The Geography of the Next Decade: Where Capital Actually Goes

There's a pattern that repeats quietly throughout American history, and it's invisible until you step back far enough to see it.

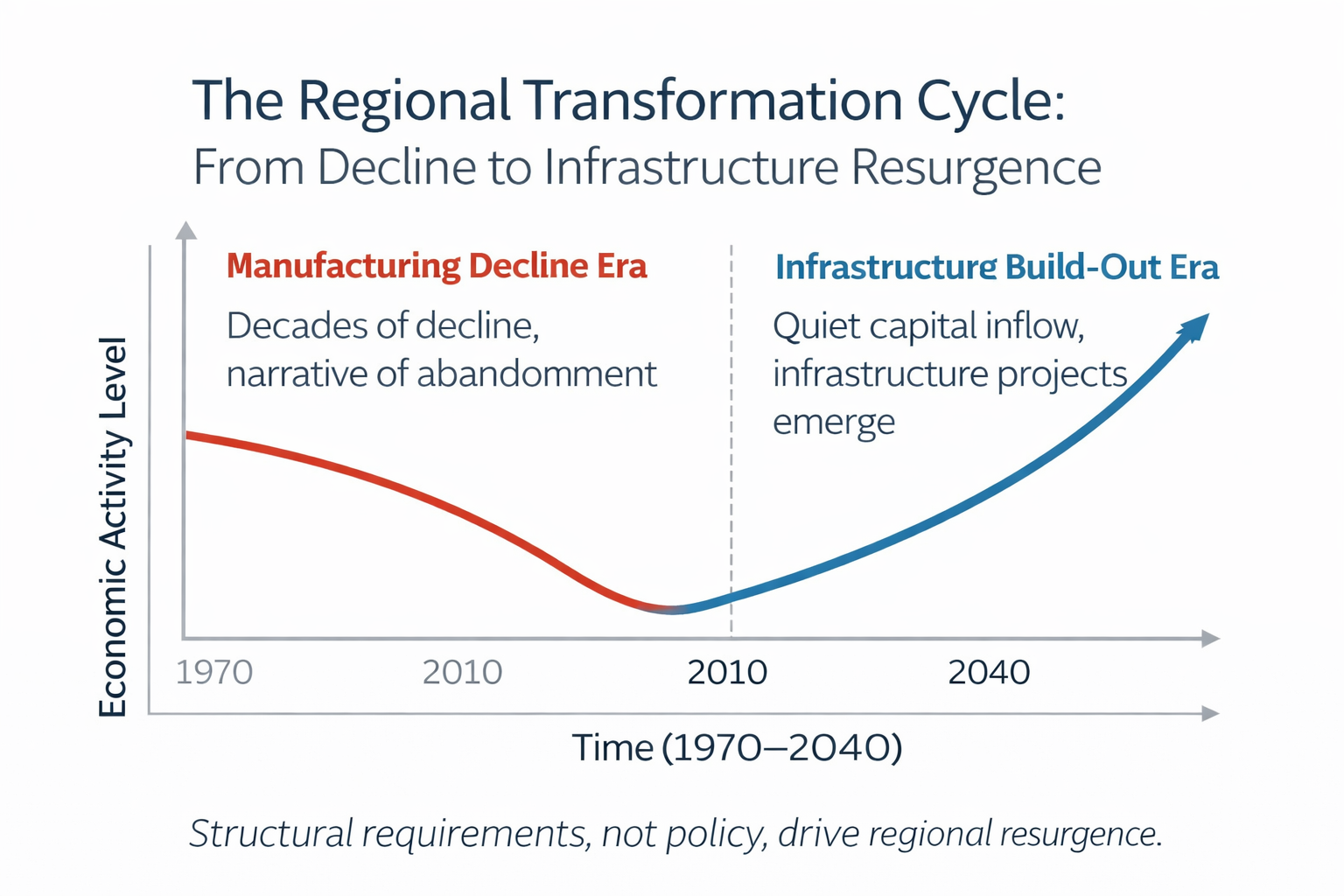

A region that was once central to the economy falls out of favor. Manufacturing declines. Young people leave. Investment dries up. For a generation or two, these places feel forgotten—economically irrelevant, politically overlooked, left behind by the national narrative.

