The Physical Layer

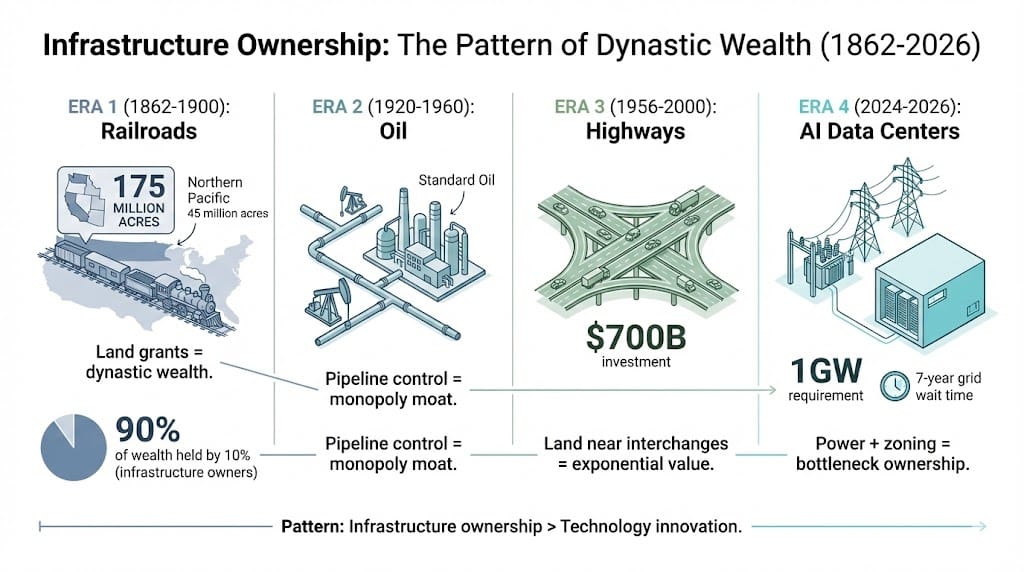

There is a quiet moment in every American transformation when the story stops being about the idea and starts being about the dirt. The railroads were not built on steam engine patents alone. They were built on the 175 million acres of federal land granted to private companies between 1862 and 1871 — a checkerboard of ownership that carved the West into fortune-making geometry. The men who became richest were not the ones who engineered better locomotives. They were the ones who owned the land underneath the tracks.

The same pattern held for oil. Standard Oil’s monopoly was not secured by drilling innovation. It was secured by pipeline control, storage terminals, and secret freight agreements that made competing transportation economically impossible. The value was not in the chemistry. It was in the choke points.

The interstate highway system, authorized by Eisenhower in 1956, spent $700 billion (in 2025 dollars) opening arteries across the continent. The federal government financed the concrete, but the wealth flowed to those who owned the land near the interchanges — commercial real estate, logistics hubs, retail corridors that became exponentially valuable because they sat at physical bottlenecks.

This is how America builds transformational wealth. Not through the technology itself, but through control of the infrastructure that technology requires.

History Lens: When Lincoln Met the Land

The Pacific Railroad Act of 1862, signed by Abraham Lincoln in the middle of the Civil War, was not an act of technological enthusiasm. It was an act of strategic infrastructure creation. The federal government granted railroads 20-mile-wide strips of land, alternating in a checkerboard pattern: odd-numbered sections to the railroads, even-numbered sections retained by the government.

The Northern Pacific Railroad alone received 45 million acres — more than double any other transcontinental line, an area larger than the state of New York. The railroads could sell this land to settlers, use it as collateral for bonds, and extract tolls in perpetuity. The government believed land values would double, making the grants self-financing. What actually happened was more concentrated: the railroads sold land cheaply to speculators, accumulated capital, and turned infrastructure ownership into dynastic wealth.

By 1900, the richest 10 percent of Americans controlled 90 percent of the nation’s wealth, largely through infrastructure monopolies — railroads, oil pipelines, telegraph lines, and shipping. The innovation mattered less than the fact that no competitor could route around their physical assets.

This was not corruption. This was structure. The government needed infrastructure. Private capital needed returns. The deal was explicit: control land, build infrastructure, capture upside. The pattern repeated with highways, airports, and fiber optic networks. The technology changed. The structure did not.

Every few decades, America does something extraordinary.

It takes a crisis... and turns it into a Gold Rush.

In 1862, Lincoln opened federal land to the railroads. Investors made fortunes. In 1910, Taft opened federal land to oil drillers. Dynasties were built.

Today, it is happening again.

But this time, we aren't laying track or drilling wells. We are building the physical backbone of Artificial Intelligence.

Data centers are the new oil wells. And they need massive amounts of land and power.

President Trump’s new Executive Order has sparked a modern-day land rush.

The biggest asset managers in the world—BlackRock, Blackstone, PGIM—are already pouring billions into this sector.

