Trump Reunites With Musk… Hours Later, Everything Changes

Credit card interest is draining your bank account. But there’s a legal way to freeze it cold for 21 months — starting today. No gimmicks. No annual fee. Just a top-rated card with a 0% intro APR that lasts nearly two years.

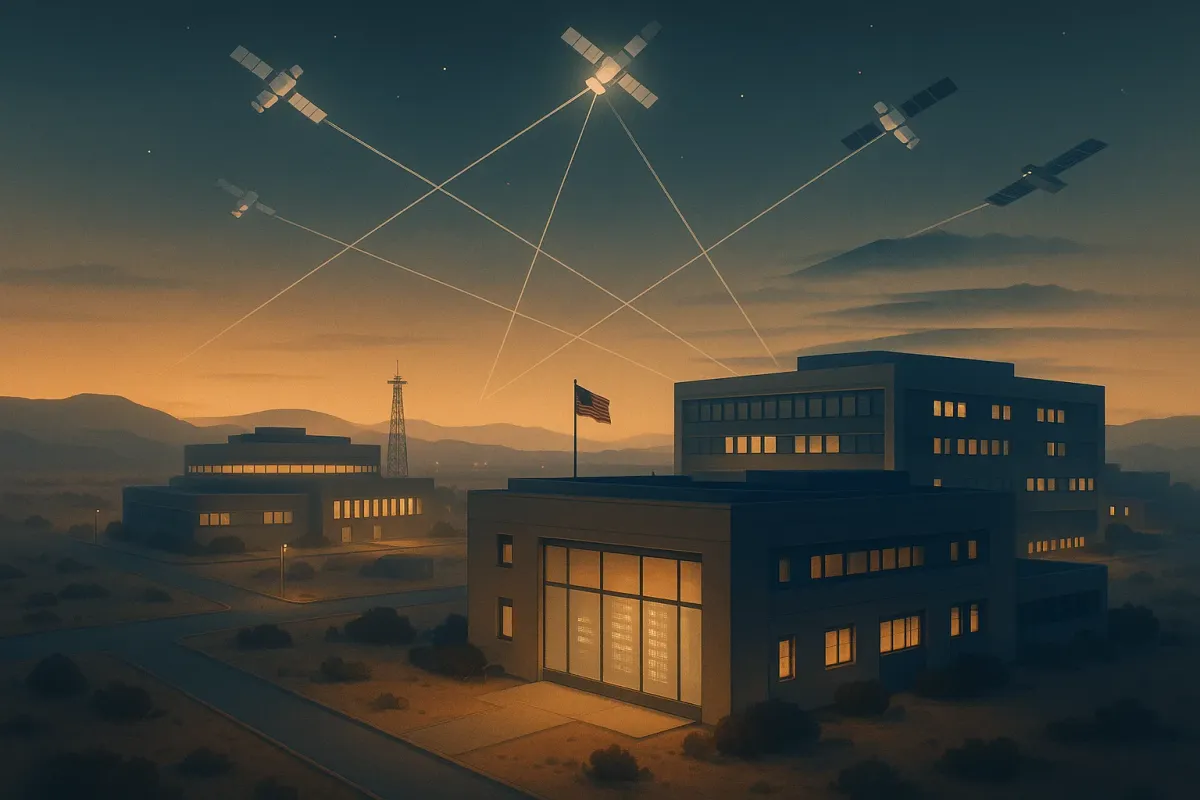

Late afternoon. A private hangar in Arizona, unmarked, the kind where deals get made outside the public eye. Two men step out of separate vehicles—one in a dark suit, the other in his usual black t-shirt and jeans. The air is tense, not with hostility, but with the weight of what comes next.

Donald Trump and Elon Musk. After months of public feuding, social media attacks, and a spectacular falling-out that dominated headlines through mid-2025, they're standing together again. Not for cameras. Not for headlines. For something more fundamental: infrastructure.

Hours later, Starlink devices appeared in federal buildings. Not announced. Not debated. Just installed—quietly powering secure networks inside the very government Musk once criticized and Trump once promised to overhaul.

This wasn't reconciliation theater. It was the beginning of a tectonic shift in how America thinks about power, autonomy, and the privatization of critical infrastructure.

