The New Geography of Money

Last year, a close friend of mine made a life-changing decision. She packed up her family, her memories, and her hopes, and moved from the high-priced bustle of California to a quieter life in Texas. It wasn't about chasing a new dream, exactly — it was about recalibrating everything to fit a new reality. The soaring cost of housing, rising taxes, and stretched budgets for everyday essentials made staying in California feel like navigating a financial maze with no end in sight.

She wanted stability, better prospects for her children, and finally, the possibility to save for retirement without constant worry. This personal story is one that echoes across everyday America — families searching for a place where their money can stretch further without sacrificing quality of life.

Today, more families like hers are redefining what it means to thrive financially, driven by a powerful shift I like to call The New Geography of Money.

Understanding the Shift in America’s Financial Map

The idea that money—and financial stability—has a geography is nothing new. But lately, that map has been redrawn in profound ways. The rising costs of housing, taxes, healthcare, utilities, and even groceries are pushing many Americans to reconsider where they live and how to stretch their dollars.

States like California and New York, once magnets for opportunity, now often feel like financial pressure cookers. Meanwhile, states such as Texas, Florida, and others in the Southeast and Mountain West are becoming new financial havens. This isn't about abandoning home — it’s about seeking financial balance in the face of rising costs.

The core forces shifting this geography include:

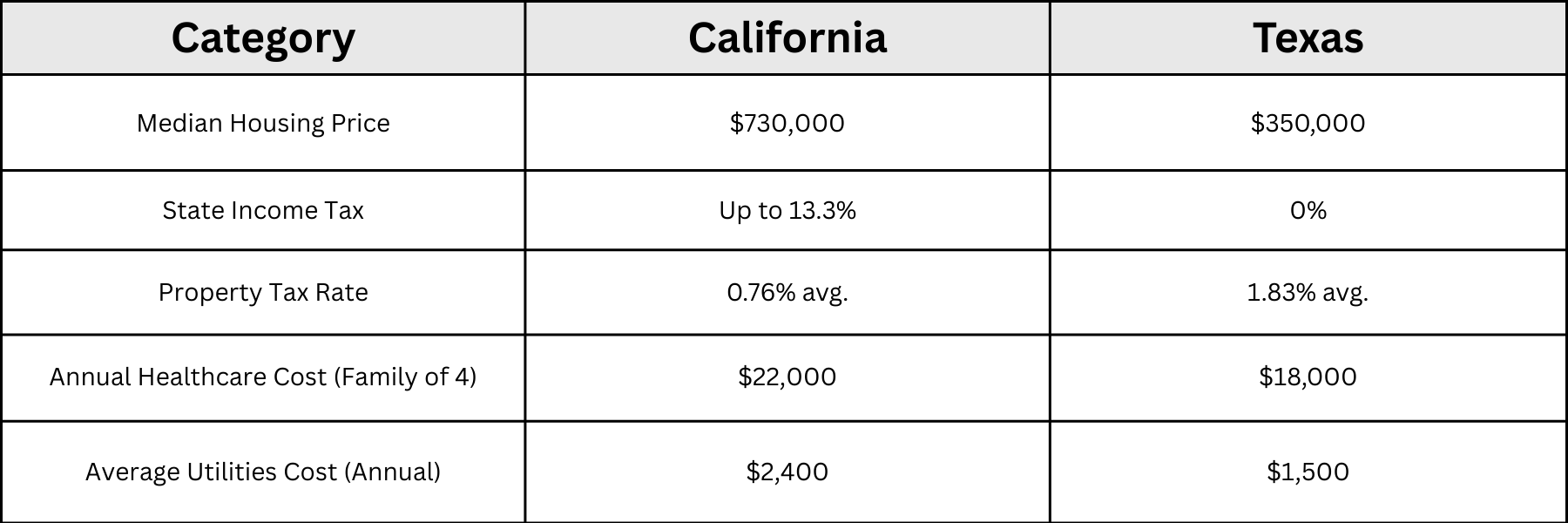

- Housing Costs: The median home price in California in 2025 averages around $730,000 compared to $350,000 in Texas.

