The Trillion-Dollar Signal: What Trump's Bitcoin Reserve Really Means

March 6, 2025. 2:17 PM Eastern Standard Time.

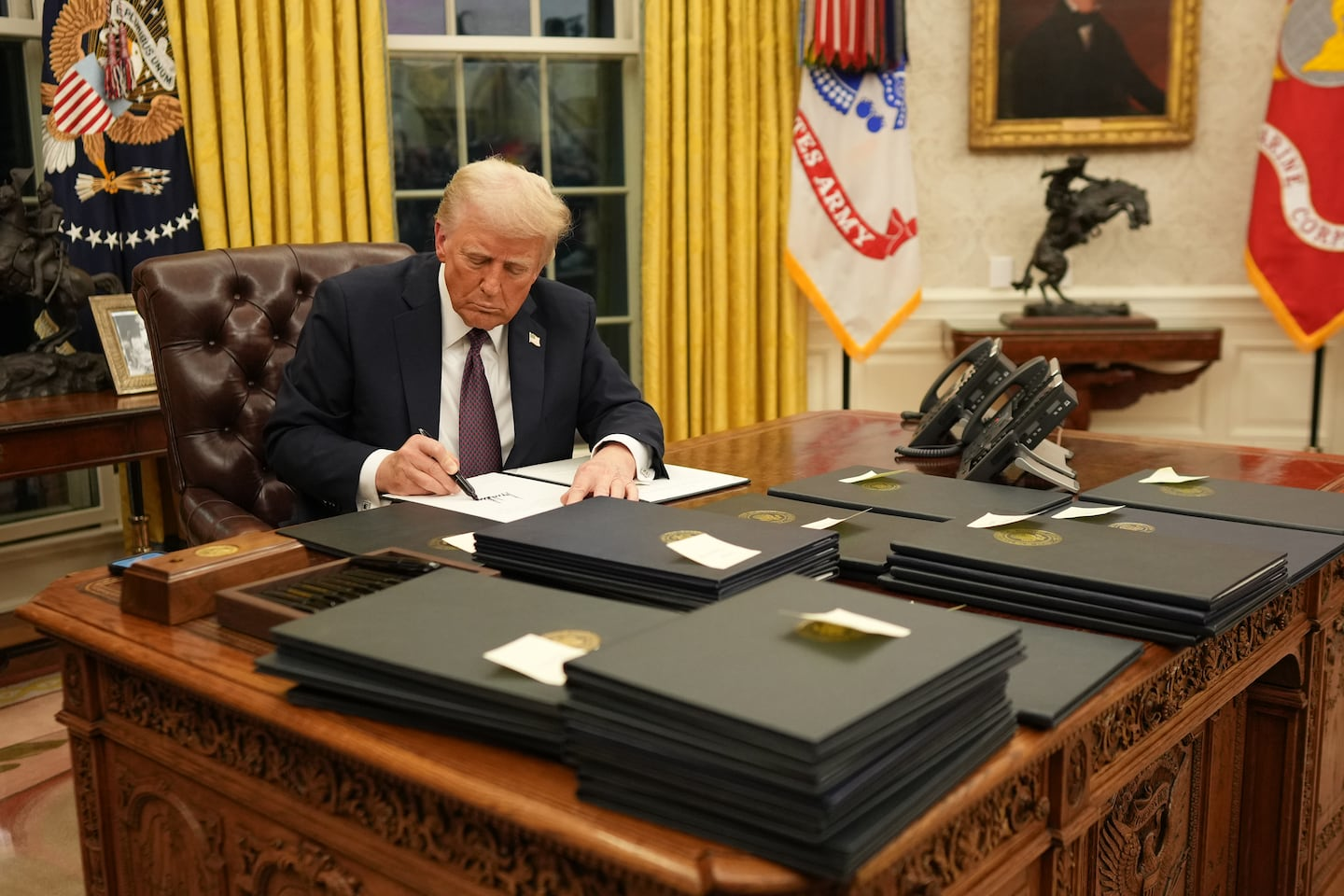

The pen touched paper. Four signatures later, the United States government officially declared Bitcoin a strategic reserve asset.

No fanfare. No press conference. Just a single executive order that changed everything.

Most Americans missed it. The headlines focused on tariffs and trade wars. But in trading rooms from Manhattan to Singapore, a different conversation began.

