The Quiet Cost of Waiting

There I was, sitting at my kitchen table, a small package delayed in transit, my mind quietly fixated on the waiting. It wasn’t an urgent matter — just a minor online purchase pushed back another day. Yet, the pause felt oddly familiar, a subtle procrastination spilling over into small corners of my life. Waiting has a curious way of feeling safe, like a soft folding of hands anticipating better times or clearer answers. Yet beneath that seemingly calm surface, waiting quietly stacks up costs, unseen and often unacknowledged.

In those small moments, hesitation can feel like a refuge: a shield against uncertainty or loss of control. But over the months and years, these moments of waiting accumulate, not unlike little droplets forming an unseen drain. Whether it’s deferring a decision on paying off a bill, delaying a retirement contribution, or hesitating to build emergency savings — the quiet cost of waiting is real, tangible, and often quite costly.

The dilemma of waiting is deeply human. We wait because it feels safer than acting without certainty. Yet the economic realities of 2024 and 2025 remind us that waiting too long can come at a cost we don’t immediately see — one that quietly grows as financial pressures mount and time slips past.

Elon Musk Just Declared War on the IRS. Your 401(k) Is Caught in the Crossfire.

Elon Musk just did what no one else dared.

He challenged the IRS head-on — and took out over 6,700 federal enforcers in one sweep.

It’s the start of a financial shakeup that could unravel the retirement system millions rely on.

Before Musk disrupted the system, Trump quietly left behind a legal IRS backdoor. A loophole designed to help Americans move their retirement savings out of government-controlled accounts — before things implode.

It’s real. It’s legal. And it’s still active.

Here's a way to shift your IRA or 401(k) into a tax-advantaged, penalty-free vehicle that isn’t tied to Wall Street or federal policy changes.

It’s outlined in the 2025 Wealth Preservation Guide — now available for free.

- No taxes

- No penalties

- No IRS strings

Just a smarter move while the window is still open.

Why We Wait

Postponement has roots in the psychology of fear and comfort. It’s natural to hesitate when faced with volatile markets, personal financial uncertainty, or a flood of choices leading to decision fatigue. The act of waiting becomes a form of emotional self-soothing, a way to manage anxiety in an unpredictable world.

In recent years, large swaths of Americans have found themselves caught in this cycle. According to recent data, about a quarter of U.S. households live paycheck to paycheck, having little margin beyond essential expenses. This reality drives many to defer substantial financial decisions, from retirement contributions to paying down debt or building emergency funds.

The reasons are varied: fear of losing hard-earned earnings to market swings, confusion about the next best steps, or simple inertia. But the consequence is a widespread pattern of delayed financial action, which in aggregate creates a quiet crisis of postponed progress and growing vulnerability.

The Economic Cost of Delay

The cold, hard numbers underscore the risks of waiting. Bank of America Institute found that approximately 25% of households live paycheck to paycheck as of 2024, a rise correlated with increasing prices for essentials like food, housing, and childcare. This tightrope walk leaves little to no margin for unexpected expenses.

Savings habits tell a similar story. A recent survey by Empower found that 1 in 3 Americans have no emergency savings at all, and the average emergency fund hovers around $500, a concerning decline from just a year prior. Financial advisors typically recommend three to six months’ worth of expenses in reserve, a benchmark few meet.

Meanwhile, credit card balances are rising, with Experian reporting a 3.5% increase in average card debt in 2024 to $6,730, alongside historically high interest rates often exceeding 20%. Despite this, many continue accumulating high-cost debt, further delaying debt payoff.

Retirement planning is another area rife with postponement. Goldman Sachs surveyed workers in 2024, revealing that over 60% expect to delay retirement due to competing financial priorities, including debt burdens, caregiving responsibilities, and ongoing financial hardships.

These factors combine into a silent economic erosion. Waiting — whether to save, to pay down debt, or to plan retirement — quietly compounds costs that surface only over time, challenging the sense of financial security many seek.

