The Weight of a Physical Object

It is July 2025. A live interview. An official sits across from a journalist and does something that, on paper, appears insignificant. He holds up a small magnetic component—a permanent magnet, neodymium-iron-boron, the kind that spins electric motors and guides weapons systems.

The interview continues. Policy questions are asked, answered with the usual abstractions. But that physical object, held visible on camera, carried more information than any spoken promise could have transmitted. The magnet was tangible. Manufactured in the United States. Proof of capability. A symbol that official policy had moved from negotiation into production.

The magnet was then put down, and the moment passed. Few people noticed. Most observers continued analyzing speeches and press releases. But something had shifted. Capital was about to move toward rare earth producers. Not because of what was said, but because of what was shown.

This is how government actually communicates to markets. Not through rhetoric, but through artifacts. Not through promises, but through symbols that carry weight because they represent completed action, not pending intention.

Why Governments Speak in Symbols

Words can be reversed. Speeches contain plausible deniability. Announcements can be abandoned. But a physical object—a magnet manufactured in America, shown on television in a government official's hand—represents something different. It is commitment made visible.

Research in behavioral public administration shows that symbolic elements in government communications increase citizen trust more than substantive policy information. This is not manipulation. It is how human cognition processes complexity. When too much information floods in, people rely on symbolic cues to decide what to believe.

The magnet is the symbol. The United States will manufacture permanent magnets domestically. This is not a proposal. It is a fact being introduced into public consciousness.

When governments move capital, they often begin with symbols. A prototype held during testimony. A facility toured with cameras present. A product sample delivered to allies. These artifacts precede formal announcements. They allow institutions—markets, foreign governments, competitors—to calibrate their response based on something more trustworthy than a promise.

The symbol says: We have decided. Now we are showing you we mean it.

Treasury Secretary Scott Bessent just issued a cryptic stock market warning on live television...

When asked about America's economic prospects for 2026, he held up a small magnet about the size of a USB thumb drive.

It's the first rare earth magnet made in the USA in 25 years.

And it holds the key to a 500%+ buying opportunity.

See, everyone knows the U.S. government has been buying stakes in publicly listed resource companies recently — with stocks like rare earth miner MP Materials gaining huge publicity as a result.

But Scott Bessent's strange message on live TV recently holds the key to the NEXT wave of companies the government could target, just days from now.

In fact, I think the Treasury Secretary's somewhat cryptic message holds the key to the single biggest financial opportunity of 2026.

I'm certain the U.S. government is about to buy stakes in dozens of stocks in the coming days.

I name them all for you right here.

The Shift from Markets to Materials

For decades, economic power was measured in abstractions. Capital markets, currency strength, GDP growth. These metrics still matter, but they obscure something more fundamental: physical inputs.

You cannot build an aircraft without neodymium-iron-boron magnets. You cannot build hypersonic missiles without them. You cannot build modern electric vehicles, AI cooling systems, or weapons-grade electronics without controlling rare earth supply chains.

This is the inversion that policy has quietly begun recognizing. Economic power flows from who controls the materials that make everything else possible.

For the past 30 years, the United States outsourced this concern. China developed rare earth processing capacity. The economics made sense: China had labor costs and environmental regulation that made it profitable. Why build domestically when buying was cheaper?

But as geopolitical friction increased—as China restricted exports of rare earths to restrict access to magnets, as military supply chains became vulnerable to foreign leverage—the economic calculus inverted. Domestically produced magnets at higher cost became strategically cheaper than externally dependent ones at lower cost.

