Palantir’s Past — and What Mode Could Mean for the Future

I still remember the day in September 2020 when Palantir Technologies went public. The buzz was electric. For months, analysts and tech enthusiasts had been whispering about this secretive data company—the one co-founded by Peter Thiel that worked with government agencies and Fortune 500 companies to make sense of massive datasets.

The IPO wasn't your typical Wall Street debut. Palantir chose a direct listing over a traditional IPO, allowing existing shares to trade immediately without raising new capital. It was unconventional, bold, and very much in character for a company that had operated in the shadows for nearly two decades.

What followed was nothing short of spectacular for early investors. Within months, the stock soared, delivering gains that reached as high as 2,500% for those who got in at the right time. Friends who had bought shares in the initial trading frenzy were suddenly sitting on small fortunes.

But as I reflect now, nearly five years later, it's clear that Palantir's explosive growth story belongs firmly to the past. The early investors captured lightning in a bottle, but the company today trades at valuations that leave little room for error—and even less room for new investors to replicate those extraordinary returns.

The Palantir Lesson: When Opportunity Windows Close

To understand why Palantir represents a closed chapter, we need to look at the numbers. The company's stock price surged from its early trading levels of around $10 per share to peaks near $45 in early 2021. Even after various corrections and market adjustments, those who bought in early still realized massive gains.

Today, Palantir trades at approximately 245 times forward earnings—a valuation that reflects incredibly high expectations for future growth.

To put this in perspective, let's use a simple financial formula:

Forward P/E Ratio = Current Stock Price ÷ Expected Earnings Per Share

When a company trades at 245× forward earnings, it means investors are paying $245 for every $1 of expected annual profit. For comparison, the S&P 500 typically trades at around 15-20× earnings. This isn't necessarily wrong—growth companies often command premium valuations—but it means the stock is priced for perfection.

Here's the challenge: when expectations are this high, even modest disappointments can trigger significant price drops. Miss earnings by a few cents, lose a major contract, or face unexpected competition, and the stock can fall dramatically. We've seen this pattern repeatedly in tech investing—companies that soar on high expectations often face equally dramatic falls when reality doesn't match the hype.

The broader lesson from Palantir is that timing matters immensely in growth investing. Those who recognized the company's potential in 2020 and early 2021 were rewarded handsomely. But trying to chase those gains now means buying at prices that assume nearly flawless execution for years to come.

The Search for the Next Big Opportunity

This reality got me thinking: while everyone was watching Palantir's meteoric rise, were other companies quietly building something potentially even bigger?

That's when I discovered Mode Mobile, a pre-IPO company with a growth story that makes even Palantir's early numbers look modest. Mode reported 32,481% revenue growth in their recent filing—a number so large it almost seems impossible.

But here's what makes this figure credible: Mode operates in the mobile app economy, specifically in the "rewards" space where users earn money for everyday activities. This sector has exploded as consumers increasingly demand value from their digital interactions.

Mode's business model is elegantly simple yet revolutionary. Instead of following Big Tech's playbook of harvesting user data while offering free services, Mode flips the equation: they pay users directly for their screen time and engagement.

Understanding Mode's Business Model

The traditional tech model that companies like Facebook, Google, and TikTok pioneered works like this: offer a free service, capture user data and attention, then monetize that information through advertising. Users get entertainment, companies get billions in ad revenue, but the actual value creators—the users—receive nothing beyond the service itself.