Opportunity Cost in Numbers

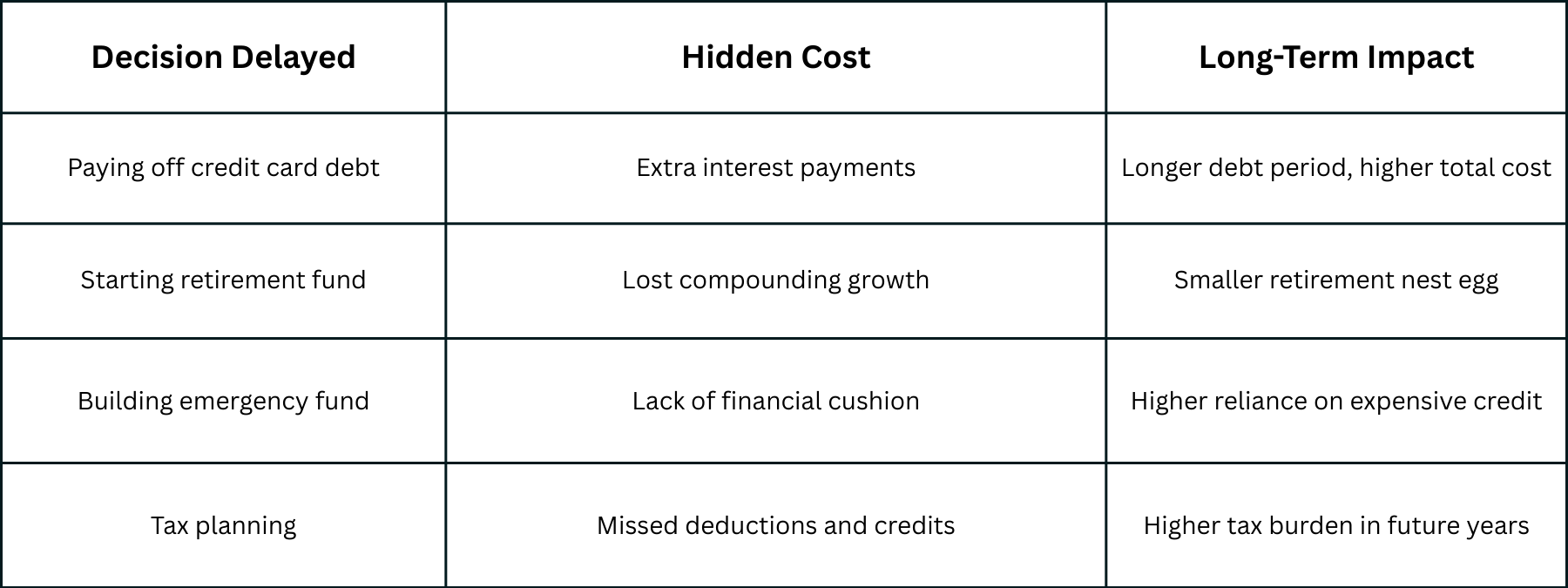

Each small decision postponed carries a hidden price tag that stacks up. The interest on unpaid credit cards might seem manageable day-to-day but snowballs into thousands of dollars over years. Retirement savings not started today lose the magic of compounding, creating a materially smaller cushion decades from now. The absence of an emergency fund often means turning to costly debt when surprises strike — adding yet more financial stress.

The Emotional Weight of Waiting

Beyond dollars and cents lies another, less visible cost — the emotional toll. The act of waiting can feel passive but often accumulates stress, uncertainty, and a lingering loss of control.

Financial insecurity is a heavy, invisible burden weighing on many American households. The constant question, "What if something goes wrong?" gnaws away quietly. Rather than alleviating anxiety, waiting can intensify it — the unknown stretching longer, worries growing louder, and that nagging feeling of being unprepared.

This emotional weight can become cyclical too, reinforcing postponement. Stress clouds judgment, making decisions harder, which in turn fuels further waiting. It is a quiet but powerful friction to progress.

Editorial Reflection — Redefining Action

Waiting feels safe. It masquerades as prudence or patience, but too often it’s a form of erosion — wearing down financial resilience and peace of mind.

True financial stability doesn’t emerge from standing still. Stability grows from consistent, small forward steps — contributions made even when markets swing, debts chipped away gradually, cushions built incrementally. These actions are neither grand gestures nor dramatic turnarounds. They are quiet, deliberate progress.

Embracing action in this context means acknowledging imperfection and uncertainty without allowing them to freeze decisions. It means rejecting the illusion that waiting indefinitely will produce better outcomes. The real risk is not acting too soon — it’s never acting at all.

Practical Checklist to Overcome Waiting

- Identify one financial decision you have delayed.

- Set a micro-deadline to take one small action, such as transferring $20 to savings or paying an extra $50 on a credit card.

- Automate that small step to build momentum without needing repeated willpower.

- Track the “lost” opportunity cost monthly to see what waiting costs you in real terms.

- Replace “later” with “next step” in your mindset — action, however small, starts momentum.

- Celebrate even modest progress; it fuels confidence and diminishes procrastination.

Closing Reflection

Back to the quiet wait by my kitchen table — I realized the cost of waiting is rarely visible in the moment, like the slow drip of water that eventually hollows stone. But the quiet mounting cost is no less real.

The risk isn’t rushing into uncertainty; it is drifting endlessly in hesitation. Progress, financial health, and peace of mind begin with one quiet decision today, one small step forward that breaks the pattern of waiting.

The cost of waiting is more than dollars. It is the slow loss of opportunity, calm, and control. It’s time to start taking back both — one deliberate step at a time.

—

Claire West