What Keeps Trust in Motion

Trust isn’t a grand event. It isn’t a shining moment broadcast across the evening news. Trust, I’ve come to see, is motion—a gentle, steady hum beneath our daily lives. My clearest lesson came on an ordinary Thursday morning. I stood in the check-out aisle, waiting for my debit card to approve a grocery run that would last the week. The moment my phone buzzed—deposit received, card approved—I exhaled. Nothing dramatic, just a small signal that all was as it should be. In these quiet passages, trust flows—through paychecks that clear, water bills that auto-draft, and cards that never blink red at the register.

The Everyday Engines of Trust

Trust comes dressed in two different coats: one visible and public, the other private and routine. When the Fed makes an announcement, or the market swings wildly, that’s a visible signal—headlines, forecasts, press conferences. These moments catch our eye but rarely change our routines that week. What keeps most of us grounded are the invisible trust engines—the click of a payment, the promise of a utility bill quietly paid, the assurance that tomorrow’s direct deposit will land without drama.

Warren Buffett didn’t stutter.

“We do not want to mess with the Fed.”

Why?

Because once political hands start steering the Federal Reserve…

Everything changes — fast.

Buffett’s spent decades warning this move could:

❌ Erase trust in U.S. markets

❌ Send inflation into overdrive

❌ And collapse the dollar’s dominance worldwide

But Trump?

He’s slamming the gas pedal in the opposite direction.

Pushing for interest rate manipulation.

This isn’t some harmless political feud.

It’s a battle for control of your money.

And the stakes?

Your savings, your retirement, and the value of every dollar you hold.

That’s why we just released a must-read report for anyone holding cash, stocks, or retirement funds:

👉 Read: “The Fed Power Play, What It Means for Your Financial Future”

( Claim Your Free Report Before the Window Closes )

Inside, you’ll see:

What could happen if Trump seizes Fed control

The #1 asset poised to skyrocket in the fallout

Why most portfolios are completely exposed right now

Buffett knows how this ends.

And if you wait to react, it’ll already be too late.

Download the urgent Fed guide 100% free while available

P.S. You won’t hear this from the mainstream…

But this shift could quietly reset America’s financial engine.

And you have just days to prepare.

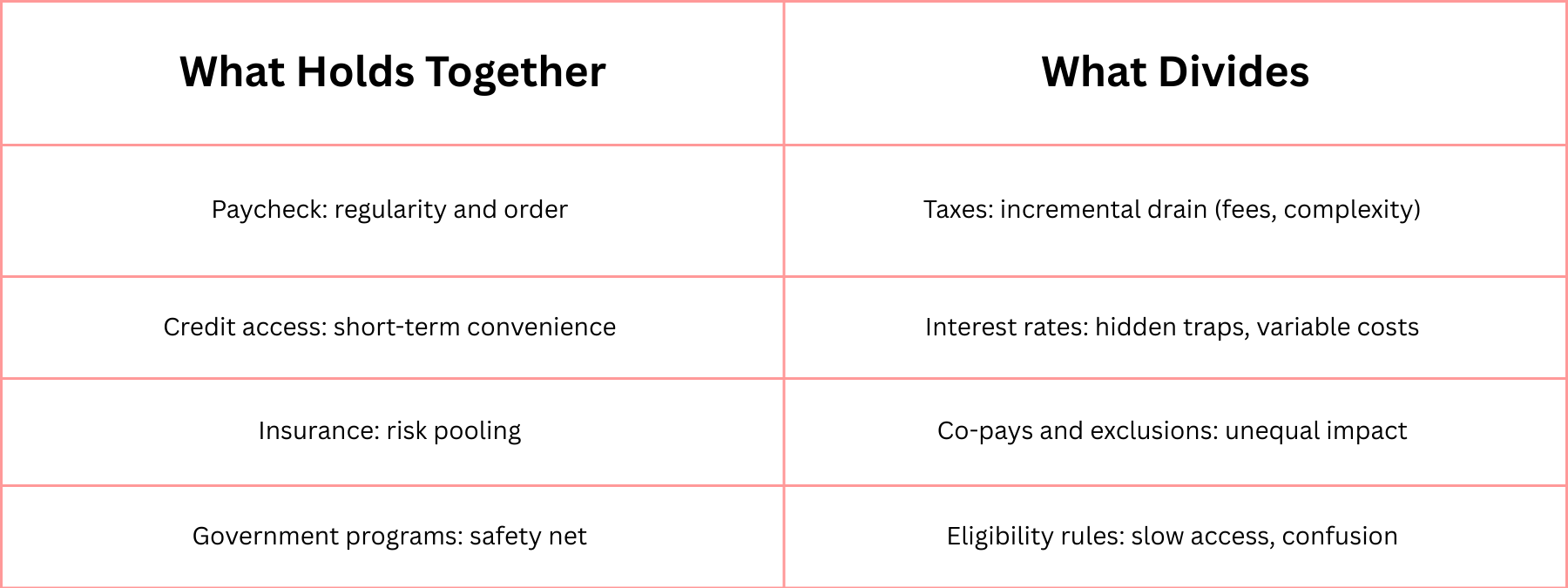

Here’s how these signals compare:

To most of us, trust is the ordinary. It’s the sum of so many small, positive signals that never make the headlines. Eighty-one percent of Americans say they trust their main bank to keep their data secure, despite all the noise about digital risks. Debit and credit card approvals, recurring bill payments, and on-time deposits are the everyday gears that keep our confidence moving forward, quietly and persistently.