Why This Meeting Matters

The Trump-Musk relationship has always been transactional. In 2024, Musk donated over $270 million to Trump's campaign, barnstormed battleground states, and led the controversial Department of Government Efficiency (DOGE) after the election. But by mid-2025, the alliance fractured over fiscal policy—Musk called Trump's landmark spending bill "utterly insane," and Trump publicly questioned whether Musk had "lost his mind."

The feud played out on X and Truth Social, escalating to threats of contract cancellations and mutual character attacks. By September, most analysts assumed the partnership was dead.

But then came the memorial for Charlie Kirk in Arizona—a moment where the two were photographed shaking hands, sitting together, the tension visibly thawing. It wasn't just personal reconciliation. It was strategic realignment.

Because what Trump and Musk both understand—better than most politicians or tech executives—is that the future belongs to those who control infrastructure. Not apps. Not content. But the rails: energy, data, connectivity, and the physical systems that underpin everything else.

After months apart, Donald Trump and Elon Musk just reunited in Arizona — and not just for headlines.

Hours later, Musk’s Starlink devices were confirmed installed in multiple federal buildings, quietly powering secure networks.

Former tech executive Jeff Brown believes this move sets up Elon’s first $1 trillion IPO — and he’s showing everyday Americans how to claim a stake for as little as $500.

This window closes when Musk files the SEC paperwork — which could happen any day now.

The Hidden Infrastructure Play

Starlink isn't just satellite internet. It's autonomy embedded in code and orbit.

While traditional ISPs rely on ground-based infrastructure—cables, towers, centralized hubs vulnerable to disruption—Starlink operates from low-earth orbit. No single point of failure. No reliance on local utilities. Just a constellation of satellites providing connectivity anywhere, anytime, without asking permission from legacy telecom monopolies.

And now, it's inside federal buildings.

According to reports, Starlink was installed in multiple government facilities by mid-February 2025—often within days of requests from DOGE personnel, bypassing the usual months-long procurement reviews. The General Services Administration confirmed installations at its Washington office. The Federal Aviation Administration is evaluating contracts. Customs and Border Protection is assessing deployment along the U.S. border.

This isn't just about faster internet. It's about resilience—the ability for government operations to function independently of traditional infrastructure during crises, cyberattacks, or geopolitical disruptions. And it's about leverage: whoever controls the connectivity controls the network.

The financial signal? Starlink's government contracts, once modest, are accelerating. From $4.1 million in 2022 to expanding military partnerships under the classified Starshield program, the trajectory is clear: Musk is embedding SpaceX infrastructure into the fabric of federal operations.

Lance attended one of the training sessions I held recently with Joel and Adam and this is what he said:

"We had a great week last week and grew $90 to $900. We started out with .1 BNB trades and ended with .4 BNB trades by scaling up." - Lance Smith

Lance's experience is just one example of what’s possible with the strategies Joel and Adam share. It’s amazing to see how quickly these techniques can make a difference, no matter where someone starts.

The perfect time to dive into crypto is RIGHT NOW, because the strategies allow you to profit whether prices are rising or falling.

In the training, you’ll see exactly how it’s done consistently and predictably. Even if you’re completely new, you’ll want to check this out today.

When Politics Meets Technology

Historically, critical infrastructure—power grids, telecommunications, transportation networks—has been either government-owned or heavily regulated. The shift toward privatization has been gradual, contested, and politically fraught.

But Musk is accelerating that shift by making his infrastructure indispensable before regulation can catch up. Starlink's utility during Hurricane Helene, its deployment in Ukraine during the Russian invasion, and now its integration into federal agencies create a dependency that's hard to reverse.

Trump's second-term agenda—energy independence, infrastructure reshoring, technological sovereignty—aligns perfectly with Musk's business model. Both benefit from a world where centralized systems give way to distributed, privately-controlled networks. And both understand that political power flows from infrastructure control.

This isn't conspiracy. It's convergence. The meeting in Arizona wasn't about burying grudges. It was about recognizing that their interests—however divergent on policy—overlap on structure.

What the "First $1T IPO" Would Mean

SpaceX remains private, valued at approximately $400 billion in secondary markets. But speculation about a Starlink spinoff IPO has intensified, with analysts projecting 2025 or 2026 as the likely window.

