When Access Isn’t the Same as Ownership

There was a moment recently that many will recognize: a bank transfer that should have taken minutes stretched into days, leaving a planned payment in limbo. Or perhaps it was a blocked debit card during an urgent purchase, despite having funds sitting quietly in an account. These moments—frustrating, inconvenient—are more than mere banking hiccups. They expose a subtle yet profound distinction in today’s financial world: the difference between owning money and actually being able to use it when needed.

This is not just a personal frustration, but a systemic feature of modern finance. Increasingly, what we “own” in terms of assets, accounts, and investments does not translate into seamless access at critical moments. Particularly for U.S. households navigating the complexities of savings, retirement, and property, the gulf between ownership and access widens, revealing hidden vulnerabilities in how financial freedom is experienced.

Understanding Ownership vs. Access

In classical terms, ownership meant control—the ability to use, spend, or move one’s assets without restriction. Today, however, ownership often comes shackled by delays, restrictions, and penalties that diminish immediate usability. Consider the following:

— Bank delays: Regulatory checks, fraud prevention, and interbank settlement processes can delay transfers for hours or days, especially across institutions or for large amounts.

— Retirement accounts: Assets in 401(k)s, IRAs, or pensions are legally yours but subject to penalties and tax consequences if accessed prematurely.

— Real estate: Owning a home is a substantial asset, but converting it to liquid cash is often a lengthy, expensive process.

— Frozen or blocked transfers: In some cases, transactions may be halted due to suspicion of fraud or compliance issues.

In each case, the fine print and institutional realities mean that access is conditional and often slower or costlier than ownership implies. This creates an invisible gap in usable wealth.

Trump Warned Us: The Digital Dollar Is Coming

With CBDC, the government could:

- Track every purchase you make

- Restrict what you’re allowed to buy

- Freeze your account with one click

CBDC is already moving forward — FAST.

👉 That’s why we put together a critical guide that shows you exactly how to legally protect your cash and privacy — starting today.

>> Click here to get the FREE report before it’s taken down <<

Once CBDC becomes the law of the land, you won’t be able to opt out.

Trump is trying to stop it. Until then — it’s up to you.

Get the facts. Make your move. Protect your money.

The Current Financial Landscape: Liquidity and Resilience

Data from credible sources in 2024 and 2025 illustrate this divide painfully well. According to the Federal Reserve’s 2022 Survey of Consumer Finances (the most recent comprehensive data available as of mid-2025), liquid assets relative to income reached nearly 15%, the highest since the Great Financial Crisis—but this masks substantial disparities. Many Americans still lack sufficient liquid savings to cover unexpected expenses.

The Federal Reserve’s 2025 Report on the Economic Well-Being of U.S. Households found that only 55% of adults reported having set aside money to cover three months’ expenses in an emergency fund. Despite headline figures on rising household wealth—which the Federal Reserve Z.1 data show hitting a record $168.8 trillion in Q3 2024—many families experience significant difficulty accessing usable cash to meet immediate needs. The paradox is stark: record wealth coexists with fragile financial resilience when liquidity is required.

The banking system itself is contending with increased regulatory scrutiny and operational complexity that can slow or limit access. FinCEN’s new anti-money laundering rules (June 2024) demand stronger due diligence by banks, potentially increasing delays and transaction blocks. Meanwhile, retirement plan rules adjusted for 2025 (IRS, October 2024) demonstrate how statutory limits and penalties continue to restrict immediate account liquidity despite growing nominal balances.

Introducing the “Usable Wealth Gap” Formula

To conceptualize this subtle but critical difference between ownership and access, imagine a simple formula:

Usable Wealth = Total Assets - (Restrictions+Delays+Penalties)

This formula reflects that total assets, while a headline measure of wealth, must be discounted for practical usability. Restrictions include legal and contractual constraints, delays encompass time lags in accessing funds, and penalties cover monetary losses from early withdrawals or transaction fees.

For example, a 401(k) holding $100,000 is valuable, but early withdrawal triggers income tax and potential penalties; the penalty and tax obligations reduce usable wealth. Similarly, a certificate of deposit (CD) may have a fixed term—withdraw early and penalty charges erode accessibility. Real estate ownership, while substantial on paper, involves significant time and transactional costs to convert to cash.

