Invisible Turning Points

In the quiet moments of a late summer evening, I noticed a subtle creak from the wooden floorboards beneath my feet. It wasn’t loud or sudden—just a gentle reminder that the house was aging, adjusting ever so slightly to the passage of time. At first, it barely registered, brushing past my consciousness like the soft rustle of leaves outside. But over days and weeks, the creaks became more noticeable, a quiet signal of change that had unfolded invisibly beneath daily life. It struck me how often this happens—not just in homes, but in life itself. The smallest shifts, those imperceptible nudges, often become the most important.

This experience feels like a fitting metaphor for the economic and financial shifts currently underway. The most significant turning points rarely arrive with fanfare or sharp headlines. Instead, they tiptoe in beneath the surface—inaudible at first, invisible to most. It is only with the benefit of hindsight that we can trace the patterns and say, “That was the moment it all changed.” But by then, the effects have rippled far beyond their origins, affecting everything from household budgets to retirement plans.

Understanding these invisible turning points requires patience and reflection—a quiet awareness of the small signals that often go unnoticed. This editorial explores why the most important shifts evade early recognition, examines recent economic data that suggests such shifts are underway in the U.S., highlights signs we tend to overlook, acknowledges the emotional cost of delay, and offers a practical framework for noticing early signals before they become urgent crises.

Elon Musk doesn’t waste words.When the world’s richest man — the guy who literally launched rockets into space — issues a dire financial warning, you’d better believe he isn’t joking.

And this time, it’s not about Tesla or Twitter. It’s about something far more personal:

- Your money.

- Your freedom.

- Your future.

Musk is warning that a seismic shift is already underway in America’s financial system — one that could strip everyday citizens of control over their savings.

By the time the mainstream media finally admits the truth, it may already be too late for most people to protect themselves.

That’s why you need to act now.

This urgent guide exposes what’s coming, how it could blindside millions, and most importantly — the moves you can make today to shield yourself from the fallout.

Don’t ignore Elon Musk’s warning.

Why We Miss Turning Points

The human mind craves patterns and stability; it seeks out familiar narratives and reassurances. This psychological bias causes us to overlook gradual change. When shifts are slow, incremental, and dispersed, they rarely register as “change” at all. Instead, they blend into the background noise of daily life, and the default assumption becomes one of continuity.

This truth reveals itself vividly in personal finance. Inflation, for example, often creeps in at such a slow pace that we barely feel the pinch month to month. A rise of 0.1 or 0.2 percent in prices hardly registers over a week or even a month—it is only after several months that we realize our dollars don’t stretch as far. Similarly, the slow but steady growth of personal or national debt tends to feel manageable “just this month,” even while it quietly compounds into heavier burdens over time.

One of the most powerful financial forces—compound interest—is itself a double-edged sword. When working in your favor, it can quietly build wealth through patient investment and savings. But when it operates against you—on credit card balances or other high-interest debt—it acts as a slow, largely invisible drain. The pace of erosion is modest, so no immediate alarm sounds, but it accumulates relentlessly.

We trust stability, continuity, and well-worn patterns because they comfort us. Admitting that change is unfolding imperceptibly requires a willingness to look beyond surface rhythms and acknowledge slow-building uncertainty. This cognitive resistance helps explain why turning points tend to surprise us, once their effects become large enough to be undeniable.

Economic Context (2024–2025)

Recent data and financial trends suggest that the U.S. economy is undergoing such invisible turning points right now. While headline inflation has moderated since 2023’s post-pandemic surge, a subtle gap between official inflation figures and consumer sentiment remains persistent. According to the latest surveys in mid-2025, many American households still perceive rising prices, particularly for essentials like food, housing, and healthcare, even as the Consumer Price Index (CPI) signals lower headline inflation. This perception gap complicates spending and saving habits, as families feel the squeeze quietly but deeply.

