When Laws Reshape Money: How Financial Systems Quietly Change Beneath the Surface

Early morning. The house is still, light barely touching the windows. On my desk sits a yellowed newspaper clipping from February 1996—a short article about the Telecommunications Act, buried on page twelve beneath headlines about budget negotiations and overseas diplomacy.

I've kept it for years. Not because it was prescient at the time—it wasn't. The article was dry, procedural, the kind of coverage that makes eyes glaze over. "Congress passes regulatory update." "FCC granted new authority." "Industry groups cautiously optimistic."

Nothing in that clipping suggested that within a decade, the law would help unleash the largest wealth creation event in modern history. That companies like Amazon , Google , and Netflix would emerge from the infrastructure it enabled. That the internet—then a novelty for academics and hobbyists—would become the backbone of the global economy.

Some revolutions don't begin with fireworks. They begin with signatures.

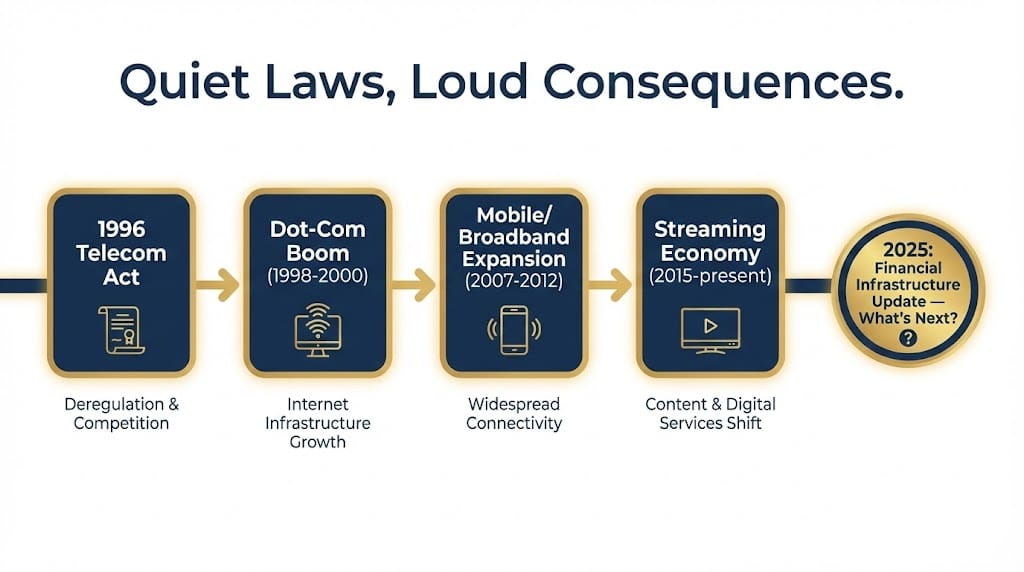

Quiet Laws, Loud Consequences

I've always been fascinated by the way systemic changes hide in plain sight.

The 1996 Telecommunications Act wasn't exciting. It was 128 pages of regulatory language about spectrum allocation, local exchange carriers, and interconnection requirements. The kind of document that gets summarized in a paragraph and forgotten within a news cycle.

But what it actually did was remove friction. It opened bandwidth. It enabled competition. It created the legal framework for private companies to build infrastructure that would carry the internet into every American home.

The consequences weren't visible immediately. For years, the law sat dormant while engineers laid fiber, investors funded startups, and consumers slowly adopted technologies they didn't yet understand. Then, suddenly, the wave arrived—and those who had positioned early captured returns that seemed impossible in retrospect.

