The Retirement Rule Change You Can’t Afford to Ignore

When David turned 62, he planned to spend his late career years focused on polishing his retirement savings and readying for the transition. But then, during a routine check-in with his financial advisor, he learned the rules had changed—significantly. A recent tweak to retirement law meant David’s catch-up contribution limits and withdrawal strategies needed urgent reconsideration. It was a sobering moment. “I’d been saving diligently,” he told me later, “but suddenly some of my assumptions no longer held true. I had to rethink everything.”

David’s story isn’t unique. Retirement laws often shift in subtle ways that can have big impacts down the road. This time, the change arrives when many are closest to retirement or already in the thick of savings growth. Understanding it isn’t just smart—it’s essential.

What’s Changing and Why It Matters

The key update centers on catch-up contributions and age thresholds for tax-advantaged retirement accounts, including 401(k)s, IRAs, and similar vehicles. Specifically:

- The catch-up contribution limits for those aged 60 to 63 are adjusting, affecting how much extra you can put toward your savings beyond the standard limits.

- The age at which you must start taking Required Minimum Distributions (RMDs) has shifted, altering when your taxable withdrawals from tax-deferred accounts begin.

These changes influence your ability to accelerate savings in your final working years and affect the timing and tax impact of withdrawals later on.

Why does this matter? Because your retirement savings aren’t just numbers on a screen—they are the foundation of your financial security, your lifestyle, and your legacy. Small tweaks to contribution limits or distribution rules can ripple through decades of planning.

Three Key Questions to Ask Yourself

As you navigate this law change, here are three questions to guide your reflection:

- Am I aware of my exact catch-up contribution limits now?

The old numbers may no longer apply. Are you maximizing your allowed contributions in this new bracket? - When am I required to start withdrawing, and how does this align with my plan?

The timing of RMDs can affect taxes and cash flow. Are you positioned to minimize surprises? - Do I need to update my retirement strategy to accommodate these rule changes?

Sometimes a tweak in timing or amounts can mean a smoother, more tax-efficient retirement.

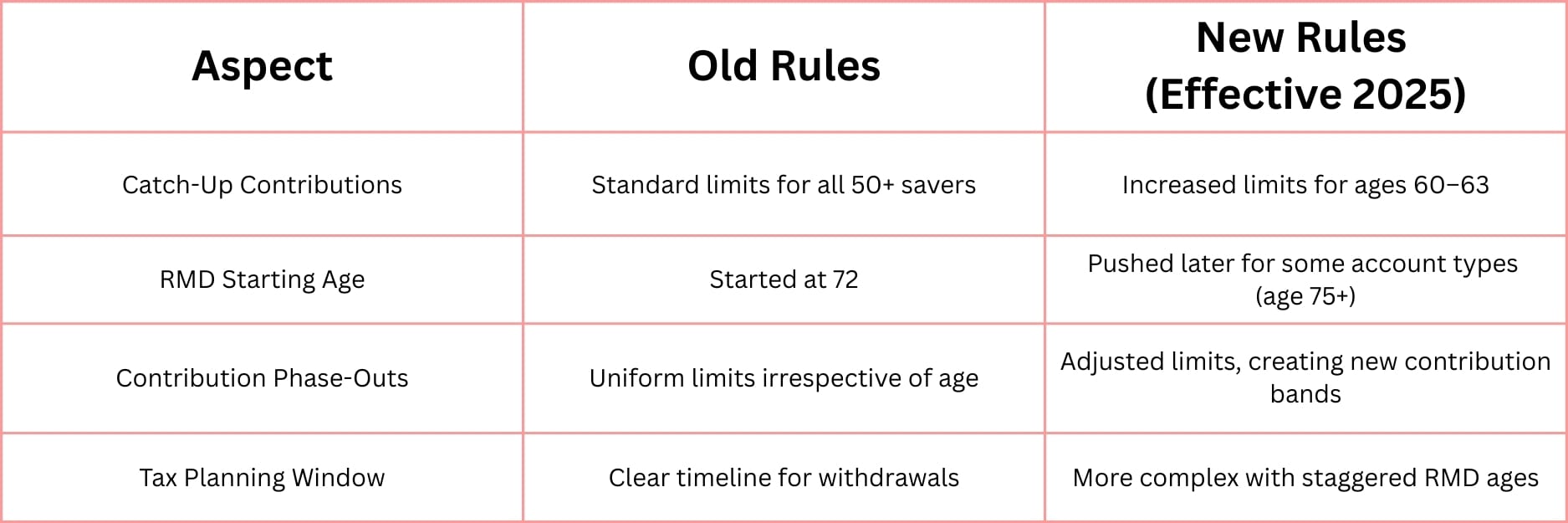

Old Rules vs. New Rules: A Side-By-Side Look

This table is simplified but offers a clear snapshot: the new environment demands more personalized tracking and planning.

This law paints an ugly picture for American retirement accounts.

You're a 62-year-old who has put money away all your life.

You've done so to secure a comfortable retirement, on your own terms.

But you also want to pass your retirement savings balance to your loved ones.

This includes your 401(k)s… traditional IRAs… even your Roth IRAs.

Of course you want your hard-earned (and growing) money to last as long as it can, and — just as importantly — to get taxed as little as possible.

Better brace yourself.

The rules we've grown accustomed to are getting completely turned upside down by Congress.

Practical Steps to Adapt

Making the best of these changes means adapting quickly. Here’s a simple plan:

- Check your account statements or talk to your plan’s administrator to verify your exact catch-up limits.

- Review your current savings rate: can you increase contributions now that limits have shifted?

Formula for monthly increase:

(New Catch-Up Limit−Old Limit) / Months Left in Year

- Plan your RMD schedule using updated age requirements—this helps avoid unexpected tax hits.

Many financial institutions offer updated calculators or personalized advice to guide you. - Consider tax efficiency:

If RMDs are delayed, think about whether Roth conversions or other moves could optimize your tax situation. - Document changes in your retirement plan and revisit this annually as legislation evolves.

I Came Across a Guide That Made This So Much Clearer

Adjusting to retirement law changes isn’t easy. It requires clear, simple information you can trust. Recently, I found a guide that lays out these rule changes in plain language with actionable insights — something every saver in this stage should have. If retirement is on your horizon, I recommend giving that guide a look.

Retired Americans Are About To Take One on the Chin…

Presented by Eagle Financial Publications

Retirement planning is never a straight line. It’s a shifting landscape, with new rules, new opportunities, and new challenges. What’s constant, though, is the value of staying informed and adaptable.

David’s story reminded me that even the best savers can be caught off guard. But by facing changes calmly, asking the right questions, and taking small, steady actions, you keep the door open for a secure and fulfilling retirement.

I hope this post helps you do just that—face the future with confidence, clarity, and calm.

—

Claire West