The Quiet Practices of Financially Resilient Families

In the soft morning light of a small kitchen, a mother patiently counts coins with her young daughter. Bills are neatly stacked nearby, and a notepad bears scribbled entries—some paid, some due. It’s an unremarkable scene, easy to overlook in a world drawn to loud success and dramatic financial windfalls. But here, in this gentle routine, is a lesson few appreciate: lasting financial resilience is not the product of one big break, but the quiet, consistent practices that families weave into everyday life.

It’s easy to imagine financial well-being as a sudden breakthrough, a lucky investment, or a windfall. Yet for the millions of American families managing uncertain incomes, rising costs, and unpredictable markets, resilience is crafted incrementally—through steady budgeting, mindful saving, and measured planning. This quiet strength often goes unnoticed, overshadowed by buzzwords and headlines promising quick riches. But as mounting inflation and economic turbulence remind us, real security is less about fortune and more about preparation.

Why Quiet Financial Resilience Matters

Today’s American households navigate a landscape fraught with challenges. Inflation remains stubbornly high, driving daily expenses up just when wage growth has slowed. Credit card debt is near record highs, imposing heavy interest charges on fragile budgets. And despite surpluses in some sectors, underlying economic uncertainty persists. According to the Federal Reserve, the average American household carries over $6,000 in credit card debt with an average APR topping 19%, a weight many struggle to bear. Yet only 40% of adults report having enough savings to cover a $400 emergency. These figures tell a story of many living close to the financial edge.

Traditional financial advice often emphasizes striking it rich, chasing offshore markets, or dedicating energy to volatile assets. For families balancing work, school, and unexpected bills, these messages can feel out of touch or unattainable. Instead, the families who endure and thrive under these conditions share a different story—one where resilience grows quietly, through everyday discipline rather than headline-grabbing moves.

The Dollar Recall May Start soon — And Most Americans Still Don’t Know

A quiet but radical shift in the U.S. financial system is approaching — one that could redefine what it means to “own” your money.

This initiative, called the Central Bank Digital Dollar, is being presented as a modernization.

But beneath the surface, it opens the door to something far more serious:

A system where your savings, your paycheck, your honestly earned dollars — may no longer be fully yours to use.

This isn’t innovation — it’s control.

Control over your time, your effort… and what you’re allowed to do with what you’ve earned.

To help Americans prepare, American Alternative Assets has released a Wealth Protection Guide with steps you can take now to safeguard your savings.

Get The Guide Now — While Your Money Still Means Freedom.

Understanding Resilience: A Simple Formula

Financial resilience boils down to managing three foundational elements: access to savings (liquidity), handling of debt, and steady habits that prevent slipping into crisis. We can think of it like this:

Resilience = Savings Access + Debt Management + Steady Habits

Savings access means having funds readily available to meet unexpected expenses or temporary drops in income, without resorting to high-interest credit. Debt management involves keeping borrowing under control, prioritizing repayment, and avoiding cycles of revolving debt. Steady habits reflect the routine actions a family takes—tracking spending, budgeting realistically, and automating saving—to keep finances balanced over time.

Data shows these dimensions are rarely standalone; they operate in tandem. For example, without sufficient emergency funds, many families rely on credit cards to bridge gaps, leading to higher debt burdens. Conversely, those with steady saving practices tend to avoid costly debt, creating a virtuous cycle that fosters confidence when the unexpected happens.

