The Quiet Moves Behind Crypto’s Next Chapter

There are moments in history when the most significant financial shifts happen quietly. I recall the financial crisis of 2008—not the headlines or the panic, but the early moves by institutions buying assets at rock-bottom prices while the rest of us watched warily from the sidelines. Similarly, after the pandemic crash in 2020, some of Wall Street’s biggest names ramped up risk-taking while many of us hesitated, unsure if the storm had passed. And then there’s blockchain, a technology coming of age over the past decade, quietly building its foundation among the titans of finance.

These moments have a pattern: institutions act first and quietly, their moves often invisible to most until the tide has shifted. For anyone watching crypto with a cautious eye—aware of the inflation and debt challenges shaping our economy—the quiet moves behind crypto’s next chapter are worth understanding. Because knowing when and why the giants move can help prepare, not predict, what’s next.

Institutional Moves: Why Quiet?

Institutions like J.P. Morgan and BlackRock aren’t about spectacle—they are about scale, regulation, and long-term strategy. They move quietly because their decisions impact billions and must align with risk management, regulatory compliance, and fiduciary responsibility. Meanwhile, retail markets may chase headlines, hype coins, or viral moments, but institutional investors focus on infrastructure—the technology and frameworks that last.

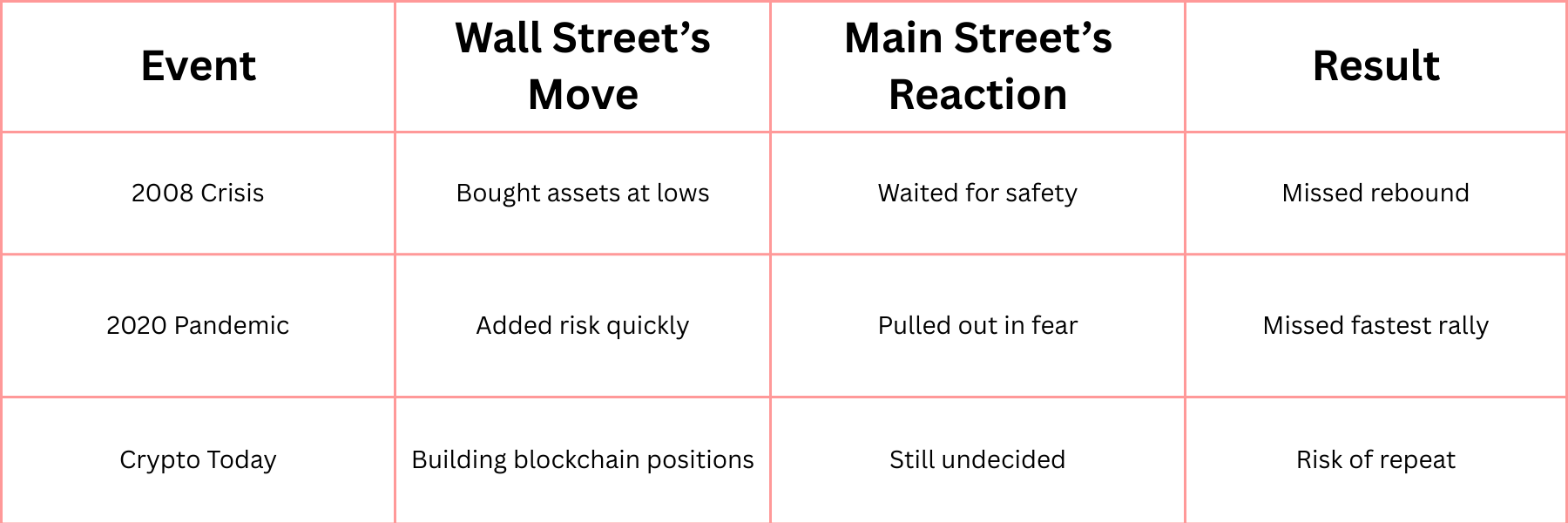

The gap between early institutional action and cautious retail participation is a recurring story. Reflect on 2008: institutions bought undervalued assets amid crisis, while many individuals stayed out, waiting to feel safe. In the 2020 pandemic rebound, institutional players quickly increased risk exposure; many retail investors hesitated or pulled out, missing some of the fastest gains. In early crypto cycles of 2017 and 2020, speculative waves drew retail attention, but institutions were quietly working on compliance, custody solutions, and regulatory clarity—laying groundwork for this moment.

Every seismic wealth shift starts with a hidden play…

Wall Street’s heaviest hitters – J.P. Morgan, BlackRock – are silently dumping BILLIONS into blockchain.

ONE coin is their dirty little secret.

No meme trash. No hype garbage.

Trump’s in charge, JD Vance is pushing crypto laws, and an executive order’s about to detonate. When it does, this coin IGNITES.

Buy this coin TODAY – or choke on the dust.

Data and Analysis: Institutional Investment in Blockchain 2023–2025

Crypto is no longer fringe. Institutional adoption is in early but growing stages, with clear momentum. According to JPMorgan’s latest report, institutions currently hold about 25% of Bitcoin exchange-traded products (ETPs), and 85% of firms surveyed plan to allocate to digital assets by 2025. This represents a marked shift from skepticism or outright avoidance to active participation.

Tokenization and the adoption of real-world assets on blockchain are expanding alongside ETF inflows. Family offices, known for early adoption, allocate as much as 25% of portfolios to digital assets, while wealth managers and individuals remain more cautious, allocating closer to 2-3%. Hedge funds have increased crypto trading strategies by over 20%, focusing on risk-managed approaches like long-short and arbitrage models. Staking assets to generate passive income rose 34%, and crypto lending and borrowing surged by 46% in 2025—signs of deepening ecosystem maturity and liquidity.

These quiet moves matter more than headlines. It’s about foundational adoption, not hype-driven spikes. A simple formula captures this:

Opportunity Missed = (Institutional Gains – Retail Entry Point Losses)

When institutions move first and retail follows later, many retail investors enter at higher prices and miss initial gains—meaning the opportunity to build wealth can narrow or shift entirely.

Institutional vs. Retail Moves Over Key Events

This pattern suggests that while crypto remains volatile and new, the institutional foundation laid today could shape opportunities for years to come.

Practical Checklist for Navigating Institutional Crypto Moves

- Don’t wait for perfect certainty—markets rarely offer it.

- Watch institutional signals: bank filings, ETF flows, and partnerships often indicate serious moves.

- Start with small, consistent allocations to manage risk.

- Balance risk by holding core assets alongside measured exposure to new digital assets.

- Monitor regulatory and policy changes closely—they can alter the landscape quickly.

- Separate fleeting hype from genuine infrastructure-level adoption to avoid costly mistakes.

What This Means Going Forward

The truth about crypto’s next chapter lies in steady preparation, not chasing every headline or coin. Institutions’ quiet moves signal that something important is underway—a recalibration of financial tools through blockchain that offers more transparency, efficiency, and diversification than previous waves of crypto mania.

For those who have watched with caution, the goal is not to rush but to understand and position thoughtfully. Protecting wealth means knowing the difference between speculation and infrastructure, timing and patience.

Every seismic wealth shift does begin with a hidden play…

Right now, Wall Street’s heaviest hitters—J.P. Morgan, BlackRock—are silently dumping billions into blockchain. ONE coin is their dirty little secret.

—

Claire West