The Liberation of Small Windows: Why Predictable Routines Beat Endless Promises

5:47 a.m. The market hasn't opened yet. Most people are still asleep, their phones dark, their worries dormant.

But in certain rooms across the country, someone is already at a desk with a coffee that's still steaming. Not frantically. Not with the manic energy of someone trying to catch every ripple. Just quietly present, aware that in a few hours, there will be a specific window—a narrow slice of time with particular conditions—where something actionable might appear.

The chaos of global markets, the endless news cycle, the algorithmic trading at light speed, the overnight moves in Asia, the cryptic Fed statements—all of it exists. But for this person, those things exist outside the frame. Inside the frame is something much smaller: a 75-minute window. A set of conditions. A clear entry and exit.

Most of financial culture screams: "You need to be ready all the time. Opportunities appear everywhere. Stay alert, stay nimble, stay in the game."

But what if the opposite were true? What if constraints—not freedom—are what actually create confidence?

The Myth of "Passive Income"

The promise has been whispered to millions: build something once, and collect forever.

Write a book, earn royalties.

Create an online course, sell it infinitely.

Find the "right" investment, watch it compound.

Identify the perfect stock, hold and prosper.

The promise is seductive because it offers something human beings crave: freedom from constant effort. The idea that you can stop striving, stop watching, stop managing—and still benefit.

But here's what actually happens:

The book needs marketing and updates.

The course requires customer support and platform maintenance.

The "right" investment enters bull and bear cycles, triggering anxiety and doubt.

The perfect stock gets disrupted or loses its moat.

Passive income, as it's commonly understood, is a myth. What people really want isn't passivity. It's predictability—knowing what to expect, when to expect it, and what action (if any) is required.

The reason most "passive" promises fail is that they deliver neither predictability nor genuine passivity. They deliver false hope and hidden complexity. You're told the work is done, but your attention remains captured by uncertainty.

I’ve seen a lot of “passive income” promises in my time.

Buy and hold. Buy more. Sit tight. Pray the market goes up.

This?

This isn’t that.