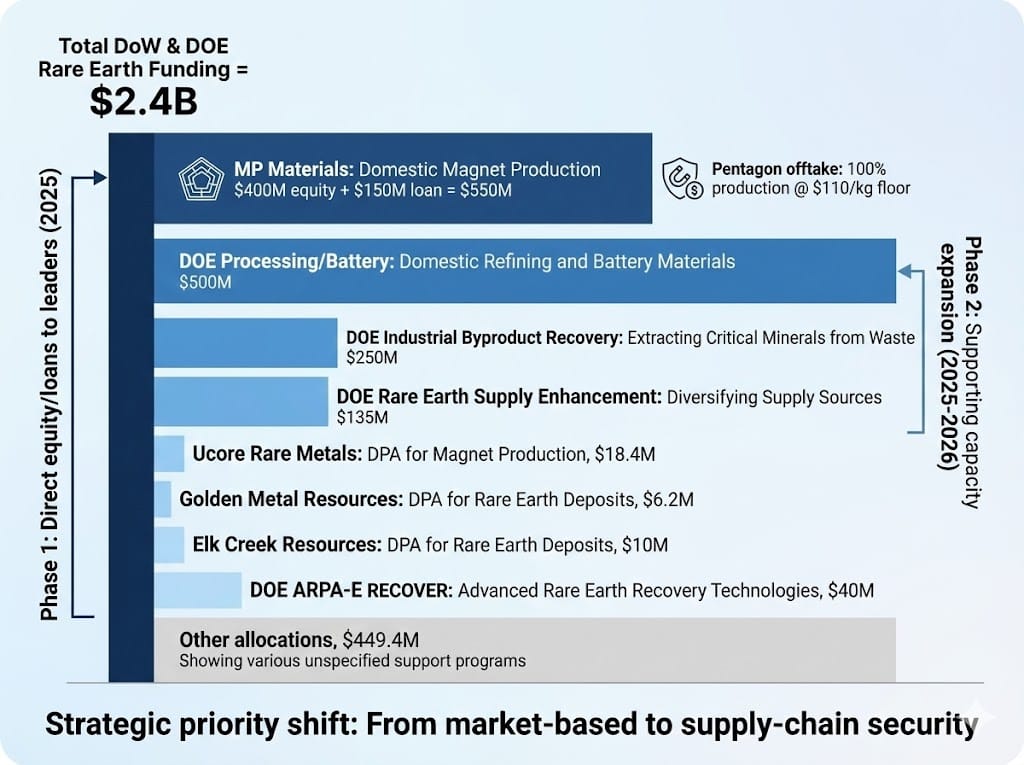

By 2025, the shift became explicit. The Department of War announced a $400 million equity investment in MP Materials to build U.S. magnet manufacturing capacity. Not a purchase. Not a contract. An equity stake in the company, with a 10-year commitment to buy 100 percent of production, at a price floor of $110 per kilogram.

This is not market-based allocation. This is industrial policy: government directly shaping capital flows toward materials independence.

The magnet held in the official's hand was the symbol of this shift. It represented the moment when materials security became strategic policy, not market afterthought.

The Psychology of the Welcome Bonus: Incentive vs. Behavior

A credit card offer arrives. Welcome bonus: $300 cash back after $1,500 spend in three months. This looks like an incentive—an offer to attract your business.

It is, technically. But it functions as something else: permission.

The bonus reframes the card from "spending tool" to "opportunity." Spending becomes not an expense, but an investment in a reward. The psychology flips. Instead of "Should I spend this?" the brain asks "How do I capture this bonus?".

Welcome bonuses now represent 20-40 percent of the total value a cardholder receives in the first year. They are not loss-leaders. They are behavior starters. The bonus is designed to establish a spending pattern that, once established, becomes habitual.

Younger consumers (Gen Z, Millennials) are particularly responsive—41-40 percent cite rewards as a major reason to use credit. But across all demographics, one pattern holds: 80 percent of active cardholders say rewards influence how much they spend on cards.

The bonus is not an incentive to use the card once. It is permission to use it regularly.

Why No-Fee, No-Purchase Structures Change Risk Perception

A credit card with no annual fee feels different than one with a $95 annual cost. Not just in dollars, but psychologically.

No fee removes the barrier to activation. No minimum spend removes activation risk. Instant approval removes uncertainty. Together, these reframe the card not as a financial commitment, but as a value-add—a tool that makes your existing spending more rewarding.

For someone already embedded in an ecosystem (Prime member, regular Amazon shopper), a no-fee card offer functions as alignment, not as a new decision. It is not "Should I take this risk?" but "Why haven't I been optimizing my existing behavior?".

The psychology shifts from "Is this a good idea?" to "This is obviously aligned with what I already do."

This is why instant application decisions matter. A decision made in 60 seconds, on mobile, with immediate gratification (approved!), feels different than an application that takes days. Speed makes the decision feel low-risk, even if the underlying credit terms are identical.

The Dopamine Loop: Why Frictionless Feels Rewarding

Every smooth transaction releases dopamine—the same neurotransmitter linked to reward and anticipation. The system is deliberately designed this way. Green checkmarks. Confirmation sounds. Vibrations that feel celebratory.

These design choices mimic psychological rewards of achievement, turning payments into micro-victories rather than losses. The brain learns: spending = reward. And that learning compounds.

This is problematic because spending via payment cards is actually a loss—money leaves your account. But the frictionless design inverts the emotional signal. The "pain of paying" (the natural discomfort you feel handing over cash) is completely removed.

Research is clear on this: cash transactions create the strongest cognitive friction and spending regulation. Digital wallets create the least friction and highest spending. The difference is not small. When the friction reduces, impulse buying increases, price sensitivity decreases, and total spending rises.

