The Summer Debt Detox: How I Stopped Letting Interest Steal My Seasons

I remember one summer vividly—not because of beach trips or barbecues, but because of a lingering feeling that everyone around me was enjoying the long, sunny days while I was deep in credit card bills. The sun shone outside, but inside, my mind was shadowed by growing debt. It felt like my money was draining away, interest sneaking off in the background, working overtime even when I tried to relax.

Life felt expensive, and no matter how much I paid, my balance seemed to barely budge. The stress built quietly in those warm evenings, turning moments that should have been peaceful into restless nights spent staring at numbers.

The Problem: High-Interest Debt Never Sleeps

Credit card interest is ruthless—compounding every day, making even small purchases grow unexpectedly into heavier burdens. Imagine this: you enjoy a dinner out for $200, but with an APR of 22%, if you only make minimum payments, that meal could end up costing you close to $260 over a few months. That’s the silent cost of high-interest debt—the sneaky thief that inflates balances and steals peace of mind.

More than just dollars, it steals your freedom. Stress creeps in, guilt follows, and nights become restless. You aren’t just juggling money—you’re carrying a weight that shadows even your happiest times.

Summer’s here—but your credit card interest isn’t taking a vacation.

If you're juggling high APRs, rising prices, and shrinking breathing room, you’re not alone.

Millions of Americans are using this 0% APR card to catch a break—from debt, from stress, from sleepless nights.

It’s not magic. It’s just smart.

For a limited time, you can transfer your balance and pay 0% APR, giving yourself space to pay down debt without paying extra.

Stop letting interest steal your summer.

Apply for this 0% APR card today »

The Breakthrough: 0% APR Balance Transfer

My turning point came when I discovered 0% APR balance transfers. It’s a simple idea, but transformational:

Balance transfer means moving your high-interest debt from one credit card to another that offers 0% interest for a limited time—often 12 to 18 months.

Why does this matter? Because this promotional period lets you pay down the principal without interest swallowing your payments. It’s breathing room, the chance to really chip away at debt, rather than just paying interest.

It felt like the first summer in years where I wasn’t just watching debt grow—I was actually shrinking it.

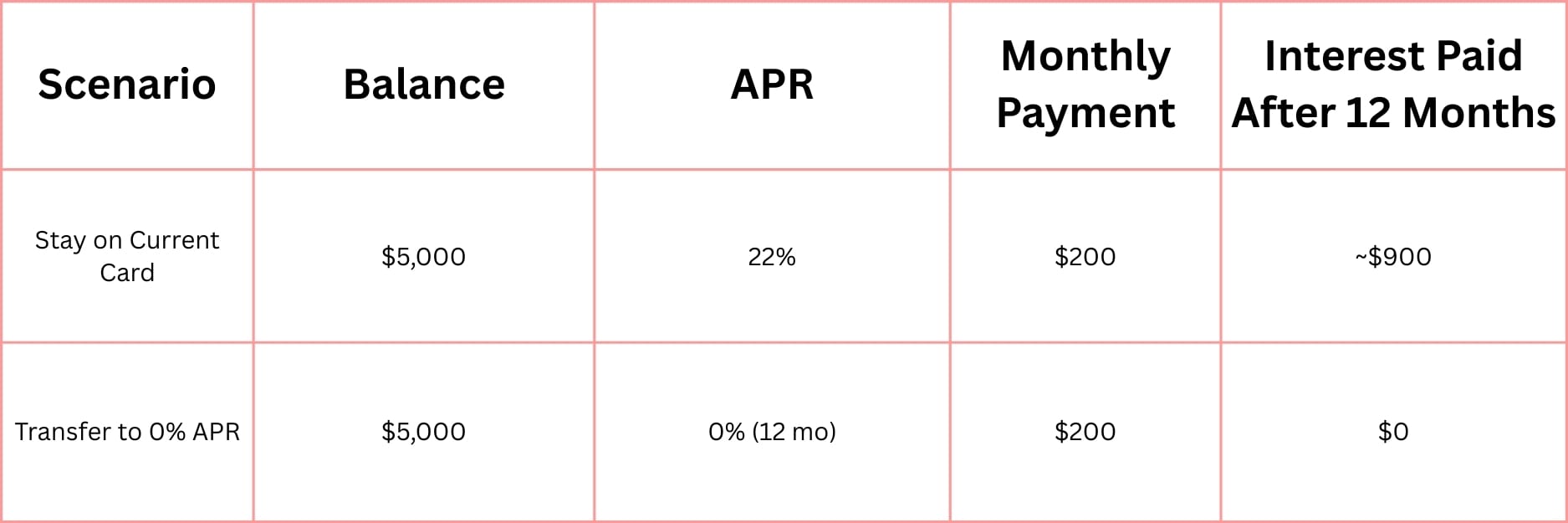

Mini Example Calculation

Switching made a clear difference. The same monthly payment, but instead of most going to interest, my money went straight to the balance.

Checklist: How to Use This Tool Wisely

- Check your current APR and balances. Know which debts cost the most.

- Compare 0% APR offers. Look for 12 to 18 months of interest-free transfer.

- Make a realistic repayment plan. Use the promo period to carefully chip away at debt.

- Avoid new debt on the old card. Don’t replace one problem with another.

- Close the loop after transfer. Pay off or close the old high-interest account to avoid slipping back.

Cautions to Keep in Mind

A few warnings that helped me stay grounded:

- Some cards charge a transfer fee—usually 3 to 5% of the amount moved. Weigh that cost before jumping in.

- You must make payments on time. Missing even one can void the 0% APR deal.

- The transfer works best when paired with discipline—it’s a tool, not an excuse to overspend.

Debt isn’t just about numbers; it’s about freedom. That summer, being able to cut out the interest felt like getting my life back. The mail no longer brought dread, and my evenings were lighter. It’s true—freedom from high-interest debt is worth more than any credit card perk or reward points.

If you’re juggling debt this summer, consider the power of a well-used 0% APR balance transfer. It might just be the detox you need.

[0% APR card guide by FinanceBuzz].

Claire West