The Hidden Architecture of Money

Most mornings begin the same: a tap at the register, a quiet swipe of plastic on a grocery run, the subtle hum of a mobile notification confirming “payment received.” These routines slide almost unnoticed across the grain of our days—mundane, efficient, invisible. Money, for most, is a minor miracle: a tool that unlocks warmth, shelter, comfort, and hope, all with the flicker of digits or the soft crumple of green bills.

Yet beneath these familiar gestures lies an architecture few ever notice—a labyrinth of wires, rules, platforms, and policies holding our money aloft. It changes shape, slowly but surely, re-drawing the boundaries of what we own, how we pay, and how we plan. The machinery of commerce hums just out of sight, but its design shapes our future with every paid bill, every hopeful savings deposit.

This is the hidden architecture of money: as quiet as a sunrise, and just as integral.

What We See vs. What Holds It Together

We trust money because it appears simple—cash is handed over, cards are swiped, a balance shines from our phone screen. Tangible, immediate, and seemingly ours.

But like any structure, what’s visible is only the beginning. Under almost every transaction, a web of infrastructure runs deep: banks, payment networks, government rules, vast clearinghouses, and back-office logistics. As architects depend on steel and concrete beneath the paint, so our money depends on servers, regulations, and a thousand silent agreements.

Imagine an old house. The painted walls and warm hearth conceal endless supports and beams. In finance, those invisible supports are:

- Banks: Not only storehouses, but tightropes between personal funds and a world of systemic rules.

- Clearinghouses: They settle debts and credits invisibly, so transactions flow smoothly.

- Payment Rails: Digital highways ferry value back and forth 24/7.

- Government Guarantees: FDIC insurance, payment regulations, anti-fraud policies—the blueprints stabilizing the whole structure.

Yet most of us rarely notice the foundations. We see only the rooms we live in; not the beams and bolts anchoring the floors.

The Digital Dollar Is No Longer a Theory -

It's Already Here...

While America's distracted, the Fed quietly launched FedNow - a 24/7 instant payment system that's laying the foundation for a U.S. Central Bank Digital Currency (CBDC).

They claim it's about speed and convenience...

But beneath the surface, a system of surveillance and control is being built impacting our financial privacy and freedom.

Ask yourself:

If every transaction becomes digital, what happens to your privacy?

Could "programmable money" be used to limit how - or where - you spend?

This isn't hypothetical.

FedNow is already live. The rails are in place.

And even Trump - who once criticized digital currencies - is now supporting a national crypto reserve... and has adopted projects like Trump-themed tokens.

The writing is on the wall. Once this system is fully operational, opting out may no longer be an option.

That's why this free guide is so urgent. It reveals the real risks - and what you can do right now to protect your financial freedom before it's too late.

Shifting Foundations in 2024–2025

The architecture is shifting, often quietly. Consider 2024–2025:

FedNow: Quiet Revolution

In July 2023, the Federal Reserve launched FedNow—a 24/7 instant payments platform. By the end of 2024, FedNow had onboarded over 1,300 U.S. financial institutions, with ambitions to reach most of the country’s 10,000+ banks and credit unions in coming years. This “rail” enables payments to settle in seconds rather than days. Payroll runs overnight. Retirees move funds instantly. Yet for most, FedNow is invisible—felt only as new convenience or speed, its impact unfolding quietly.

Rising Credit Card Balances

While payment systems trend digital, another architectural beam is under strain: credit. By mid-2025, U.S. revolving credit card balances hit a record $1.21 trillion, up from $1.18 trillion at the start of the year. Household use of cards is expanding—they are used for everyday purchases, online orders, and even rewards. Yet beneath the polished interface, defaults and delinquencies are up: 6.93% of balances entered delinquency in 2025, with subprime borrowers seeing the most stress. What seems like easy access is shaped by a system under pressure.

Digital Payments Overtake Cash

Cash usage is stable, but sliding. In 2024, cash accounted for only 14% of all U.S. consumer payments, with credit cards capturing 35% and debit cards 30%. Mobile payment usage tripled since 2018, with adults aged 18–24 using phones for nearly half their payments. The digital tide rises, each payment crossing networks and databases, not pockets or purses.

Subscription Economy: The New Backbone

Behind everyday subscriptions—from Netflix to Cloud storage—lies a different architecture. The U.S. subscription economy generated over $207 billion in 2024, expected to hit $232 billion by 2025. These automated, recurring payments are convenient, yet they hinge on invisible contracts and algorithms, often softly increasing costs or shaping habits unseen.

All these shifts mark quiet renovations in our financial house, each changing what Americans truly “own” or control.

Fragility Behind the Facade

Visible stability is not always real resilience. Underneath, conditions apply—and those can shift quickly.

Here’s a simple formula for today’s world:

Resilience=Access+Stability−Hidden ConditionsResilience=Access+Stability−Hidden Conditions

Access means being able to use your funds, move money, pay bills—whenever needed. Stability is about balances holding value, systems resisting shock. Hidden conditions, though, can quietly erode both.

- Accounts frozen: A single flagged transaction can lock a person out of savings, sometimes for days.

- Delayed transfers: ACH payments, still used for over half of direct deposits and bill payments, can take two days or more to clear. Even FedNow, with its speed, is not yet universal.

- Inflation eroding deposits: 2024–2025 saw ongoing cost-of-living rises. High inflation quietly whittled away the “real” power of cash holdings and deposits.

