The Dashboard That Replaced My Budget

For years, I wrestled with traditional budgeting. Like many, I started with apps that promised clarity but delivered stress. The endless categorizing, receipt chasing, and daily transaction logging felt less like empowerment and more like a second job. Budgeting, which was supposed to bring calm, only seemed to amplify worry and guilt.

So, I asked myself: What if I stopped trying to track every penny and instead focused on a few meaningful numbers? What if I replaced the clutter of categories with clear, actionable metrics that reflect my real financial health?

That’s how my “Budget OS Lite” was born—a simple dashboard built in a Google Sheet that tracks just three core metrics: Savings Rate, Runway, and Fixed Cost Ratio. This system didn’t just streamline my finances; it changed my relationship with money, helping me trade stress for confidence and control without the noise.

Why I Ditched Traditional Budgeting

Traditional budgeting methods often come wrapped in good intentions—track everything, categorize every expense, avoid spending outside the lines. But for me, they ended up feeling rigid and guilt-laden. Missing a categorization, or overspending in a category, wasn’t just a mistake—it was a mark of personal failure.

I also found that obsessing over daily transactions distracted from the bigger picture. I lost sight of the financial story I was trying to write and got caught in the weeds instead.

I wanted a system that felt light, calm, and scalable—not a mess of guilt and complexity.

The Three Metrics That Became My Financial Compass

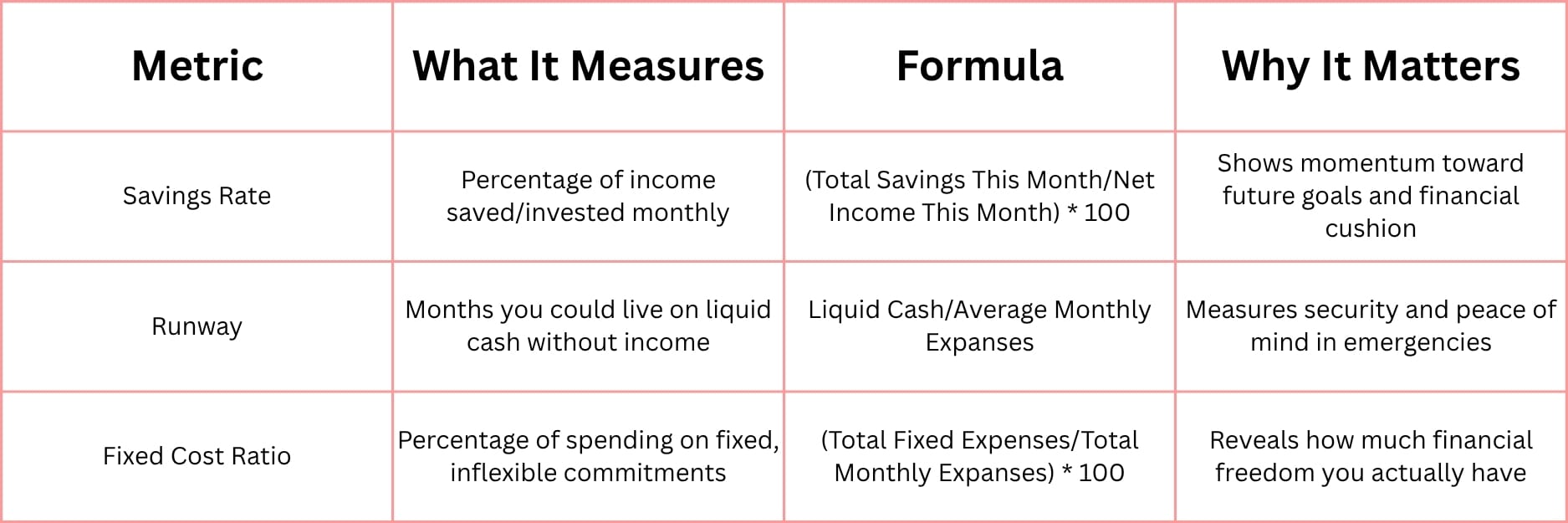

Instead of dozens of line items, Budget OS Lite focuses on three foundational metrics that together tell a full story of financial health:

Savings Rate: Your Progress Tracker

The Savings Rate measures how much of your income you’re setting aside each month—not just as a number, but as your financial forward motion. It’s the percentage of your net income that you save, invest, or use to aggressively pay down debt.

Tracking this monthly helps me celebrate progress and set realistic goals. Even a modest rate builds meaningful safety over time. It’s my way of knowing I’m creating space between me and future worries.

Runway: Your Breathing Room

Runway is how long you could cover your expenses with what’s in your bank accounts if your income stopped today. This simple number brings huge peace of mind. It turns uncertainty into a buffer and empowers choices—from negotiating a job offer to taking time for self-care without panic.

Knowing my runway means I never have to rush decisions out of fear, and it reminds me that financial security isn’t just about how much I earn, but how well I manage what I have.

Fixed Cost Ratio: Your Flexibility Gauge

This ratio measures the proportion of your spending that’s “fixed”—things like rent, utilities, insurance, and subscriptions that recur every month and are hard to adjust quickly. The higher this number, the less wiggle room you have to change your financial path without making big sacrifices.

Seeing this metric regularly helps me make intentional decisions about where to cut back, renegotiate, or choose flexibility over rigidity—actions that increase my freedom and resilience.

How I Use Budget OS Lite

I keep the dashboard simple and stress-free:

- Monthly check-in: Once a month, I open my Google Sheet, pour a cup of tea, and update my income, savings, liquid cash balance, and general spending totals.

- No daily or weekly tracking: I don’t log every transaction. Instead, I focus on totals that capture the patterns without the noise.

- An honest pulse: Alongside the numbers, I write a brief note about how money felt that month—was it calm, tight, or hopeful? This emotional check-in keeps me connected without judgment.

The sheet automatically calculates the three metrics for me, acting like a financial compass. It doesn’t tell me exactly what to do, but it shows me where I stand—and that clarity is powerful.

What Changed When I Stopped Budgeting and Started Building a Dashboard

Replacing a complicated, guilt-heavy budget with this simple dashboard shifted how I relate to money in ways I hadn’t expected.

- Less anxiety: I stopped feeling like I was failing by the moment or the receipt. Instead, I track progress at a meaningful pace.

- More confidence: Knowing my runway and fixed cost ratio means I can make choices with real context—whether that’s saying yes to a trip, no to an impulsive buy, or yes to a job offer that needs negotiation.

- Greater freedom: I no longer want to micromanage every dollar because I trust the system to highlight what matters.

- Money as a tool, not a task: The dashboard helps me see money as a resource to cultivate—not a list of rules to obey.

A Gentle Invitation

If tracking every last expense feels overwhelming or joyless, consider swapping the clutter of categories for clear, steady metrics. Budget OS Lite is my way of sharing a light, clear path toward calm financial awareness. It’s not about perfection—it’s about presence, progress, and peace with your money.

Money doesn’t have to be complicated to be meaningful. Sometimes, less truly is more.

—

Claire West