The Invisible Tax: How Interest Steals Progress

It arrives like most statements do—an email notification, a soft alert, nothing dramatic. But this time, when you open it, something clicks.

Interest charged this month: $247.

You scroll up. The balance hasn't moved much despite paying $300 last month. The month before, you paid $280. Before that, $260. The numbers on the statement show you're paying, consistently, but the balance feels stuck—like walking uphill while someone's pushing you backward.

Then it hits: more than a quarter of your payment isn't reducing the debt. It's just covering the cost of owing it.

That's not a spending problem. That's an interest problem. And it's one that discipline alone—cutting back on lattes, skipping dinners out, trimming budgets to nothing—can't actually solve. No amount of willpower changes the math that $247 of your next payment is already spoken for before it even leaves your account.

This moment, when the invisible becomes visible, is where everything shifts. Not because you suddenly understand budgeting better, but because you understand what's actually working against you.

The Invisible Tax of Interest

Interest is a tax on the present value of money owed. It's invisible because it's not labeled as such. But it functions exactly like one: a percentage of your payment that doesn't go toward reducing the problem, it goes toward paying for the problem itself.

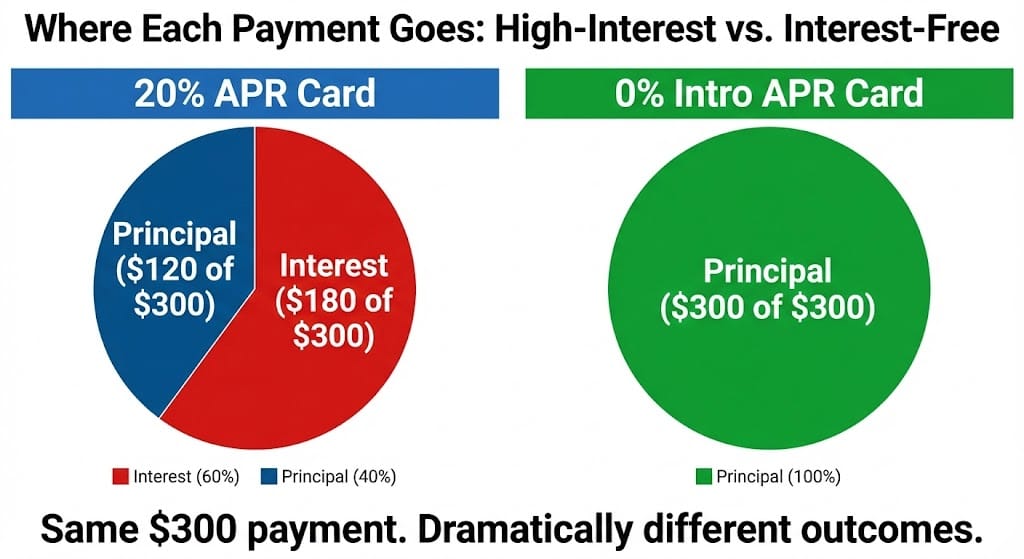

Here's the compounding cruelty:

A $10,000 balance at 20% APR costs roughly $1,667 annually in interest alone.

If you pay $300/month ($3,600/year), more than half goes to interest.

That means you're only paying down principal by $1,933/year.

At that pace, it takes 9+ years to pay it off.

But that's assuming you don't add new charges. In reality, most people do. New purchases hit the card, immediately accrue interest, and the balance barely moves despite years of payments.

Interest isn't a fee. It's a friction tax that compounds quietly while you're focused on the wrong problem.

Most financial advice tells you to stop spending. But if interest is consuming half your payment, spending is almost secondary. You could cut spending to nothing and still barely move the needle. The real problem is the rate at which time converts money to interest charges.

- If you have outstanding credit card debt, getting a new 0% intro APR credit card could help ease the pressure while you pay down your balances. On top of all that, these top credit cards offer up to an insane 6% cash back and a generous welcome bonus. Click through to see what all the hype is about

- If you’re struggling to pay down high interest debt (or you’re planning a major purchase this year), this might be the exact thing you need. There’s a card that allows you to completely pause credit card interest into 2027 … and the best part is that it could be easier than you think. It’s an extremely powerful card that gives you 0% intro APR for an astounding 15 months on purchases and balance transfers. That’s right — you can now finance large purchases you’ve been sitting on without paying massive interest. Or, transfer crippling high interest debt to this card and let your payments go directly to paying down your balance, without piling on additional interest charges — all with no annual fee. But it doesn’t end there. This card also lets you earn a welcome bonus of up to $200 as well as up to 6% cashback!

FinanceBuzz editors have done their research and have chosen the best card in this category, so you don’t have to do the work.

