Leaked Footage: The Device Behind Nvidia’s $100B Move

The building doesn’t look like the future.

From the sidewalk, it could be any warehouse on the edge of an industrial park—concrete walls, roll-up doors, a chain-link fence humming under a sodium-vapor streetlamp.

But inside, something is awake.

Light leaks through the high windows in pulses, reflecting off parked cars in soft, shifting bands. There’s a low, constant hum—air systems, cooling units, servers or test benches running long after office buildings have gone dark. A loading dock door is cracked just enough to see the pale glow of screens and the undertone of machinery doing work too important to pause.

Walking past, the thought is impossible to ignore: the world’s biggest changes rarely start on stages or in boardrooms. They start in places that look completely ordinary. Anonymous buildings where parts are tested, components are assembled, and the infrastructure for the next trillion-dollar shift is measured in pallets, cables, and racks.

From the outside, it’s just a warehouse of light. From the inside, it might be the factory floor of the future.

The Unseen Part of Every Breakthrough

Headlines love giants.

Nvidia announces a historic deal and the market reacts in minutes. Tesla unveils a new platform and social media detonates. OpenAI ships a new model and the internet briefly forgets to breathe.

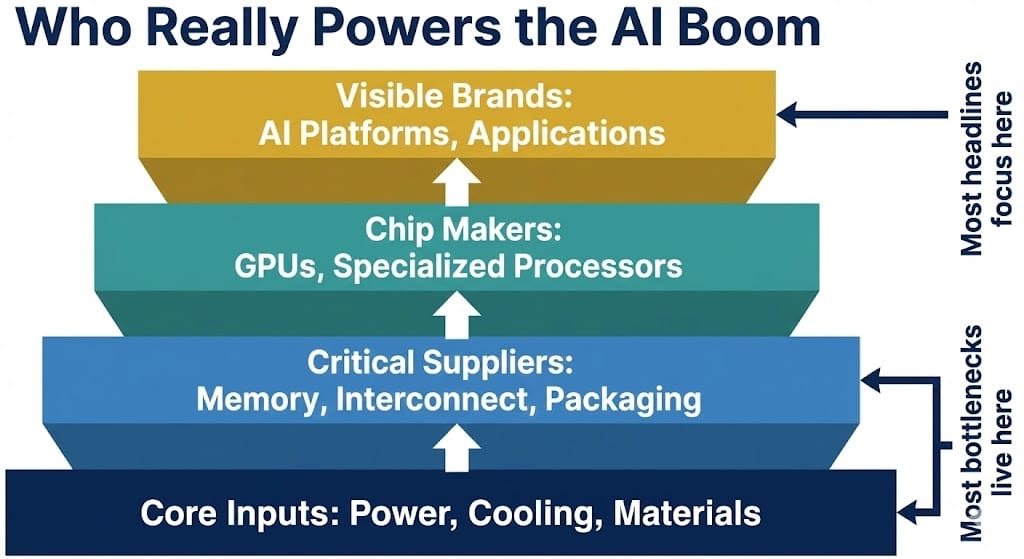

But every explosive breakthrough rests on layers of invisible suppliers no one talks about. The optics company that makes the one lens no one else can produce. The substrate maker whose material allows chips to survive higher power densities. The interconnect firm that solves a bandwidth bottleneck just before demand doubles again.

Public excitement fixates on the visible: the brand on the chip, the logo on the car, the name on the model demo. The real architecture—the companies providing cooling, memory, packaging, power delivery, interconnects—stays in the footnotes, if it gets mentioned at all.

Those silent enablers feel the shift first. Their order books swell before the giant announces anything. Their capacity constraints show up in engineering calls, not press conferences. They are the early signals inside the machine, long before the outside world catches up.

The Acceleration Problem

Modern innovation now moves faster than narratives can keep up.

A deal is negotiated, a supply agreement signed, pilot production ramps, and only weeks later do commentators begin piecing together what it means. By then, the real opportunity—to recognize where value is migrating—has already started to compress.

The gap between “what’s happening” and “what people understand” is widening. AI infrastructure, chip supply chains, data center buildouts—these cycles used to unfold over years. Now they shift in quarters. Information still travels at human speed. Capital no longer does.

Most people see the story when it hits mainstream outlets. But by the time a breakthrough is framed into a headline, the internal re-rating—the repricing of suppliers, the renegotiation of capacity, the quiet race for scarce components—has been underway for months.

