The Convergence Nobody Is Watching

The Federal Reserve meets. Market watchers dissect the language. Traders position for rate expectations. Portfolios are rebalanced. The machinery of market conversation turns, month after month, around a single variable: interest rates.

It is the most important, and simultaneously, the most misleading focus in modern finance.

While markets fixate on the Fed, something far more significant is happening in the spaces between the headlines. Geopolitical blocs are restructuring capital flows. Demographic shifts are undermining the transmission of monetary policy itself. Artificial intelligence is compressing industrial transformation from decades into quarters. Defense budgets are becoming permanent fixtures of government spending. Supply chains are being deliberately torn apart and reassembled along political lines, not economic ones.

These forces are not cyclical. They are not responding to rate moves. They are, instead, reshaping the environment in which rates operate at all.

This is convergence. And it arrives invisibly.

Why Rate Debates Make Investors Feel Certain

There is comfort in rate discussions. The variable is singular. The Fed moves; markets react. The logic is linear, the causality clear. A quarter-point cut creates a measurable effect. Duration extends. Yield-sensitive sectors outperform. The narrative holds together.

This comfort is not without reason. Rate changes do affect markets. But the reason rate conversations are so dominant is precisely because they are tractable—they feel knowable in a way that geopolitical reshaping or demographic structural shifts do not. You can forecast a Fed meeting. You cannot forecast when a government decides to restructure its entire supply chain strategy, only that it will take a decade to complete.

Markets are biased toward stories they can analyze quarterly. Structural shifts unfold across administrations and generations. By the time structural shifts become obvious, the investors who positioned earlier have already gained years of compounding.

Here is the critical insight: interest rates can no longer be interpreted solely as macroeconomic tools. They have become political signals, social stress points, and market risk factors simultaneously. A rate move is no longer just a Fed decision. It is also a geopolitical signal, a debt servicing crisis waiting to manifest, a currency fragmentation event, and a signal about the capacity of governments to finance themselves.

The single-variable analysis fails when the system is changing.

While everyone's focused on the Fed and interest rates... most investors are missing the real story.

There's a deeper, more powerful economic shift happening behind the scenes, one that's unlike anything I've seen in my four decades on Wall Street.

I call it The Economic Singularity.

We're talking about an economic transformation so profound it could create explosive wealth for those who understand it. But for those that don't, it could bring devastating financial consequences.

I don't say this to scare you, folks. In fact, I want to make sure you know exactly what's coming and how you can prepare for it the right way.

That's why I've prepared this new video to explain why this matters and what you can do to stay safe in this economic shift that could reshape America's financial landscape as we know it.

What Actually Converges

Economic convergence is not a metaphor. It is a specific pattern: multiple independent forces—technological, political, demographic, fiscal—begin interacting at the same time, creating amplification effects where each force intensifies the others.

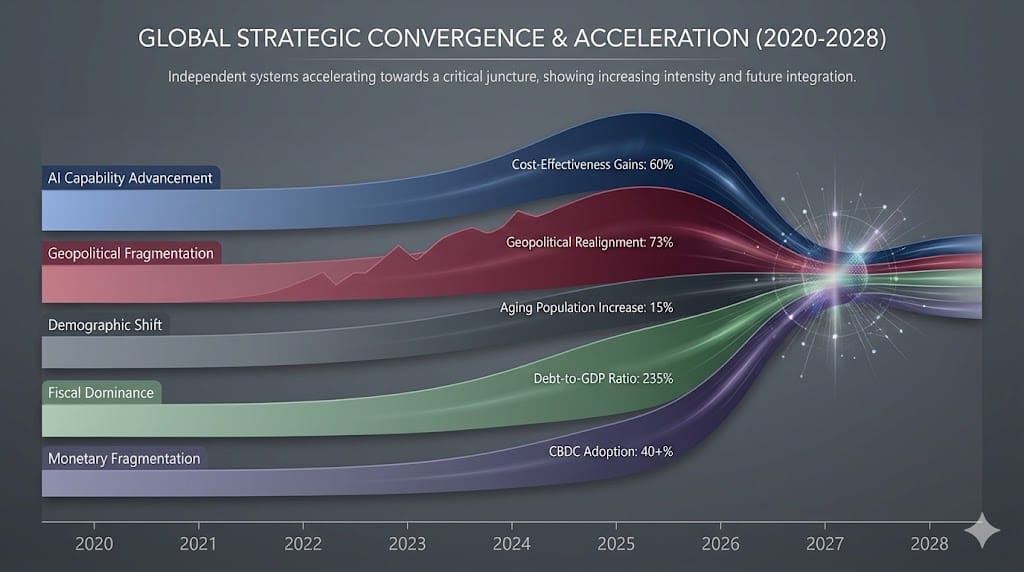

Consider the components visible in 2025:

Artificial Intelligence is reaching performance thresholds where it displaces human labor across sectors, not sequentially but simultaneously. Cost-effectiveness ratios are becoming viable. Compressed timelines mean industrial transformation happens in months and quarters, not decades.

