What My Money Looked Like at 25 — and What I’d Do Differently

At 25, I was a blend of excitement and uncertainty, stepping into the world of full-time work with a decent paycheck but very little financial clarity. My income felt promising, but my spending was scattered—and my habits around money ranged from hopeful to haphazard. I juggled credit card balances, put off saving for retirement, and sank a good chunk of cash into lifestyle choices I barely scrutinized. I didn't have an emergency fund, and my financial future felt more like a distant dream than a plan.

Looking back, I’m not judging that young version of me—she was navigating new freedoms and growing pains. But reflecting now, there are clear lessons I wish I’d embraced earlier. This is both a story of where I was and a map of what I’d change if I were starting fresh.

Where I Was at 25

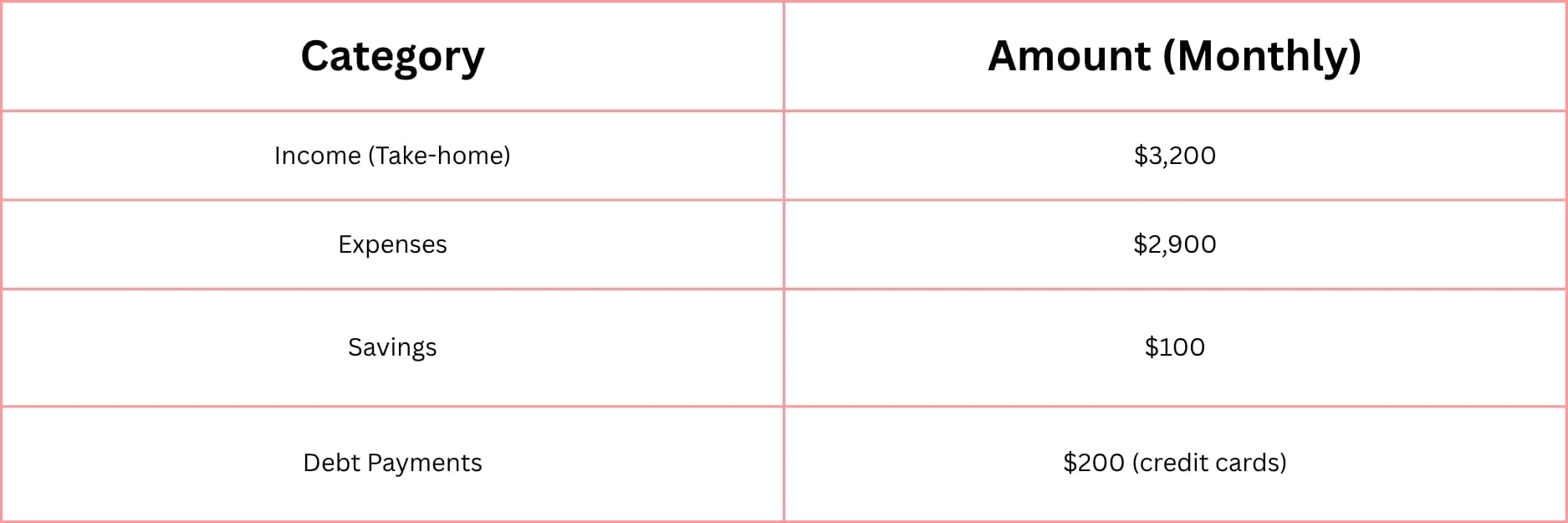

Before digging into the mistakes, here’s a snapshot of my financial picture at that time:

The margins were thin. I was living paycheck to paycheck more than I realized, with nearly all my income spoken for by rent, bills, dinners out, and a mix of lifestyle extras that slowly crept up. My savings rate hovered around 3%, a number so low I barely tracked it. I owed more on credit cards than I should have given my income, largely because I didn’t pay close attention to interest or limits.

The 4 Big Mistakes I Made

1. No Emergency Fund

I remember the first unexpected car repair at 26. It brushed aside my sense of security like a cold wind. I had no cash saved for emergencies, so I resorted to credit cards — which piled on more debt and stress.

Without a safety net, every surprise felt like a crisis, and I borrowed to cover basic needs, setting off a cycle of worry I struggled to break.