Rare Earths as Strategic Infrastructure

Rare earth magnets sit at an unusual intersection. They are militarily critical (F-35 flight controls, hypersonic weapons, naval propulsion, satellite systems). They are economically critical (EV motors, wind turbines, medical imaging). They are civilly critical (robotics, consumer electronics, industrial automation).

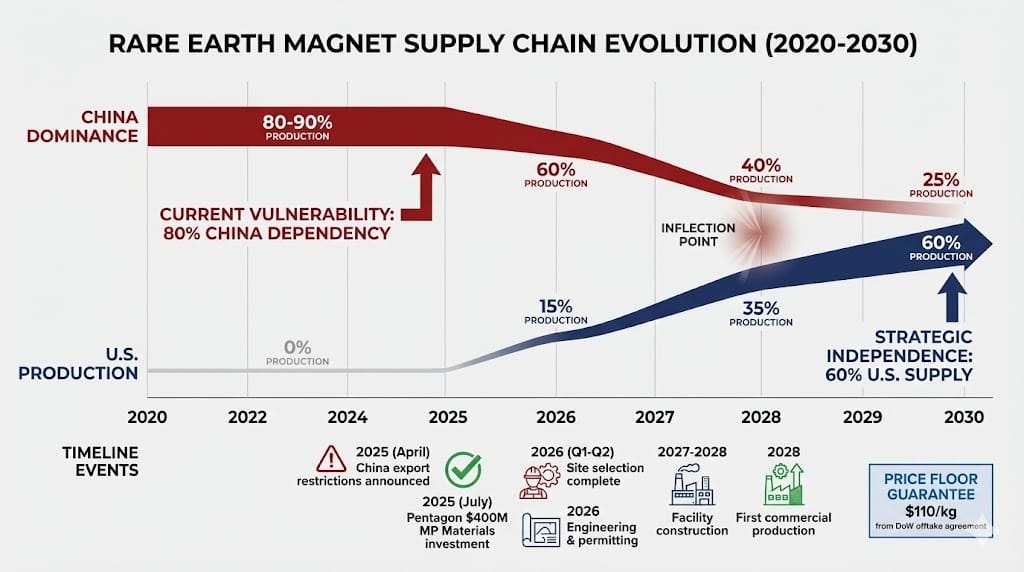

And China controls approximately 80-90 percent of global production.

In April 2025, China escalated this advantage by announcing the strictest rare earth export restrictions to date. The new framework requires Chinese government approval for any magnet export containing even trace amounts of Chinese rare earth material, or produced using Chinese technology. Starting December 1, 2025, companies affiliated with foreign militaries are largely denied export licenses entirely.

This is economic strangulation disguised as regulation. It gives China the power to slow U.S. military production simply by withholding magnets.

The Pentagon recognized the vulnerability immediately. By July 2025, they had committed $400 million in direct equity investment to establish a domestic magnet supply chain. Not to save money, but to eliminate geopolitical hostage exposure.

The magnet on camera was not a product. It was the symbol of independence—the physical proof that the United States no longer had to negotiate with Beijing for core military components.

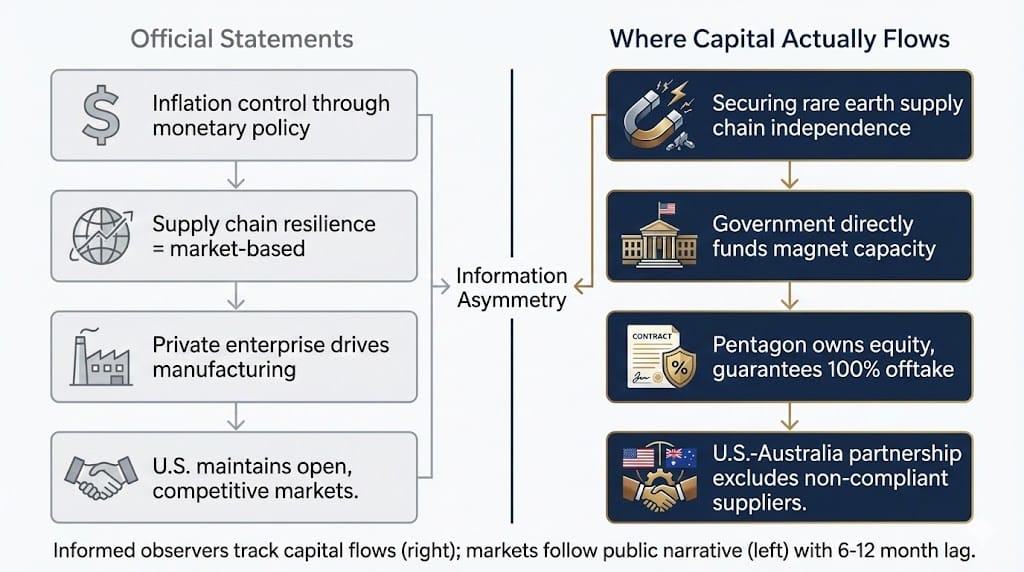

Policy Before Capital: The Information Asymmetry

Markets move slowly when policy intent is unclear. Companies invest cautiously when government commitment is ambiguous. Capital waits for certainty before flowing to new sectors.

