When Diplomacy Turns Into Leverage

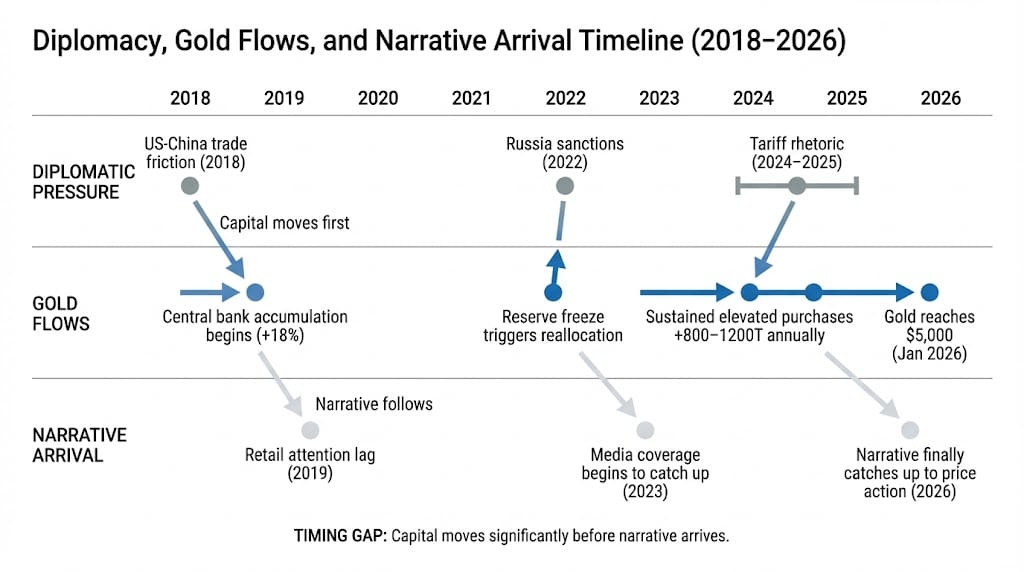

There is a moment in geopolitical tension — usually quiet, unremarked — when markets stop waiting for headlines and start pricing in constraints. The headlines will come later. The money moves first.

This is not a dramatic moment. It is not a crash or a spike. It is a slow accumulation of defensive positioning by institutions that understand something before it is visible in the news cycle: that what looks like negotiation on the surface is actually a recalibration of who controls what, and who owes whom.

Gold moves in these moments, not because markets are afraid of chaos, but because markets are repricing the cost of certainty. When diplomatic hardening is underway — when leverage is being tested, when trade routes are being mapped, when power flows are being contested — the institutions that manage trillions in capital reach for an asset that cannot be frozen, cannot be sanctioned, cannot be weaponized against them. Gold is not a fear trade. It is a settlement asset. A balance-sheet insurance policy written in a language older than nation-states.

The Pattern: When Friction Precedes Fortune

History is consistent. The moments when capital rotates into hard assets are not the moments when crises are obvious. They are the moments when pressure points are being established.

In 2018 and 2019, as the U.S. and China entered their first trade friction, gold rose roughly 18 percent as tensions escalated. Retail investors noticed later. Institutional capital moved first. The narrative did not catch up for months.

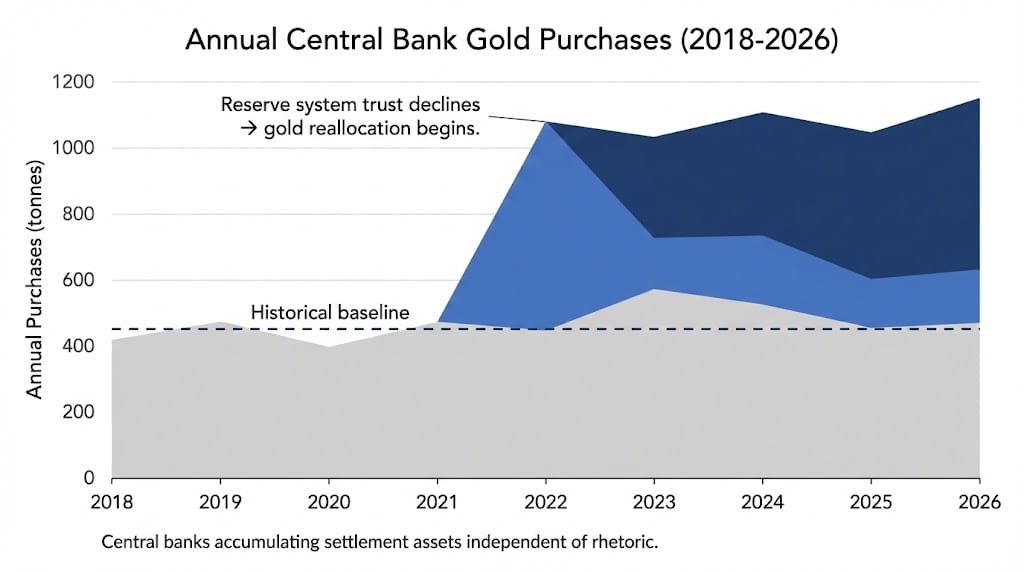

In 2022, when Russia's foreign exchange reserves were frozen in response to geopolitical events, central banks across the world — from India to China to the BRICS collective — began quietly and systematically accumulating physical gold. Not from fear of imminent war. From recognition that the international settlement system could no longer be trusted as permanent. That realization became a structural flow that persists today.

