The Quietest Tax: Why 0% APR Windows Are the Only Real Relief Most Families Ever Get

It's a Tuesday evening. The kitchen light is warm, dishes stacked in the sink, the day's weight settling into tired shoulders. She opens the credit card statement on her phone—a routine gesture, almost automatic—and pauses.

Interest charged this month: $187.34.

She scrolls up. Minimum payment: $75. Balance: $11,200. She's been paying $200 a month for two years, and the balance has barely moved.

For a moment, she does the math. $187 in interest. That's more than her car insurance. More than her grocery budget for a week. More than the birthday gift she couldn't afford for her daughter last month.

She closes the app. Not because she doesn't care. Because the math is designed to be too painful to look at closely.

This scene plays out in millions of American homes every month. The details vary—different balances, different rates, different levels of awareness—but the pattern is the same: interest quietly consuming more than families realize, compounding in the background while life moves forward.

The Hidden Math

Here's what most people don't understand about credit card interest: it doesn't feel like a tax, but it functions like one.

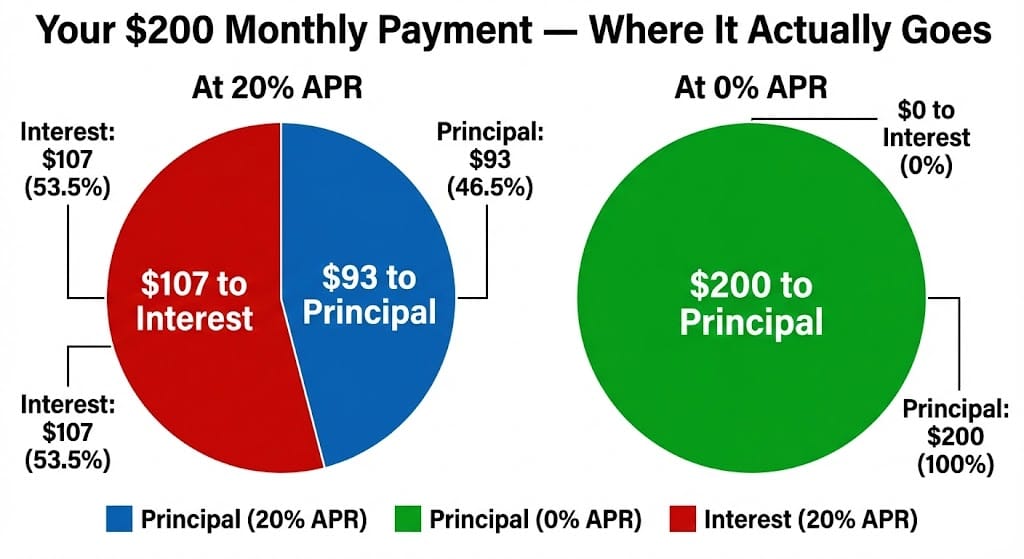

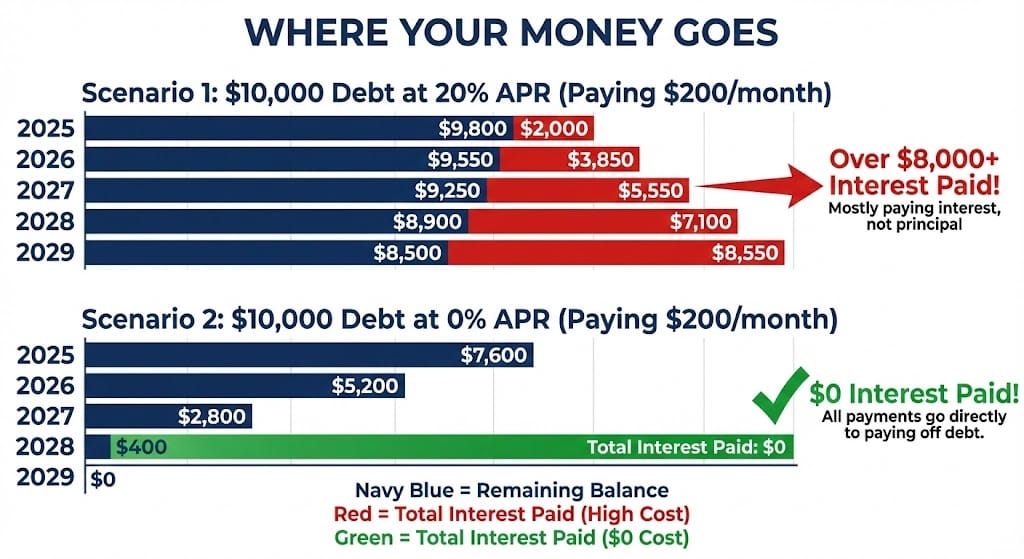

A 20% APR doesn't mean you pay 20% once. It means you pay roughly 1.67% per month, compounded on your remaining balance. On $10,000, that's $167 the first month. But because most people pay minimums—or slightly above—the balance barely shrinks. Next month, interest accrues on nearly the same amount.

Over a year, that $10,000 balance at 20% APR generates $2,000+ in interest charges—money that doesn't reduce your debt, doesn't buy groceries, doesn't go toward rent. It just disappears into the bank's margin.

And banks know this. They've built business models around what they call "sleepy balances"—accounts where customers pay consistently but never aggressively enough to pay off principal. These accounts are more profitable than late fees, more reliable than new customer acquisition. The interest flows quietly, month after month, year after year.