2. Ignoring Retirement Accounts

401(k)s and IRAs were terms I vaguely understood, but I didn’t act. I thought retirement was too far off to worry about. Even when my employer offered a match, I skipped enrolling, thinking I’d “catch up later.”

This hands-off approach cost me more than I realized. Time is the most powerful factor in growing savings, and what looks like a small delay can mean thousands missed in compounding growth.

3. Too-High Fixed Costs

My rent was about 40% of take-home pay—a stretch that left little room for flexibility. Subscriptions, a gym membership I rarely used, and a few extra “treat yourself” habits added to my monthly bills. I felt strapped, but didn’t prioritize lowering fixed costs.

A high fixed cost ratio limited my ability to adjust when things changed, intensifying stress during lean months or unexpected bills.

4. Lifestyle Creep

As income increased in later years, so did my spending—on dinners out, gadgets, weekend trips, and shopping. I felt I deserved the upgrades, but I never hit pause to ask if spending more was aligned with my goals.

This invisible inflation of lifestyle quietly ate any chance for bigger savings or investment.

What I’d Do Differently

1. Build an Emergency Fund First

Start with a simple goal: save 3 to 6 months of essential expenses in a liquid savings account. This fund becomes your runway, softening shocks and breaking the debt cycle.

Emergency Fund Target = Monthly Essential Expenses × 3 to 6

Start small—$500, then $1,000—whatever you can, consistently.

2. Maximize Retirement Savings Early

Even if it’s just a sliver of your income, start contributing to a retirement account—especially if there’s an employer match.

Pro tip: Aim for a starting savings rate of 10%, which includes retirement contributions. Use this simple formula for your savings rate:

Savings Rate (%) = (Total Savings Contributions / Net Income) × 100

The earlier you start, the longer your money grows—and compounding is your best friend.

3. Lower Fixed Costs Wherever Possible

Track and trim your fixed expenses. Look for:

- Rent that fits under 30% of take-home pay.

- Subscriptions or memberships that no longer add value.

- Utility or phone plans that can be negotiated or downgraded.

Fixed Cost Ratio formula:

Fixed Cost Ratio (%) = (Total Fixed Monthly Expenses / Total Monthly Expenses) × 100

Aim to keep this below 50% to maintain flexibility.

4. Stay Mindful of Lifestyle Inflation

Be intentional with extra income—don’t let lifestyle creep eat every penny.

Try this:

- When you get a raise or bonus, allocate a chunk (20–50%) toward savings or debt payoff.

- Use the rest consciously on things that truly bring joy.