The question wasn't if governments would embrace cryptocurrency. The question was what comes next.

The Background: When Governments Become Holders

The language sounded bureaucratic. "Establishment of the Strategic Bitcoin Reserve and United States Digital Asset Stockpile".

But the implications were seismic.

For years, Bitcoin existed in regulatory limbo. A curiosity. A speculation. An asset the government seized from criminals and quietly auctioned at market lows, costing taxpayers an estimated $17 billion in forgone gains.

Executive Order 14233 ended that practice.

The order directed Treasury Secretary Scott Bessent to establish two separate offices: one to manage the Strategic Bitcoin Reserve, capitalized with approximately 198,000 to 207,000 BTC already held by the federal government through criminal and civil asset forfeitures. Another to oversee the U.S. Digital Asset Stockpile, containing Ethereum, XRP, Solana, and Cardano obtained through similar proceedings.

The directive was explicit: Bitcoin in the Strategic Reserve would not be sold. It would be "maintained as reserve assets of the United States utilized to meet governmental objectives in accordance with applicable law".

Compare that to gold. The U.S. gold reserve held approximately 261 million troy ounces as of February 2025, valued at roughly $11 billion. The government's Bitcoin holdings? Already worth between $17 billion and $20 billion by August 2025.

And unlike gold, Bitcoin's supply was permanently capped at 21 million coins. Scarcity wasn't a geological question. It was mathematical certainty.

“What is Trump’s Trillion-Dollar Crypto Shocker?”

I’ll tell you.

Trump is about to buy massive amounts of Bitcoin.

In fact…

He’s already begun.

Sitting at his desk in the Oval Office, Trump signed Executive Order #14233…

Which created a national stockpile of Bitcoin – just like the U.S. government’s stockpile of oil and gold.

But here’s what most Americans don’t know…

Trump’s Bitcoin reserve is just the start.

Based on what we see coming from the White House

I’m led to believe…

The Data: The Reflexivity of Sovereign Demand

The market didn't react immediately. Bitcoin dipped from $90,600 to below $85,000 on announcement day. Analysts called it anticlimactic. The order created no new purchases. No taxpayer dollars allocated. Just a policy to hold what the government already owned.

But the sophisticated money understood something different.

Gemini's analysis of the Market Cap Multiplier revealed the reflexive nature of Bitcoin demand. Every dollar deployed into Bitcoin historically moved market capitalization by $1.70 over time—or up to $25 in short-term bull markets. The mechanism was supply scarcity meeting sovereign legitimacy.

When governments declared Bitcoin a strategic asset, institutional confidence shifted. Following the executive order, public and private companies began accumulating over 20,000 BTC per month—one of the most aggressive institutional inflow periods since 2021.

MicroStrategy, now formally called Strategy, led corporate adoption with 553,555 BTC acquired for $37.90 billion as of April 2027—an average cost basis of $68,459 per coin. Chairman Michael Saylor continued purchasing through volatility, adding 15,355 BTC for $1.42 billion in late April alone.

But Strategy wasn't alone anymore. Windtree Therapeutics allocated $520 million for BNB holdings. Sharps Technology committed $400 million for Solana acquisition. BlackRock's IBIT Bitcoin ETF reached nearly $100 billion in assets under management within a year of launch.

The data painted a clear picture: 71% of institutional investors had invested in digital assets as of mid-2025. Another 41% held spot cryptocurrencies, with 46% planning to invest in vehicles owning underlying crypto assets within 2-3 years. A staggering 96% believed in the long-term value of blockchain and digital assets.

This wasn't retail speculation. This was institutional reallocation.

The Shift: From Seizure to Strategy

The turning point came quietly.

On June 6, 2025, Representative Tim Burchett introduced H.R.3798—the Executive Order 14233 Act of 2025—to codify Trump's order into permanent law. Senator Cynthia Lummis introduced the BITCOIN Act of 2025 on March 11, proposing that Treasury acquire one million BTC over five years through budget-neutral strategies.

One million Bitcoin represented approximately 5% of the total global supply. At October 2025 prices near $113,000, that equaled $113 billion. Analysis suggested that if Congress mandated such accumulation, supply shock dynamics would force Bitcoin's clearing price significantly higher to draw out sellers.