Into that widening gap slips a certain kind of message—half signal, half flare.

You better move fast…

Nvidia’s made historic $100 billion deal

…and it’s thanks in part to this mysterious device you see here:The biggest production

According to our research…

This $100 billion deal boom could even turn this little-known supplier…

…into the next trillion-dollar stock.

The Real Bottleneck

For all the talk about AI “intelligence,” the real constraints aren’t mystical. They’re physical.

Bandwidth: getting data into and out of GPUs fast enough. Cooling: pulling heat away from chips pushing power envelopes never seen before in commercial systems. Memory density: stacking enough high-bandwidth memory close enough to compute to keep it fed. Interconnect architecture: stitching thousands of accelerators into a single, coherent system.

These are not problems Nvidia or any other headline name solves alone. They are ecosystem problems. The limiting factor isn’t always the next chip—it’s the substrate it sits on, the optical link it relies on, the cooling loop that keeps it alive at full load.

When analysts talk about “AI capacity,” they often mean chips. But in practice, the next decade of performance may be defined just as much by who can build the fastest pipes and the most efficient plumbing around those chips.

That’s the quiet irony: the companies that never appear in Super Bowl commercials may end up steering the trajectory of entire sectors.

Inversion: The Myth of Early = Risky

Everyone's used to thinking: entering early — risky. Later — safe. But the logic is inverted.

Entering late — that's real risk. When signal becomes hype, price already reflects expectations. The Times Square flash doesn't make opportunity safe — it makes it visible to everyone. Early positions — those taken before noise — give room for error, time for evaluation, chance to exit with profit.

Early — not risk. Just unfamiliar. And unfamiliarity — best filter from the crowd.

The Pattern: Primary vs Secondary Signals

This dynamic isn’t new. It’s just accelerating.

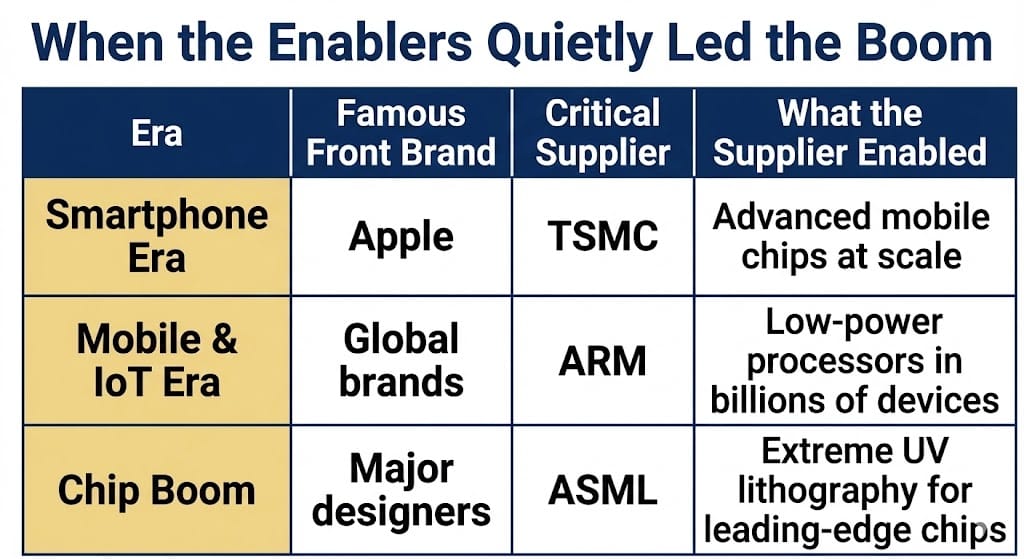

ASML spent years in relative obscurity while chip designers took the spotlight. Yet without its EUV lithography tools, the entire advanced semiconductor roadmap would have stalled. The stock only stepped into the broader conversation after the industry was already dependent on its machines.

TSMC was once “just” a contract manufacturer. As the smartphone revolution took off and Apple leaned on TSMC for leading-edge nodes, that quiet foundry became one of the most critical—and profitable—companies on the planet.

ARM lived in the background of the mobile era, its logo rarely seen by consumers. But its low-power architectures quietly powered billions of devices, capturing value through licensing while others chased hardware margins.

