They Tax You. They Spend It. This Ends Now.

It’s the same story every pay period: You clock the hours, see your paycheck, and already know what’s coming. Taxes slice off the top—federal, state, Social Security. Your bonus? Shaved down before it ever hits your account. Every step forward seems to come with a hidden hand reaching back. For ordinary Americans, “playing by the rules” too often means financing a system that only seems rigged—not for you, but against you.

You plan, you save, and you sacrifice. Yet, every time relief is in sight—retirement, a little luxury, a gift for your family—Washington changes the rules. New levies, stealthy inflation, repo men in three-piece suits. Meanwhile, those snug in the city’s boardrooms quietly draft a different set of rules—a set only accessible if you know where to look.

Trump’s Exposé — and the Hidden Door He Left Open

During his presidency and still today, Trump made a public sport of calling out the “two-tier” tax system: one for average folks, another for the well-connected. His speeches hammer home how Wall Street, K Street, and Silicon Valley know how to dance around every tax hike—using loopholes so intricate most Americans never hear of them.

But here’s what the news cycle missed: Trump didn’t just complain. He quietly kept a legal door open—a tax-advantaged maneuver any American can use if they know it’s there. Some call it the “Patriot Tax Loophole.” Legally, it rests on IRS Section 408(m)—a long-standing rule that lets regular people protect part of what they’ve earned from Washington’s appetite.

Here’s the irony: The same system meant to defend “the little guy” hid this escape route in dense legal code, even as elites winked and walked through the open door. Now, with inflation biting harder and new IRS proposals for expanded surveillance, that loophole means more than ever.

The truth is brutal: Washington has been bleeding you dry for decades.

Every paycheck—gone. Every tax season—robbed. Meanwhile, the elites use hidden rules to protect their fortunes while hardworking Americans foot the bill.

Trump exposed the scam. And now, the Patriot Tax Loophole is your chance to turn the tables.

This legal, IRS-approved strategy could:

- Slash the taxes you hand over to the swamp

- Shield your retirement from government grabs

- Keep thousands more in YOUR pocket, not theirs

Washington insiders hate this because it puts power back where it belongs—with the people.

That’s why this guide may not be around forever. Once too many Americans start using it, you can bet they’ll slam the door shut.

How the Loophole Works

Let’s get clear. The Patriot Tax Loophole is not some gimmick, gray-market trick, or crypto shell game. It is federal law—the exact tool Washington insiders have exploited quietly, now written plainly for all.

Section 408(m) of the IRS Code gives Americans the right to move a portion of their IRA, 401(k), or similar retirement funds into physical gold (and sometimes silver or other eligible tangible assets) without extra taxes or early withdrawal penalties. It’s as above-board as a W-2—approved, affirmed, and compliant for decades.

- No penalty.

- No tax on the transfer.

- No new loopholes needed—just paperwork that any IRA or 401(k) administrator can process.

Why did almost no one talk about it? Because, until recently, few realized how fragile “safe” paper money had become. While insiders balanced their portfolios with real assets, ordinary Americans trusted banks, bonds, and funds—leaving themselves exposed.

This is still how many in Washington finance their own independence from policy risk. And now, it’s available for everyday patriots, too.

Why It Matters Now

Consider the timing:

- Inflation remains stubbornly above target. Every grocery run reveals how much less a dollar buys—and inflation acts as the quietest tax of all.

- Government debt keeps ballooning. Above $35 trillion and counting, it’s clear the bill will eventually come due—one way or another.

- IRS expansion and surveillance proposals are advancing. New tools to monitor more accounts, new enforcement aimed at “compliance.” It’s not about chasing billionaires; it’s about squeezing every drop from the middle class.

For ordinary Americans, this loophole is more than a tax break or hedge: it is a shield against shifting rules, runaway spending, and a bureaucracy eager to “borrow” more of your savings, piece by piece.

This is self-preservation masquerading as paperwork. When you use IRS Section 408(m) to diversify—moving a piece of your savings into physical, legally-protected gold—you’re doing what every clear-eyed patriot has always done: Protect the fruits of your work from those who’ve forgotten what work means.

Your Turn to Push Back

The headlines will always debate “fair share” and “loopholes” and “tax justice.” Here’s the quiet truth: This isn’t about tax evasion—it’s about refusal to be played.

You don’t get to write tax laws.

But you can choose to use the doors left open—before new reforms quietly close them yet again.

Empower yourself. Three steps:

- Review your retirement savings. If you have an IRA or 401(k), you probably qualify.

- Ask your administrator or advisor specifically about a Section 408(m) rollover. Insist on the legal process—don’t let them sidestep.

- Diversify now, not when it’s too late. Don’t wait for another rule change. Use what’s legal, just like the insiders do.