Then, almost imperceptibly, something shifts. Not out of sentiment or nostalgia, but because of structural requirements that only those regions can meet. Capital begins flowing back. New infrastructure starts being built. And the forgotten places re-emerge as central to the next era of national infrastructure.

This isn't conspiracy. It's logistics meeting geography meeting economics. It's what happens when the demands of a new system intersect with the supply of resources and land in unexpected places.

Why Energy Always Precedes Power

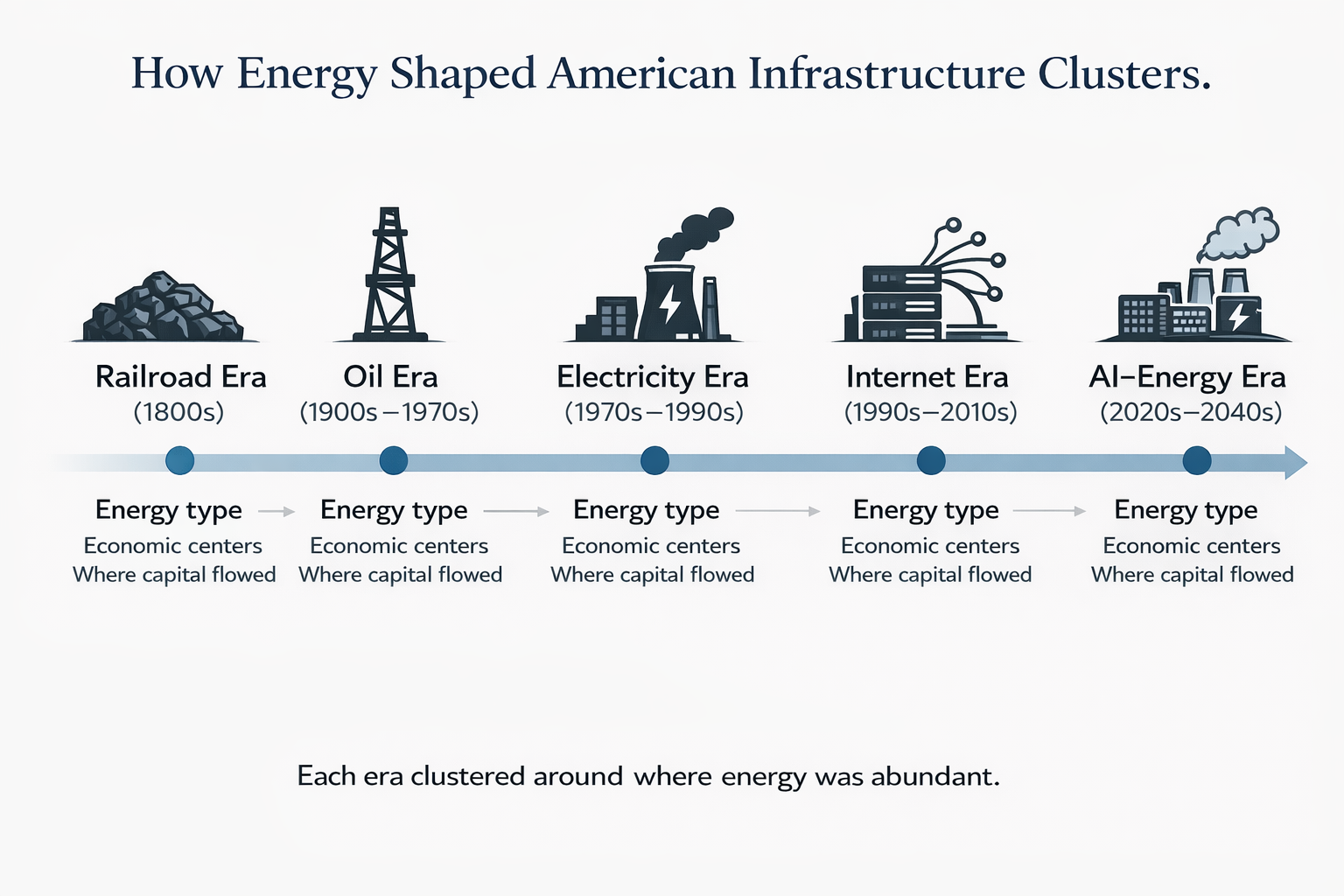

Throughout American economic history, energy infrastructure has preceded—and determined—where power concentrates next.

The railroad network in the 1800s followed coal deposits and navigable rivers. Industrial centers didn't emerge randomly; they emerged where energy was cheap and abundant.

The oil economy of the 20th century followed discovery zones and refining capacity. Texas, Oklahoma, California didn't become wealthy because of narratives or policy. They became wealthy because energy was there.

The internet backbone of the 1990s was routed through existing fiber corridors and power-rich regions. Data centers today cluster where electricity is cheap and abundant—not in major cities, but in regions with excess power capacity.

Energy is always the first constraint. Without it, nothing else scales. With it, infrastructure follows.

This is why the next inflection point—AI and advanced computing at scale—will be determined not by chip design or software talent, but by where energy, cooling, and land converge.

Is Trump really building the new American Energy Empire — and doing it in a forgotten Pennsylvania town?

Multiple insiders are now claiming Trump & Musk have quietly reunited, pouring billions into the same AI-energy corridor that’s turning Appalachia into something BIGGER.

$10B from Elon Musk..$100 billion from Microsoft, NVIDIA, and BlackRock $500 billion commitment from President Trump

And a new thing is clear…

This project is now under Trump’s protection.

If that’s accurate… early investors could see a massive shift.

AI's Real Bottleneck: Power, Not Processing

The narrative around AI focuses on chips, algorithms, and data. But the actual constraint is energy and space.

A modern data center training AI models consumes megawatts of power continuously. Cooling systems require massive water usage or advanced liquid cooling infrastructure. The physical footprint needed for thousands of GPUs, the redundancy required for reliability, the grid infrastructure required to feed all of it—these are the real limiting factors.