In late 2024 and 2025, as trade rhetoric hardened and diplomatic leverage was being tested, gold rose to record levels — above $5,000 by January 2026. Central banks, particularly China, continued their 14-month buying spree. The narrative was fragmented: some attributed it to Fed independence concerns, others to geopolitical anxiety, others to monetary debasement fears. All were partially correct. But the deeper signal was simpler: when systems are being reorganized, when power is being rebalanced, when choke points are being controlled, physical assets that operate outside those systems become valuable.

Greenland just became a pressure point.

Tariff threats, leverage, allies getting cornered…

When politics turns into a hardball, markets don’t “wait and see.”

Money moves fast — into hard assets.

I’m watching one setup right now: the Golden Anomaly. It’s a rare disconnect in gold that could create outsized upside.

See it here (and the 4 picks)

Why Pressure Points Matter More Than Headlines

The distinction is critical. A war is a headline. A pressure point is structural. Wars end. Pressure points reshape capital flows for decades.

A supply chain choke point — control of rare earth elements, for example — is not a headline until one nation cuts off exports. But for years before that moment, it reshapes incentives quietly: investment flows, strategic hoarding, geographic diversification. The financial leverage begins long before the political leverage becomes obvious.

Tariff rhetoric is not a pressure point. Tariff implementation, coupled with evidence that supply chains must be reorganized, is a pressure point. When 82 percent of surveyed companies report that their supply chains are affected by tariffs, when 43 percent plan to shift operations to the United States within three years, when 38 percent plan to reduce Chinese supply chain presence — that is when capital begins to flow toward assets that hedge geographic and policy risk. Gold flows alongside.

Geopolitical pressure points create institutional incentives that outlast political rhetoric. A central bank that has experienced or fears sanctions will not simply go back to the old reserve system. Once gold is reestablished as a settlement asset, as a sanctions-proof reserve, the flow persists.

Gold's Role: Settlement Asset, Not Fear Trade

This is where most narratives misunderstand gold. The retail investor thinks gold is a fear trade — buy it when markets panic. The institutional investor knows gold is a settlement asset — hold it when systems are being reorganized.

Central banks are not buying gold because they expect a stock market crash. They are buying gold because they are repricing the cost of depending on any single nation's currency or financial system. The World Gold Council reported central bank gold purchases of 1,082 tonnes in 2023 and record levels continuing through 2025. These are not panic purchases. They are deliberate, strategic reallocations.

Russia doubled its gold reserves after 2022, not from fear, but from necessity: gold operates outside the SWIFT system, outside the dollar framework, outside the reach of sanctions. China has been accumulating gold for 14 months straight as of January 2026 — not from panic, but from strategic positioning within a reorganizing international monetary system.

Gold's role in a fragmented world is not psychological. It is mechanical. When you cannot trust the settlement system controlled by your potential adversary, you accumulate the one asset that does not require permission.