As an expert noted in a central banker’s speech: “A resilient financial sector can help the economy withstand shocks... but our work to make the banking sector more resilient is not yet complete.” The façade may gleam, but the foundation needs constant care and awareness.

Survey results echo this caution: over 90% of U.S. adults plan to keep using cash in 2025—for payments or as a store of value. Most are not seeking fear, but “just-in-case” resilience.

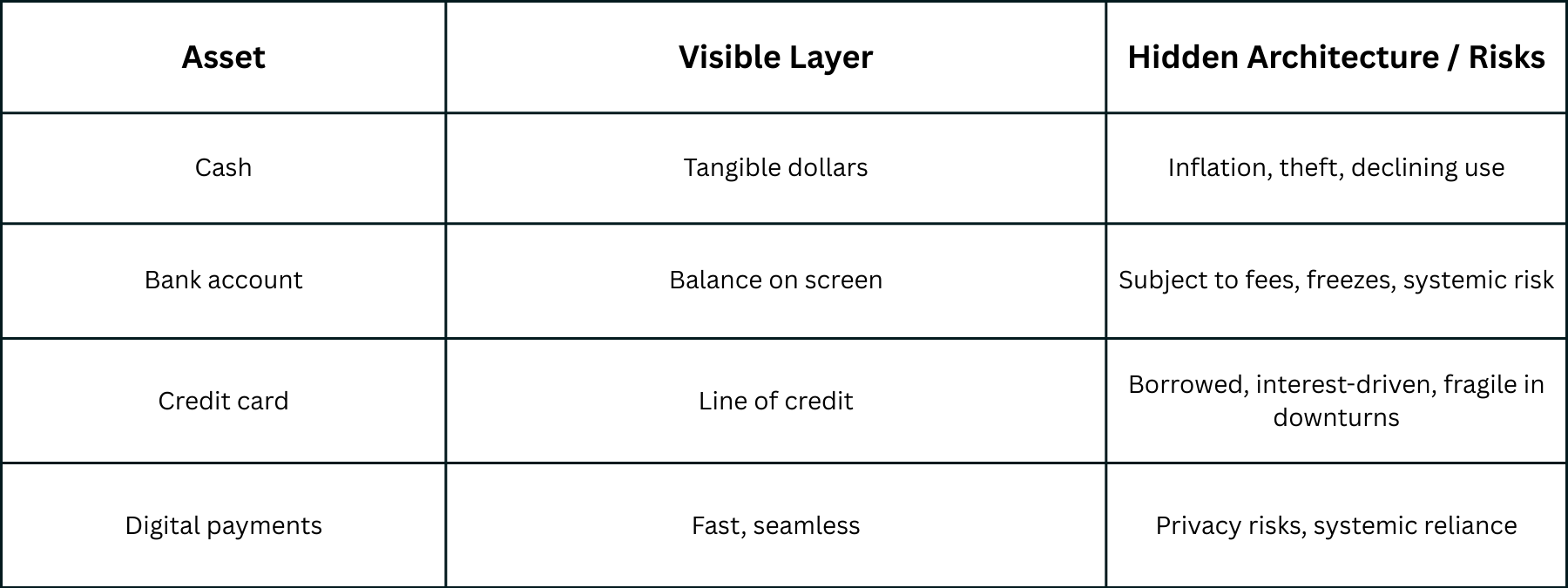

Everyday Lessons & Data Table

It helps to see plainly what we “own” and what underlies it. Here’s a table comparing the visible layer to the hidden architecture—and the risks beneath:

A credit card looks like money, but is actually a loan—conditional, potentially fragile if incomes dip or systems falter. Digital payments are swift, but depend on internet, policy, and privacy protections. Even bank balances are shaped by rules, terms, and network reliability.

Reflection — Why Awareness Matters

Architecture is not dangerous; it is necessary. It gives order, safety, and clarity to a complex world. The trouble arises only when we forget it is there, or assume it can never shift.

Preparedness doesn’t mean suspicion or alarm—it means clarity. Knowing the difference between what is “owned” and what is “borrowed,” between what is stable and what is conditional, lets us plan calmly for just-in-case moments.

Resilience—personal and financial—grows not from fearing shadows but from seeing the sun and the beams beneath the roof, and paying attention to how the building changes.

As a market analyst wrote in January 2025: “The hope must be that, when they arrive, the global economy and financial system display the same surprising resilience they have shown in the past.”

Practical Checklist — Everyday Resilience

- Diversify accounts and payment methods.

- Keep a portion of savings liquid and accessible.

- Monitor recurring fees and hidden conditions in subscriptions.

- Stay mindful of credit dependence and monthly balances.

- Review terms of service for all major accounts.

- Practice small resilience habits—like weekly financial check-ins.

These practices are not dramatic. They are calm, quiet rituals—like locking a door, or checking a foundation stone.

The Structure Beneath

The next time a card swipes or a bill pays itself, pause for a breath. The ritual may seem simple, but it rests on an architecture—vast, evolving, and powerful.

Awareness does not mean fear. It means clarity, and with clarity, the freedom to adapt. True financial security isn’t found in isolated routines, but in seeing the structure beneath the surface, and trusting—not blindly, but wisely—in foundations that hold up everyday life.

So we live within architecture built for our daily comfort, our future hopes—and, if attended to, our resilience.

—

Claire West