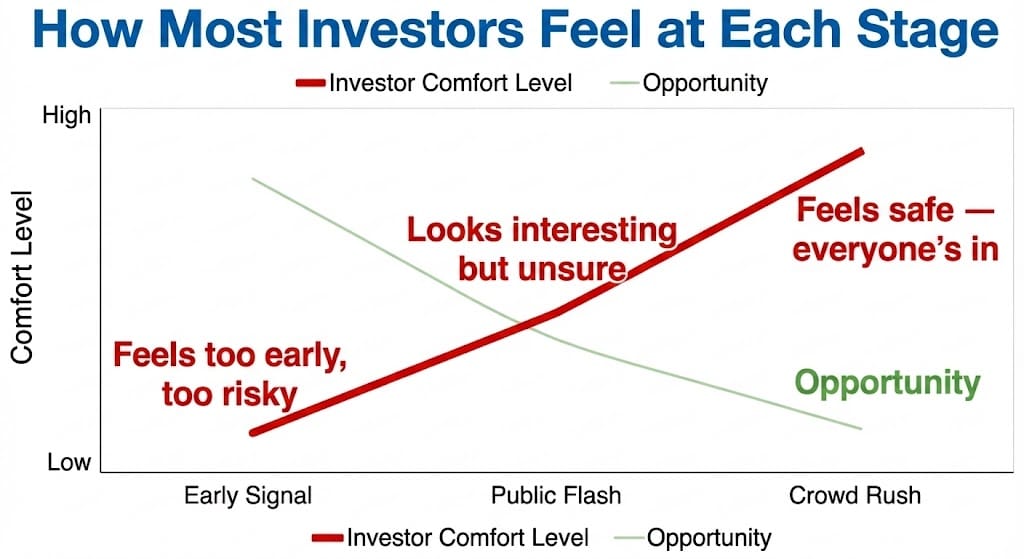

Inversion: The Myth of Early = Risky

Everyone's used to thinking: entering early — risky. Later — safe. But the logic is inverted.

Entering late — that's real risk. When signal becomes hype, price already reflects expectations. The Times Square flash doesn't make opportunity safe — it makes it visible to everyone. Early positions — those taken before noise — give room for error, time for evaluation, chance to exit with profit.

Early — not risk. Just unfamiliar. And unfamiliarity — best filter from the crowd.

The Freeze Response

The human brain reacts to new signals predictably. Freeze.

Information too fresh — conflicts with worldview. "Too early, means dangerous." "Not for me, too uncertain." Psychology protects: better miss than err.

I've seen this with investor friends. They missed early rallies because "too speculative." Then bought at peaks when everyone knew. Freeze — not caution. Inertia disguised as reason.

Historical Parallels

The cycle always the same: hidden → whispered → visible.

Coinbase existed in shadow of exchanges like Binance until public market exit. Early users knew. Crowd learned later.

Nvidia made gaming chips for decades — until AI made its architecture essential. Whisper in 2016 became scream in 2023.

Shopify seemed toy for small business — until pandemic showed its strength.

Bitcoin moved from forums to ETF through years of whispers.

Each example — flash that made hidden visible. And each time early saw first.

Surface vs. Substance

Why so hard to distinguish noise from signal? Because surface distracts from substance.

Bright Times Square screen — surface. But structure behind: $40M, 7000 participants, Nasdaq-ticker — architecture. Money raised. Intentions formalized. Regulation obtained. Not hype. Foundation.

Looking inside the flash — distinguishing surface from substance. Crowd stops at brightness. Those seeing further read between lines.

The Investor's Dilemma

This hardest moment for investor. Door still visible, but already starting to close. Such signal always seems "not it" — too new, too public too early, too contradictory to yesterday's beliefs.

Times Square quiets. Screen fades, blending with thousands other lights. Crowd flows on, noticing nothing unusual.

But signal was there. Short, bright, unexpected. Most important signals always appear amid noise. They don't shout — they flash. And recognize them only those trained to look inside the flash, not at its brightness.

City breathes. Night continues. And window — already narrowing.

—

Claire West