The math is simple, but the psychology is powerful: if you never look closely, you never feel the bleed.

The Psychological Trap

There's a reason most people don't escape credit card debt: they've been conditioned to believe they can't.

The trap has multiple layers:

Anchoring bias: When your balance has been $10,000 for three years, you start to think of it as permanent. You budget around it. You normalize it. The idea of paying it off feels abstract, distant—something that happens to other people.

Minimum payment design: Banks set minimums low enough that you feel like you're "managing" the debt, but high enough that you never question the interest accumulating behind the scenes. It's comfortable—until you realize comfort is costing you thousands annually.

Shame and silence: Debt carries stigma. People don't talk about their balances, don't compare strategies, don't realize how common the trap is. The isolation makes the problem feel personal rather than systemic.

This isn't accidental. It's architecture. Banks spend billions on behavioral research, on statement design, on app interfaces that minimize the visibility of interest charges. They want you paying. They don't want you paying attention.

Every time you swipe your card, banks profit. You pay 20% interest. They give you 1% back—and call it generous.

Here’s the better deal: 0% intro APR into 2026. Up to 5% cash back. No annual fee. Groceries? Gas? Balance transfers? Covered. And all while you pay nothing in interest. Find a more valuable, penalty-free card—and I’ll apply with you. Otherwise…

Interest Isn't Fixed

Here's the counterintuitive truth most families never discover: you can legally reduce your interest rate to zero for nearly two years.

Not through negotiation. Not through hardship programs. Through a mechanism that's been available for decades but remains underutilized: 0% APR balance transfer cards.

These cards offer introductory periods—typically 15 to 21 months—during which transferred balances accrue no interest. You move your existing debt from a 20% card to a 0% card, and suddenly every dollar you pay goes toward principal, not the bank's margin.

The math transforms:

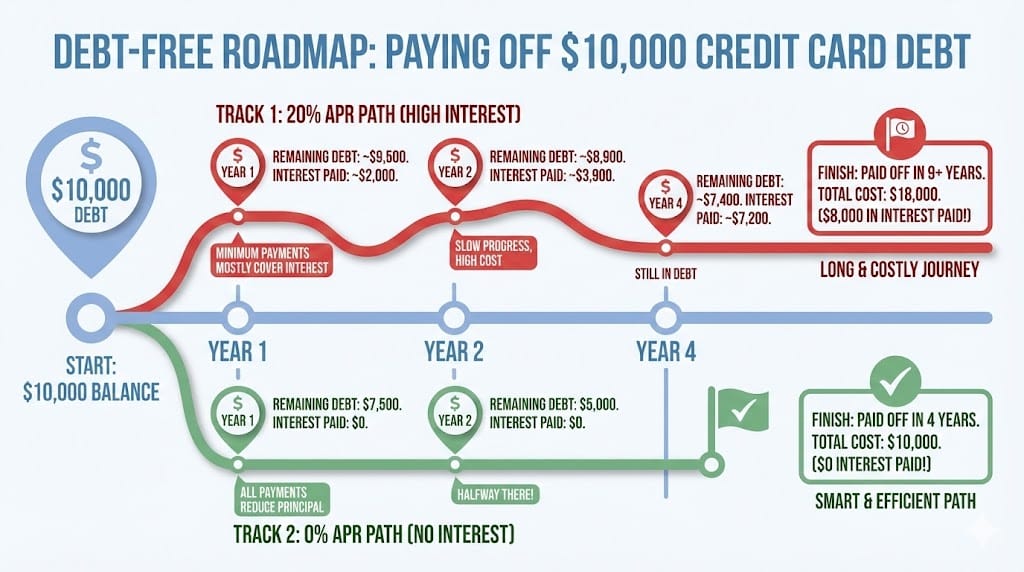

- Before: $200/month on $10,000 at 20% APR → 9+ years to pay off, $8,000+ in interest.

- After: $200/month on $10,000 at 0% APR → 50 months to pay off, $0 in interest.

Same payment. Same effort. Radically different outcome.

Why 0% APR Windows Matter

The advantage isn't just mathematical. It's psychological.

Snowball effect: When you see the balance actually declining—$10,000 becoming $9,800, then $9,600—momentum builds. You're not running in place anymore. You're moving.

Cash-flow relief: That $187/month in interest? It goes back into your budget. Groceries. Insurance. Emergency savings. The breathing room changes everything.

No-penalty structure: Most 0% APR cards don't charge prepayment penalties. Pay extra when you can. Pay minimum when you can't. The flexibility removes the pressure that makes debt feel suffocating.

Behavioral advantage: Debt at 0% doesn't trigger the same anxiety as debt at 20%. The psychological weight lifts, making it easier to engage with finances rather than avoid them.

This isn't a hack. It's using the system's own mechanisms to neutralize its extractive edge.

The Big Insight

Moving debt to 0% APR isn't cheating. It's not gaming the system. It's removing the bank's structural advantage and giving yourself time to actually solve the problem.

Banks offer these cards because they profit on balance transfer fees (typically 3-5%) and hope you'll carry balances past the introductory period. But if you use the window strategically—paying down principal consistently—you capture the benefit while avoiding the trap.

The insight isn't about cleverness. It's about clarity: interest is optional if you know how to sidestep it.

Breathing Room

I think often about what financial safety actually feels like. Not wealth. Not abundance. Just the absence of that low-grade anxiety that hums beneath every purchase, every bill, every decision.

For families carrying high-interest debt, that anxiety is constant. They budget carefully, sacrifice deliberately, and still watch balances refuse to decline. The system extracts quietly, and the exhaustion accumulates.

A 0% APR window doesn't solve everything. But it creates breathing room—the space to think clearly, to plan strategically, to feel like progress is possible. And that breathing room, for many families, is the difference between despair and dignity.

A Path Worth Considering

Today's partner offers a 0% intro APR card into 2026, up to 5% cash back, and no annual fee—one of the few penalty-free ways to stop interest cold.

Not everyone will qualify. Not every situation fits. But for families drowning in interest while making consistent payments, exploring this option costs nothing and could save thousands.

Small Steps, Real Agency

I don't believe in financial miracles. I believe in small, strategic steps that compound over time—the same way interest compounds against you, but working in your favor instead.

Moving debt to 0% APR is one step. Building an emergency buffer is another. Learning to read statements closely, to understand the math, to recognize when systems are designed to extract rather than serve—these are the quiet skills that create resilience.

You don't need to become a financial expert. You just need to stop accepting that the system's default settings are the only options.

—

Claire West