The Invisible Leverage in Everyday Money

It is a Tuesday. You are already a member of Amazon Prime. Your card information is saved. An email arrives offering a new credit card—no annual fee, welcome bonus, instant application. You click. Your phone asks three questions. Sixty seconds later: approved.

This feels like a normal offer. A discount, a convenience, maybe a small reward. But what actually happened is more consequential. A frictionless system aligned itself with your existing habits. A financial leverage point embedded itself into your routine. And the distinction between "optimization" and "behavioral shift" collapsed entirely.

This is where modern financial advantage actually lives. Not in flashy products or aggressive sales. In systems so smooth, so aligned with how you already move through the world, that they stop feeling like decisions at all.

The Rise of Embedded Finance: Hidden Inside Your Routines

Embedded finance is finance that lives inside the products you already use. Not a separate trip to a bank. Not a deliberate search for a loan. But a financing option that appears at the exact moment you are about to buy something, from the exact merchant you trust.

Amazon. Apple. Your gym. Your favorite retailer. Each is now a small financial institution. They offer credit, installment plans, rewards integration—all without you leaving their ecosystem.

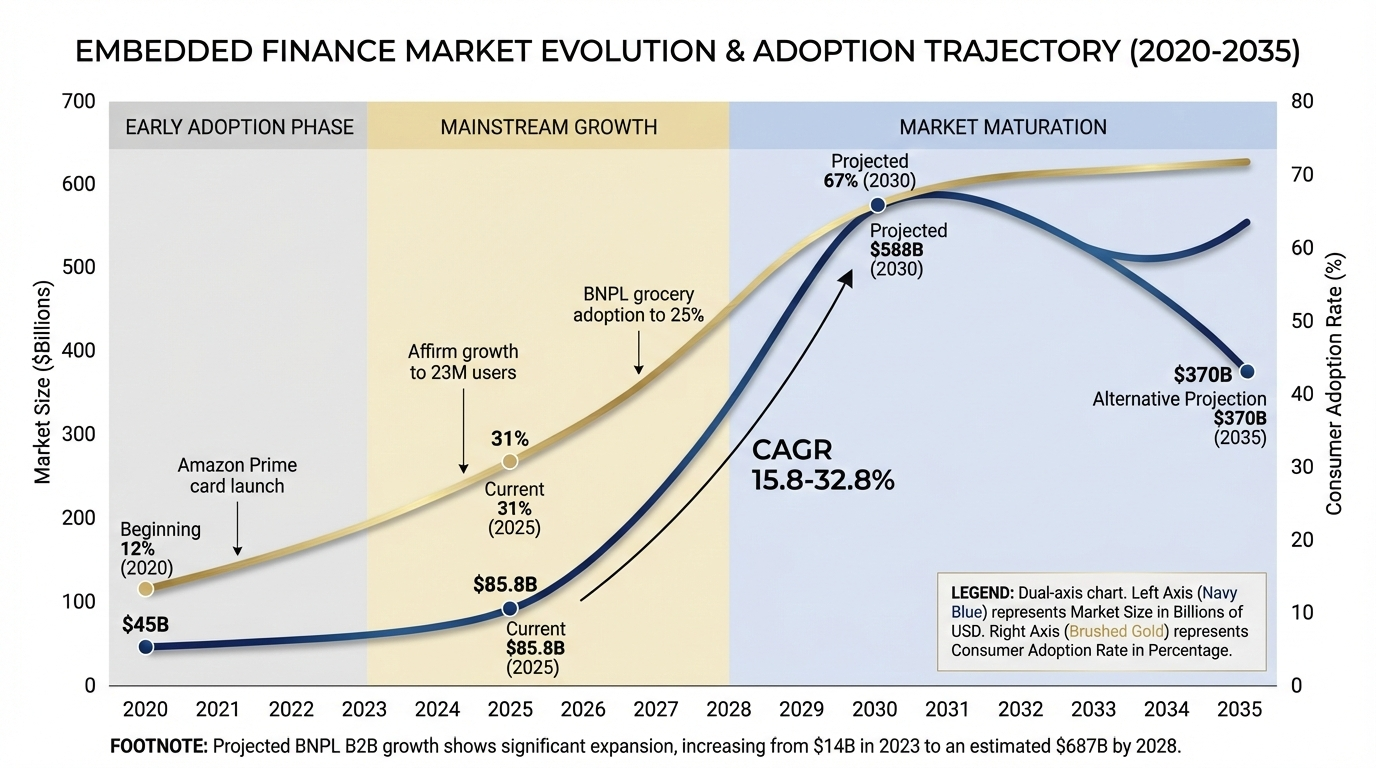

The market is growing at 15-30 percent annually. By 2030, embedded finance will be a $600 billion industry, up from $85 billion today. This is not niche innovation. This is how financial products will be distributed in the future.