They want to own the land.

But I’ve found a "Backdoor" that lets you stake your claim alongside them—starting with just a few hundred dollars.

See the 3 stocks that let you own the "Digital Soil" of the AI revolution.

Click here now to watch the full presentation.

Shift to Present: AI’s Physical Requirements

Artificial intelligence is now undergoing the same transformation. For three years, the narrative has been about software, algorithms, and models. But the narrative is quietly shifting to power substations, cooling systems, and acreage.

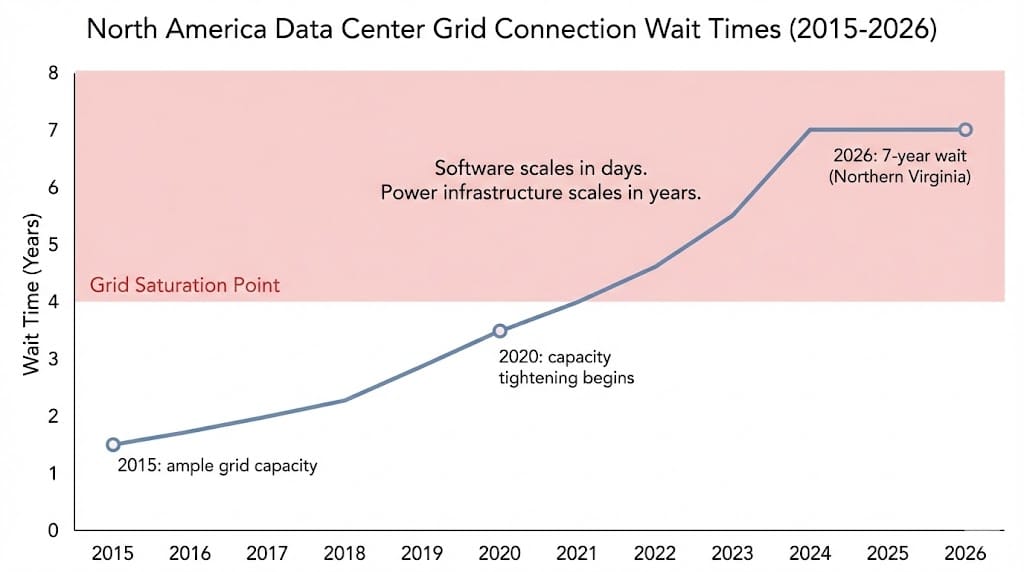

A single hyperscale AI data center requires one gigawatt of electricity by 2026 — the output of a nuclear reactor. Meta, Microsoft, and OpenAI have committed hundreds of billions to data center construction. Project Stargate alone aims to invest $500 billion. But the constraint is not capital. It is not even chips. It is speed-to-power — the time required to connect a facility to the electrical grid.

In Northern Virginia, the world’s largest data center market, wait times for grid connection now stretch to seven years. In Memphis, xAI had to rent portable gas-fired generators — at far higher unit cost than grid power — because grid access was unavailable. The hyperscalers are so desperate for power that they are prioritizing sites with existing infrastructure over cheap land.

This is the physical reality: software scales infinitely, but electrons do not. You cannot route around a power substation. You cannot negotiate with physics. The bottleneck is no longer code. It is copper, concrete, and cooling water.

The Bottleneck Thesis

The thesis emerges quietly: AI is not a software story anymore. It is a land, power, and logistics story. Data centers are the new oil fields. Energy, zoning, and acreage are the real choke points.

Every transformative era has followed this arc. The railroads needed land. Oil needed pipelines. Electricity needed generation and grid. The internet needed fiber and data centers. AI needs power, cooling, and land with permissive zoning.

The digital narrative — infinite scalability, zero marginal cost, software eating the world — is colliding with physical reality. A data center cannot be built where the grid is saturated. A cooling system cannot be engineered around a water shortage. Zoning boards do not move at the speed of software deployment.

This is why the infrastructure moment is arriving now. The hyperscalers have committed to building. The capital is allocated. But the physical layer is not ready. And the only way to make it ready is to own or control the physical assets that enable it.

