What Holds Us Together—And Apart

Some evenings settle in gentle silence, the golden hour turning windowpanes to honey. There’s a table not far from the door, where bills collect like paper leaves—some opened, some waiting. The room glows with the quiet flick of a switch. A small moment: electricity summoned invisibly, order restored with a gesture. These scenes repeat in homes across America—simple systems that hold our routines, that stitch together hours and seasons. Yet within the calm lies the tension of things unseen: the structures that sustain us can just as easily strain us, reveal quiet divides.

The Systems We Rely On

It’s tempting, once the lights flicker on, to trust that everything works as it should. Behind each moment of order—paychecks deposited, cards swiped for groceries, health insurance claims approved—stands a complex latticework: banks, taxes, credit, and government programs. These systems, inherited and built over generations, promise predictability, a sense of security. They buffer us from chaos—the sudden break, the loss, the unpayable expense.

Banks turn paychecks into balances and credit into possibility. Taxes, regular and inevitable, fund roads, schools, and the social safety net. Credit cards fill the gap between need and payday, sometimes cushioning emergencies, sometimes just smoothing an uneven month. Government programs—Social Security, Medicare, unemployment insurance—are threads in the weave, promising some comfort in a world not known for its guarantees.

The miracle is not that these systems exist, but that they continue to work—most days. As citizens, we rarely witness the machinery under the surface: the clearing of checks, the pricing of risk, the negotiation of benefits, the annual recalibration of taxes. The very predictability of these routines breeds trust and a subtle dependency.

But every structure exacts a cost. The fine print of stability—fees, taxes, shifting rules—can blur at the edges. For all they hold together, these systems also carry fragility, often hidden until stress reveals the fault lines.

Did you know there’s an IRS loophole—408(m)—that lets you pull monthly or weekly income from your 401(k), IRA, TSP or 403(b) completely tax-free?

This isn't a theory. It’s a legal, IRS-approved strategy that can put a second, tax-free paycheck in your pocket—no cash conversion, no red tape, no catching penalties.

Grab your FREE 408(m) Guide now

Stay protected when the next crash hits.

P.S. Wall Street won’t tell you about 408(m). The insiders move first.

Claim your guide (and bonus gold coin) before everyone else wakes up.

When the Balance Shifts

It is not always a sudden event—a job loss, a diagnosis, a market tumble—that exposes cracks. Sometimes, the change arrives quietly: inflation flickers higher, monthly bills bend upward, retirement drifts further away in time. Numbers tell the story. U.S. inflation, after easing in late 2024, reaccelerated in 2025: July’s rate, 2.7%, climbed to 2.9% in August—the highest in months—with food and vehicle costs driving the increase. Shelter and transport costs remain sticky, core inflation holding near 3.1%—just above the Federal Reserve’s target.

The backdrop is a government that owes $37.3 trillion as of August 2025—up 31% since 2019—with interest payments gobbling up 13% of federal expenditures. Debt as a share of GDP hovers near 119%, quietly shaping discussions about future tax rates, safety net stability, and retirement security.

For many, the result is deeply felt: working harder or longer, yet watching progress stall. There’s a common thread woven through incomes high and low—a sense that the gap between effort and outcome widens, even as the systems promise order. Sometimes, the struggle is not with budgets but with time: retirement, once mapped by milestones, now hesitates, deferred by market volatility and persistent price increases.