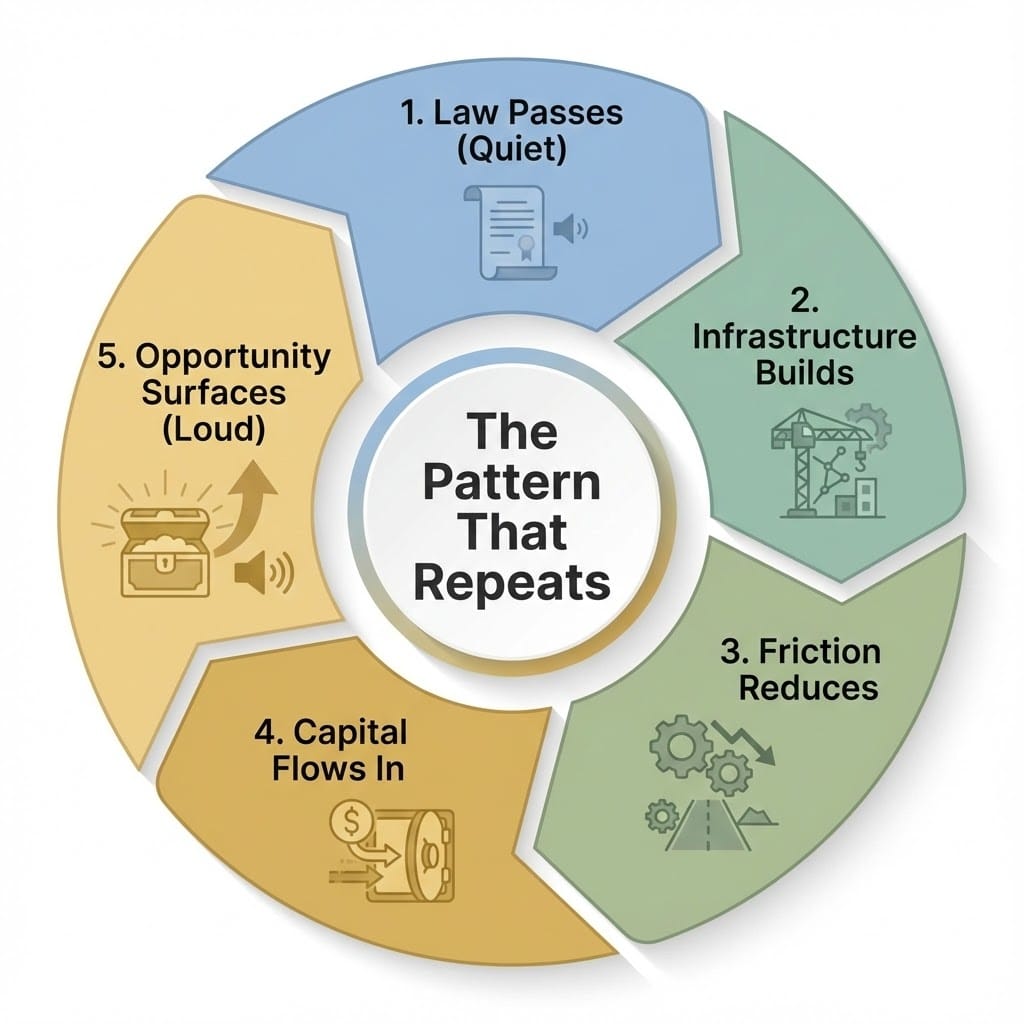

This is the pattern: infrastructure changes quietly, opportunity surfaces later, and most people don't realize the stakes until the wave is already underway.

The dot-com boom. The mobile revolution. The streaming economy. Each traced back to regulatory frameworks that enabled the infrastructure beneath them. Not caused by the laws—but enabled by them. The foundation poured before the building rose.

Why These Laws Matter for Personal Finance

When financial architecture shifts, the effects ripple into every corner of personal finance—even if the connection isn't obvious.

Access changes. Laws that enable new payment rails, new account structures, or new asset classes expand what's available to ordinary investors. What was once institutional becomes retail. What was once complex becomes simplified.

Friction reduces. Settlement times compress. Transaction costs decline. The gap between intention and execution shrinks. Markets that once required brokers and phone calls become accessible from phones during lunch breaks.

Speed accelerates. Information flows faster. Capital moves faster. And the advantage shifts from those with privileged access to those who understand how the new infrastructure operates.

Asset valuation shifts. When infrastructure changes, the companies building or utilizing that infrastructure often reprice—sometimes dramatically, sometimes over years. The winners aren't always obvious at first, but they become visible to those watching structural trends.

Opportunity flow redirects. Capital follows infrastructure. When laws enable new pathways, investment flows toward them—creating asymmetric opportunities for early participants and leaving latecomers to buy at higher valuations.

This isn't abstract. It's how wealth transfers during transitions: from those who don't notice the shift to those who do.

Editor’s Note: Tech legend Jeff Brown is warning that everyone should prepare for what could be the biggest change to our financial system in 54 years. If you have an account with Chase, Bank of America, Citigroup, Wells Fargo,or U.S. Bancorp… Click here to see the details or read more below.

