The FedNow Era — And How to Keep Control of Your Money

It Happened While No One Was Watching

While the world’s attention raced from one loud political headline to another, the Federal Reserve quietly made a huge change to the way money moves in the United States. In July 2023, the Fed launched FedNow, a new system that enables money transfers 24 hours a day, every day of the year. No fanfare, no public speeches—just a smooth, behind-the-scenes evolution of how your dollars flow.

This is a story of silent change — shifts so foundational that by the time they become obvious, they’re already deeply embedded. If you’ve ever felt like financial systems move faster than you can keep up, FedNow is a perfect example. It promises convenience and speed on the surface, but it also raises important questions about privacy, control, and the future shape of money itself.

What FedNow Really Is

In plain terms, FedNow is a new instant payment system operated by the U.S. central bank. It allows banks and credit unions—which are signed up for the service—to send and receive money in real time, around the clock, on weekends and holidays, without waiting for typical clearing delays.

Before FedNow, most electronic payments outside business hours were processed later, sometimes taking up to three days (think ACH transfers). FedNow changes that, making payments settle in seconds, no matter the hour.

Imagine sending a paycheck or paying a vendor, and the money arriving instantly — no waiting, no delays. That’s the official pitch: faster, simpler, and more convenient payments for individuals and businesses alike.

But there’s another layer here: FedNow’s underlying technology and infrastructure potentially form the foundation for the U.S. to introduce a Central Bank Digital Currency (CBDC) in the future—a digital dollar fully controlled by the federal government. While FedNow itself is not a digital currency, it shares many technical features and regulatory frameworks that could make future rollout of programmable, traceable money much easier.

Risks to Financial Privacy & Autonomy

The Fed emphasizes safety, accessibility, and speed, but observers warn the reality could be more complex and concerning:

“FedNow provides a safe, efficient, and widely accessible payment system designed to drive convenience for consumers and businesses.”

VS.

“With every transaction visible to a government entity, FedNow potentially gives the federal government unprecedented surveillance access to everyday spending. This includes intimate details like the cost of a child’s piano lesson, how friends split a dinner bill, or what couples spend on a concert—a level of visibility without warrant or oversight. Programmable money raises fears of spending controls and restrictions, turning autonomy into control.”

The worry is not just about privacy (or lack thereof). It’s about the control that such visibility enables. Imagine your spending being restricted based on where or how much you spend. A future CBDC could theoretically allow limits on purchases, outright blocking certain transactions, or even imposing negative incentives if rules aren’t followed.

This kind of "programmable money" offers government and regulators extraordinary power over personal finances, far beyond just watching numbers move.

The Digital Dollar Is No Longer a Theory - It's Already Here...

While America's distracted, the Fed quietly launched FedNow - a 24/7 instant payment system that's laying the foundation for a U.S. Central Bank Digital Currency (CBDC).

They claim it's about speed and convenience...

But beneath the surface, a system of surveillance and control is being built impacting our financial privacy and freedom.

Ask yourself:

- If every transaction becomes digital, what happens to your privacy?

- Could "programmable money" be used to limit how - or where - you spend?

- Could access to your savings or retirement be limited by someone else's rules?

This isn't hypothetical.

FedNow is already live. The rails are in place.

And even Trump - who once criticized digital currencies - is now supporting a national crypto reserve... and has adopted projects like Trump-themed tokens.

The writing is on the wall. Once this system is fully operational, opting out may no longer be an option. If adoption becomes widespread, preserving financial alternatives could become impossible.

That's why this free guide is so urgent. It reveals the real risks - and what you can do right now to protect your financial freedom before it's too late.

Get the guide now. While you still can.

Thousands of Americans Have Already Gotten This Guide And Utilized The Strategies Inside

Global Trends Are Not Waiting

The U.S. effort is part of a worldwide movement. China’s digital yuan (e-CNY) is already in wide circulation, with millions using it daily. The European Union is actively developing its digital euro, expected to launch pilot programs soon.