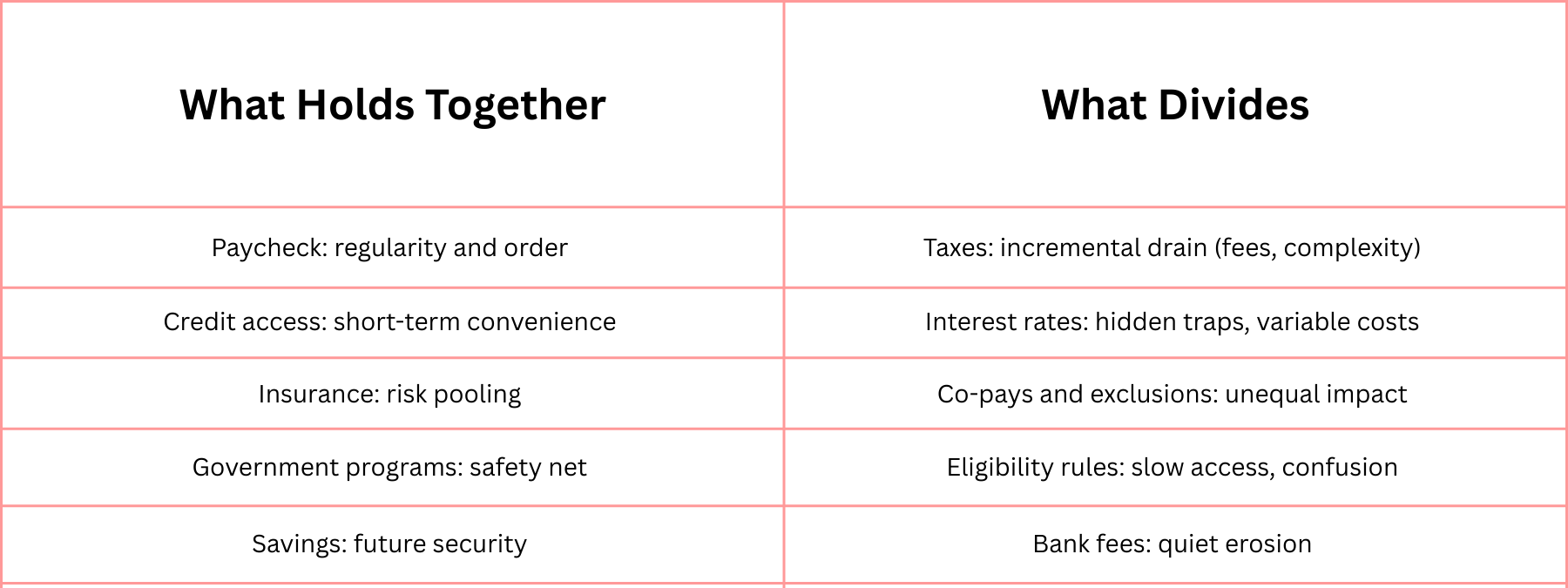

The Cost of Being Apart

Systems—by their nature—organize and separate. The division is rarely about effort, and often not about wealth alone. It runs quietly through access to information, tools, and the little-known rules that govern outcomes. A credit card offers convenience but penalizes the inattentive with fees and opaque rates. Taxes are meant to fall evenly, yet deductions and credits unearth advantages for the few who know where to look. Insurance plans promise coverage but may splinter into co-pays and exclusions. Even government programs, designed to level the field, can separate by eligibility or slow, labyrinthine processes.

The separation is subtle—measured not by dollar amounts, but by the confidence to navigate the system. As consumer finance advocate Maya Morales observed in a spring 2025 survey, “Most American households face the same maze. But for those trained to read the signs, the path is smoother; for those who aren’t, the cost is felt in unexpected ways”.

Credit, for example, appears as a tool for all—but interest rates vary, limits and rewards shift. Fees on checking and savings accounts can sap earnings quietly. Taxes take their share, but only some know how to claim exclusions or deductions. Government benefits require forms, patience, and time many cannot spare. Even the so-called “universal” systems carry seeds of separation, sometimes as legacy, sometimes as oversight.

Paths Toward Resilience

Resilience is not about abandoning these systems. It is about awareness—recognizing fragility, creating small layers of protection, and refusing to place blind faith in any single structure. The following checklist offers practical steps, gathered from financial planners and household surveys, aimed not at the wealthy or expert—but at all who wish to build steadiness in uncertain times:

Resilience Checklist

- Build Small Cushions: Regularly dedicate a small portion of inflows to an emergency fund—even $10 a week. Consistency is more powerful than scale.

- Diversify Where Money Sits: Use multiple accounts or banks, including high-yield savings, to hedge against systemic failures or local disruptions.

- Review Recurring Costs Thoroughly: Annually audit subscriptions, insurance premiums, and hidden fees. Negotiate or cancel where value is unclear.

- Pay Attention to Overlooked Strategies: Examine options for tax deductions, claimable credits, and employer benefits each year—even if eligibility changes.

- Maintain Steady Awareness of Rules: Track changes in account terms, government program updates, and credit policy regularly—not just in crisis moments.

- Limit Reliance on a Single Credit Source: Spread out financial commitments, avoiding concentration in one lender or card provider whenever possible.

Table: What Holds Together vs. What Divides

Expert Voices on Resilience

In September 2025, economic strategist Joseph Wu reflected: “U.S. households have shown unexpected sturdiness this year, even as inflation and policy uncertainty linger. The lesson is clear: broad diversification and persistent awareness are more valuable than timing markets or hunting for perfect systems”.

Similarly, behavioral economist Maya Morales puts it softly: “True resilience flows from small, nearly silent choices—the kind that accumulate unnoticed but form a buffer when systems tremble. Most of us won’t change the world’s rules, but we can learn to notice their cracks”.

As night closes, and the last bill is tucked away, the light remains gentle—a small assurance against the surround. What holds us together, day after day, are the systems designed for order: banks, taxes, programs, and credit. They promise comfort and deliver much of it. Yet, within each structure, seeds of division remain—sometimes in complexity, sometimes in subtle inequity.

The answer is not to forsake the machinery, nor to sound alarms. Instead, true resilience asks for recognition of fragility—a steady, listening awareness that sees the lines as they are drawn and finds ways to soften their impact. The strength to endure is seldom noisy; it is quiet, persistent, and calmly protective.

We live, often, in concert with these systems, occasionally frustrated by their limits, but always invited to adapt. The table is set, the bills await, but the light—flicked on with a gentle hand—is the reminder: what endures is not absolute certainty, but the habit of paying attention. Order arrives, not as a gift, but as a principle to be tended.

Despite inflation staying above target, despite ballooning national debt and delayed retirements, most American households stand firm—not out of privilege or extraordinary means, but simply from incremental, deliberate preparations. The fabric of resilience is built not of declarations, but of choices made calmly, each one a line sewn quietly across the months.

And here, in the gentle hush that follows, is the true lesson: what holds us together also, quietly, holds us apart. The path forward is never to hope for flawless systems. It is to recognize their character, measure their risk, and build small, quiet protections of our own.

—

Claire West