Gold at $3,500: What It Really Means for Everyday Investors

I remember the first time I bought a gold coin. It wasn’t about chasing profits or market timing—it was a quiet moment of seeking stability. I held it in my hand and felt the weight of something timeless, something real amid the uncertainty that swirled around us. To me, that little coin symbolized a kind of financial calm, a reassurance that transcended numbers on a screen.

Fast-forward to today, and gold has shattered yet another milestone, pushing past $3,500 an ounce. This new peak isn’t just a headline—it feels like a signal that the financial system is under pressure in ways many everyday investors sense but struggle to explain.

What does this record-breaking gold price truly mean for those of us planning retirement, watching inflation, and wondering about the dollar’s future? Let’s take a deeper look.

Why Gold Broke Records

Several forces have converged to push gold to these heights:

- The weakening of the U.S. dollar, fueled by massive government borrowing and a growing trade deficit.

- Central banks around the world buying gold aggressively—notably China, Russia, and parts of the Middle East—diversifying away from dollars and euros.

- Persistent global uncertainty due to geopolitical tensions, economic slowdowns, and shifting alliances.

Market watchers have taken note:

Goldman Sachs forecasts prices near $3,700 by Q3,

JP Morgan predicts gold could reach $4,000 by 2026,

And Frank Holmes, a longtime mining investment expert, sees gold possibly hitting $6,000 during Trump’s next presidential term.

These aren’t wild guesses from fringe voices—they reflect serious analysis framed by decades of market patterns.

This isn’t hype. It’s happening.

The dollar is unraveling.

Global markets are on edge.

Central banks are stockpiling gold.

Every day you wait, gold gets more expensive.

The system is cracking.

Gold is the exit.

Miss this window, and you could be locked out for good.

What Gold Signals for Ordinary People

For ordinary Americans, gold is more than an abstract speculator’s metal—it is a hedge, a fear barometer, and a store of value.

History reminds us that gold prices tend to spike during periods of inflation, wars, or major shifts in global currency dominance. It’s the asset people buy when trust in paper money or political stability falters.

In today’s context, gold’s rise echoes fears about:

- Inflation eroding dollar purchasing power.

- Debt levels unsustainable and growing.

- The dollar’s global dominance finally being challenged.

It serves as a reminder: when uncertainty rises, gold shines.

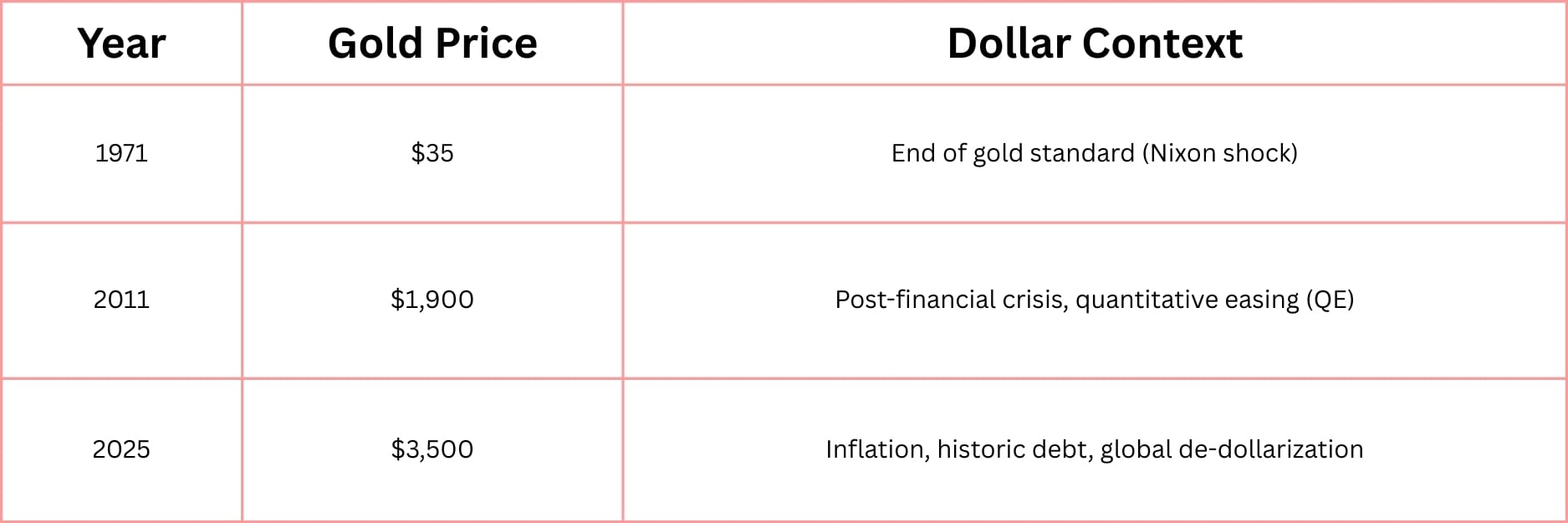

Gold vs. Dollar Over Time

Each era where gold spiked aligns with fundamental shifts or shocks in the monetary system. The current moment fits squarely into that pattern.

Gold Is Not Just a Metal

Gold’s true value lies in trust—an attribute that doesn’t depend on Federal Reserve policies or political promises. It’s a refuge for retirees protecting their savings against currency fluctuations. For savers, it represents a reliable hedge against the slow decline in dollar value.

Unlike stocks or bonds, gold is physical and finite. It can’t be printed or diluted. That tangibility is priceless when confidence wanes.

Checklist: Mine Practical Takeaways

- Know how much of your portfolio is currently dollar-only. Many Americans underestimate their exposure to currency risks.

- Understand the role physical assets like gold play. They aren’t about quick gains but about preservation and balance.

- Don’t over-concentrate on gold. It’s a hedge—not a lottery ticket or speculative asset.

- Pay close attention to policy shifts, especially changes at the Fed, political transitions, and moves by major countries like China.

Every chart tells a story. At $3,500, gold isn’t just making news—it’s sending a message.

It’s both a warning and, perhaps, an invitation: to rethink how we define financial security in uncertain times, to look beyond typical portfolio allocations, and to embrace a broader understanding of value.

As always, calm reflection and practical steps will serve best.

—

Claire West