Why are companies building this? Because conversion rates increase 15-30 percent when financing is frictionless. Average order value rises. Customer retention improves. The math is straightforward: fewer steps between intent and purchase = more completed sales.

But the leverage goes deeper than transaction mechanics. It is behavioral.

Prime members could get a welcome bonus worth hundreds, issued after approval.

No purchase required to get the bonus.

No annual fee.

Application Decision in seconds.

If Amazon is already part of your routine, this could fit naturally.

Learn more

Convenience Often Beats Optimization

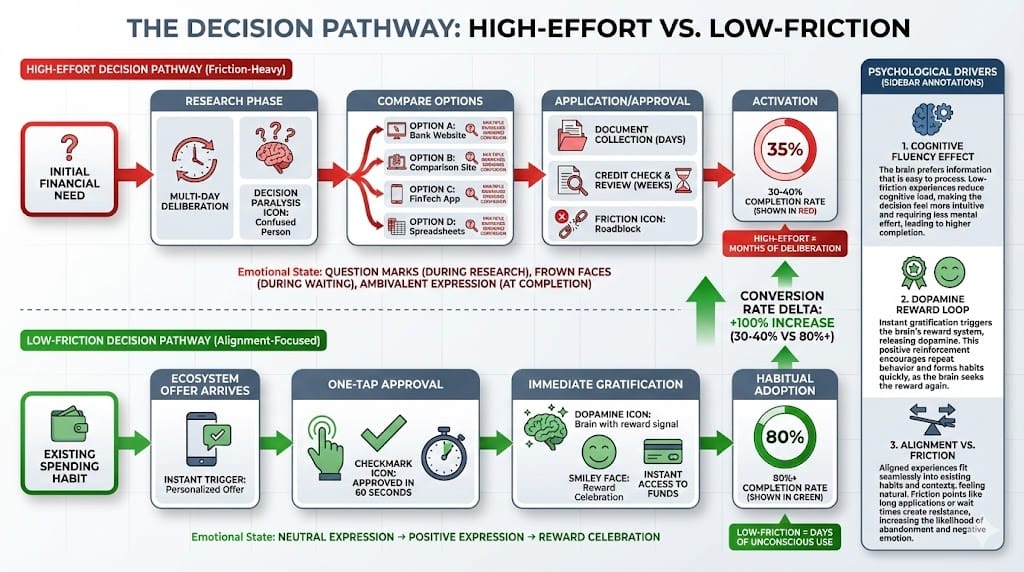

The assumption is that people optimize financially: they compare rates, evaluate terms, make deliberate decisions. In reality, most people default to whatever requires the least effort.

This is not a character flaw. It is a fact of human psychology called "cognitive fluency"—the tendency to favor experiences that feel simple and intuitive. When a process requires less thinking, the brain interprets it as positive and trustworthy.

One-click checkout beats comparison shopping. Instant approval beats multi-day underwriting. Seamless integration beats separate platforms.

The magic is that these "conveniences" are not neutral. They change behavior. A study on Malaysian digital payment users found something striking: once people habituated to digital payments, their spending behavior was shaped more by habit and emotional response than by any feature, reward, or incentive. The rewards didn't matter. The convenience did.

This is why embedded finance works. It does not require convincing. It does not require a new habit. It asks: what are you already doing? And then it aligns itself with that motion.

The Psychology of the Welcome Bonus: Incentive vs. Behavior

A credit card offer arrives. Welcome bonus: $300 cash back after $1,500 spend in three months. This looks like an incentive—an offer to attract your business.

It is, technically. But it functions as something else: permission.

The bonus reframes the card from "spending tool" to "opportunity." Spending becomes not an expense, but an investment in a reward. The psychology flips. Instead of "Should I spend this?" the brain asks "How do I capture this bonus?".

Welcome bonuses now represent 20-40 percent of the total value a cardholder receives in the first year. They are not loss-leaders. They are behavior starters. The bonus is designed to establish a spending pattern that, once established, becomes habitual.

Younger consumers (Gen Z, Millennials) are particularly responsive—41-40 percent cite rewards as a major reason to use credit. But across all demographics, one pattern holds: 80 percent of active cardholders say rewards influence how much they spend on cards.

The bonus is not an incentive to use the card once. It is permission to use it regularly.

