The Psychology of Warnings

Human beings don’t have a great track record with early warnings.

We’re built to respond to what’s immediate and visible: flashing lights, urgent banners, people around us reacting. Quiet signals—an unfamiliar chart bending upward, a new technology quietly adopted in the background—don’t trigger the same response.

Behavioral research shows how strongly we cling to existing narratives, especially when they’ve worked for us in the past. If a certain investment approach has kept a portfolio growing for ten years, it’s hard to accept that the underlying conditions might have changed. The mind whispers: “This is probably just another blip. Things will go back to normal.”

Several biases reinforce that instinct:

- Status quo bias: preferring the current state, even if it’s fragile.

- Confirmation bias: seeking information that supports what we already believe and ignoring what doesn’t.

- Herd behavior: feeling safer when our choices look like everyone else’s—even if the crowd is late.

Early warnings feel lonely. They don’t come with consensus. They rarely feel urgent. So most people file them away under “interesting, but not actionable,” and go back to familiar routines.

By the time the signal becomes loud enough to feel real, it’s no longer early. It’s already the new environment.

How Hidden Breakthroughs Ripple Into Everyday Money Decisions

Technological shifts almost never show up first in a personal budget spreadsheet. They show up in the infrastructure underneath the economy.

A new AI tool helps corporations allocate ad dollars more efficiently.

Payment rails become faster and cheaper behind the scenes.

Robo-advisors and automated savings tools change how ordinary people interact with money.

At the outset, these are enterprise conversations. Product teams. CTOs. Procurement leads. But the effects eventually leak outward:

- Companies that adopt effective tech quietly widen their margins.

- Jobs tied to legacy processes start to feel unstable.

- Consumers experience subtle changes in pricing, offers, and product design.

Years later, individuals “feel” the shift in concrete ways: less job security in certain roles, more nudges to use digital platforms, changing expectations around fees and yields.

By then, the original breakthrough—an AI model, a software platform, a new API—is old news in technical circles. The early signal has already matured. The personal finance impact is the aftershock, not the event.

A well-known innovator recently said something that shook the AI world — and it wasn’t a prediction.

It was a warning.

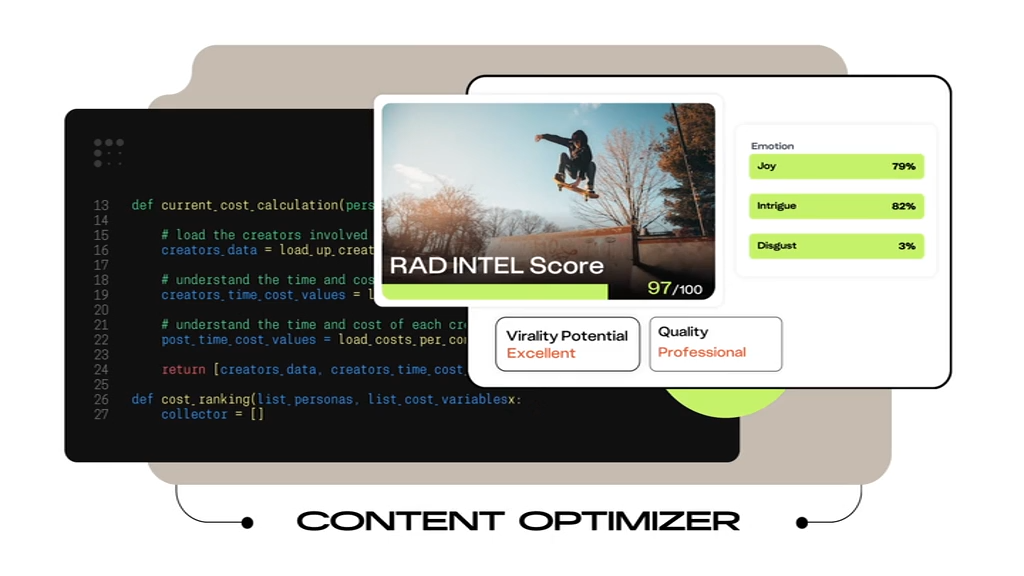

Our team has been tracking a breakthrough company outperforming expectations behind the scenes.

This is the company quietly building technology that even leading AI infrastructure companies are taking note of.

RAD Intel is delivering measurable ROI (per SEC filings) for Fortune 1000 brands through predictive intelligence — the kind of performance traditional tools can’t match.

With a Nasdaq ticker reserved as $RADI, a 4,900% valuation expansion, and an early-stage Reg A+ offering at $0.85/share, this AI platform is rapidly becoming one of the most-watched opportunities of 2025.

