What Remains When the Hype Fades

Markets exhale differently than they breathe.

The inhalation is loud—headlines, enthusiasm, FOMO, everyone talking about the next big thing. The exhalation is quiet. Prices compress, attention drifts elsewhere, and what's left standing is often very different from what the hype suggested.

I was thinking about this recently, watching how AI—specifically, the excitement around AI—has moved through its first full cycle. The peak was unmistakable: every company suddenly had an "AI strategy," every investor wanted AI exposure, every conversation ended with "but what about AI?"

Now, the fever has cooled. Not disappeared—just normalized. And in that normalization, something interesting becomes visible: which AI-related companies and tools are actually embedded in how people work, and which were just riding narrative.

The ones that remain aren't always the most talked-about. They're often the quiet ones—the infrastructure, the productivity tools, the things that solve specific friction in daily workflows.

The Post-Hype Phase

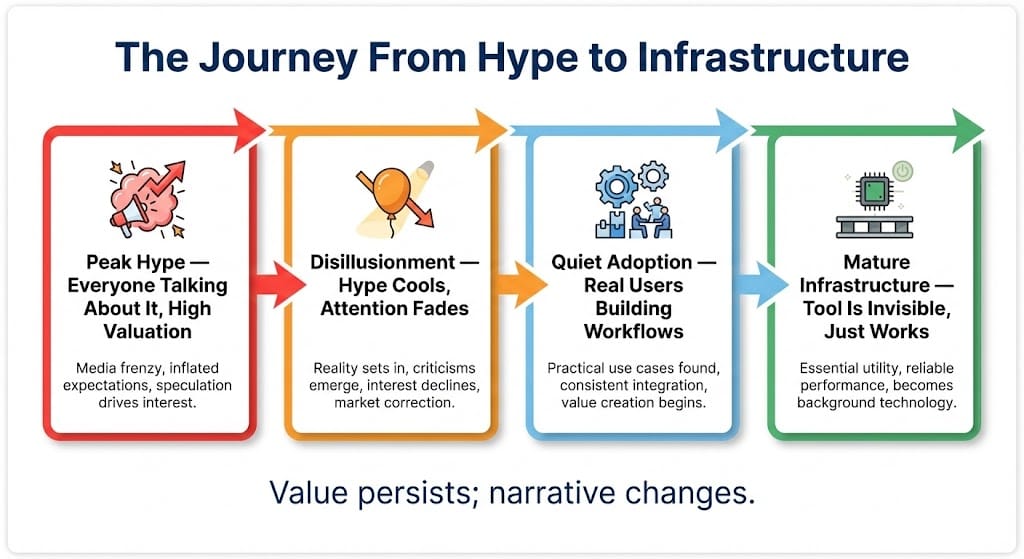

Every major technology wave follows a familiar pattern. Peak Hype. Disillusionment. Gradual Adoption. Mature Integration.

We're somewhere in the transition from Peak Hype to Disillusionment in AI. Stock prices have already adjusted. Venture funding has cooled. The cocktail party conversation has moved on to something else.

But here's what's revealing: the things that were solving real problems haven't stopped being useful. They've just stopped being exciting.

A company using AI to automate customer support still needs that automation. A developer using AI-assisted coding tools still saves hours every week. A team using AI for data analysis still gets better insights faster. The utility doesn't vanish when the narrative cools.

What does vanish is the premium valuation built on speculation about future dominance. What remains is the more modest (but more durable) value of something that actually works.

This distinction matters enormously. In the hype phase, people buy stories. In the adoption phase, people use products. The two audiences are different. The valuations are different. The sustainability is different.

Even the biggest names in tech are struggling to find footing in 2025’s volatile market. AI cooled. Rates climbed. Valuations contracted.

But beneath the surface, early-growth companies with real traction—and real utility—are catching the attention of smart investors.

Immersed is one of them.

They’re building immersive VR workspaces that allow users to focus, collaborate, and get more done—without physical distractions. Their platform already supports remote teams, developers, and designers around the world.

Now, through a Reg CF offering, investors can get in before a potential Immersed public listing and they could receive an 8% discount on shares if they invest by December 18.