Geopolitical fragmentation is restructuring supply chains, energy markets, and defense spending not based on economic efficiency, but on political alignment. Supply chain destruction—the deliberate reshoring of critical infrastructure—is now a national strategy. This is structural, not cyclical.

Demographic shifts are fundamentally weakening the transmission of monetary policy. Aging populations respond less to rate changes than younger ones. The elderly hold assets; they care less about borrowing costs. This is not a forecast. This is measurable reality already embedded in advanced economies.

Fiscal dominance has shifted from aberration to structural norm. Governments prioritize strategic investment in defense, AI, infrastructure. Austerity is no longer the governing framework. Global debt stands at 235 percent of GDP, constraining policy flexibility. Rate decisions are now made within a fiscal straitjacket, not a vacuum.

Monetary fragmentation is already visible. Central banks face conflicting mandates between inflation control and financial stability. Competing monetary blocs and alternative payment systems are emerging. Trust in fiat currencies is being tested.

Each of these forces is real. Each moves at different speeds. But together, at a specific moment, they begin reinforcing each other. AI acceleration intensifies geopolitical competition. Geopolitical fragmentation constrains monetary flexibility. Fiscal dominance limits rate-setting independence. Demographic structure weakens the effectiveness of whatever rates are chosen.

This is not prediction. This is description of what is already happening.

Why Linear Thinking Fails During Convergence

Investors typically assume smooth transitions. GDP grows steadily. Asset prices move in correlated patterns with yields. Volatility is cyclical. Systems decompose linearly.

But convergence points are not linear. They are inflection moments where velocity accelerates faster than historical models suggest. A system that moves at steady-state for decades can shift direction rapidly when multiple pressures align.

The danger is that during the buildup to convergence, each force individually seems manageable. AI disruption is real, but adoption is gradual. Geopolitics is tense, but supply chains are sticky. Rates are rising, but markets are stable. Demographics are aging, but slowly. Fiscal dominance is evident, but sustainable for now.

But the system does not change when you understand it intellectually. It changes when the forces actually collide.

This is why preparation beats prediction. You cannot time convergence exactly. No analyst can say "convergence occurs March 2026, volatility rises 40 percent." But you can understand the forces and position for the range of plausible outcomes. You can think in scenarios rather than point forecasts.

Historical Echoes

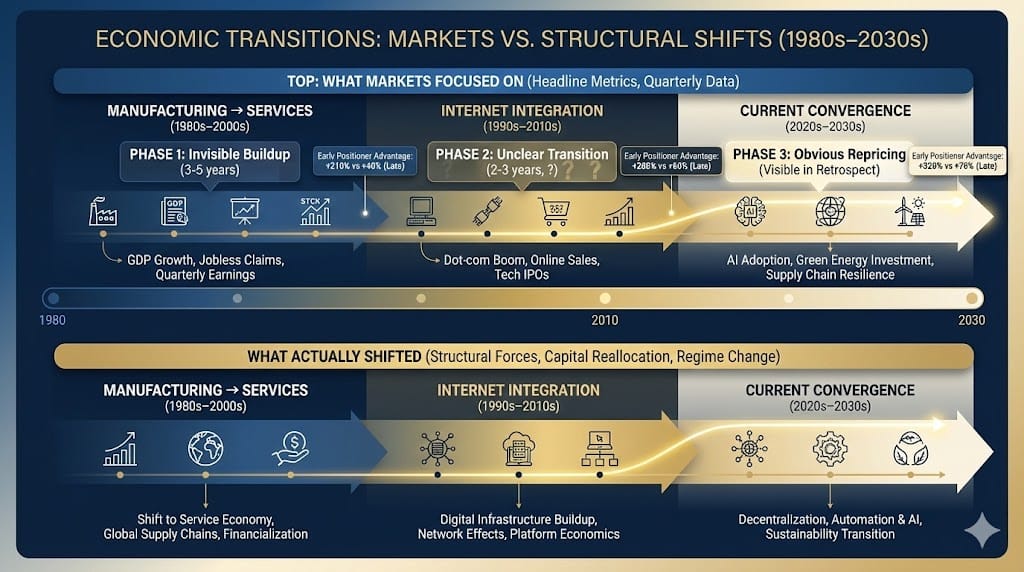

Moments of major systemic change—not crashes, but actual directional shifts—share a consistent pattern: they are invisible during buildup, obvious only in retrospect.

Nobody predicted the transition from manufacturing to services economies because they saw it happening quarterly. The transition occurred because capital, technology, and labor gradually reorganized. By the time it was obvious, entire regions had already been restructured.

