The Algorithm That Beat Wall Street Just Flashed Green Again

Every bull run begins quietly — not on CNBC, not in Reddit threads, but deep inside data models that see what humans don’t.

For decades, the world’s smartest traders have searched for an edge. Some chase headlines, others follow instincts. But the most consistent wins rarely come from either. They come from signals — silent, persistent, and often ignored by the crowd. The Weiss Ratings algorithm is one of those rare signals. Not hype or rumor, but cold, quantified pattern recognition that has a track record even Wall Street whispers about.

This isn’t some Twitter trading cult. The Weiss system called Apple at 50¢, Nvidia at 40¢, Netflix at $3.70 — and stuck to its rules, even when the narratives were bearish. Across hundreds of picks — wins and losers included — the system has logged a staggering 300%+ average return. It’s not perfect, but it doesn’t need to be. And now, as mainstream attention looks elsewhere, the algorithm just flashed green on three new names.

The Secret of the Weiss Method

Forget gut feeling. Forget chatroom tips. The Weiss Method is pure quantified advantage. Here’s the secret: it isn’t magic or insider info, it’s relentless analysis.

The Weiss system uses:

- Decades of historical price and earnings data,

- Balance sheet momentum to find companies quietly accelerating,

- Cash-flow velocity (think money moving through the books faster than competitors),

- Sentiment compression — detecting when panic or apathy has mispriced a winner.

It’s like running an MRI on the entire market, layer by layer, until invisible strength shows up before the story breaks.

No trying to outguess Fed policy, no celebrity CEO drama. Just data, logic, discipline.

Specifically, it identified three under-the-radar picks that could thrive in 2025 and beyond …

And we're giving away their names and ticker symbols — FOR FREE .

That's right, if you missed out on the 3x … 5x … or even 10x gains of the past years …

This could be your best chance to make it right.

Make sure you don't miss it.

Why This Moment Feels Different

2025 isn’t smooth. AI disruption, interest rate whiplash, and retail fatigue have shaken the easy optimism out of tech and blue chips. Volatility reigns.

Most analysts have retreated to “safe” predictions, wary of sticking their necks out for the next 10-bagger. But Weiss algorithms thrive in this environment — because chaos amplifies mispricing, and when emotional noise drowns out logic, data-driven systems shine.

In markets like these,

“Where others see noise, the model sees signal.”

This year, fresh money will flow mostly after the move is obvious. But the edge — the place where outsized returns are captured — lives in the quiet moment when the model flashes green, and nobody else is watching.

Proof in the Numbers

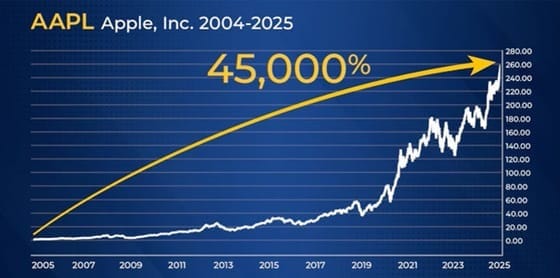

Apple (AAPL): The algorithm tagged it at 50¢ when the Mac was “dead” and the iPod was still a dream. Now? +45,000%.

Nvidia (NVDA): Flagged at 40¢, when “graphics” sounded like a boring adjunct to Dell. Now? +30,000%.

Netflix (NFLX): Called at $3.70 — back in the days of mail-order DVDs and Blockbuster dominance. Now? +27,000%.

You missed those once.

You don’t have to miss what’s next.

The Three New Flashing Greens

Here’s where the anticipation sharpens.

In the last 48 hours, the Weiss algorithm triggered three new “all-green” signals — stocks with the profile that beat both fear and apathy.

No tickers revealed yet, but here’s what they have in common:

- Still under $15, all with room to 10x without stretching reality,

- Stable enough to survive a downturn, dynamic enough for explosive upcycles,

- Anchored in sectors the masses continue to underestimate: AI infrastructure, long-duration energy storage, and defense tech riding the new global rearmament.

They won’t be hidden much longer.

The real clue? Big money is already circling. Institutional order books show new block buys and options volume. The same patterns that preceded the last three big winners have returned.

The Human Angle — Eliza’s Warning

Sometimes, the best clarity comes from someone on the inside.

Eliza, the Weiss chief analyst, puts it this way:

“Every single time the system flashed like this, the average gain was 303%. And it’s flashing again now. Most investors only see it in hindsight. But right now, the door is open — briefly.”

This is not promise, not prophecy. It’s probability, backed by decades of objective testing. If you’re reading this before the move — you’re early. If you wait for the crowd, the best seat will be gone.

Apple at 50¢. Nvidia at 40¢. Netflix at $3.70.

Now, Weiss Ratings’ algorithm is lighting up for three new stocks — and they’re giving the names away for free.

The signal never lies — but it rarely shouts.

Three new names are flashing. The algorithm is green. The next legendary trade might already be loading. The only real question: Will you act, or will you wait until CNBC is writing the script?

—

Claire West