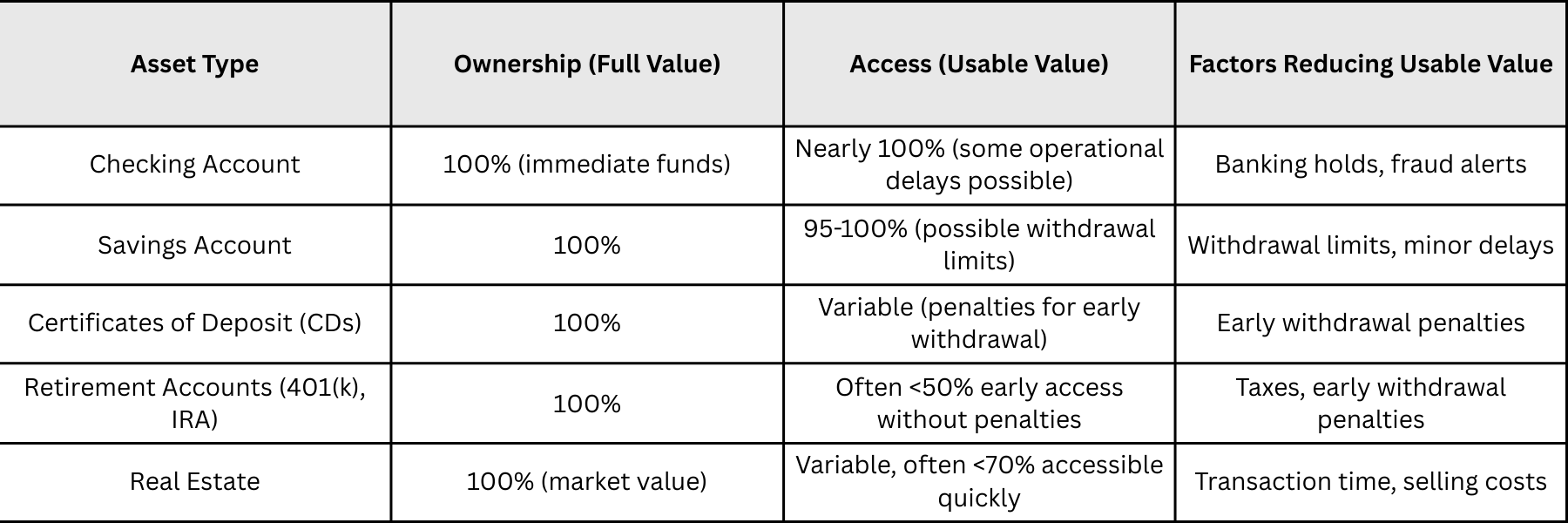

Ownership vs. Access Across Asset Types

This table shows that even assets deemed “owned” can have drastically different liquidity profiles depending on underlying restrictions and penalties.

Financial Freedom: Beyond Ownership to Usability

Financial freedom is often portrayed as how much wealth one holds, but the real measure lies in how freely that wealth can be deployed when needed. The “Usable Wealth Gap” is a lens through which to view financial freedom more realistically. It challenges common assumptions that growing asset balances equate to flexibility.

During emergencies or opportunities, what counts is not just what is owned, but what is accessible. Without a clear understanding of this gap, families may be blindsided by liquidity crises despite seemingly adequate net worth.

Practical Lessons for Closing the Gap

While the system’s complexity is unlikely to change soon, households can take thoughtful steps to narrow their usable wealth gap:

— Maintain a liquidity buffer: Keep a portion of assets in easily accessible accounts—checking or savings—to handle unexpected cash needs without delay or penalty.

— Understand account rules: Know the restrictions on all accounts, especially retirement and CDs, to avoid surprises and optimize access strategies.

— Diversify access types: Balance assets across varying liquidity profiles; avoid overconcentration in illiquid or penalty-heavy accounts.

— Track restrictions and penalties: Regularly review how delays, fees, and penalties could affect your ability to use funds quickly.

— Plan for timing: Anticipate long transaction times for large transfers or real estate sales and avoid relying on those assets for immediate needs.

Closing Thoughts

The distinction between owning assets and accessing them is an evolving challenge for American households. Preparation, grounded in awareness rather than prediction, is the anchor of financial resilience. In a world of growing regulations, operational complexities, and economic uncertainties, recognizing and managing the “Usable Wealth Gap” protects not only individual financial freedom but the well-being of families relying on those resources day to day.

Metaphorically, it is the difference between having the key and actually opening the door—sometimes, the key alone is not enough. Financial success is no longer solely about accumulation but about thoughtful stewardship of usable wealth.

By focusing less on the headline asset numbers and more on the realities of access, individuals can cultivate the kind of financial freedom that endures through friction and uncertainty. This is a subtle shift, but one that makes all the difference in protecting savings and preparing thoughtfully for whatever comes next.

—

Claire West