The internet did not "crash the economy" in the 1990s; it restructured capital allocation, rewarded connectivity, punished intermediaries. The transition happened over years, through recessions and booms, until a new regime stabilized.

In each case, investors who positioned during the unclear middle phase—when forces were converging but not yet synchronized—benefited disproportionately from early recognition. Investors who waited for clarity waited too long.

The pattern is consistent. Convergence is invisible until it isn't. By the time it becomes obvious, repricing has already begun.

Why Understanding Matters More Than Timing

The intent of this analysis is not to predict when convergence peaks or which asset reprices first. It is to clarify that markets are currently obsessing over a single variable (interest rates) while multiple systemic forces are organizing simultaneously beneath headlines.

This creates an asymmetry. Investors focused on Fed calls are preparing for cyclical volatility. Investors aware of convergence are preparing for structural transition. One group is optimized for short-term noise. The other is positioned for long-term regime change.

You cannot predict exactly when geopolitics reshapes capital flows. But you can recognize that it is happening and position accordingly. You cannot time the moment AI integration creates mass displacement. But you can identify companies leveraging AI for competitive advantage before the market prices it.

You cannot forecast when aging demographics make rate policy less effective, but you can understand that this weakening is already here, changing what rates actually accomplish in the economy.

The preparation is not about perfection. It is about frameworks—thinking in scenarios, understanding reinforcing dynamics, recognizing that isolated variables no longer explain market behavior.

The Convergence Nobody Is Watching

The Federal Reserve meets. Market watchers dissect the language. Traders position for rate expectations. Portfolios are rebalanced. The machinery of market conversation turns, month after month, around a single variable: interest rates.

It is the most important, and simultaneously, the most misleading focus in modern finance.

While markets fixate on the Fed, something far more significant is happening in the spaces between the headlines. Geopolitical blocs are restructuring capital flows. Demographic shifts are undermining the transmission of monetary policy itself. Artificial intelligence is compressing industrial transformation from decades into quarters. Defense budgets are becoming permanent fixtures of government spending. Supply chains are being deliberately torn apart and reassembled along political lines, not economic ones.

These forces are not cyclical. They are not responding to rate moves. They are, instead, reshaping the environment in which rates operate at all.

This is convergence. And it arrives invisibly.

Why Rate Debates Make Investors Feel Certain

There is comfort in rate discussions. The variable is singular. The Fed moves; markets react. The logic is linear, the causality clear. A quarter-point cut creates a measurable effect. Duration extends. Yield-sensitive sectors outperform. The narrative holds together.

This comfort is not without reason. Rate changes do affect markets. But the reason rate conversations are so dominant is precisely because they are tractable—they feel knowable in a way that geopolitical reshaping or demographic structural shifts do not. You can forecast a Fed meeting. You cannot forecast when a government decides to restructure its entire supply chain strategy, only that it will take a decade to complete.

Markets are biased toward stories they can analyze quarterly. Structural shifts unfold across administrations and generations. By the time structural shifts become obvious, the investors who positioned earlier have already gained years of compounding.

Here is the critical insight: interest rates can no longer be interpreted solely as macroeconomic tools. They have become political signals, social stress points, and market risk factors simultaneously. A rate move is no longer just a Fed decision. It is also a geopolitical signal, a debt servicing crisis waiting to manifest, a currency fragmentation event, and a signal about the capacity of governments to finance themselves.

The single-variable analysis fails when the system is changing.

What Actually Converges

Economic convergence is not a metaphor. It is a specific pattern: multiple independent forces—technological, political, demographic, fiscal—begin interacting at the same time, creating amplification effects where each force intensifies the others.

Consider the components visible in 2025:

Artificial Intelligence is reaching performance thresholds where it displaces human labor across sectors, not sequentially but simultaneously. Cost-effectiveness ratios are becoming viable. Compressed timelines mean industrial transformation happens in months and quarters, not decades.

Geopolitical fragmentation is restructuring supply chains, energy markets, and defense spending not based on economic efficiency, but on political alignment. Supply chain destruction—the deliberate reshoring of critical infrastructure—is now a national strategy. This is structural, not cyclical.

Demographic shifts are fundamentally weakening the transmission of monetary policy. Aging populations respond less to rate changes than younger ones. The elderly hold assets; they care less about borrowing costs. This is not a forecast. This is measurable reality already embedded in advanced economies.

Fiscal dominance has shifted from aberration to structural norm. Governments prioritize strategic investment in defense, AI, infrastructure. Austerity is no longer the governing framework. Global debt stands at 235 percent of GDP, constraining policy flexibility. Rate decisions are now made within a fiscal straitjacket, not a vacuum.

Monetary fragmentation is already visible. Central banks face conflicting mandates between inflation control and financial stability. Competing monetary blocs and alternative payment systems are emerging. Trust in fiat currencies is being tested.