Why Discipline Alone Often Fails

I've watched people cut their spending aggressively, sacrifice genuinely, and still fail to escape high-interest debt. Not because they lacked willpower, but because willpower doesn't change compound math.

The psychological toll is real too. You're paying $300/month, seeing the balance barely move, and your brain keeps telling you: "This isn't working. Why bother trying?" That learned helplessness is devastating, not because you're weak, but because the system is engineered to feel futile.

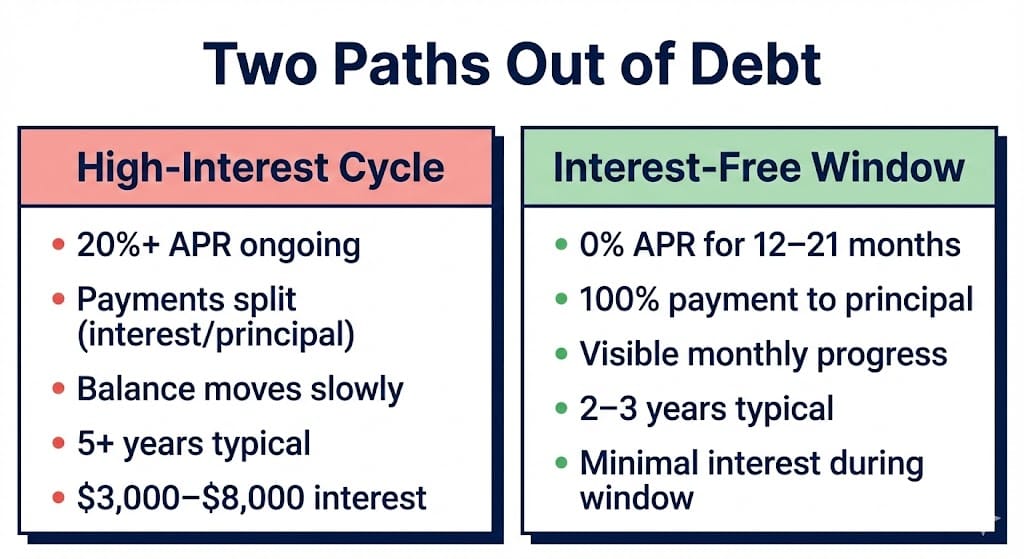

This is where the distinction between discipline and structure matters enormously.

Discipline says: "I will make larger payments despite financial pressure."

Structure says: "The interest rate is temporarily zero, so my full payment goes to principal."

Both involve sacrifice. But structure offers something discipline doesn't: visible progress. When your payment goes entirely toward reducing the balance—instead of paying interest—you actually see the debt shrink month to month. That momentum is psychologically powerful.

Structure also removes the constant negotiation. You don't wake up each morning fighting the urge to use the card. You don't lie awake worrying about whether you're paying enough. The rules are set. The game has changed.

Time as a Financial Lever

Here's something most people don't fully appreciate: time is the most powerful financial lever available when interest is the problem.

If you could pause interest for 18-21 months while maintaining the same payment level, the impact would be transformative.

On a $10,000 balance:

With 20% interest and $300/month payments: 9+ years, $8,000+ in interest paid.

With 0% interest and $300/month payments: 33 months (2.75 years), $0 in interest paid.

That's not a small difference. That's literally years of freedom restored and thousands of dollars returning to your control instead of flowing to a lender.

The payment is the same. Your discipline is the same. But time—the one variable you can't manufacture through willpower—has been restructured in your favor.

This is why interest-free windows, despite sounding counterintuitive, are genuinely powerful tools. They're not a magic solution to spending habits. But they are a legitimate restructuring of how time works in your favor.