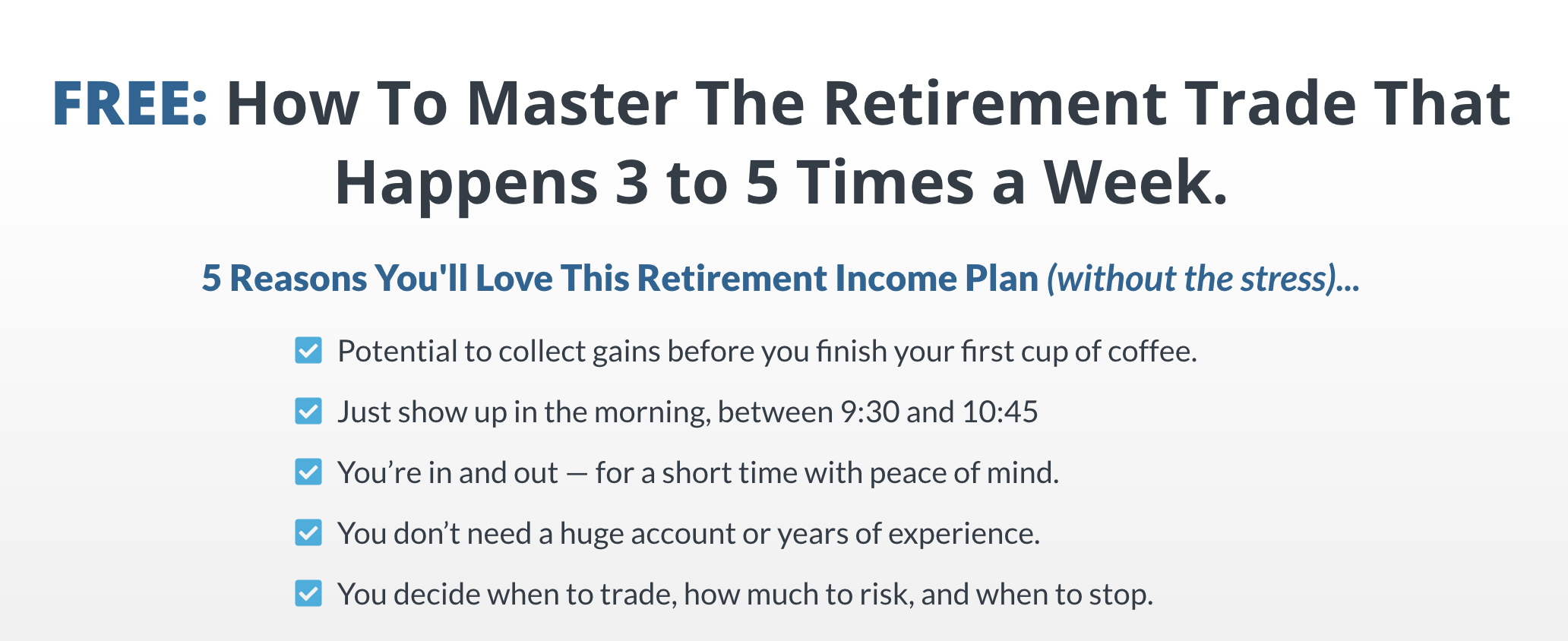

What I saw was a short, repeatable trading window that shows up 3 to 5 times a week, between 9:30 and 10:45AM.

✅ No late nights.

✅ No wild swings.

✅ No waiting years to maybe break even.

Just one move — in and out.

Before your coffee’s even cold.

You don’t need a huge account.

You don’t need 10 monitors.

You need a few minutes, a plan, and the guts to take control of your time.

They call it The Retirement Trade.

I call it the best-kept secret on the street.

Get the free strategy guide — and see it for yourself.

The Psychology of Constrained Decision-Making

Here's a counterintuitive insight from behavioral psychology: limitations reduce overwhelm.

When you have unlimited choices and unlimited time, decision-making becomes paralyzing. Should you trade now or wait? Should you hold or sell? Should you chase this opportunity or ignore it? The freedom becomes a prison.

But when you add constraints—a specific time window, clear entry rules, defined risk parameters—something shifts:

The paralysis dissolves.

Emotional noise quiets.

Clarity arrives.

This is why casinos can be oddly relaxing: the rules are crystal clear. You know exactly what's allowed, what's not, what happens if you win, what happens if you lose. There's no hidden complexity. No wondering if you're making the "right" decision in an undefined landscape.

Financial decisions don't have to happen that way. But many traders and investors have discovered that imposing artificial constraints on themselves—narrow time windows, predefined setups, strict risk rules—paradoxically creates more freedom, not less.

The freedom to stop checking charts obsessively.

The freedom to do other things with your day.

The freedom to know exactly what you're doing and why.

Mini-Case: How Short Windows Shift the Emotional Load

Consider someone using a defined, time-bound trading approach.

Instead of: "I need to watch markets all day and be ready for anything"

They have: "I have a clear window (9:30–10:45 AM) where I look for a specific pattern"

Instead of: "I'm wondering if I missed something, if I should check again"

They have: "My rules are written down; if the conditions don't appear, I don't trade"

Instead of: "I'm hoping this works out; I have no idea when to sell"

They have: "My exit is predetermined; when the rule triggers, I act"

The emotional load shifts from constant vigilance to disciplined execution. That shift is profound.

Your brain stops running in background anxiety mode. You're not checking your phone at 2 a.m. wondering if you missed something. You're not haunted by "what ifs." You're not riding an emotional roller coaster tied to every market move.

Instead, you have a routine—one that's narrow, predictable, and finite.

Research in behavioral finance shows that rule-based trading frameworks significantly reduce emotional stress compared to discretionary approaches, while often delivering similar or better outcomes through improved discipline and consistency.

Passive Hope vs. Active Structure

The contrast is worth naming clearly:

| Passive Hope | Active Structure |

|---|---|

| Undefined timeline ("someday it'll pay off") | Clear window (9:30–10:45 AM, specific days) |

| Waiting on markets to cooperate | Acting within predetermined rules and conditions |

| Emotional drift (hope, fear, doubt) | Rule-based boundaries (execute, move on, repeat) |

| Unclear when/if something happens | Finite ritual, repeatable, measurable |

| Constant monitoring | Focused attention at scheduled times only |

| Anxiety about missing opportunities | Relief from knowing the setup, taking action, exiting |

| "Maybe this will work" | "If conditions align, I know exactly what to do" |

One promises liberation but delivers captivity. The other demands discipline but actually delivers freedom.