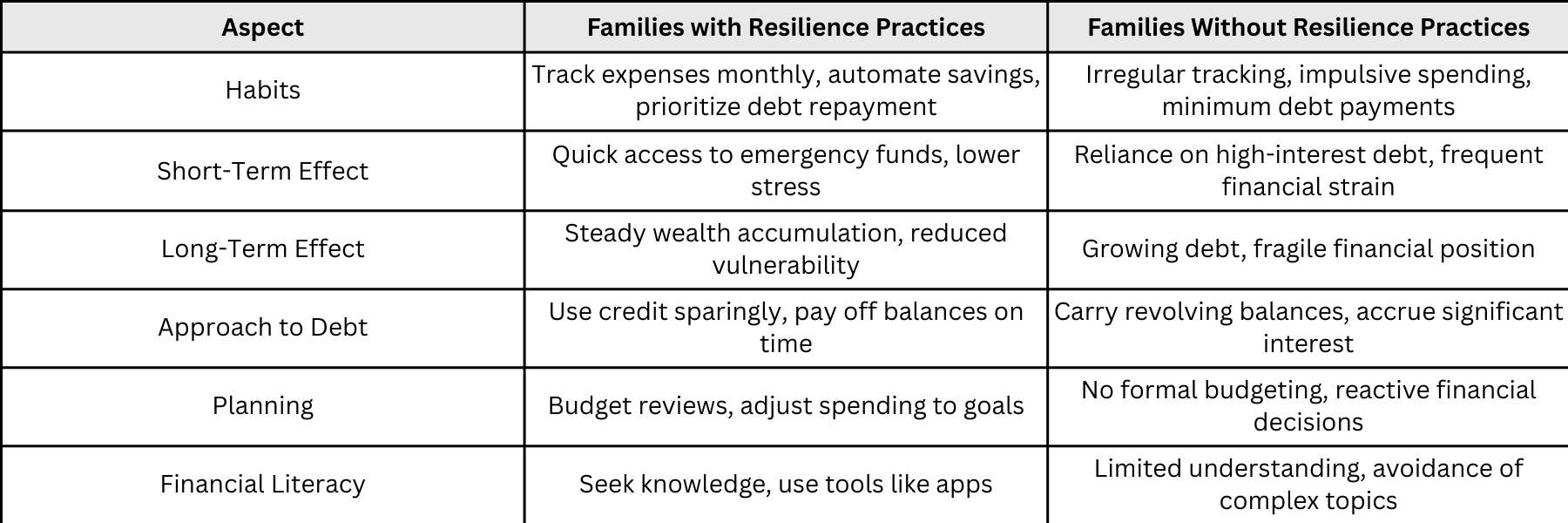

How Families Differentiate Themselves: A Comparison

The table below contrasts two archetypes: families practicing quiet financial resilience and those lacking these habits.

This comparison reveals how resilience is less about income levels and more about behaviors resilient families build over time. Even modest incomes, when managed prudently, can generate strong buffers against shocks.

The Quiet Work Behind the Numbers

Resilience is rarely about fast moves or large gambles. Instead, it emerges through small, seemingly mundane steps. Collecting receipts, reviewing bank statements, setting aside a few dollars each paycheck—these are the quiet practices that compound into stability.

Consider the power of automating savings, a common habit among resilient families. This simple practice removes the temptation to spend what’s intended for emergencies and ensures consistent fund growth without requiring ongoing effort. Data from the U.S. Bureau of Economic Analysis shows that although the national personal savings rate has declined overall since 2023, households automating their savings reported 20% higher emergency fund balances than those relying on manual deposits.

Debt management likewise benefits from routine attention. Families who regularly review credit card statements and prioritize paying down balances earn significant savings by avoiding cumulative interest charges that can add thousands over months and years. For instance, choosing a $5,000 balance with a 19% APR and paying only the minimum monthly payment could result in about $4,000 paid solely in interest before clearing the debt—a startling figure many overlook.

Maintaining steady habits often means confronting uncomfortable realities. Families confronting overspending patterns, seeking affordable alternatives, or delaying discretionary purchases invest in long-term resilience at the expense of short-term comfort. While these choices may not attract headlines, they are the bedrock of ongoing financial well-being.

Practical Steps to Build Quiet Resilience

Financial stability may never feel glamorous, but it becomes a reliable shield when practiced consistently. Here is a checklist to cultivate these quiet habits:

Checklist for Building Financial Resilience

- Automate savings transfers to a separate emergency fund account, targeting at least three months of essential expenses.

- Track and categorize monthly expenses to understand spending patterns and identify avoidable costs.

- Prioritize paying off the highest interest debts first, and avoid accumulating new revolving balances.

- Review bills and subscription services annually to cut unnecessary expenses or renegotiate terms.

- Diversify savings across accessible liquidity (checking, savings accounts) and longer-term growth (retirement funds).

- Commit to regular financial check-ins, adjusting budgets and goals as circumstances change.

Each step reinforces the underlying pillars of resilience, making the family less vulnerable to shocks and more confident in everyday decisions.

Reflecting on Quiet Strength

Financial resilience is not a matter of luck or sudden fortune. It is forged in the quiet moments at kitchen tables, in conversations about pennies and priorities, in the choice to save a little more today rather than spend it all now. It is a reflection of values as much as numbers.

Preparing early and patiently—whether through automating savings or managing debt carefully—gives families an advantage that shows not in headlines or quick tips but in the lived experience of security and peace of mind. The small choices compound quietly but powerfully, safeguarding not just dollars but dignity.

As we face an economic environment that offers no guarantees, embracing these steady practices becomes less optional and more imperative. Financial resilience is a journey, not a sprint, and those who walk its path with care construct a foundation that carries them through uncertainty with calm assurance.

—

Claire West