Most Americans Missed Section 408(m) — Don’t Be One of Them

I still remember 2008 with a kind of uneasy clarity. The news was a blur of falling banks and bruised blue-chip stocks, but what stands out most isn't the headlines—it’s the feeling of being a passenger as my savings shrank. I’d open my retirement account, watch the numbers slip each week, and reassure myself to simply “wait it out.” But underneath, I wondered: Was there something I could have done? Was there a lifeline I didn’t know about?

I wish I’d understood the options. Back then, I didn’t realize there were legal, overlooked moves that could have added a measure of stability when the seas turned rough—moves the financial press rarely discussed.

If you’re feeling that same passenger anxiety today, this post is for you. There’s more than one way to weather a storm, and sometimes the raft is right there—if you know where to look.

The Storm Around Us

In 2025, the headlines are again turbulent. We see banks closing branches and tightening withdrawal rules. Treasury signals reveal worries about debt, inflation, and (in some corners) the dollar itself. Stock charts look like heart monitors—spikes one quarter, drops the next.

This turbulence isn’t limited to big investors or Wall Street traders. It surfaces in quiet conversations at kitchen tables and community centers. People worry aloud: Will my 401(k) last? Should I trust the “wait it out” plan again?

- Retirees fret about account balances being slashed just as they need income most.

- Families saving for college or a first home fear each stock drop cuts their dreams down.

- Mid-career workers question if the “safe” path is as secure as it once seemed.

The storm is more than numbers—it’s a rising sense of uncertainty. Many feel they’re holding on tight, but don’t like the view from deck.

Here's what few are talking about - but the wealthy already know:

U.S. Tax Code Section 408(m)

Never heard of it? That's the point.

This IRS-backed provision allows qualified Americans to reposition a portion of their 401(k), IRA, TSP, or 403(b) - without penalties, without moving to cash, and without staying fully exposed to a system that's clearly shaking.

No hype.

Just protection, privacy, and a strategy Wall Street rarely mentions.

Request your FREE 408(m) Guide now and uncover how this little-known IRS rule could be the raft that helps you ride out the next wave - before it's too late.

The Illusion of Holding Tight

“Just wait it out.” It’s the common wisdom, echoed in books, blogs, and often by advisors with a stake in keeping assets parked in mutual funds.

But the truth is, waiting it out isn’t always the safest option. Let’s look at real-world scenarios:

- Retiree: In 2008, millions watched years of careful savings vaporize. For those already living off withdrawals, staying “fully invested” forced them to sell at new lows—turning paper losses into permanent ones.

- Family Saver: In 2020, market chaos alongside global headlines hit IRAs and 529 plans. “Waiting” brought roller coaster anxiety, and some exited at the worst possible moment out of fear.

- Mid-career Worker: With decades left, market declines can sound like “buy low,” but for anyone nearing a job change, relocation, or early retirement, the risk of waiting out another major drawdown becomes very real.

The doctrine of “holding tight” only works if you have unlimited time, zero need for liquidity, and a stomach for volatility most people never truly possess.

And yet—for most, it’s the only path they’ve ever been shown.

The Raft Few Mention: IRS Tax Code 408(m)

Enter IRS Section 408(m)—a part of tax law that has quietly offered an alternative for those paying attention. Here’s what matters:

- 408(m) allows you to move retirement savings (e.g., from an IRA, 401(k), or other qualified plans) into physical precious metals—like gold and silver—without triggering taxes or penalties.

- Accounts that may qualify: Traditional and Roth IRAs, some 401(k)s, TSPs, and 403(b) plans (rules for rollovers/eligibility may vary).

- Why so few mention it? Large Wall Street firms profit from keeping your assets inside equities and bonds, where they charge management fees. Moving part of your nest egg into alternative assets cuts into their bottom line—meaning you rarely hear about 408(m) in glossy fund prospectuses.

How does it work? Under well-defined IRS rules, you can transfer a portion of your qualified retirement account to a self-directed IRA that lets you hold approved metals. This isn’t a loophole or a risky scheme—it’s in the code, there for the prudent to use.

Why It Matters

Why does this move—the “raft”—matter so much?

- Peace of Mind: When markets lurch, you know a portion of your savings isn’t rising and falling tick for tick; historically, gold and silver often hold value through both inflation and crisis.

- Volatility Protection: Diversifying with physical assets can help offset stock and bond losses during economic earthquakes.

- Privacy: Physical gold and silver in your self-directed retirement account can offer more privacy and less systemic risk than typical brokerage assets.