The Patriot Tax Loophole lets everyday Americans use the same IRS-approved strategy the elites rely on to protect their wealth.

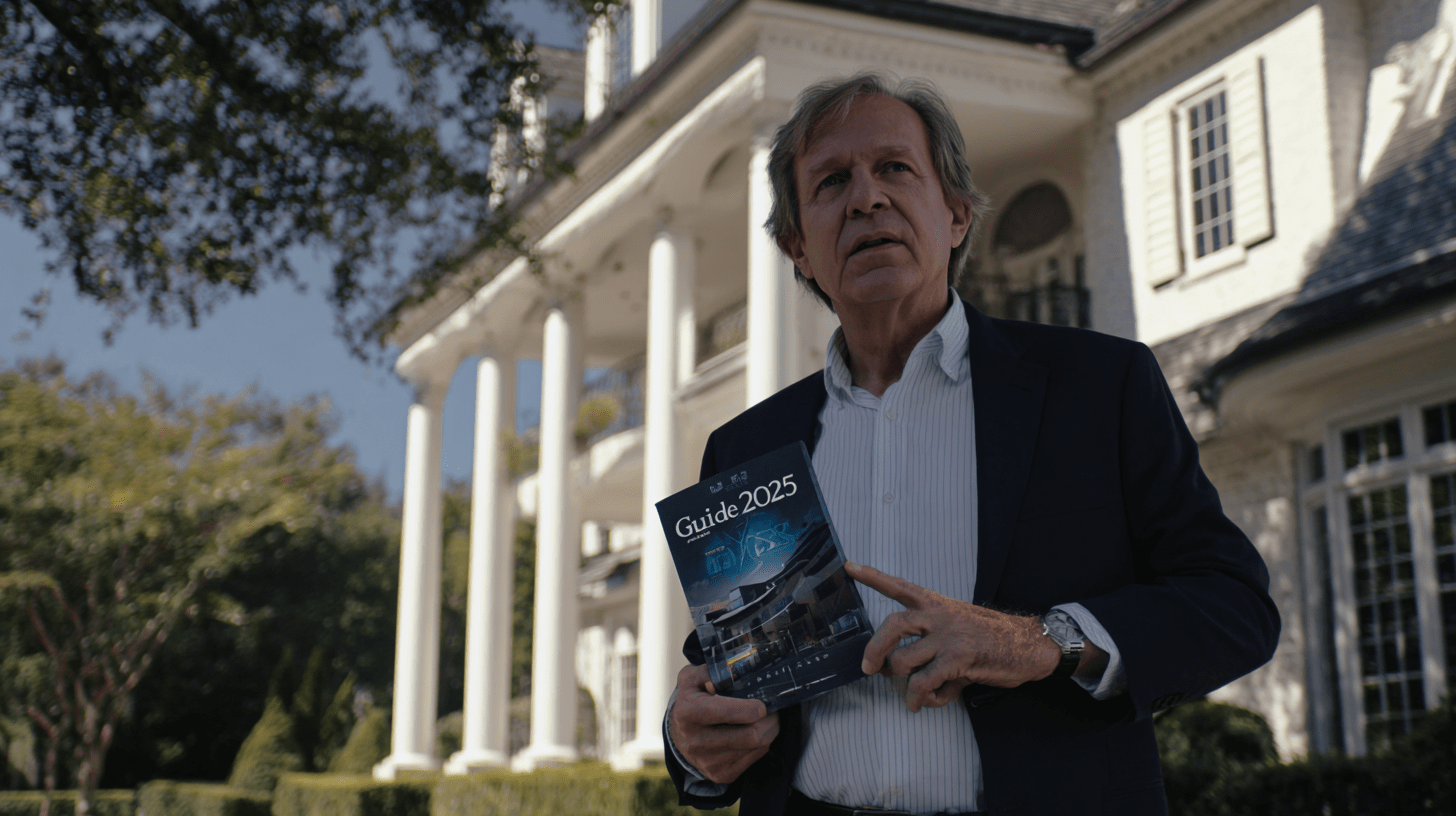

Grab your free 2025 Wealth Protection Guide before they take it offline.

Rebellion isn’t always loud. Sometimes it’s just a signature, a piece of paper, a decision to stand where the rules say you’re allowed—but the system hopes you won’t. Trump didn’t close the loophole he could have—he left it for those with eyes to see and hearts stubborn enough not to give up what they’ve earned.

There’s still time to push back, to defend your savings from a system built to siphon a little more every year.

Stand tall. The loophole is still open, but the hour is late. Get the guide. Make the move. Stand with the millions of Americans who refuse to bow their heads when the rules change—again.

Because what you’ve earned is yours.

—

Claire West