When the Motion Slows

But what happens when that invisible motion stutters? A few years ago, my direct deposit didn’t land on time—a technical delay, my bank told me. It was sorted in a day, but for those hours, every small decision felt uncertain. Do I buy gas? Will my rent draft bounce and trigger a fee? Even as someone who lives by checklists and backup plans, I felt the gears grinding.

It doesn’t take crisis headlines to erode trust. Small disruptions—delayed payments, sneaky fees, rumors about a shaky regional bank—chip away at our ease. After a surge of payment system glitches in 2024, more Americans reported checking their accounts daily, no longer taking those quiet signals for granted. Economic research finds that trust is sticky but not invincible: fees, delays, and policy changes can gradually slow the current, making us second-guess the systems we count on.

Across the system, this plays out in metrics. In June 2025, debit card usage dropped by 16% year-over-year as some consumers pulled back after minor—but widely felt—system downtime. Meanwhile, credit card use jumped 28%: a sign that many quickly shifted trust to whichever method moved the smoothest that month. Even brief interruptions ripple outward, slowing the current of trust for millions.

Building Trust With Eyes Open

It’s tempting to wish trust stayed on autopilot. But the practice of financial trust shouldn’t be blind. In clinics and town hall calls, I hear worries from neighbors and friends: “How do I know my money’s safe?” or “When should I move accounts?” The lesson? Trust, maintained, is trust earned—by being proactive, not passive.

Here’s my own checklist for keeping trust in motion:

How I Keep My Own Trust in Motion

- Diversify where I hold savings: I don’t put all my cash in a single bank—just in case.

- Watch the small signals: Fees sneaking in, deposit times changing, or other new policies.

- Use smarter tools: I look for no-fee accounts, avoid overdraft traps, and pick cards with 0% APR when possible.

- Track monthly progress: Each month, I review statements, seeing what’s working and where I’m losing money to fees or delays.

- Maintain an emergency fund or backup account: It doesn’t have to be huge, but a cushion—even a couple hundred dollars—means I never rely on a single point of failure.

These steps aren’t about pessimism—they’re practical self-respect. In today’s environment, where trust in U.S. banks remains high but not bulletproof, and 46% of Americans say they sometimes feel pressured into products that serve the bank over themselves, it’s reasonable—wise, even—to keep a close eye on our own signals.

Trust Is Motion, Not Magic

As I reflect in quieter moments, I keep coming back to this: trust doesn’t collapse overnight. In 2025, as the world keeps lurching through headlines and market hiccups, trust slows before it stutters—before it ever breaks. We notice a fee. A payment’s late. A rumor spreads. The current, once invisible, suddenly demands attention.

But just as disruptions can erode trust, our quiet habits rebuild it—one check, one call, one account review at a time. As one analyst recently observed, “Strength in the banking system relies not on drama but on the daily, reliable operation of countless small transactions. When those signals are consistent, confidence follows”. Another put it plainly: “Even in times of economic uncertainty, the resilience of everyday payment systems is what matters most for consumer trust”.

Looking forward to 2026, I believe this more than ever: trust is a living, moving thing. It flows as smoothly as our actions and preparations allow. For me, that’s not a call for fear, but a gentle nudge to stay curious, awake, and ready for the next quiet signal—approved, not declined; deposited, not delayed.

Resilience in Small Motions

As night closes, and the last bill is tucked away, the light remains gentle—a small assurance against the surround. What holds us together, day after day, are the systems designed for order: banks, taxes, programs, and credit. They promise comfort and deliver much of it. Yet, within each structure, seeds of division remain—sometimes in complexity, sometimes in subtle inequity.

The answer is not to forsake the machinery, nor to sound alarms. Instead, true resilience asks for recognition of fragility—a steady, listening awareness that sees the lines as they are drawn and finds ways to soften their impact. The strength to endure is seldom noisy; it is quiet, persistent, and calmly protective.

We live, often, in concert with these systems, occasionally frustrated by their limits, but always invited to adapt. The table is set, the bills await, but the light—flicked on with a gentle hand—is the reminder: what endures is not absolute certainty, but the habit of paying attention. Order arrives, not as a gift, but as a principle to be tended.

Despite inflation staying above target, despite ballooning national debt and delayed retirements, most American households stand firm—not out of privilege or extraordinary means, but simply from incremental, deliberate preparations. The fabric of resilience is built not of declarations, but of choices made calmly, each one a line sewn quietly across the months.

And here, in the gentle hush that follows, is the true lesson: what holds us together also, quietly, holds us apart. The path forward is never to hope for flawless systems. It is to recognize their character, measure their risk, and build small, quiet protections of our own.

—

Claire West