Mini-Case: How Principal Acceleration Changes Everything

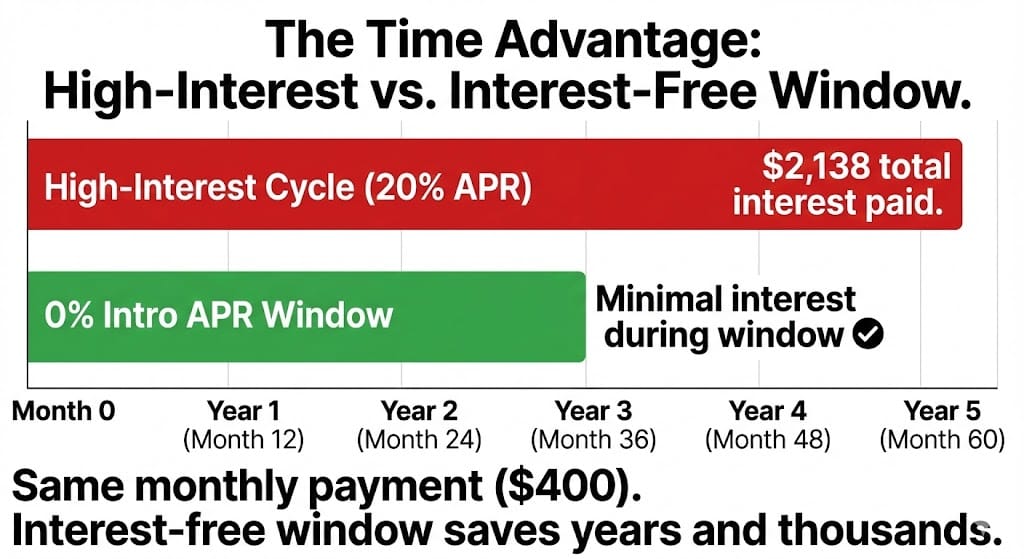

Consider someone with a $15,000 balance, paying $400/month.

Traditional high-interest card (20% APR):

- Year 1: $1,067 goes to interest, $3,733 to principal. Balance: $11,267.

- Year 2: $752 goes to interest, $3,948 to principal. Balance: $7,319.

- Year 3: $301 goes to interest, $4,199 to principal. Balance: $3,120.

- Year 4: $18 goes to interest, $4,782 to principal. Balance: $0.

- Total interest paid: $2,138. Timeline: 4 years.

0% introductory APR card (21-month window):

- Month 1-21: Full $400 goes to principal monthly. Balance reduced by $8,400.

- Remaining balance: $6,600.

- If returned to regular card after intro period, final payoff on reduced balance is faster and cheaper.

- Total interest paid: Minimal during intro period, then calculated on reduced balance. Timeline: 2-3 years.

The difference isn't subtle. The principal acceleration compounds. You're not just saving interest; you're buying years of freedom.

Why Relief Tools Feel Counterintuitive

Here's the uncomfortable psychology: tools that provide relief often feel like cheating.

If you've internalized the message that you "should" be able to solve this through discipline and willpower, then accepting a structural tool—a temporary interest pause—can feel like admitting failure or taking an unfair shortcut.

But that's backwards. Using a tool to restructure an unfavorable situation isn't cheating. It's recognizing that willpower has limits and structure is stronger.

An 0% APR period isn't a silver bullet for spending habits. If you go back to overspending, you're back where you started. But if you use it strategically—as a window to eliminate existing debt before moving forward—it's one of the few legitimate ways to restructure time in your favor.

The counterintuitiveness comes from a cultural message that says: "Real financial health comes from discipline alone." But that message ignores compounding math. Sometimes what you need isn't more willpower. You need the interest to stop working against you for long enough to catch your breath.

Protecting Mental Bandwidth

What doesn't show up in financial calculations is the mental cost of persistent debt stress.

Carrying high-interest debt isn't just a math problem. It's psychological pressure that quietly consumes decision-making capacity. You're less able to focus on work because you're worried about money. You make worse financial decisions because you're stressed. You avoid opening statements because the numbers hurt.

An interest-free window doesn't just change the math. It changes the psychological environment. Suddenly, you can breathe. The pressure eases. And paradoxically, that mental relief often leads to better overall decisions—not because you're more disciplined, but because you have cognitive space to think clearly.

This isn't something that gets captured in a spreadsheet. But it's real.

A Tool, Not a Solution

Some people use strategic 0% intro APR tools to manage transitions, fund purchases without accruing interest, or attack existing balances.

Certain cards offer 0% intro periods combined with cash-back incentives and welcome bonuses, making them temporary tools rather than long-term solutions. The key word is temporary—a structured window, not a permanent fix.

The tool doesn't change underlying habits. It doesn't teach budgeting. What it does is pause the penalty while you restructure behavior. And sometimes, that pause is exactly what someone needs to reset the trajectory.

Stopping Damage vs. Building Wealth

Here's a distinction worth making: stopping damage is different from building wealth, but it's the necessary prerequisite.

You can't build financial security while interest is consuming your payments. You can't compound savings while debt is growing. The first move has to be structural: stop the bleeding before you try to move forward.

That's what an interest-free window does. It stops one specific form of bleeding—the silent compound cost of owing money. It doesn't solve everything. But it removes one major obstacle.

Take a Break From High Interest: This Top Card Offers 0% Intro APR Until 2027

Finance Buzz

Financial progress rarely begins with heroic discipline. It usually begins with relief.

Relief from the pressure of high interest. Relief from the feeling that payments aren't working. Relief from the psychological weight of debt that seems immovable.

Once that relief arrives—through whatever legitimate tool provides it—people make better decisions. Not because they suddenly developed more willpower, but because they now have space to think, plan, and adjust.

The invisible tax of interest steals more than money. It steals clarity and agency. Removing it, even temporarily, restores both.

That restoration is where real financial progress becomes possible.

—

Claire West