- Control: You’re not all-in on Wall Street or reliant on any one company or currency for your entire future.

Owning even a fraction of your long-term savings outside the “hold tight and hope” playbook is an act of self-reliance—one Wall Street is unlikely to offer you directly.

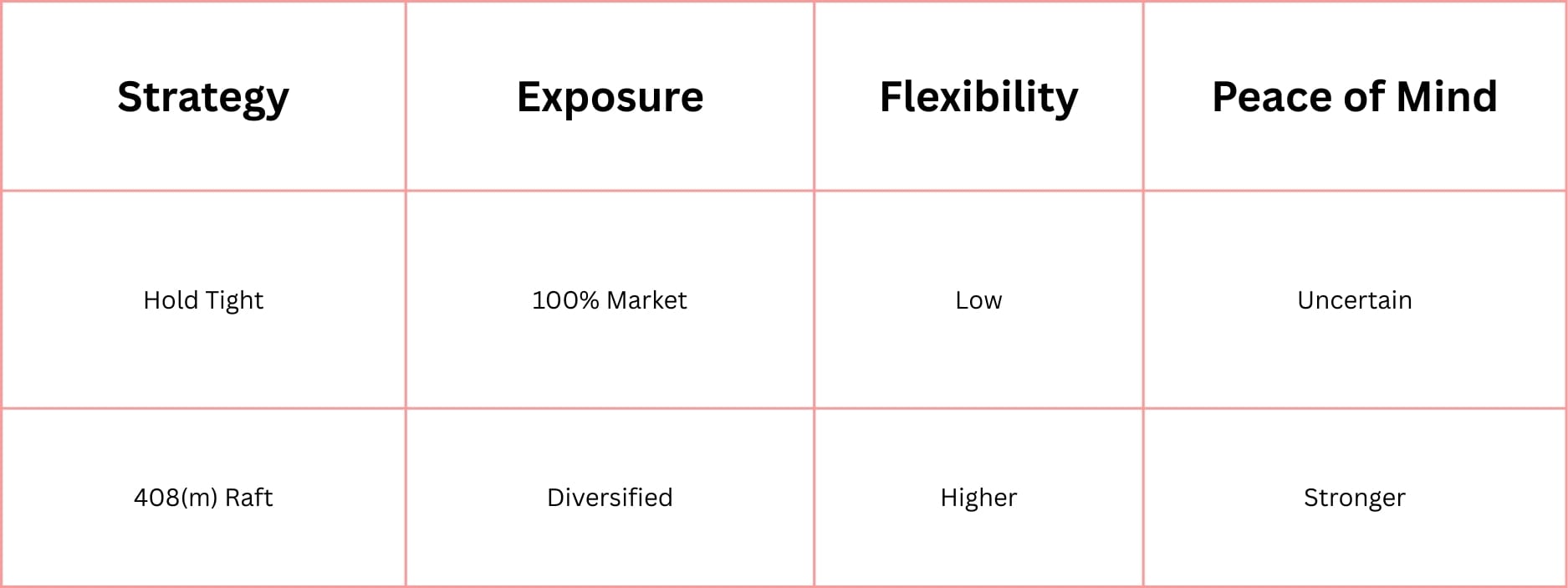

“Holding Tight” vs 408(m) Move

The difference here isn’t just what you own—but how it makes you feel when the market’s waves rise.

Checklist: How to See If 408(m) Is Your Raft

- Check if you qualify: Review your current retirement accounts—does your IRA, old 401(k), or similar plan allow rollovers?

- Review your account type: Not all plans are eligible for precious metals rollovers. Understand what can (and can’t) move.

- Talk to a tax advisor or trusted specialist: They can clarify the process and ensure compliance.

- Research reputable custodians: If you proceed, choose a self-directed IRA provider with experience in precious metals.

- Start modestly: You don’t have to jump in fully—see if moving even a small portion helps you sleep better.

The storms aren’t new. What changes is how prepared you are when the next wave crests.

Will you “hold tight,” gritting your teeth and hoping for the best? Or will you, quietly and wisely, choose a raft—an alternate course embedded in the law, but overlooked by most?

Don’t wait for someone else to offer you the life jacket. Ask the questions, learn your options, and choose the combination of strategies that fits your future—not just your fund manager’s bottom line.

In a world where waves are coming, the crucial question isn’t whether they arrive—but whether you’ve picked your raft in time.

—

Claire West