Why Predictability Matters More Than Dreams

Most financial advice is built on dreams: your money will compound endlessly, you'll retire at 40, you'll achieve financial independence without ever having to think about it again.

But human psychology doesn't respond to dreams as well as it responds to predictability.

Predictability is calming.

Predictability is grounding.

Predictability allows you to plan other parts of your life without financial anxiety consuming your attention.

When you know:

- What you're looking for

- When you're looking

- What you'll do if you find it

- What happens if you don't

Your nervous system settles. Your energy becomes available for other things. Your sense of agency—the feeling that you have some control over outcomes—actually increases.

This matters more than most people realize. A sense of control is one of the strongest predictors of emotional wellbeing and reduced financial anxiety. And control isn't achieved by dreaming bigger. It's achieved by understanding your system better.

The Appeal of Tight Routines

There's something almost meditative about a small, daily financial ritual done with intention.

You wake. You have coffee. At 9:30, you open your charts.

You look for the specific setup you've defined.

If it appears, you execute according to your rules.

If it doesn't, you close the charts and move on with your day.

That's it. No second-guessing. No "what if." No emotional spiral about missed opportunities.

The ritual is tight enough that it fits into your life without consuming it. It's predictable enough that you can plan around it. And it's structured enough that you know whether it's working or not.

This kind of routine doesn't require genius. It requires consistency and honesty—showing up, executing the plan, and being willing to admit when the plan isn't working.

Small daily rituals compound. Not just in returns (though they may), but in emotional stability and sense of agency. You're not at the mercy of markets. You're engaged with them on your own terms, in your own time window, following your own rules.

Protecting Time, Energy, and Control

At its core, this approach is about protection.

Protection of your time: knowing that financial management happens in a defined window, not constantly.

Protection of your energy: having a framework that reduces the psychological load of decision-making.

Protection of your sense of control: doing something intentional, measurable, and repeatable—rather than hoping and waiting.

For people in their 40s, 50s, and beyond, these protections matter enormously. Your time is less abundant. Your energy is more precious. Your need for a sense of agency—especially in areas where external forces feel overwhelming—is real.

A constrained system offers all three. Not perfectly. Not always. But more reliably than the alternative of endless, vague, emotionally exhausting hope.

A Framework for the Practical

Some traders have found structure in what's known as a time-bound trading setup—a pattern that appears consistently in a narrow morning window.

Traders using Dave Aquino's "Retirement Trade" framework say the appeal isn't big promises—it's the structure: a clear, repeatable window between 9:30 and 10:45 AM. His free guide explains the logic behind the setup and how people apply it in practice.

Whether or not a specific framework like this resonates with you, the principle holds: structure beats promises. A clear, narrow, repeatable process beats vague dreams about wealth building.

In a culture obsessed with optimization, abundance, and endless opportunity, there's a quiet rebellion in choosing constraint.

Not constraint born from fear or limitation, but constraint born from clarity.

The person who trades in a 75-minute window isn't missing opportunities. They're making a conscious choice about which opportunities they'll engage with, and which they'll let pass.

The person who checks their portfolio on a schedule instead of obsessively isn't being passive. They're being intentional about where their attention goes.

The person who follows a rule instead of following their gut isn't being rigid. They're protecting themselves from the worst impulses of emotion and fatigue.

Financial progress doesn't require consuming your entire day. It doesn't require constant vigilance. It doesn't require abandoning hope for predictability.

What it requires is discipline—small, repeatable, honest discipline. The kind that builds over time. The kind that lets you sleep at night. The kind that frees you to live a life beyond the pursuit of endless optimization.

The market opens at 9:30. For some, the real work happens in the 75 minutes that follow.

For the rest of the day, they're free.

That freedom—the kind earned through structure, not promised by passivity—is what actually sustainable financial life looks like.—

Claire West