Why No-Fee, No-Purchase Structures Change Risk Perception

A credit card with no annual fee feels different than one with a $95 annual cost. Not just in dollars, but psychologically.

No fee removes the barrier to activation. No minimum spend removes activation risk. Instant approval removes uncertainty. Together, these reframe the card not as a financial commitment, but as a value-add—a tool that makes your existing spending more rewarding.

For someone already embedded in an ecosystem (Prime member, regular Amazon shopper), a no-fee card offer functions as alignment, not as a new decision. It is not "Should I take this risk?" but "Why haven't I been optimizing my existing behavior?".

The psychology shifts from "Is this a good idea?" to "This is obviously aligned with what I already do."

This is why instant application decisions matter. A decision made in 60 seconds, on mobile, with immediate gratification (approved!), feels different than an application that takes days. Speed makes the decision feel low-risk, even if the underlying credit terms are identical.

The Dopamine Loop: Why Frictionless Feels Rewarding

Every smooth transaction releases dopamine—the same neurotransmitter linked to reward and anticipation. The system is deliberately designed this way. Green checkmarks. Confirmation sounds. Vibrations that feel celebratory.

These design choices mimic psychological rewards of achievement, turning payments into micro-victories rather than losses. The brain learns: spending = reward. And that learning compounds.

This is problematic because spending via payment cards is actually a loss—money leaves your account. But the frictionless design inverts the emotional signal. The "pain of paying" (the natural discomfort you feel handing over cash) is completely removed.

Research is clear on this: cash transactions create the strongest cognitive friction and spending regulation. Digital wallets create the least friction and highest spending. The difference is not small. When the friction reduces, impulse buying increases, price sensitivity decreases, and total spending rises.

Decision Speed as a Hidden Variable

Fast decisions correlate with higher adoption. But they also correlate with higher default rates.

When your brain processes a choice slowly—when there is friction, delay, deliberation—you engage prefrontal cortex systems. When decisions are instant, you rely on limbic (emotional) systems. The faster decision feels more positive in the moment, but often becomes regrettable later.

Embedded finance exploits this. Instant approval feels like a win. Your brain releases dopamine. Sixty seconds of positive emotion override weeks of buyer's remorse that arrive in the form of credit card statements.

This is why speed of decision is often inversely correlated with long-term financial discipline.

Why Alignment Matters More Than Perks

A credit card with a $300 welcome bonus does not work because the bonus is compelling. It works because it creates alignment. You already shop at Amazon. You already use Prime. A card that rewards Amazon spending does not feel like a new commitment—it feels like an optimization.

This is the critical distinction. Behavioral change driven by alignment is silent and permanent. Behavioral change driven by incentives is visible and temporary.

A Malaysia-based study found something instructive: convenience and rewards did not predict spending behavior post-adoption. But habit did. Once people integrated digital payments into their routine, their behavior was shaped by momentum, not incentives.

This means the welcome bonus is just the activation energy. Once you use the card three times, the bonus becomes irrelevant. The behavior is established.

For people already embedded in an ecosystem, embedding finance into that ecosystem is not a sales pitch. It is inevitability.

The Risk Layer: Credit as Tool, Not Free Money

The embedded finance market is growing at 30 percent annually partly because consumers like it, and partly because credit is becoming necessity, not option.

Buy Now, Pay Later usage for groceries has risen from <1 percent pre-pandemic to 25 percent today. This is not preference. This is household budget stress. BNPL for essential spending signals that income is insufficient to cover baseline costs upfront.

Credit card debt reached $1.2 trillion in 2025—a record. Average cardholder carries multiple cards. Installment obligations accumulate invisibly through subscriptions and auto-renewals.

The psychological risk is real. When payment friction is removed entirely, spending awareness declines. Users stop tracking individual transactions. The "silent wallet" accumulates obligations on autopilot.

This is why financial literacy acts as a moderator. High-literacy users, even with frictionless systems, can use dashboards and alerts to maintain spending discipline. Low-literacy users, even with tools available, tend toward uncontrolled spending.

The system is not evil. But it is designed to make spending easier, not harder. And for people without strong financial boundaries, frictionless systems amplify, not restrain.

Money Systems Work Best When They Stay Boring

The future of finance is not exciting. It is not dramatic innovations or disruption narratives. It is alignment—when tools match habits instead of fighting them.

A credit card that lives inside the retailer you already visit, that asks for no new behavior, that approves instantly, that offers a small reward—this is not novel. This is obviously aligned.

These are the systems that will persist. Not because they are revolutionary. Because they require nothing from you except to continue what you were already doing.

The most expensive financial decisions never feel like decisions. They feel like alignment.

—

Claire West