You can't train state-of-the-art models in downtown Manhattan. The grid can't support it. The real estate is too expensive. The water usage would be politically impossible.

But you could train them in regions with:

- Abundant, cheap electricity (preferably from power generation the region already has)

- Cheap, available land (often post-industrial regions with depressed real estate)

- Existing infrastructure (fiber, water, grid access)

- Political willingness to support large industrial projects

These characteristics don't describe major cities. They describe forgotten regions.

Why Capital Clusters Geographically

Once energy and land converge, capital follows—and compounds.

It's not because regional policy is brilliant or local leadership discovered something. It's because infrastructure begets infrastructure. Once the first large project arrives, the ecosystem around it becomes more valuable. Supply chains form. Workforce develops. Supporting infrastructure gets built.

This is why tech didn't scatter evenly across America. It clustered in Silicon Valley, then moved to Austin, Seattle, and increasingly to smaller regions with favorable conditions.

The clustering happens not through grand strategy, but through simple economic logic: if one major project requires engineering talent and supply chain support, the second project benefits from that same ecosystem. The third project benefits even more. Eventually, an entire region becomes known for something.

This process is slow while it's happening. It's invisible while it's underway. It only becomes obvious in retrospect—when the region that seemed forgotten a decade earlier is suddenly central to a new economy.

Mini-Case: Post-Industrial Regions as Infrastructure Zones

Look at Appalachia and the Rust Belt over the past 50 years.

Manufacturing declined. Coal mining became economically marginal. The regions emptied out. The narrative was written: these places were left behind.

But underneath that narrative, something structural persisted: abundant cheap electricity (hydroelectric in Appalachia, grid infrastructure in the Rust Belt), abundant available land, and existing power generation capacity.

These are exactly the characteristics needed for large-scale energy-intensive infrastructure. Not a coincidence.