If Starlink goes public at a $1 trillion valuation, it would be the largest IPO in history—eclipsing Saudi Aramco, surpassing even the most optimistic projections for OpenAI. The capital flow would be unprecedented: institutional buyers, sovereign wealth funds, and retail investors all competing for exposure to a company that's not just profitable, but embedded in government, defense, and global connectivity infrastructure.

For context: when Alibaba went public in 2014, it raised $25 billion. When Rivian IPO'd in 2021, it hit a $100 billion valuation on day one. A $1 trillion Starlink IPO would dwarf both—creating wealth concentration on a scale modern markets haven't seen.

The timing matters. IPO windows are narrow. Once SEC paperwork is filed, the momentum accelerates. Early positioning—before institutional allocations are set, before retail FOMO drives prices—captures the asymmetry. Late entry captures the hype, but not the leverage.

Ordinary Americans vs. Institutional Access

Historically, the most lucrative investments have been gatekept. Pre-IPO rounds go to venture capital firms, sovereign wealth, and ultra-high-net-worth individuals. By the time retail investors gain access, valuations reflect future dominance, not present obscurity.

But regulatory changes—specifically Regulation A+ offerings and secondary market platforms—have created narrow windows where ordinary investors can position before institutional lockup expires. Not at seed-stage pricing, but earlier than traditional IPO access.

This is where analyst Jeff Brown enters. Brown, known for early calls on NVIDIA (recommending in 2016 before the AI boom) and Bitcoin , has built a following by identifying infrastructure shifts before consensus. His thesis on Starlink isn't hype—it's structural: Musk is building a monopoly on connectivity, and monopolies mint fortunes for early stakeholders.

Brown's claim: everyday Americans can position with as little as $500, accessing pre-IPO exposure through secondary platforms or Regulation A+ vehicles tied to SpaceX suppliers and partners. Not direct SpaceX shares, but adjacent infrastructure plays that scale as Starlink expands.

Carrying Concealed.. and jail?

Don’t let it happen to you.

Know the answers to common state laws:

Are handguns allowed near your k-12 schools?

Some states outlaw ammunition instead of guns.

What ammo is prohibited in your state?

Can you carry in a State Park?

These are only 3 out of the more than 28 common questions this State Gun Law Guide answers.

It doesn't matter where you live, we made a free guide for each of the 50 states... just pay a small s&h charge.

It’ll only take a few minutes to get, and you can easily store it in your bag or glove box.

Don’t let confusion about your state gun laws stop you from carrying and protecting your community.

The Real Risk: Waiting

Every major wealth event has a narrow positioning window—the span between signal and consensus. Miss it, and you're buying at consensus prices. Act early, and you capture asymmetry.

The risk isn't acting. It's waiting for certainty. Because certainty arrives late, after institutional capital has rotated, after media validates the thesis, after prices reflect future dominance instead of present opportunity.

Starlink's government integration, the Arizona meeting, and Musk's public hints about IPO timing—all are signals, not proofs. But signals precede events. And those who wait for events miss the positioning window entirely.

Decision Point

Here's what ordinary investors must consider:

Timing: If Musk files SEC paperwork in the next 6–12 months, the IPO momentum accelerates immediately. Early positioning—through secondary markets, Reg A+ offerings, or adjacent suppliers—captures pre-consensus pricing.

Scale: A $1 trillion IPO creates capital flows that cascade through adjacent sectors—satellite manufacturing, ground infrastructure, defense contractors. Early exposure to the ecosystem, not just the headline company, multiplies leverage.

Access: This may be the first mega-IPO where retail investors have parallel access to institutional channels, thanks to regulatory shifts. But access windows close fast once momentum builds.

The decision isn't whether Starlink will succeed. It's whether you'll position while asymmetry remains.

Trump & Elon Reunited — and What They’re Planning Next Will Shock Wall Street

Brownstone Research

Trump and Musk didn't reconcile because they like each other. They realigned because they recognize that the future belongs to those who control the rails—energy, data, connectivity. And for the first time in modern history, those rails are being built by private companies moving faster than governments can regulate.

The opportunity isn't just about Starlink. It's about recognizing that every epoch-defining technology creates a wealth transfer—from those who wait for proof to those who position during signals.

The Arizona meeting was a signal. The federal installations, another. And the coming IPO—whenever it arrives—will be the event.

The question is whether you'll be positioned when asymmetry is still available, or whether you'll watch from the sidelines as the window closes.

—

Claire West