How I Track My Finances Now

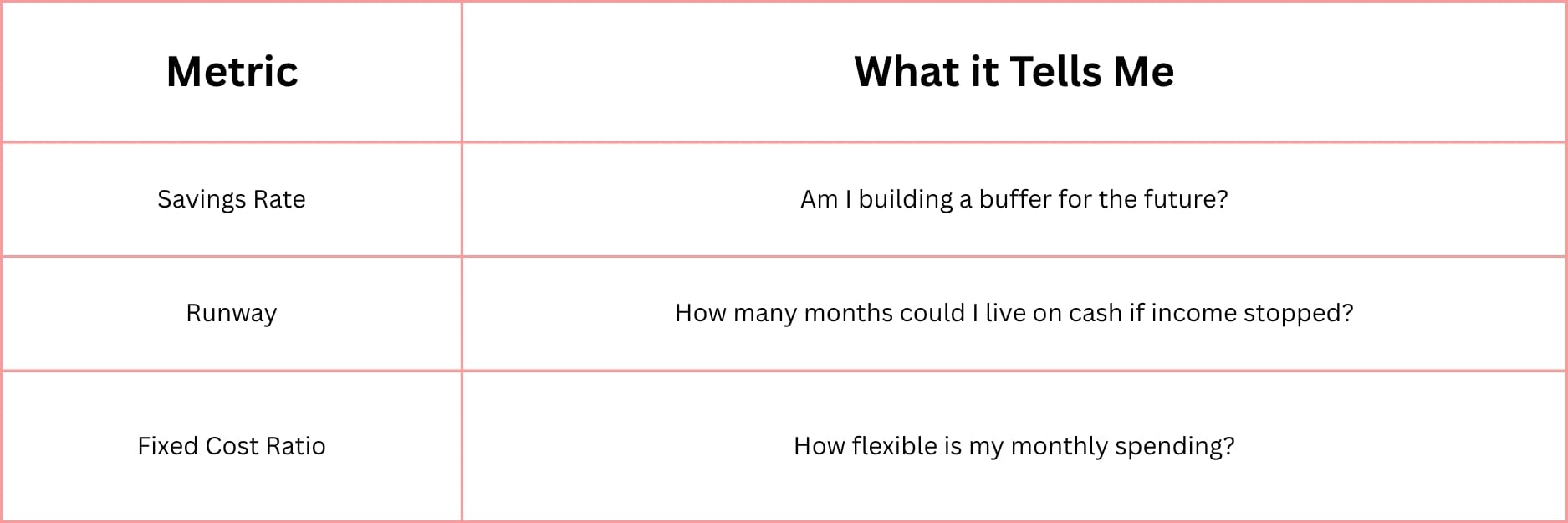

I keep my system simple and stress-free—no daily logging or apps that send endless notifications. My core tool is a Google Sheet I update once a month with three key metrics:

This monthly check-in offers clarity without obsession. I pair it with a brief note on how money feels that month—honest, gentle, non-judgmental.

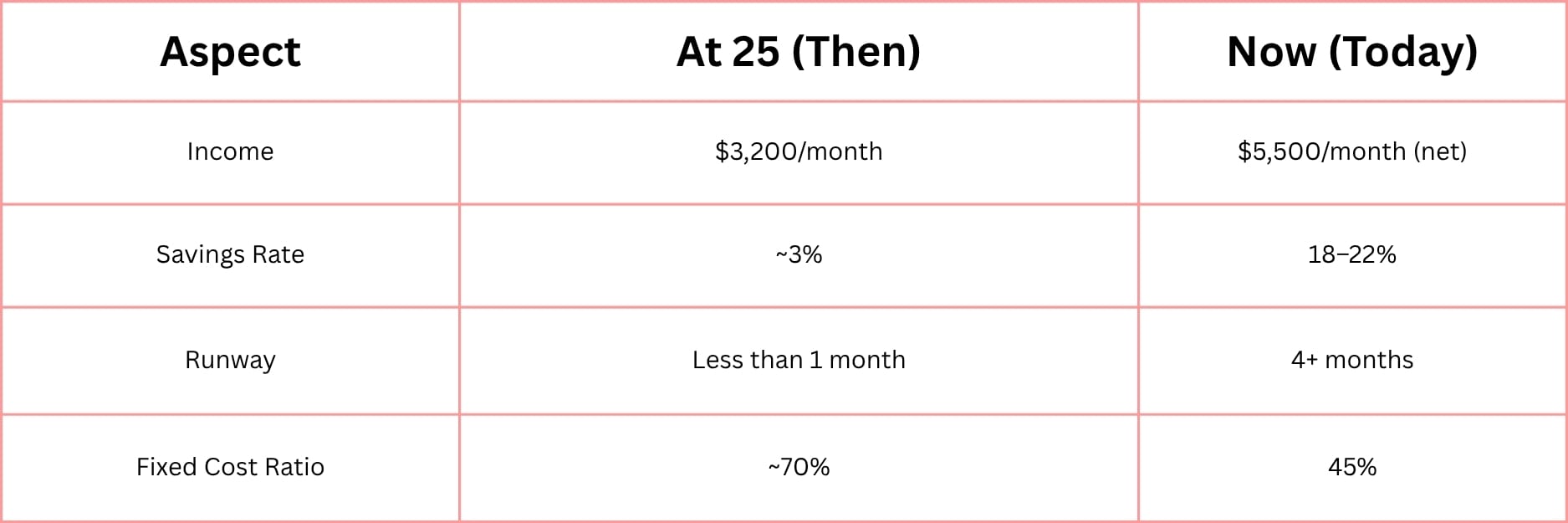

Then vs. Now: What Changed

Looking back, I see how much stress and worry earlier clarity and simple habits could have saved me. But financial growth isn’t a race—it’s a journey. The great news is, the best time to start building steadiness and intention is today, no matter your age or past habits.

Start small, be kind to yourself, and lean into tools that offer clarity without guilt. Money should be a source of calm and confidence, not a weight you carry alone.

You’ve got this.

—

Claire West