Some of the earliest major data center investments in recent years have been in these very regions—not because technology companies suddenly discovered nostalgia for coal country, but because the structural requirements of data centers aligned perfectly with what those regions offered.

The regions themselves haven't announced some grand AI-infrastructure plan. Capital just quietly started moving there because the math worked.

Narrative Headlines vs. Capital Reality

The contrast is worth mapping explicitly:

| What Headlines Say | What Capital Is Doing |

|---|---|

| "Tech industry is dying in post-industrial regions" | Building data centers in post-industrial regions |

| "These regions can't compete in the new economy" | Investing in infrastructure that requires those regions' assets |

| "We need to transform the economy" | Following power, land, and economics (unchanging rules) |

| "Look at booming coastal cities" | Moving compute away from coastal cities to cheaper, more viable regions |

| "This is about policy and politics" | This is about energy and logistics (which happen to align with certain regions) |

Capital doesn't follow narratives. It follows structural requirements meeting available resources.

Why Political Protection Matters

Large infrastructure projects take 10-20 years to mature. They require political stability, consistent regulatory treatment, and the ability to operate without sudden hostile shifts.

This is why bipartisan support for major projects—or at least, protection from political whipsaws—matters so much. It's not about ideology. It's about timeline certainty.

A massive data center or energy infrastructure project can't proceed if investors worry that a political shift in 4-6 years will halt everything. It requires confidence that the underlying logic—energy, economics, efficiency—will remain the priority regardless of who's in office.

This doesn't mean projects are immune to politics. It means they require enough structural importance and bipartisan economic incentive that they survive political transitions.

What Happens When Government, Capital, and Energy Align

When all three align—when government provides policy stability, capital sees the infrastructure opportunity, and energy is available—massive regional transformation becomes possible.

It's slow. It's quiet. It doesn't announce itself with fanfare.

But it compounds over years. Supply chains develop. Workforce migrates. Real estate values shift. Supporting infrastructure gets built. And 15 years later, a region that seemed economically dead is central to a new economy.

Why Investors Miss the Where While Focusing on the Who

Most investment analysis focuses on companies and founders — who's building it, what's their track record, are they competent?

Much less analysis focuses on geography and logistics — where is it being built, why that location, what are the structural advantages?

This is a significant blind spot. Because while founders and companies can be replaced, geography and logistics are fixed. They're constraints that can't be overcome with better management or more funding.

The investors who understand this dynamic have an advantage: they can recognize when a region's structural properties align with new infrastructure needs—before the rest of the market catches up.

The Quiet Infrastructure Shift

Some analysts believe a major AI–energy infrastructure corridor is quietly forming in the U.S. A recent briefing outlines why early-stage attention to these regions may matter long before projects become visible to the public.

The appeal of such analysis isn't certainty about which specific project will succeed. It's structural awareness — recognizing when geography, energy, capital, and timing align in ways that create durable change.

Reflection — Separating Evidence from Excitement

Here's the discipline worth applying: distinguish between structural evidence and narrative excitement.

Structural evidence is:

- Actual capital flowing to specific regions

- Energy infrastructure being developed

- Real estate pricing shifts

- Workforce development in specific sectors

- Political alignment around major projects

Narrative excitement is:

- Headlines about transformation

- Policy announcements

- Speeches about regional renewal

- Claims about what "should" happen

Capital behavior reveals what's actually happening. Narratives reveal what people hope is happening.

When the two diverge—when capital is flowing to places the narrative hasn't yet recognized—that's often where structural change is quietly underway.

The geography of the next decade is already being written. Not through grand announcements or political speeches, but through where energy is available, where land is cheap, where infrastructure requirements can actually be met.

Forgotten regions will re-emerge—not because policy makers discovered them, but because their structural properties align with what the next era requires.

This process will feel slow and invisible for years. Then, suddenly, it will feel obvious. Retrospectively, everyone will ask why it wasn't obvious all along.

The answer is: it was. You just had to look at the map and follow the energy.

—

Claire West