When Everyday Bills Don’t Come From Your Bank Account

Last week, I stood at the gas pump watching someone swipe their card to pay, smile, and drive away. It was such a simple scene, but it made me pause: What if our daily bills didn’t always come straight out of our bank accounts? What if there were ways to shift that flow, to ease the squeeze on wallets fighting against inflation?

It’s a curious thought, one that’s becoming more relevant as the relentless rise in everyday expenses forces many to rethink how they manage money.

The Pressure of Everyday Costs

Gas prices, grocery bills, and utility costs—these expenses have been climbing faster than most wages. For a typical household, monthly essentials add up like this:

- Groceries: $600

- Utilities (electric, water, gas): $400

- Fuel for transportation: $200

That’s roughly $1,200 a month, and likely more in many parts of the country.

When recurring bills grow and income doesn’t keep pace, it’s easy to feel trapped. Every paycheck seems swallowed whole, leaving little room for savings or discretionary spending. The stress gnaws not just finances but everyday peace of mind.

A Different Kind of Cash Flow

Amid the headlines of rising costs, I stumbled upon an intriguing story. A Florida man was caught on camera filling his gas tank—not just paying for it, but doing so without touching his bank account on that day.

How?

His groceries, gas, and even dinners out were covered through a clever market strategy that pays him before he spends. Instead of funds leaving his account to pay bills, this approach flips the equation—market-generated income arrives first, helping cover daily expenses seamlessly.

He filled his tank—and didn’t spend a cent from his bank account. With prices for gas, groceries, and utilities soaring, most Americans feel trapped. But this Florida man uses a simple cash-generating move that helps cover his everyday expenses before he even reaches the register.

Watch it happen on camera and see exactly how it works.

If the market could help pay your bills, why pay yourself?

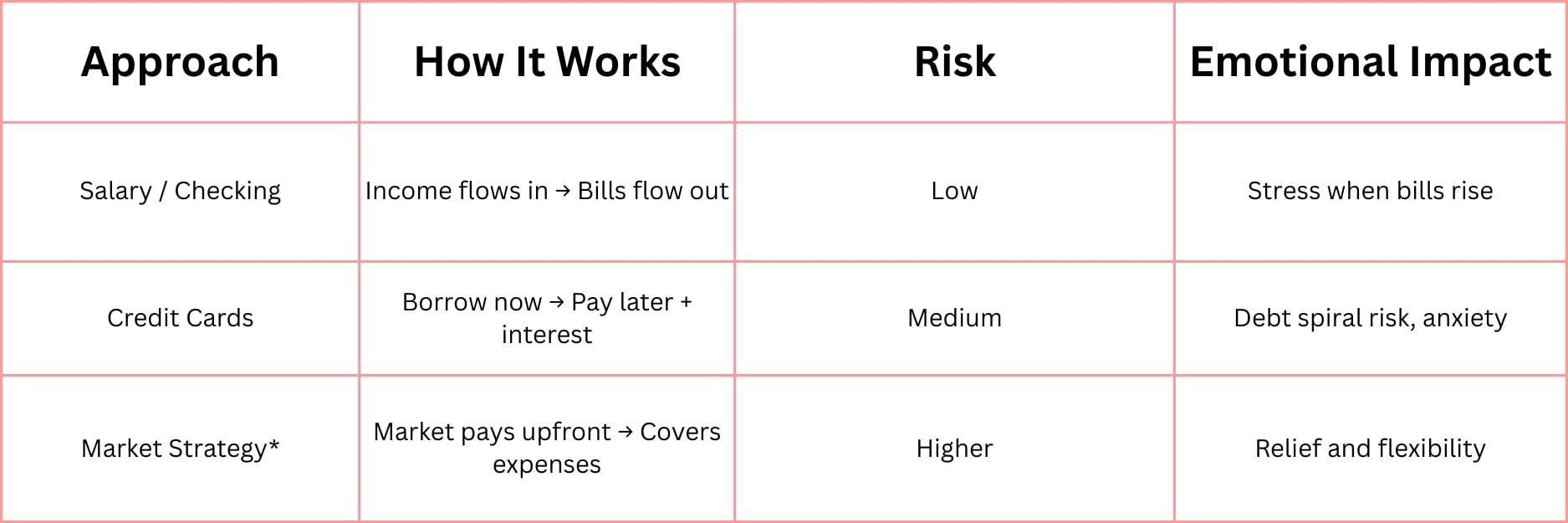

Comparing Traditional vs. Alternative Cash Flows

*Based on the Florida case study and similar approaches.

Why This Resonates

What makes this idea compelling isn’t the promise of “free money." It’s the possibility of flipping the cash flow rhythm, so daily bills don’t feel like traps but become manageable, predictable parts of life.

The psychological benefit alone—knowing your essentials are covered before you even open your bank statement—can change how you relate to money entirely.

How to Begin Thinking Differently

- Know your monthly “survival cost” number. Understand exactly what must be covered to keep daily life smooth.

- Look for ways to align cash flow with those essentials. Whether through side hustles, market strategies, or other income sources, experiment thoughtfully.

- Treat new strategies as experiments. Start small, test the waters without risking your entire budget.

- Track results carefully. Don’t blindly trust promises—data and discipline matter most.

I’m not saying everyone should rush into the latest market tactic—or rely solely on unconventional income methods. What I am saying is this: the way we think about bills and cash flow is overdue for disruption. If there’s a way for markets or strategies to pay part of your life’s expenses before those costs hit your bank account, it deserves a look.

Sometimes, relief isn’t just about earning more—it’s about changing the timing of income and spending.

—

Claire West