But governments move in stages. Phase one: develop capability, show a prototype, brief key officials. Phase two: announce formal commitment, allocate capital, establish timelines. Phase three: begin production, capture capital flows, consolidate supply chains.

The magnet displayed in July 2025 represented Phase Two completion. It was visible proof that Phase One was done—that U.S. magnet manufacturing was no longer theoretical, but functional.

Markets react slowly to symbols because they remain skeptical. Is this government theater, or genuine commitment? The $400 million equity stake answered the question. If the Pentagon was willing to take equity ownership of a magnet company, they were not speculating.

This creates an asymmetry for informed observers: those tracking physical symbols (actual investments, signed contracts, equipment displayed) move ahead of those waiting for formal announcements.

Hedge funds and institutional capital began positioning in rare earth producers in early July, before the magnet announcement. By late July, when the symbol was displayed, mainstream analysis had caught up, and capital was already flowing.

Why This Matters to Individuals (Without Being a Trade)

This is not investment advice. This is literacy about where policy moves first.

Governments rarely announce that they are reshaping supply chains. They show magnets on live television, allocate capital quietly, and establish partnerships before formal programs begin.

Understanding this pattern—where the symbol appears before the capital flows—helps individuals recognize policy shifts before they become consensus. It is not about predicting stock prices. It is about understanding where national priorities are moving, and what that means for economic and geopolitical structure.

When the Pentagon displays a domestically manufactured magnet, it is signaling: this industry is now strategic. When it invests $400 million in equity, it is confirming: this will be funded. When it commits to 10-year offtakes at price floors, it is declaring: this will succeed.

These are not speculative signals. They are policy in motion.

Why Symbols Matter More Than Promises

A government can promise anything. A government cannot show you something that does not exist. When an official holds a domestically manufactured magnet in their hand, they are showing you that capacity exists, that the commitment is real, and that the timeline is concrete.

Markets believe symbols more than speeches because symbols require execution. You cannot fake a working prototype. You cannot display a non-existent facility. You cannot make an equity investment without committing capital.

This is why the magnet became the moment. Not the words surrounding it, but the object itself. The symbol that said: this is happening, and you should calibrate your expectations accordingly.

Capital Flows Follow Clarity

The companies that benefited from the July 2025 announcement were not surprised by it. They had been positioned—receiving early DPA allocations, conducting pilot production, building facilities in targeted locations. By the time the magnet was shown on television, institutional capital had already begun moving.

The asymmetry advantage went to those who recognized the symbol's meaning before it was universally understood. Once the magnet was displayed publicly, the interpretation became consensus, and late capital followed.

This pattern repeats: the Pentagon funds a magnet facility quietly in 2024. Investors research and position. In 2025, the magnet is shown on camera. By 2026-2027, the facility begins producing. By 2028, the narrative becomes "the inevitable domestication of magnet production."

Only the first group—those who tracked the symbol from Phase One—captured the full asymmetry.

Understanding Without Speculating

This is the distinction: understanding policy mechanics is not speculation. It is literacy.

Recognizing that the U.S. is shifting toward supply chain sovereignty in critical materials is understanding context. Understanding that governments signal this shift through symbols (equipment displays, equity investments, signed agreements) before formal announcements is recognizing patterns. Understanding that capital follows these symbols in stages is historical observation.

None of this requires predicting outcomes. It simply requires paying attention to what governments show, not only to what they say.

The Object Carries More Weight Than the Announcement

In October 2025, the same government that displayed that magnet announced a formal U.S.-Australia framework for securing critical minerals supplies, establishing price mechanisms, and coordinating production. By then, markets had already absorbed the signal from the July magnet. The formal announcement was confirmation, not revelation.

This is why policy scholars study symbols: they often precede formal policy by months or years. By the time a policy is officially announced, the capital markets have already adjusted.

The real signal was not the October announcement. It was the July magnet. Not the words of officials, but the object in their hand. Not the promise, but the proof.

Government moves capital toward materials independence by first showing you the material. It is the oldest language in policy: not speaking intent, but displaying capability.

The magnet was quiet. It required no announcement. But for those watching where the Pentagon allocates equity stakes and 10-year offtakes, it carried the only information that mattered.

—

Claire West