My One-Page Financial Plan

A few years ago, I found myself tangled in complicated financial plans that stretched across dozens of spreadsheets, apps, and documents. Each new tool promised more insight, but instead, I felt overwhelmed and disconnected from my money’s real story. The more I tried to capture every detail—projecting retirement decades ahead, calculating every category, tracking every receipt—the less clear things became.

One quiet evening, I pulled out a blank page and asked myself a simple question: What if my whole financial life fit on just one page? This wasn’t about oversimplifying or ignoring nuance. Instead, it was about clarity through structure, about a calm dashboard that shows me where I stand and what matters most.

That’s how my one-page financial plan was born. It’s warm, personal, and straightforward enough to use every month—and it’s earned a permanent place in my routine. Today, I want to share it with you, so you can build your own roadmap to financial clarity without the noise.

The 5 Core Sections of My One-Page Financial Plan

My plan is organized into five clean, focused sections. Each section answers a key question about your money, using clear, simple language and practical numbers.

1. Goals

What am I aiming for?

This section lays out your top 3–5 financial goals—big or small, short or long term. Goals keep your plan purposeful, not just reactive.

Examples:

- Build a 6-month emergency fund

- Pay off credit card debt in 12 months

- Save for a down payment on a house

- Max out retirement account contributions

- Take a memorable vacation next summer

Writing goals this way invites intention, focus, and momentum. No vague hopes, but clear resolutions.

2. Assets

What do I own?

Here, you list your key financial resources—accessible cash and invested assets that grow your cushion and options.

Examples:

- Checking account balance: $5,000

- Savings account: $10,000

- Retirement accounts (401(k), IRA): $35,000

- Brokerage account: $12,000

Assets don’t have to be fancy numbers or complex assets—just what you currently have and can count on.

3. Debts

What do I owe?

This section tracks outstanding balances and paints a clear picture of liabilities that affect your net worth.

Examples:

- Credit card balances: $3,200

- Student loan balance: $18,000

- Car loan: $7,500

- Mortgage: $150,000

Knowing your debts is key to making intentional paydown plans, and it’s reassuring to see progress in the numbers.

4. Income

Where does my money come from?

This section captures your regular inflows—the foundation for planning and spending.

Examples:

- Salary (after taxes): $4,200/month

- Freelance income: $700/month (variable)

- Dividends/Side hustle: $150/month

Calculating a realistic total income helps keep your plan grounded and actionable.

5. Expenses

Where does my money go?

Here, I focus on big-picture expense buckets rather than detailed categories, simplifying the view into digestible pieces.

Examples:

- Rent/Mortgage: $1,200

- Utilities & Bills: $300

- Groceries: $400

- Transportation: $150

- Discretionary spending: $600 (dining out, hobbies, etc.)

Tracking broad groups prevents analysis paralysis and shines a light on where adjustments will matter most.

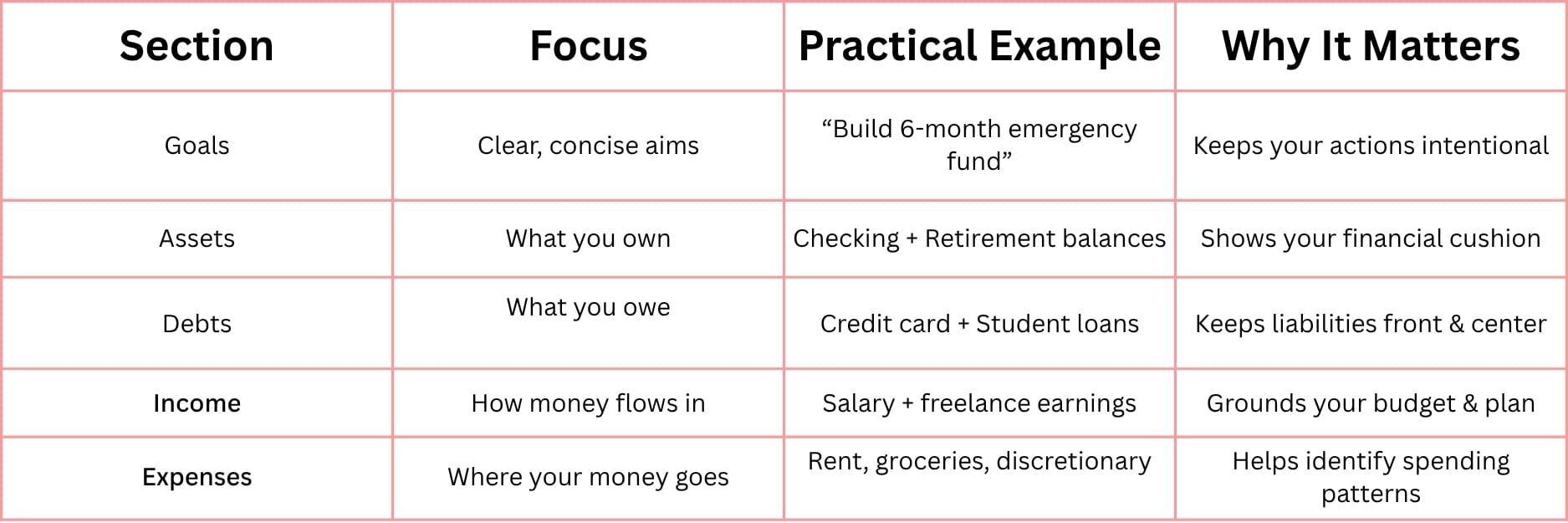

A Simple Visual Summary of the Plan

Below is a table that summarizes the one-page plan layout, with a calm, minimalistic aesthetic in mind. This structure fits perfectly into a single printable page, a Notion doc, or a well-formatted Google Sheet.

A Practical, Gentle Checklist for Creating Your Own One-Page Plan

- Set aside a quiet 30 minutes. Pull up a fresh document or sheet—your canvas for clarity.

- Jot down 3 to 5 key financial goals. Write them like promises to yourself, not vague wishes.

- List the balances in your main asset accounts. Include cash, retirement, and investment accounts.

- Record your outstanding debts and balances. Be honest—this is your launchpad for progress.

- Calculate your regular monthly income from all sources. Use averages if income fluctuates.

- Estimate your broad expense groups for a typical month. Keep it simple—round numbers are fine.

- Review and update monthly or quarterly. Your plan is a living document, growing with your goals.

- Add a short note on how your money felt this month. The emotional check-in helps maintain connection and kindness.

Final Thoughts: Empowerment in Simplicity

Financial plans often get tangled in complexity, as if more spreadsheets or endless categories equals more control. But the truth I’ve learned is that clarity comes from simplicity. A one-page financial plan invites you to see the forest, not just the trees. It aligns your goals with your reality and grounds your choices in numbers that actually matter.

If you’ve ever felt frozen by financial overwhelm, this approach offers an invitation to start fresh today. No fancy tools required—just your honest numbers, your intentions, and a little space for reflection.

Your money story doesn’t have to be complicated to be powerful. It just has to be clear, kind, and yours.

—

Claire West