The Anomaly: When Paper Disagrees With Physical

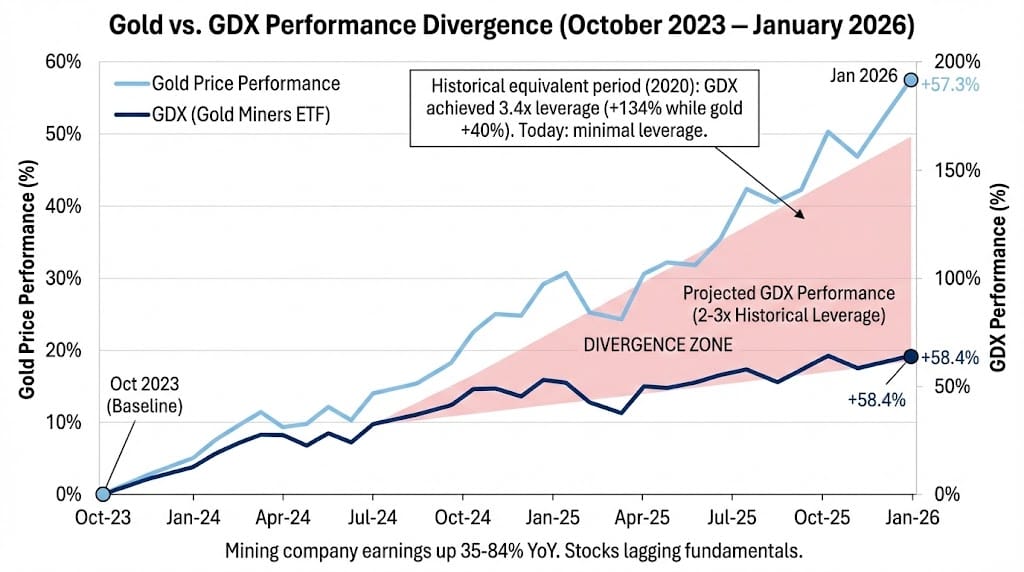

Here is where the signal becomes investable. Gold has risen 57.3 percent over 16 months (October 2023 to January 2026). In historically equivalent periods, gold mining stocks — measured by GDX, the gold miners ETF — should have amplified those gains by 2x to 3x, based on the operating leverage of mining companies.

Instead, GDX rose only 58.4 percent — roughly 1.0x leverage, or no amplification whatsoever. This is not normal. This is an anomaly.

During the last equivalent monster gold upleg in 2020, GDX achieved 3.4x leverage to gold, climbing 134 percent while gold rose 40 percent. Today, gold is at record highs, the mining industry is producing record profits — GDX component companies' implied unit profits rose 42%, 35%, 84%, and 74% year-over-year in four consecutive quarters. Yet the stocks have lagged their fundamental driver by a historic margin.

This is a paper-versus-physical disconnect. Gold futures and spot prices have been repriced upward by institutional capital flows and central bank demand. But mining company equities have not caught up — they trade at valuations divorced from their own earnings growth.

The anomaly explains itself: retail capital has been enthralled by artificial intelligence stocks, ignoring alternative investments. Institutional capital has flowed into physical gold and reserves management. But mining company stocks — which remain partially equity-driven vehicles rather than pure commodity plays — have been starved of capital inflows despite record earnings.

This is the bottleneck. This is where structure and sentiment diverge.

Headline Risk vs. Structural Risk

| Dimension | Headline Risk | Structural Risk |

|---|---|---|

| Catalyst | News cycle, political rhetoric, trade announcements | System reorganization, reserve reallocation, choke point control |

| Timeline | Days to weeks (fades quickly) | Months to years (persists through cycles) |

| Capital Source | Retail flows, momentum traders, sentiment | Central banks, pension funds, strategic allocators |

| Impact on Gold | Temporary spikes or dips | Sustained elevated pricing |

| Underlying Driver | Fear of consequences | Recognition of structural change |

| Example | "Trade war announced" → spike | Central banks shift reserves → sustained flow |

| Reversal Risk | High (headline fades) | Low (system change is sticky) |

| Gold Mining Stocks | React tactically (same as gold) | React with lag due to equity risk premium |

| Detectability | Visible immediately | Requires structural analysis |

The gap between columns is where capital misses opportunity. Headline risk gets priced in immediately. Structural risk is priced in slowly, by the institutions moving first.

Why This Moment Is Missed

Retail investors miss this phase for three reasons. First, the timing is wrong. The central bank accumulation has been underway for 18 months. The diplomatic pressure has been building for years. But the narrative coherence is just now forming. By the time retail investor attention arrives, the "obvious" part of the move is over.

Second, the optics are boring. Central banks accumulating gold reserves does not trend on social media. Gold mining stocks trading at disconnected valuations from their earnings does not generate retail enthusiasm. The story that matters — structural reserve reallocation by the world's largest institutional capital pools — is not a story that moves Reddit. It moves Bloomberg terminals.

Third, the complexity is inaccessible. Understanding that a tariff setup creates a supply chain reorganization that creates a reserve currency crisis that creates demand for settlement assets requires a chain of logic that most investors do not have infrastructure to analyze. Retail has price. Institutions have structure.

This is not a criticism. It is a pattern that repeats every cycle.

Capital Moves Before Narratives Arrive

The final lesson is this: when diplomacy hardens into leverage, when systems are reorganizing, when choke points are being contested, markets reprice before they announce. Capital flows into assets that are not dependent on any single nation's goodwill. Institutions that manage reserves accumulate gold because they no longer trust the existing settlement system to remain permanent.

This is not conjecture. This is documented in World Gold Council data showing central banks adding 1,082 tonnes in 2023 and record levels continuing through 2025. It is documented in China's 14-month buying spree as of January 2026. It is documented in the structural realization — shared by central banks from Moscow to Beijing to New Delhi — that single-nation financial dominance is no longer guaranteed.

The gold mining stock anomaly exists because paper gold has been repriced by institutional flows but equity gold has not caught up — still trading at valuations that ignore the fundamental earnings growth supporting the sector. This gap is not permanent. Mean reversion, historically, follows these disconnects.

Wealth is rarely made by following headlines. It is made by understanding when the underlying system is being reorganized, and positioning accordingly while the disconnect remains visible.

Patience is a strategy. Structure is the edge. And the biggest opportunities are often visible only to those watching anomalies, not emotions.

—

Claire West