More than 130 countries are now exploring or implementing CBDCs, signaling that digital central bank money is no longer a theory or distant possibility—it’s unfolding worldwide.

What This Means for You — Everyday Implications

FedNow’s rollout and the potential for digital dollars affect many parts of daily financial life:

- Imagine your retirement account withdrawals being subject to new layers of scrutiny or restrictions.

- Your everyday purchases could come with built-in rules or caps, invisible until you hit a spending threshold.

- Charitable donations, tipping, or peer-to-peer transfers might be monitored or limited based on regulation or policy.

The underlying truth is:

When every transaction is traceable, every transaction is controllable.

Convenience carries a price. It’s up to each of us to understand the trade-offs and act accordingly.

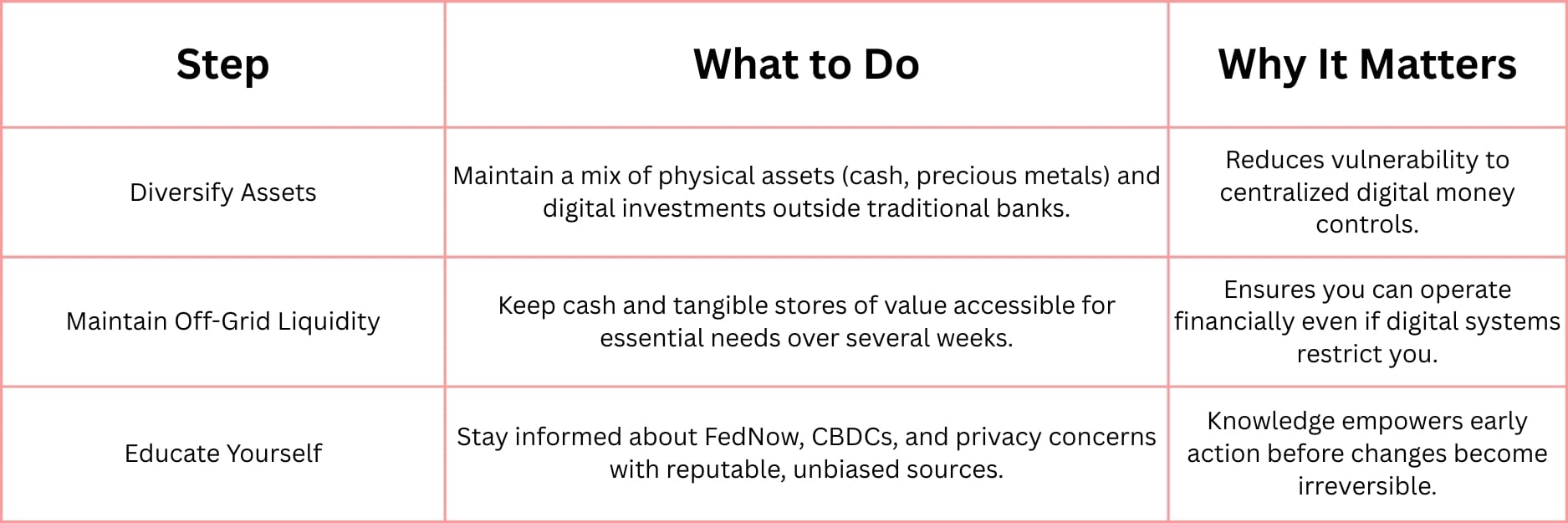

Action Plan — 3 Steps to Protect Your Financial Freedom

Here’s a clear, practical plan to maintain your autonomy and privacy as this new era unfolds:

Why This Guide Matters

That’s why this free guide is so urgent. It reveals the real risks — and what you can do right now to protect your financial freedom before it’s too late.

Preparation Is Freedom

Change is coming, and while we can’t control the politics, technology, or economic forces that shape our world, we can choose how prepared we are.

Knowledge brings calm. Preparation brings choice.

The FedNow era is an invitation to reclaim clarity and vigilance in a fast-evolving landscape. Your autonomy and financial dignity are yours to protect — and starting today means building a future where you move with power, not fear.

—

Claire West