Another quiet shift is the national debt, which has now surpassed $37 trillion, a historic milestone. This number dwarfs past records but receives far less dramatic media attention than expected. The implications of such large public debt are cumulative and diffuse—affecting interest rates, tax policy, and government spending over many years rather than exploding suddenly.

Meanwhile, consumer credit is at record highs, with credit card balances rising steadily throughout 2024 and into 2025. The average U.S. household carries over $7,000 in credit card debt, reflecting an ongoing dependence on revolving credit for day-to-day expenses. This slow build-up of debt creates an invisible vulnerability: minor shocks in income or expense can quickly escalate into financial crises for many.

Savings rates have shown a subtle decline too, especially among middle-aged and pre-retirement households. A recent Federal Reserve survey revealed that nearly 40% of Americans aged 40–65 report they have less saved for retirement than they expected at their current age. At the same time, the proportion of U.S. households with no emergency fund continues to grow, quietly weakening financial resilience.

Taken together, these indicators do not present with sudden drama or sharp spikes. Instead, they signal a gradual shift beneath the surface—a series of invisible turning points affecting economic stability and personal financial security.

Signs We Overlook

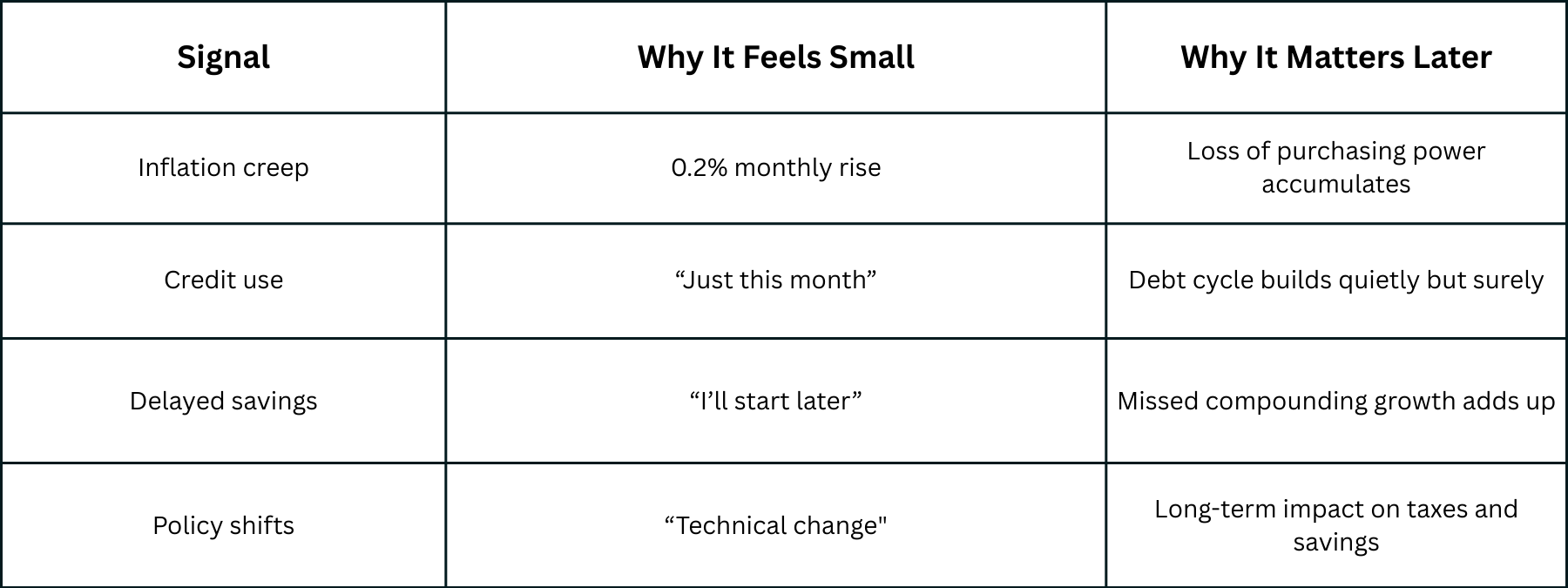

Each of these signals shares a common thread: the initial effect is modest and easily explained away as temporary or trivial.