The mainstream hasn’t caught on yet — but when they do, the window will close.

Financial Blind Spots: When Technology Outran Awareness

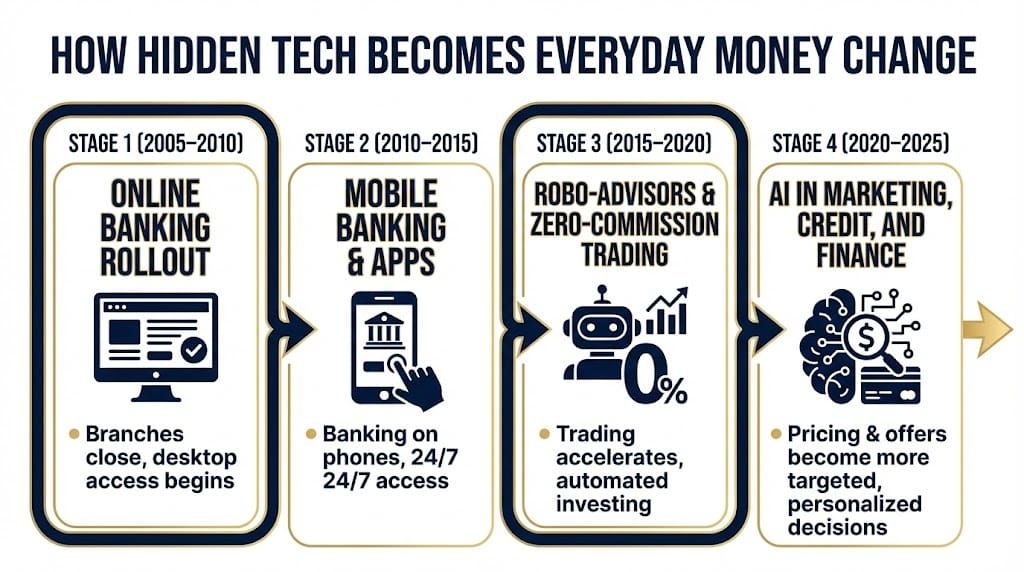

History is littered with moments when new technology outpaced public awareness—and financial behavior lagged behind.

Early online banking felt optional. Some adopted it; many didn’t. But as digital channels became primary, branch networks shrank and the entire relationship between consumers and banks changed. Those who adapted early navigated the shift calmly. Those who resisted found familiar touchpoints disappearing.

High-frequency and algorithmic trading began as niche strategies in institutional finance. Yet over time they altered liquidity and intraday volatility in ways that affected retail investors watching “weird” moves they couldn’t explain.

The first wave of smartphones seemed like expensive toys. Few foresaw that mobile computing would become the default interface for banking, shopping, investing, and work. Entire business models were built—or crushed—on the back of a device people initially mocked as unnecessary.

In each of these cases, the financial blind spot was the delay between:

- When the technology was real

- When institutions reorganized around it

- When individuals realized their money habits needed updating

The people who navigated these transitions best weren’t necessarily the most tech-savvy. They were simply the ones who noticed earlier that the ground was moving.

Visible Changes vs. Invisible Drivers

The gap between what we see and what actually drives change is often wide.

| Visible Change | Invisible Driver |

|---|---|

| Splashy headlines about “AI revolutionizing markets” | Quiet deployment of AI into marketing, credit models, and operationspapers.ssrn+1 |

| New investing apps and zero-commission trading | Backend infrastructure cutting transaction costs and raising trade volumepmc.ncbi.nlm.nih |

| More “personalized” pricing and offers | Data analytics engines profiling behavior across platformspapers.ssrn |

| Banks closing branches | Long-term migration to digital-first services and automated adviceczasopisma.uni.lodz+1 |

Most people react to the left column. Their financial lives are shaped by the right.