VanEck's Strategic Bitcoin Reserve calculator projected that if Bitcoin compounded at 25% annually—below its historical average—each coin could reach approximately $21 million by 2049. Even conservative 15% annual growth suggested Bitcoin could exceed $1 million per coin within a decade.

The mathematical case was straightforward: permanent scarcity plus sovereign demand equals asymmetric upside.

By October 2025, Senator Lummis publicly stated that the Trump administration was considering selling portions of the U.S. gold reserve to finance Bitcoin acquisitions. "This would allow us to build a strategic reserve without new borrowing, leveraging Bitcoin's asymmetric upside as a store of value," she explained.

The signal was unmistakable: the U.S. government was preparing to actively accumulate digital assets.

The Consequence: The Arms Race Nobody Discusses

For the average American watching from outside the financial system, the implications felt abstract. Bitcoin? Government reserves? What did any of it mean for retirement accounts or grocery bills?

But for those paying attention, the consequence was profound.

Sixteen U.S. states introduced Bitcoin reserve legislation as of March 2025. Arizona, New Hampshire, and Texas passed laws allowing state treasuries to hold Bitcoin. The Texas Strategic Bitcoin Reserve became operational in June 2025.

Internationally, El Salvador continued accumulating. Bhutan held approximately 13,000 BTC. The Czech Republic, Sweden, and others explored similar frameworks. The phrase "crypto arms race" entered policy discussions.

The dynamic created a prisoner's dilemma at the sovereign level. If the U.S. accumulated 5% of global Bitcoin supply, other nations faced a choice: accumulate now while prices remained (relatively) accessible, or risk being priced out as sovereign demand compressed supply.

The reflexive feedback loop was already visible. Trump's executive order triggered institutional accumulation. Institutional accumulation compressed available supply. Compressed supply increased price. Increased price validated the strategic thesis. Validation attracted more institutional capital.

For individuals, the window to position alongside institutions was narrowing.

I've covered monetary policy for twenty years. Watched central banks accumulate gold. Watched sovereign wealth funds diversify into alternative assets. Watched institutions position years before retail investors understood what was happening.

Executive Order 14233 wasn't just about Bitcoin. It was about legitimacy.

When the U.S. government declares an asset a strategic reserve—placing it alongside gold, petroleum, and Treasury securities—perception shifts. What was speculative becomes strategic. What was fringe becomes foundational.

The executive order contained a single paragraph that revealed everything: "Because there is a fixed supply of BTC, there is a strategic advantage to being among the first nations to create a strategic bitcoin reserve".

First nations. Not first investors. Nations.

The game theory was explicit. Sovereign competition for scarce digital assets. A 21st-century gold rush with mathematical scarcity enforced by code instead of geology.

Treasury Secretary Bessent stated in November 2025: "Bitcoin never shuts down". The comment came during a government shutdown, needling Democrats while highlighting cryptocurrency's operational independence from political dysfunction.

The contrast was deliberate. Traditional government operations froze. Bitcoin continued processing transactions every ten minutes, exactly as designed.

Institutional investors understood the signal. EY's 2025 survey found that 86% of surveyed institutional investors had exposure to digital assets or planned allocations in 2025. Another 59% planned to allocate over 5% of assets under management to cryptocurrencies.

The percentage engaging with DeFi was set to triple from 24% to 75% within two years. Stablecoin usage was expanding rapidly. Tokenized asset interest reached 57%.

This wasn't a bubble. This was infrastructure being built in real-time.

The executive order is signed. The legislation is pending. The accumulation has begun.

But the window for individual positioning alongside institutional capital remains open—barely.

History shows that when governments telegraph strategic intent, markets front-run implementation. The March announcement triggered the pattern. Corporate treasuries responded within weeks. State legislatures followed within months. International governments are positioning now.

Section 408(m) of the Internal Revenue Code allows qualified retirement accounts to hold IRS-approved precious metals and, increasingly, digital assets through specialized custodians. Direct rollovers avoid taxation and penalties. The framework exists for individuals to position retirement capital in the same asset class governments are declaring strategic.

The choice crystallizes: recognize the pattern while positioning remains accessible, or wait for confirmation that arrives after prices reflect the new reality.

The trillion-dollar signal has been sent. The only question is who's listening.

—

Claire West