Who Is Moving First

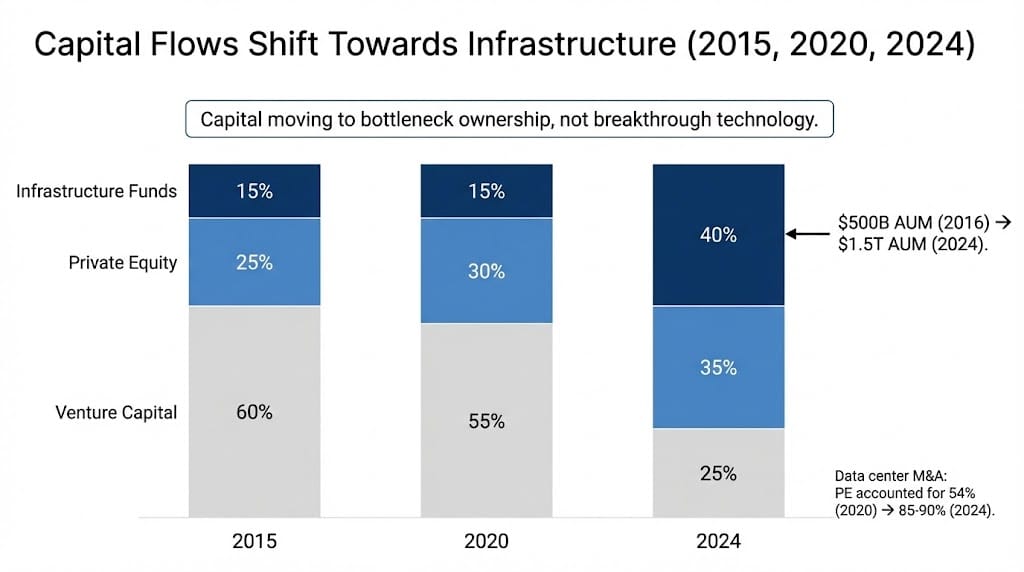

The capital is not waiting for headlines. It is moving now.

Private equity now accounts for 85 to 90 percent of data center M&A value, up from 54 percent in 2020. Infrastructure assets under management have surged from $500 billion in 2016 to $1.5 trillion in 2024. Sixty-five percent of institutional investors surveyed by Nuveen plan to increase allocations to digital infrastructure.

The deals are already happening. Meta selected Blue Owl Capital and PIMCO to finance a $29 billion data center project in Louisiana. Nuveen raised $1.3 billion for an energy and power infrastructure credit fund. PGIM Real Estate closed a $2 billion Global Data Center Fund.

The money is not flowing to AI startups. It is flowing to the power plants, transmission lines, and land parcels that AI startups require. The asset managers, pension funds, and sovereign wealth funds are not betting on models. They are betting on electrons.

This is the institutional playbook: buy the bottleneck, not the breakthrough. Own the physical layer that the digital layer cannot exist without.

Digital Narrative vs. Physical Reality

| Dimension | Digital Narrative | Physical Reality |

|---|---|---|

| Constraint | Code, compute, algorithms | Power, cooling, land, zoning |

| Scalability | Infinite (copy software) | Finite (copper, steel, concrete) |

| Speed | Deploy in days | Build in years (permits, grid) |

| Marginal Cost | Near zero (software) | Rising (power, materials, labor) |

| Bottleneck | Talent, chips | Substations, transmission, acreage |

| Wealth Creation | IP ownership | Infrastructure ownership |

| Competitive Moat | Network effects | Physical monopolies (location) |

| Example | AI model weights | AI data center campus |

| Capital Source | Venture capital | Infrastructure funds, pensions |

| Risk | Obsolescence | Stranded asset (if demand shifts) |

The gap between columns is where the next fortunes will be made or lost. The digital narrative is priced in software valuations. The physical reality is priced in real estate, power contracts, and transmission rights.

Why Retail Usually Misses This Phase

Retail investors miss the infrastructure phase for three reasons. First, the timing is wrong. The headlines are about AI breakthroughs, ChatGPT, and model capabilities. The physical layer is being built quietly, with long lead times, far from Silicon Valley press releases.

Second, the optics are boring. A power substation does not make for compelling CNBC segments. A data center in rural Texas does not trend on Twitter. The wealth is being built in permits, zoning approvals, and 20-year power purchase agreements — the least glamorous documents in finance.

Third, the complexity is daunting. Understanding grid interconnection queues, cooling water rights, and tax incentives for industrial power generation requires expertise that retail investors do not have. The asset managers moving capital have infrastructure teams, energy analysts, and regulatory specialists. Retail has Robinhood and Reddit.

This is how it has always been. The railroad land grants were not available to small investors. The highway interchanges were bought by developers before the public understood the map. The fiber routes were leased by carriers before the internet was commercial. The physical layer is built by institutions, for institutions, long before the transformation is visible to the crowd.

Wealth Is Built Quietly

The final lesson is this: every American transformation looks like a technology story in retrospect, but it was an infrastructure story in real time. The railroads, the oil fields, the highways, the internet backbone — all were built on land control, power access, and physical bottlenecks.

AI will be no different. The models will improve. The code will evolve. The applications will proliferate. But the infrastructure that enables them — the power plants, the transmission lines, the cooling systems, the acreage with permissive zoning — is being locked up now.

The wealth is not in the prediction. The wealth is in the permission to build. And that permission is granted through ownership of the physical layer.

Patience is a strategy. Understanding structure is an edge. And the biggest fortunes are rarely made by chasing the obvious. They are made by owning the choke points before the crowd realizes they exist.

—

Claire West