Each of these forces is real. Each moves at different speeds. But together, at a specific moment, they begin reinforcing each other. AI acceleration intensifies geopolitical competition. Geopolitical fragmentation constrains monetary flexibility. Fiscal dominance limits rate-setting independence. Demographic structure weakens the effectiveness of whatever rates are chosen.

This is not prediction. This is description of what is already happening.

Why Linear Thinking Fails During Convergence

Investors typically assume smooth transitions. GDP grows steadily. Asset prices move in correlated patterns with yields. Volatility is cyclical. Systems decompose linearly.

But convergence points are not linear. They are inflection moments where velocity accelerates faster than historical models suggest. A system that moves at steady-state for decades can shift direction rapidly when multiple pressures align.

The danger is that during the buildup to convergence, each force individually seems manageable. AI disruption is real, but adoption is gradual. Geopolitics is tense, but supply chains are sticky. Rates are rising, but markets are stable. Demographics are aging, but slowly. Fiscal dominance is evident, but sustainable for now.

But the system does not change when you understand it intellectually. It changes when the forces actually collide.

This is why preparation beats prediction. You cannot time convergence exactly. No analyst can say "convergence occurs March 2026, volatility rises 40 percent." But you can understand the forces and position for the range of plausible outcomes. You can think in scenarios rather than point forecasts.

Historical Echoes

Moments of major systemic change—not crashes, but actual directional shifts—share a consistent pattern: they are invisible during buildup, obvious only in retrospect.

Nobody predicted the transition from manufacturing to services economies because they saw it happening quarterly. The transition occurred because capital, technology, and labor gradually reorganized. By the time it was obvious, entire regions had already been restructured.

The internet did not "crash the economy" in the 1990s; it restructured capital allocation, rewarded connectivity, punished intermediaries. The transition happened over years, through recessions and booms, until a new regime stabilized.

In each case, investors who positioned during the unclear middle phase—when forces were converging but not yet synchronized—benefited disproportionately from early recognition. Investors who waited for clarity waited too long.

The pattern is consistent. Convergence is invisible until it isn't. By the time it becomes obvious, repricing has already begun.

Why Understanding Matters More Than Timing

The intent of this analysis is not to predict when convergence peaks or which asset reprices first. It is to clarify that markets are currently obsessing over a single variable (interest rates) while multiple systemic forces are organizing simultaneously beneath headlines.

This creates an asymmetry. Investors focused on Fed calls are preparing for cyclical volatility. Investors aware of convergence are preparing for structural transition. One group is optimized for short-term noise. The other is positioned for long-term regime change.

You cannot predict exactly when geopolitics reshapes capital flows. But you can recognize that it is happening and position accordingly. You cannot time the moment AI integration creates mass displacement. But you can identify companies leveraging AI for competitive advantage before the market prices it.

You cannot forecast when aging demographics make rate policy less effective, but you can understand that this weakening is already here, changing what rates actually accomplish in the economy.

The preparation is not about perfection. It is about frameworks—thinking in scenarios, understanding reinforcing dynamics, recognizing that isolated variables no longer explain market behavior.

What People Usually Realize Too Late

The most dangerous moment in a system change is not the inflection point itself. It is the moment right before, when data is still mixed, forecasts are still uncertain, and changing your positioning feels premature.

This is the moment we are approaching. AI capability is clearly advancing; its labor displacement effects are not yet obvious in aggregate data. Geopolitical tension is clear; supply chain restructuring is occurring, but not yet disruptive at scale. Demographic aging is measurable; its impact on monetary transmission is still debated. Fiscal dominance is visible; sustainability questions remain abstract.

Each force individually can be contextualized, explained away, absorbed into existing models.

But they do not operate individually.

When convergence actually occurs, the repricing can be rapid. Not because the outcome was unpredictable, but because the market was operating under the assumption that forces would remain separate, manageable, linear.

The investors who recognize convergence during the unclear phase—when it is still debatable—gain years of positioning advantage over those who wait for confirmation.

This is not a market forecast. It is a description of how systems actually change. Slowly at first, then rapidly, then obviously. By the time obvious, the opportunity has largely passed.

Calm Recognition

The point of understanding convergence is not to panic or rush into tactical moves. It is to recognize that the environment has shifted. Rate debates will continue. They matter, but less than they have mattered. Multiple forces are now shaping outcomes simultaneously.

Preparation is not about perfect timing. It is about positioning for multiple scenarios, understanding the forces at work, and recognizing that the system you are operating in today is not the system you will operate in within five years.

Systems do not collapse overnight. But they do change direction quietly, in the spaces between headlines, through the convergence of forces nobody is watching closely enough to name it while it happens.

By the time convergence becomes consensus, the quiet investors have already adapted.

—

Claire West