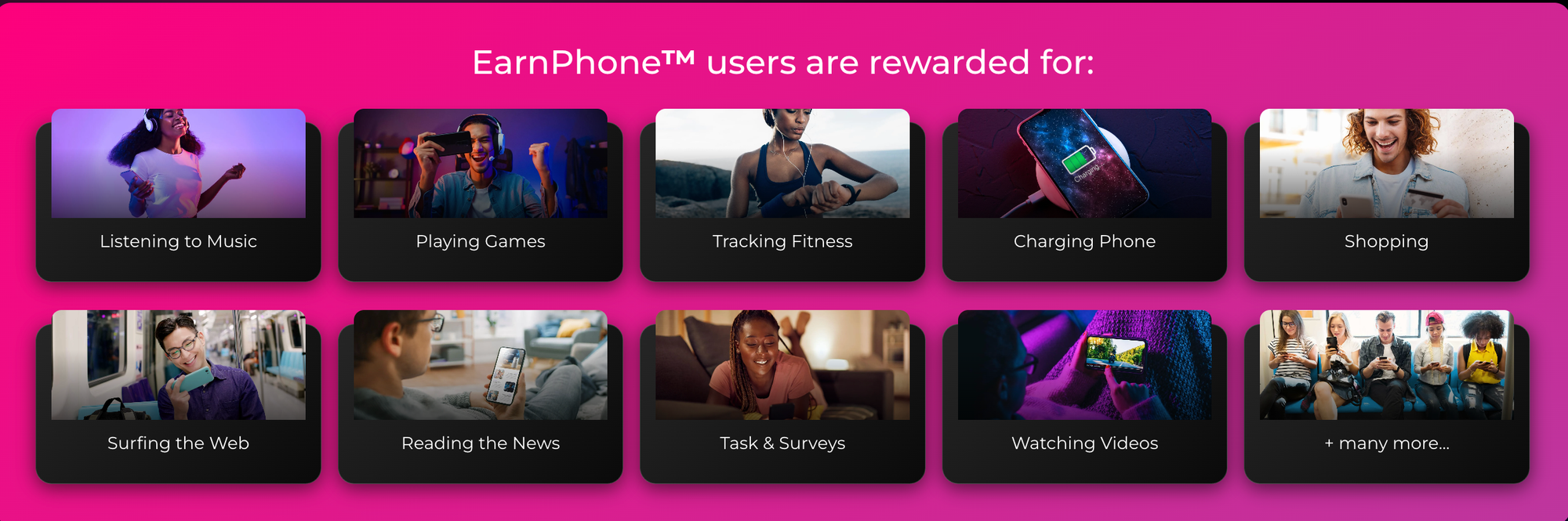

Mode changes this dynamic fundamentally. Their mobile app pays users for activities they're already doing: watching videos, playing games, shopping online, or simply using their phones. The company partners with advertisers and brands who pay for user engagement, then shares a portion of that revenue directly with users.

This isn't just charitable—it's smart business. By paying users, Mode creates incredibly high engagement rates. Users have a financial incentive to remain active on the platform, leading to the kind of "stickiness" that advertisers value most.

The numbers back this up: Mode claims over 50 million active users and has paid out more than $325 million directly to those users. For context, that's more than many public companies distribute in dividends to shareholders.

Perhaps most importantly, Mode has generated $75 million in actual revenue—not just user growth or engagement metrics, but real money flowing through their business. In an era where many tech companies trade on potential rather than performance, Mode's revenue generation stands out.

Why Mode's Timing Could Be Perfect

Several macro trends suggest that Mode's approach—paying users for their data and attention—may be arriving at exactly the right moment.

First, regulatory pressure on Big Tech is intensifying. Governments worldwide are scrutinizing how companies like Facebook and Google collect and monetize user data. Mode's transparent, revenue-sharing model could appeal to regulators looking for more ethical alternatives.

Second, consumer awareness about data value is growing. People increasingly understand that their personal information has monetary worth and are beginning to demand compensation. Mode positions itself at the forefront of this shift.

Third, the creator economy has exploded, with platforms like YouTube, TikTok, and Instagram paying billions to content creators. Mode extends this concept to regular users—everyone becomes a potential earner, not just influencers with large followings.

The company has also secured a Nasdaq ticker symbol: $MODE, signaling serious intent to go public. This isn't a speculative startup hoping to eventually list—it's a company with the fundamentals to support a major exchange listing.

The Pre-IPO Opportunity and What It Means

Here's where Mode's story becomes particularly interesting for individual investors. While institutional investors and venture capitalists typically dominate pre-IPO investing, Mode is making shares available to everyday investors at $0.30 per share.

This democratization of pre-IPO access represents a significant shift in how companies approach fundraising. Traditionally, retail investors could only buy after a company went public—often after the biggest gains had already been captured by insiders.