- Taxes: State tax burdens vary widely; for example, California’s combined state income and property taxes can exceed 12% for many households, while Texas has no state income tax and lower property taxes overall.

- Healthcare: Healthcare costs vary by region and state policy, adding thousands annually to family budgets in higher-cost states.

- Utilities: Energy prices can be double in some Northeast states compared to parts of the South and Mountain West.

This confluence of factors creates a complex but undeniable financial inequality map, influencing migration trends and family decisions nationwide.

Trump’s Bitcoin Reserve Is No Accident…

When Trump does something, it’s never by accident. So when whispers started swirling that he’s backing a crypto reserve… We knew something big was coming.

Now, it’s official: Trump insiders are preparing to launch a new digital asset movement, and it starts with what is being called “The Number One Coin.”

This isn’t Bitcoin.

This isn’t Ethereum.

It’s something quietly rising behind the scenes—and if you blink, you’ll miss the whole damn rocket launch.

Right now, average Americans are getting in. Not hedge funds. Not billionaires.

You did the work.

Now let your money work for you.

But listen—this isn’t some get-rich-slow strategy. This coin is on the move now. Every hour you wait, the window shrinks.

You’ve seen what happens when Trump bets big. This time, you can bet with him.

Click here to see the coin Trump may be backing.

Your shot at owning this coin starts here.

But blink… and you’ll miss it.

—

Your future self will thank you,

if you click before this goes viral.

Migration Trends and Cost Comparisons

Recent data in 2025 clearly lays out the new migration patterns and cost differences shaping American lives.

Migration Trends

- Top gainers: Texas (+300,000 net new residents), Florida (+280,000), Arizona (+120,000), and South Carolina (+80,000).

- Top losers: California (-250,000), New York (-210,000), Illinois (-110,000).

These figures highlight a clear movement from high-tax, high-cost states to more affordable, tax-friendly states.

Cost of Living Snapshot (2025):

Note: Although Texas has higher property tax rates, the lack of state income tax and lower housing prices significantly reduce overall financial pressure for many families.

A Practical Checklist for Families Considering the Move or Budget Adjustments

Whether you’re seriously considering relocation or simply aiming to recalibrate your family's budget where you live, here are actionable steps to keep your financial health intact:

- Examine State Tax Policies: Carefully study income, sales, and property taxes. Use calculators to estimate your net savings after taxes and fees.

- Assess Housing Costs: Research current home prices and rental markets. Plan for additional costs like property insurance and maintenance.

- Healthcare Expenses: Beyond premiums, consider out-of-pocket costs unique to each state’s healthcare networks and policies.

- Understand Utility Prices: Variations in electricity, water, and gas costs can surprise you. Utilities often reflect regional climate and infrastructure differences.

- Job Market Analysis: Ensure your profession or industry offers strong employment prospects and salary potential in the new location.

- Community and Quality of Life: Look beyond dollars—consider schools, safety, cultural amenities, and social support systems crucial for long-term happiness.

A Simple Formula for Comparison

When weighing a decision, use this calculation to roughly estimate your potential cost savings or additional expenses when moving:

Cost of Living Gap = Current Total Expenses − Projected Expenses in New Location

A positive result means potential savings, while a negative number indicates higher costs.

Control Through Understanding

Moving to a different state is a monumental decision, rooted in deeply personal factors—family ties, career ambitions, lifestyle preferences. For some, it’s the key to reclaiming control over their financial future. For others, staying put and optimizing within their current geography makes more sense.

What I’ve learned through hearing stories like my friend’s, and examining the data, is this: No matter where you live, understanding the new geography of money empowers families to plan smartly and live confidently. It’s not just about chasing a lower price tag; it’s about aligning your life with thoughtful financial choices and realistic budgeting.

Whatever path feels right, the first step is clarity—a clear view of the shifting financial landscape and your place within it. That clarity, more than anything, is what helps keep budgets balanced, futures secure, and families thriving.

—

Claire West