The Value of Breathing Room in Your Finances

One afternoon, not long ago, I found myself at a crossroads. A pile of unopened bills sat on my kitchen table, and the feeling of overwhelm crept in like a thick fog. But then, an unexpected paycheck arrived a bit early, allowing me some breathing room—those precious extra days to catch up, cover essentials, and plan without panic. That brief moment of financial space made all the difference. It reminded me that having even a little breathing room in our finances isn’t about luxury; it’s about peace, calm, and control.

Financial breathing room is that margin of safety in our budgets, the ability to cover what we must without stretching ourselves thin. It’s the difference between reacting to emergencies with stress or meeting them with calm preparedness. For many Americans, that margin is shrinking, and the stress is mounting. Understanding how to build and protect this breathing room can transform how we live and plan our financial futures.

When Financial Stress Builds

Debt, mounting bills, minimum payments, and surprise expenses—they all chip away at our financial breathing room. For countless households, the reality is this: juggling multiple debts, facing high-interest credit card rates, and navigating bills that outpace income leave little margin to breathe.

According to recent data from 2024 and 2025, Americans collectively owe about $1.21 trillion in credit card debt alone. The average credit card balance has climbed to $6,730, while average interest rates hover near 24%, some of the highest on record. For those carrying balances month to month, interest charges become a heavy weight, making it harder to chip away at the principal debt. Meanwhile, only about 46% of U.S. households have enough savings to cover three months of expenses, and nearly one in four have no emergency savings at all. With such tight budgets, unexpected costs—car repairs, medical bills, or job interruptions—quickly become crises.

Financial anxiety is real and widespread. Surveys show that around 80% of Americans feel some level of anxiety about their finances, with a third facing moderate to severe stress. This constant pressure makes thinking beyond immediate payments difficult and can keep many stuck in a cycle of reactive, rather than proactive, money management.

What would you do with an extra 21 months of financial breathing room?

- Plan that long-delayed home upgrade

- Cover surprise expenses without the stress

- Pay down balances—without piling on interest

It’s about giving you time to take control.

And with no annual fee, protection perks, and exclusive merchant savings, it’s built to work for you long after the intro period ends.

Measuring the Margin: Data and Analysis

Understanding the scale and impact of tight finances is crucial to appreciate the value of breathing room. Here are the most recent stats and what they tell us about the U.S household financial picture:

- U.S. credit card debt rose to $1.21 trillion by late 2024, up 8.6% year-over-year.

- Average credit card APRs near 24% mean carrying a balance accrues significant interest charges.

- 24% of Americans have no emergency savings, while only 46% can cover three months of expenses from savings.

- About 80% of Americans report financial anxiety; 34% experience moderate to severe financial stress.

- Total household debt, including mortgages, auto, and student loans, topped $18.39 trillion as of Q2 2025, rising steadily.

These figures reflect a nation where many are balancing on a tightrope—with little financial slack to weather sudden blows or build toward a secure future.

A Simple Formula for Breathing Room

To think clearly about creating that margin, consider this simple formula:

Breathing Room = Income − Fixed Expenses − Debt Payments

This formula shows that breathing room is what remains after covering essential costs and necessary debt payments. When that number is zero or negative, no margin exists; every dollar is already spoken for, and stress follows naturally. The goal is to increase this breathing room so there is money left over to save, invest, or simply rest easier.

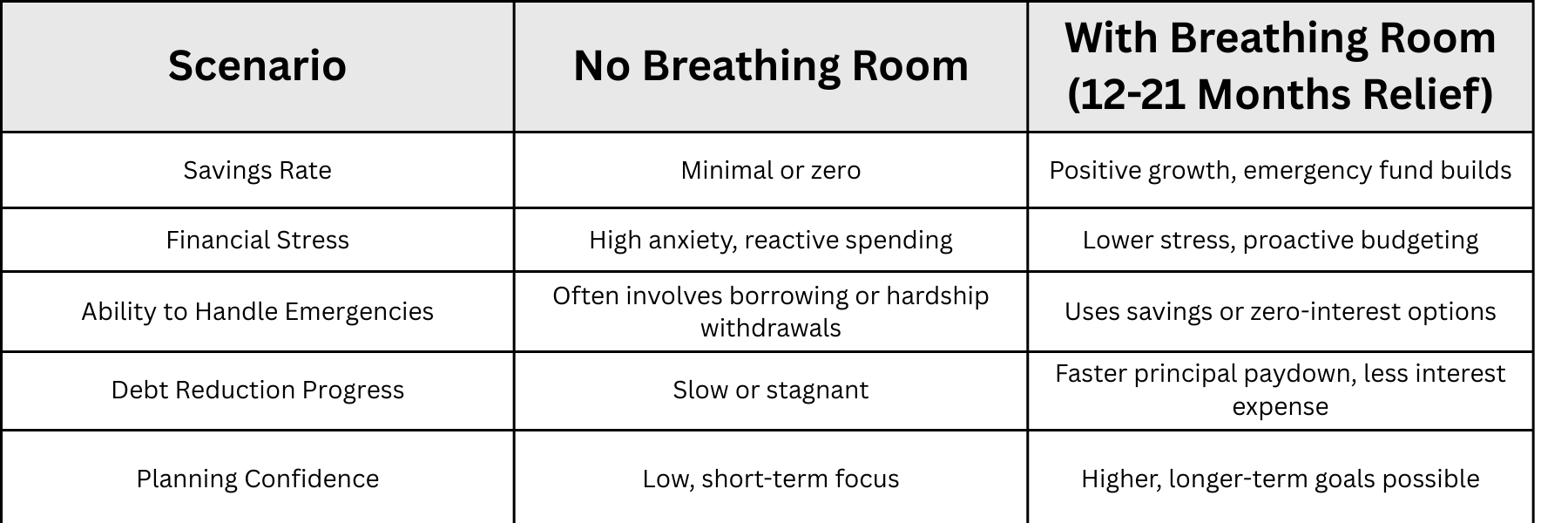

This contrast illuminates how financial breathing room transforms not just numbers on a spreadsheet but real lived experience—from a daily grind to a place of calm control.

Closing Reflection

Financial success isn’t solely about growing wealth or hitting ambitious targets. It’s equally about carving out the space to breathe, reflect, and plan without constant pressure. That margin—those extra dollars, days, or months—allow for clarity in decision-making and resilience in hard times.

I’ve lived the difference that breathing room makes. It turned moments of panic into opportunities for planning. For everyday Americans, particularly those juggling household budgets and financial stress, creating and protecting that breathing room is a quiet yet powerful act of self-care. It’s about giving yourself permission to take a breath and move forward steadily, no matter how tight the times.

Take that breath. Your finances—and your peace of mind—will thank you.

—

Claire West