Inflation creeping up by a fraction of a percent monthly rarely prompts an urgent response. Yet, over a year, this small rise erodes purchasing power by several percentage points—a real cost when applied to food, energy, and healthcare.

Credit card balances accumulating “just this month” feel manageable. It’s a common story—extra bills, unexpected expenses, holiday costs—yet such incremental borrowing compounds, carrying high interest that chip away at both credit scores and future spending capacity.

The phrase “I’ll start saving later” is heard often, whether by choice or circumstance. Delaying savings, even by a few years, can subtract tens of thousands of dollars from retirement security, as missed compounding years cannot easily be recovered.

Finally, policy shifts that appear highly technical—changes in tax laws, retirement account rules, or healthcare subsidies—can quietly reshape financial planning over the long term. Because these changes don’t hit headlines daily, they often feel irrelevant until their consequences become apparent years down the road.

Recognizing these small signals matters, as doing so improves the odds of adapting and preparing before vulnerabilities magnify.

The Emotional Cost of Delay

Choosing to ignore—or simply overlook—these turning points does not mean safety. Rather, it creates a hidden fragility that can amplify stress and anxiety later on. Waiting for a crisis to become visible before acting appears safe in the moment but often leads to rushed decisions under pressure with fewer options.

The emotional toll is subtle but powerful. Financial stress ranks as one of the leading contributors to poor sleep, strained relationships, and declining health among middle-aged adults. This stress feeds on uncertainty, and uncertainty grows when slow changes go unacknowledged.

Paradoxically, the feeling of “not acting yet” gives a false sense of security, even as underlying risks quietly increase. When debt escalates without notice or savings stagnate, the eventual realization can be shockingly disruptive. The invisible turning points thus double as a double-edged emotional burden—first inducing complacency, then triggering regret and urgency.

The calming choice—though not always easy—is to pay attention to gradual shifts, to invite small, manageable adjustments as signals ring faintly. This steady engagement wards off the late-stage anxiety of crisis-driven reaction.

Editorial Reflection — Seeing in Advance

True financial resilience is not about predicting the future with perfect accuracy. Instead, it is the art of noticing quiet signals before they become crises, and weaving adaptability into daily life. It means building systems and habits that respond flexibly to slow shifts rather than waiting for sudden jolts.

This perspective echoes a broader life lesson that goes beyond finance: resilience is cultivated not in the eye of the storm but in the gentle weather before it. For families and individuals, it manifests in patient attention to small expenses, consistent review of changing policies, and readiness to make incremental adjustments rather than abrupt overhauls.

The invisible turning points remind us of the power of reflection in an era obsessed with speed and instant reaction. Quiet awareness, sustained over months and years, may well be the most reliable strategy in an unpredictable world.

Practical Checklist for Navigating Invisible Turning Points

- Track small, recurring expenses monthly to detect subtle increases.

- Compare interest paid on debts with interest earned on savings accounts or investments.

- Monitor policy changes affecting savings, taxes, or benefits, even when described as technical.

- Start micro-savings now—small automatic transfers add up over time.

- Diversify where money sits to reduce risk and improve flexibility.

- Create a quarterly habit of reviewing financial signals—budget variances, debt levels, and new economic data.

Returning to that quiet creak in the floorboard, I see how it mirrors the way financial turning points unfold. They begin as faint murmurs beneath our attention, easy to overlook while life carries on. Yet these murmurs carry the first notes of change, the signals of a future that requires neither panic nor complacency, but steady observation.

Invisible financial turning points work like the slow settling of a home—sometimes unsettling, sometimes revealing. They become visible only after they have taken hold, but they can be managed with calm awareness and gentle preparation. Resilience is built not by waiting for the storm, but by noticing the first subtle winds of change.

—

Claire West