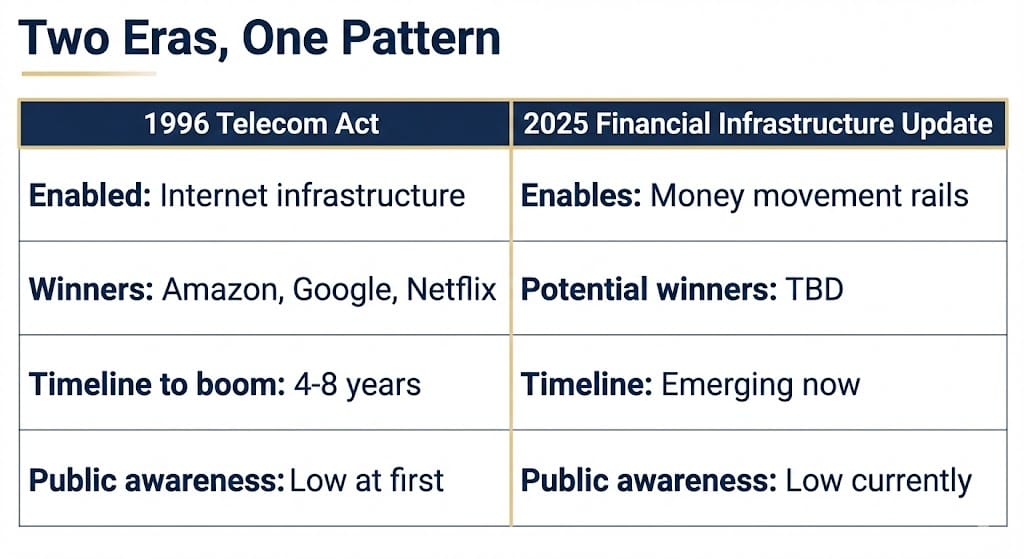

The Wall Street Journal predicted that Trump’s new law S.1582 could…“Unleash a wave of innovation like the one the 1996 Telecommunications Act fostered for the internet.”This is a very big deal because…

That 1996 telecom act essentially set the legal framework for the development of the internet…

Enabling phone and cable companies to offer broadband services.

That greatly accelerated the adoption of the internet…

Triggering a historic melt-up in the small companies that were building the web infrastructure.

For example, in the late 1990s, had you invested just $1,000…

You could have cashed out with more than $155,000 in shares of network testing company, Viavi Solutions…

More than $183,000 in shares of QLogic…

And almost $200,000 in Veritas Software…

All in just a few years.

Just like that telecom law unleashed an internet revolution in the late 1990s…

I believe this new Trump law will unleash a $21 trillion money revolution.

Click here to get the details because President Trump called this… “The greatest revolution in financial technology since the birth of the internet itself.”And if you know what to do…

You could walk away from this revolution with some of the biggest gains you've ever seen.

The Framework Emerging Today

We're in another one of those moments—though it's easy to miss amid the noise of daily headlines.

A new regulatory framework is taking shape. Not a single law, but a constellation of policy updates affecting how money moves, how accounts are structured, how transactions settle, and how financial services connect to emerging technologies. Some call it the first comprehensive update to financial infrastructure in over fifty years.

The details are technical. The language is bureaucratic. And most people will scroll past it the way they scrolled past the Telecom Act in 1996.

But the structure is changing beneath the surface. Settlement rails are being upgraded. Account architectures are being modernized. And the companies positioned at the intersection of old infrastructure and new frameworks may be entering a period of significant revaluation.

Tech analyst Jeff Brown says President Trump's new law, S.1582, could "unleash a $21 trillion money revolution," similar to how the 1996 Telecommunications Act triggered the early internet boom. His full breakdown covers what the law enables—and how everyday Americans could position themselves.

I share this not as prediction, but as context. The pattern is familiar. The infrastructure is shifting. And whether this particular framework delivers on its potential—or becomes another footnote—depends on execution, adoption, and the thousand variables no analyst can fully anticipate.

What matters is awareness: knowing that these moments exist, and that they reward attention.

The Real Takeaway

Here's what I've learned from watching these cycles:

These waves come rarely. Major infrastructure shifts—the kind that reshape entire industries—don't happen every year. They happen once or twice per generation. Recognizing them early is valuable. Recognizing them late is expensive.

You can't time them perfectly, but you can prepare. No one knew in 1996 exactly when the internet would explode, which companies would win, or how long the transition would take. But those who understood that something structural was changing positioned themselves to benefit when clarity emerged.

Individual investors need filters, not predictions. The goal isn't to predict the future. It's to build a framework for recognizing structural shifts, filtering noise from signal, and positioning thoughtfully when the probability of significant change rises.

Structural changes reward those who understand context. The investors who captured the internet boom weren't necessarily the smartest or the fastest. They were the ones who understood that the Telecom Act had changed the rules—and that new rules create new winners.

This is the lens I apply today. Not hype. Not fear. Just pattern recognition and prepared attention.

U.S. banks are preparing for what could be the biggest tech revolution in our financial system in 54 years…

Brownstone Research

I look back at the clipping on my desk. Thirty years old now. The paper fragile, the ink fading. A quiet law that triggered a noisy aftermath.

The reporters who covered it in 1996 couldn't have known what it would become. Neither could the legislators who drafted it, the lobbyists who shaped it, or the executives who lobbied for it. They saw pieces of the puzzle. History assembled the full picture.

We're in a similar moment now. A framework is emerging. Infrastructure is shifting. And somewhere in the technical language and regulatory filings, the seeds of the next structural transition are being planted.

I don't know exactly how it will unfold. No one does. But I know this: awareness precedes preparation, and preparation precedes opportunity.

The goal isn't to chase every new law or framework announcement. It's to maintain enough awareness that when something significant does emerge—when the pattern matches what history has taught us—you're positioned to evaluate it thoughtfully rather than discover it too late.

Quiet laws. Loud consequences. And the steady discipline to watch, prepare, and act with intention.

—

Claire West