Why this is resonating with early investors:

✅ Exposed to major growth themes

Immersed sits at the intersection of productivity, spatial computing, and remote work—all rising, despite market uncertainty.

✅ Strong organic demand

Thousands of professionals use Immersed every day to work smarter and more efficiently—proof the product solves real problems.

✅ Limited-time access and discount incentive

With share price subject to change, December 18 marks a critical deadline to earn an 8% discount on shares on your investment.

Tech markets go through cycles. But companies solving present-day problems—especially ones that help people work better—tend to emerge stronger on the other side.

Immersed is still early. Still building. And still open to everyday investors—at least for now.

Utility vs. Narrative

Markets love narratives. Stories are easier to understand than spreadsheets. Vision is easier to price than current revenue.

But humans—the actual workers using these tools—don't buy narratives. They buy solutions to problems they have today.

A tool that reduces meeting time by 30% gets used, regardless of whether the company is valued at $1 billion or $100 million. A workflow that solves a repetitive task gets adopted, regardless of whether the founder has a compelling vision statement. An interface that reduces friction gets integrated into daily practice, independent of market sentiment.

Narrative changes. Utility persists.

This is why certain categories of tools survive volatility better than others. Productivity infrastructure—the things that sit in the middle of how people actually work—tends to have stickier adoption curves than "vision plays" that require the world to change before they make sense.

You can be skeptical about the AI revolution and still use an AI-powered tool if it genuinely solves something you need solved. You can be pessimistic about growth and still keep using software that makes you more efficient. The personal decision to use something useful is independent of the macro narrative about its category.

Mini-Observation: Remote Work as Infrastructure

Consider how remote work itself evolved.

In 2018, it was a "trend"—something startups were doing, early-stage companies were experimenting with, traditional businesses were skeptical about. The narrative was "maybe the future of work?"

Then 2020 happened, and remote work became a necessity, then a practice, then an infrastructure choice.

By 2025, it's not controversial. It's just how certain categories of work function. The debate isn't "is remote work real?" It's "which tools make remote work better?"

That shift—from narrative to infrastructure—is exactly what happens to technologies that have real utility. They stop being interesting conversation topics and start being invisible parts of how work happens.

The companies that survived and thrived through that transition weren't always the most hyped. They were the ones that kept solving specific problems: communication, collaboration, focus, asynchronous work.

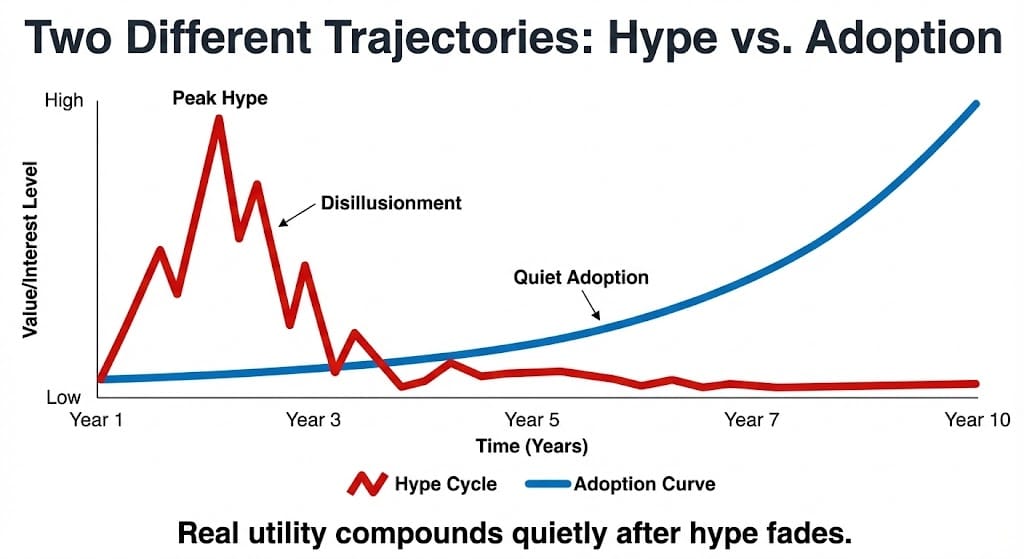

Hype Cycles vs. Adoption Curves

Here's a framework that distinguishes between the two:

Hype Cycle:

- Driven by potential

- Measured in headlines and sentiment

- Peak before real adoption

- Valuation based on possibility

- Volatility: high

Adoption Curve:

- Driven by utility

- Measured in users and workflows

- Steady climb over years

- Valuation based on current value + discounted future

- Volatility: lower (more grounded in reality)

Most early-stage technologies experience both simultaneously. The hype attracts capital and attention. The adoption curve determines whether the capital was justified.

When hype peaks before adoption catches up, you get crashes. When adoption eventually exceeds hype, you get sustained compounding. And when adoption happens quietly while everyone's attention is elsewhere—that's often where the best positioning happens.

Why Traction Matters

Hype can be manufactured. Traction can't.

Traction means:

- Daily active users who chose to show up

- Real workflows depending on the tool

- Friction solved (not promised, actually solved)

- Organic adoption beyond early believers

You can spin a narrative about potential. But you can't fake usage. You can't fabricate a team of developers who wake up each morning and choose to use your tool because it makes them better at their job.

When evaluating what survives the hype cycle, traction is the leading indicator. Not revenue (early-stage tools often give away access to build traction). Not valuation (that's often inflated). Just: are real people using this daily to do real work?

If yes, then the utility is real. The company might fail for business reasons—poor monetization, bad management, competitive threats. But the fundamental value of what they've built is already proven.

Early-Stage Access, Quiet Periods

Here's something counterintuitive: some of the best access to early-stage tools comes during quiet periods—not at peak hype.

When a company is at peak valuation and peak attention, secondary market access is expensive and assumption-heavy. Everyone's excited, everyone's pricing in future scenarios, and risk is high.

But when the same company is in a quieter phase—still growing, still being used daily, but not trending—there's sometimes an opportunity to access it at more reasonable terms, often through mechanisms like equity crowdfunding that let individual investors participate before traditional venture structures.

This isn't about timing perfectly. It's about recognizing that early-stage companies that survive the hype cycle are often better positioned long-term than they appear during the quiet period.

Immersed is building VR-based workspaces used daily by remote teams and developers. Through a Regulation CF offering, everyday investors can access shares ahead of any potential public listing, with an 8% share price discount available until December 18.

The appeal of such offerings isn't "this will make you rich." It's: "this tool has real traction, real users, real utility—and you can participate in ownership at terms that reflect current reality, not peak hype."

Early-Stage ≠ Early Hype

There's an important distinction worth making: early-stage doesn't mean early hype.

A company can be early-stage (small, pre-profitability, not yet public) without being pre-adoption. It can have real users, real traction, and real utility—and still be small and accessible.

Conversely, a company can be at peak hype (everyone talking about it, sky-high valuation) while still being pre-utility. The software doesn't work yet, the product-market fit isn't proven, the traction is all venture capital and narrative.

When evaluating early-stage opportunities, the distinction matters enormously. Traction during quiet periods is more predictive than hype during loud ones.

A Reflection on Cycles

Markets cycle. Attention cycles. Narratives rise and fall.

What persists is tools that people actually use because they solve real problems. Not because they're supposed to. Not because the founder had a great vision. Just because they make work easier, faster, or better in a way that's obvious to the person using them.

Those tools don't always make headlines. They don't always have the most compelling pitch. But they tend to compound more reliably than the alternatives.

The Next Device After Smartphones

Immersed

The hype cycle will continue. AI will have its moment of peak excitement, then will quiet down as it becomes infrastructure. New technologies will follow the same pattern.

But the tools that solve real friction? The ones that get built into workflows? The ones that people keep using regardless of market sentiment?

Those tend to remain.

You don't need to predict which technologies will dominate. You don't need to time the market or catch the wave at exactly the right moment. You just need to recognize when something has moved from narrative to utility—when it's being used because it works, not because it's trendy.

In quiet periods, that distinction becomes visible. And for those paying attention, that clarity is often more valuable than all the hype that came before it.

—

Claire West