Mode's approach allows regular investors to participate at the same price point as institutional backers. If the company successfully goes public and performs well, early investors could potentially realize significant returns similar to what Palantir's early backers experienced.

- 50M+ users;

- $325M+ paid to users;

- $75M in real revenue;

- Nasdaq ticker secured for potential IPO;

- Pre-IPO shares available at just $0.30/share;

>>> See how to get Mode pre-IPO shares before the round closes

(by Mode Mobile)

Risk Assessment and Realistic Expectations

However, it's crucial to approach any pre-IPO investment with clear eyes about the risks involved.

First, most startups fail. Even companies with impressive early metrics can struggle to scale, face unexpected competition, or encounter execution challenges. Mode's growth numbers are encouraging, but they don't guarantee future success.

Second, pre-IPO investments are illiquid. Unlike public stocks that can be sold immediately, pre-IPO shares typically can't be traded until the company goes public—if it ever does. Investors should only allocate money they can afford to have tied up for extended periods.

Third, valuations can be volatile. A $0.30 pre-IPO share price might seem attractive, but there's no guarantee the public market will value the company higher. Some companies actually trade below their pre-IPO prices after going public.

Finally, regulatory changes could impact the business model. Mode's revenue-sharing approach, while innovative, operates in a rapidly evolving regulatory environment around data privacy and user compensation.

Actionable Checklist for Speculative Investing

For readers considering pre-IPO or other speculative investments, here's a practical framework:

- Limit allocation size: Never invest more than 5-10% of your portfolio in any single speculative opportunity

- Read the offering circular: Understand the company's business model, financials, and risk factors thoroughly

- Verify key metrics: Look for third-party validation of user numbers, revenue claims, and growth statistics

- Consider your timeline: Pre-IPO investments may be illiquid for years—ensure you don't need the money

- Diversify your risk: If investing in pre-IPO companies, spread investments across multiple opportunities

- Stay informed: Follow the company's progress and industry trends that could affect its prospects

The Broader Investment Philosophy

What Palantir taught us—and what Mode reminds us—is that the biggest opportunities often come from recognizing trends before they become obvious to everyone else.

Palantir benefited from the growing importance of big data analytics at a time when most investors didn't understand the space. Early backers who recognized this trend were rewarded accordingly.

Mode may be positioned similarly at the intersection of several emerging trends: the creator economy, data monetization, regulatory pressure on Big Tech, and growing consumer awareness about data value.

The key is learning to identify these inflection points while maintaining realistic expectations about risk and reward.

Financial Formula for Evaluating Growth Companies

When evaluating high-growth companies like Mode, I use a simple framework:

Growth Sustainability Score = (Revenue Growth Rate × User Retention) ÷ Customer Acquisition Cost

This helps balance impressive growth numbers against the underlying economics. Companies with high growth, strong retention, and efficient user acquisition typically have more sustainable business models.

Lessons from Yesterday, Opportunities for Tomorrow

Palantir showed us what's possible when technology meets timing and investor recognition converges at the right moment. Those who recognized the company's potential in 2020 captured extraordinary returns, but that window has largely closed.

Mode Mobile presents a different kind of opportunity—one that's still in the early stages, with a business model that could reshape how we think about user-platform relationships.

The question isn't whether Mode will replicate Palantir's success—every company's journey is unique. The question is whether the trends Mode is riding—user empowerment, data monetization, regulatory pressure for fairness—will prove as powerful as the big data revolution that lifted Palantir.

For investors, the lesson is clear: yesterday's winners teach us to recognize tomorrow's opportunities. Palantir belongs to the past, but stories like Mode remind us that the next chapter is always being written.

The challenge, as always, is recognizing those stories before they become obvious to everyone else.

👉 Learn more about Mode's pre-IPO opportunity before the current round closes (by Mode Mobile)

Disclosures

Mode Mobile recently received their ticker reservation with Nasdaq ($MODE), indicating an intent to IPO in the next 24 months. An intent to IPO is no guarantee that an actual IPO will occur.

The Deloitte rankings are based on submitted applications and public company database research, with winners selected based on their fiscal-year revenue growth percentage over a three-year period.

Please read the offering circular and related risks at invest.modemobile.com.

—

Claire West