In each case, the primary signal—the visible brand—created noise that distracted from the secondary signal—the enabling supplier whose leverage was growing quietly underneath.

History suggests that when giants surge, someone in the shadows is being pulled upward with them.

A Quiet Machine, A Loud Trajectory

Humans anchor on what they recognize.

Show someone a server rack, and they’ll ask if it’s “running Nvidia.” Show them a car, and they’ll ask if it’s “a Tesla.” The brand becomes the story. The supply chain becomes invisible infrastructure.

This misplaced focus creates opportunity—and fear.

Opportunity, because attention is a finite resource. When everyone’s eyes are on the same three tickers, pricing tends to converge toward consensus. The lesser-known enablers, even when their economics are improving faster, often trade with less scrutiny.

Fear, because shifting attention away from household names feels like stepping off solid ground. Evaluating a supplier means confronting unfamiliar balance sheets, niche technologies, and acronyms that don’t fit easily into cocktail party conversations.

A quiet machine in a warehouse doesn’t look like a story. But its trajectory might be louder than anything on the Times Square screens.

The Economics of Dependency

Nvidia’s growth is not just a function of demand for its chips. It’s a function of its suppliers’ ability to keep up.

When chip performance scales, bottlenecks move outward:

Parts: substrates, capacitors, connectors that can handle higher frequencies and currents.

Power: delivery systems capable of feeding multi-kilowatt racks without instability.

Memory: high-bandwidth stacks manufactured with tolerances that leave no room for error.

Thermal layers: advanced cooling systems—liquid, immersion, or something stranger—that prevent thermal runaway at scale.

If any one of those layers falls behind, the whole system slows. That’s why an AI boom can turn into a power infrastructure problem, or a memory manufacturing crunch, or a packaging capacity constraint.

For regular investors, the mechanics matter more than the slogans. When you see a $100 billion deal, it’s not just a vote of confidence in one company. It’s a promise of multi-year demand rippling across an entire stack of suppliers—some well-known, many barely understood outside specialized circles.

A Crisis of Perception

So why do people miss these moments?

Expectation bias: We expect the future to look like the recent past. If Nvidia led the last wave, we assume it must lead every adjacent wave. That expectation blinds us to new leverage points.

Expertise intimidation: Supply chains feel “too technical.” Investors tell themselves they don’t understand photonics, packaging, or cooling, so they default to the brands they know. Complexity becomes a barrier to curiosity.

Headline reliance: If it hasn’t been featured on Bloomberg or in a viral tweet, it feels unimportant. We outsource our filters to editors and algorithms designed for engagement, not early signal detection.

Underneath all of this is a quieter emotion: regret avoidance. Missing the next Nvidia feels bad. Owning an obscure supplier that doesn’t work out feels worse. So many people choose the familiar pain of being late over the unfamiliar discomfort of being early.

What This Means for Regular People

None of this is about predicting the next trillion-dollar stock.

It’s about understanding that awareness is leverage. When you grasp how architecture works—who enables whom, where bottlenecks live, how dependencies evolve—you no longer need to chase the loudest story in the room.

You can watch for where capital is flowing beneath the headlines. You can notice when a supplier’s name keeps appearing in technical briefs or earnings calls from bigger players. You can treat public flashes—not as instructions, but as invitations to look deeper.

Early visibility doesn’t obligate action. It creates optionality. The option to learn before everyone else is paying attention. The option to decide slowly, rather than react quickly. The option to recognize when a warehouse of light is more than just an anonymous building with machines humming in the dark.

Behind the frosted windows, shapes move—cranes, racks, maybe test stations throwing off that same rhythmic glow. Trucks idle at the loading dock. Somewhere inside, a machine spins up. Somewhere else, a board cools down.

From the street, nothing has changed. No sign announces what’s being built. No banner declares a new era. But the feeling is unmistakable: the invisible is at work.

The next trillion rarely announces itself with a drumroll. It leaks through lighted windows, buried supplier lists, and technical diagrams few people read. And by the time the story reaches the front page, the most asymmetric part of the opportunity has already moved on.

Walking away, she thinks: the job isn’t to guess which warehouse, which supplier, which stack wins.

The job is to remember that behind every bright headline, there is always a quieter room where the real shift began—and to train your eye to look toward the light behind the curtain, not just the logo on the screen.

—

Claire West