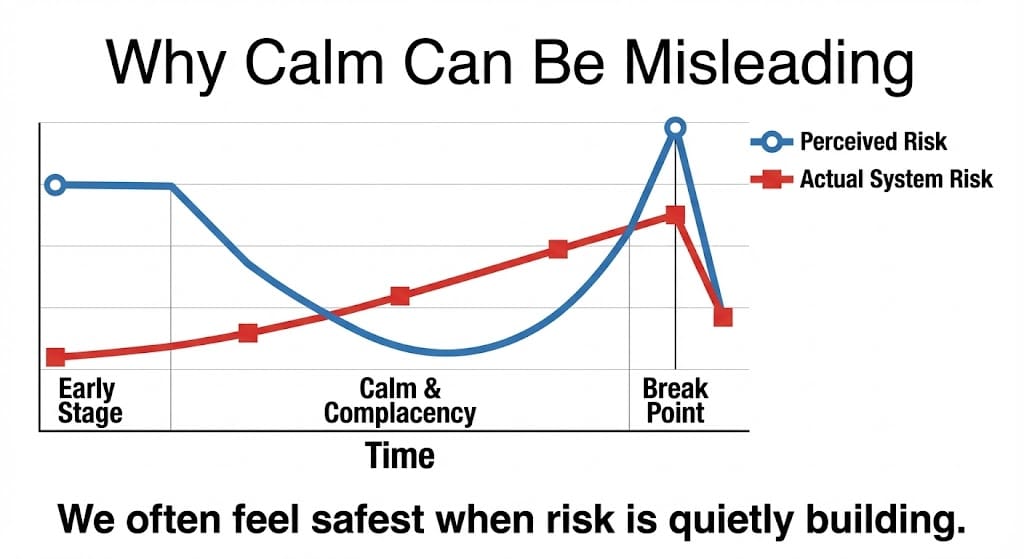

Why Calm Environments Get Misread

There’s a particular cognitive trap that shows up late in cycles: mistaking calm for safety.

If volatility is low, headlines are boring, and account balances drift upward, it’s easy to assume the system underneath is sound. Stability, in that sense, becomes aesthetic: if things look fine, we believe they are fine.

But research on market behavior suggests that periods of low volatility and high complacency often precede larger breaks. Quiet can be a signal—not of health, but of risk being underpriced.

Technological shifts amplify this problem. Systems can be quietly re-architected for years—more leverage, more complexity, more automation—without any visible stress. When something does go wrong, the reaction looks “sudden” only to those who weren’t watching the plumbing.

A calm surface doesn’t tell you much about the current beneath it. It just tells you that, for now, the current hasn’t hit anything.

The Emotional Advantage of Early Attention

Paying attention to early signals isn’t about jumping first. It’s about thinking sooner.

If you notice that your industry is adopting automation tools aggressively, you have time to:

- Up-skill into roles that complement the new tools

- Adjust expectations for future income

- Change your savings or investment plans with a calmer head

If you notice that financial platforms are pushing more automation, you have time to:

- Understand how those tools make decisions

- Decide which ones align with your goals

- Set boundaries around what you will and won’t delegate

The emotional advantage is simple: when a visible change finally arrives—job restructuring, product sunset, new fee structure—you’ve already processed the idea. You’re not making decisions under shock. You’re executing a plan you had time to form.

Early awareness doesn’t remove uncertainty. But it shrinks the window where fear is in charge.

Who You’re Really Protecting

For most readers of The Budget Analyst, this isn’t an academic exercise. It’s about protecting specific people and promises:

A spouse who has built a life around certain retirement assumptions.

Children or grandchildren you hope to help in a world that may be less forgiving than the one you entered.

A parent whose care may depend on your financial resilience if their own savings fall short.

In that context, awareness outranks prediction.

You don’t need to know which AI platform or fintech app will dominate the next decade. You do need to recognize when your current assumptions—about job security, inflation, returns, or access to services—no longer fit the environment being built underneath them.

Awareness buys time. And time, in personal finance, is often the most valuable asset you have.

A Quiet Example of a Quiet Shift

Some readers find it helpful to ground these ideas in specific, real-world cases.

A group of analysts has been tracking a lesser-known AI company, RAD Intel, that Fortune 1000 brands reportedly use for measurable ROI (per SEC filings). With a 4,900% valuation expansion and an early-stage Reg A+ round at $0.85/share, some investors see it as an example of how quiet shifts can unfold before the mainstream catches up.

Whether or not a company like this fits your own risk tolerance, the pattern is instructive: the infrastructure of change is often under discussion long before it earns a headline.

Clarity doesn’t come from guessing the future correctly. It comes from understanding what’s already true, but not yet obvious to most people—and giving yourself enough time to respond thoughtfully.

The psychology of early signals will probably never feel natural. Our minds will always prefer the comfort of the known. But you can build habits that tilt the odds in your favor:

Read one layer deeper than the headline.

Notice when your everyday experience stops matching the story you’re being told.

Ask where the infrastructure is changing, not just where the noise is loudest.

You don’t have to chase every new technology or overhaul your life with every shift. You just have to resist the temptation to sleepwalk through transitions that will shape your savings, your work, and your options later in life.

In a world where many people only react once the story is fully formed and frightening, there’s quiet power in being the person who simply pays attention a little earlier, feels a little less surprised, and moves a little more deliberately.

Not clairvoyant. Just awake.

—

Claire West