When Money Stops Being Able to Move

I remember a quiet evening a few months ago. I sent my son some money for groceries—just a simple, routine transfer through my phone. It took seconds. That ease, that immediate access, felt normal. But then a thought struck me: how fragile is this freedom? What if tomorrow that transfer was blocked or limited? What if the money I have could no longer move freely to those I trust or need?

This simple moment opened my eyes. Our lives are deeply dependent on the ability to move money without friction or permission. Yet, that freedom is increasingly under pressure. What happens when money stops being able to move as easily—or when the costs to move it are too high?

The History of Financial Freedom: Convenience at a Cost

Not long ago, money was always physical—cash in your wallet meant immediate, private control. No one tracked your purchases, and transactions were anonymous. Then came banks and checks, a step toward convenience but still limited to business hours and local access. With the rise of digital payments—credit cards, online transfers, mobile apps—money moves faster than ever before. Almost overnight, convenience reshaped our relationship with cash.

But every step toward convenience has exacted tradeoffs. Hidden fees, limits on transactions, and the loss of privacy have quietly crept in. Every card swipe or digital payment can be tracked, recorded, and analyzed.

Now we stand at a new crossroads: the Federal Reserve’s FedNow system promises instant payments nationwide around the clock. Alongside this, Central Bank Digital Currencies (CBDCs) are no longer distant concepts but pilot programs underway worldwide.

FedNow offers speed, but CBDCs bring an element of control. Unlike cash or cards, a CBDC could allow governments to monitor and potentially restrict how, when, and where money moves. What started as financial freedom is tilting toward financial oversight.

Understanding the Context: Why Governments Want More Control

The United States now carries nearly $37 trillion in national debt. Such immense obligations pressure governments to tighten financial systems, aiming to prevent fraud, tax evasion, and illicit flows. On the surface, these goals seem reasonable. But they come with broader implications.

Digital adoption is overwhelming. Over 90% of Americans use electronic payments regularly. Our dependency on digital money means the government—and tech platforms—can track nearly every cent that moves.

Looking at international examples is instructive. China’s digital yuan piloting has shown how CBDCs can be tools for enforcing limits and surveillance, from restricting spending categories to monitoring individuals’ financial behavior. The European Union’s plans for a digital euro similarly raise privacy concerns, even as they promise efficiency.

The digital dollar rollout isn’t about innovation.

It’s about control.

FedNow is just the beginning.

If you think you’ll be able to move money freely, think again.

They’re laying the groundwork for restrictions on:

How much you can send

What you’re allowed to buy

Where your money goes

But here’s the part they don’t want you to know:

You can legally opt out.

You can shield your retirement.

You can fight back—without penalties or taxes.

Reagan Gold Group just released a powerful FREE guide showing everyday Americans how to take action while they still can.

Click here to get the free guide now

If you have an IRA or 401(k), this affects you.

Don’t wait until they flip the switch.

Don’t give the government total access to your finances.

Protect yourself now—download the guide

This isn’t hype. It’s what’s already happening behind the scenes.

The question is—will you sit back or prepare?

PS: This isn’t about politics. It’s about your future.

Get the facts before the system locks you out.

Click here for the free Wealth Protection Guide

A Simple Way to Understand Financial Freedom

Financial freedom is more than just having money. It depends on your ability to access, use, and control that money without undue interference. We can express this as a straightforward formula:

Financial Freedom=Access−Restrictions−SurveillanceFinancial Freedom=Access−Restrictions−Surveillance

Where:

- Access means anytime, anywhere ability to use funds.

- Restrictions are limits on transactions or amounts.

- Surveillance refers to monitoring or oversight by third parties.

The more restrictions and surveillance you face, the less financial freedom you have.

Comparing Payment Systems

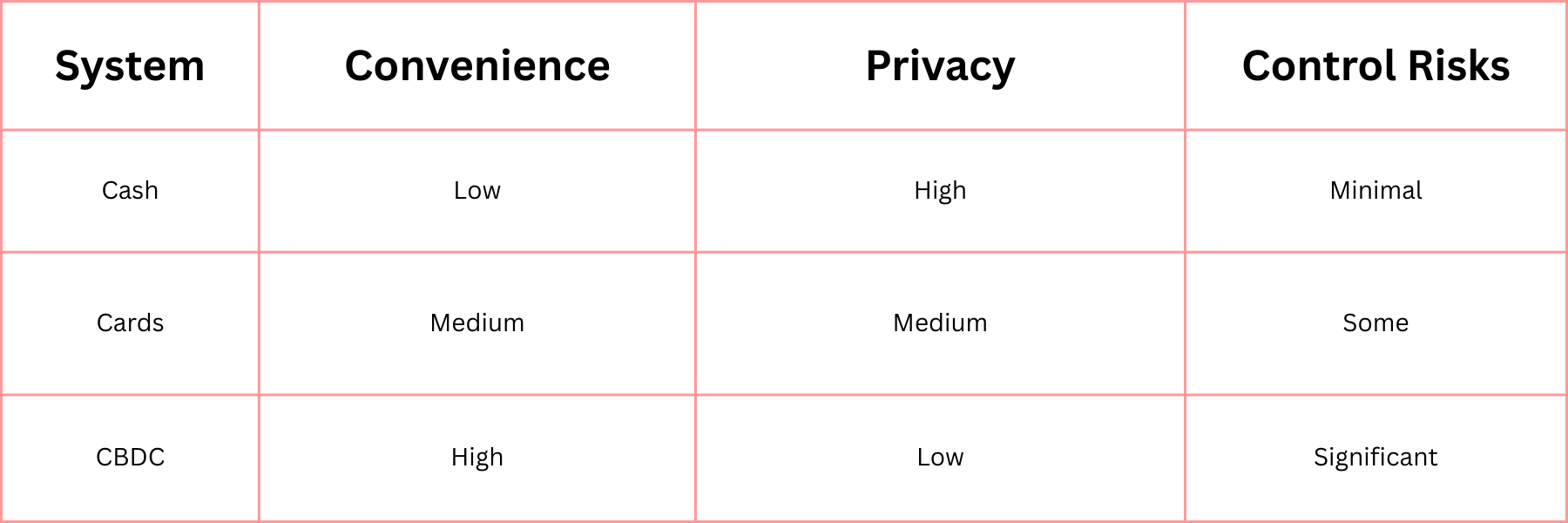

Cash is inconvenient in today’s world but offers privacy and no control risk. Cards strike a balance but lose privacy. CBDCs promise ultimate convenience but raise the greatest risks to privacy and control.

Practical Checklist for Financial Preparedness

- Keep a portion of assets outside the banking system, such as cash or precious metals, to maintain privacy and control.

- Diversify retirement accounts, including options that offer defensive strategies to hedge against market or policy risks.

- Follow Fed and Treasury updates on digital currency development to stay informed about potential impacts.

- Maintain liquid emergency savings you can access freely without restrictions or delays.

- Balance convenience of digital financial tools with the security of alternative payment methods and storage.

- Prepare calmly—fear won’t help, but awareness and thoughtful planning will.

Freedom in Your Hands

Money is meant to enable freedom — freedom to provide for yourself and your family, to plan for the future, and to move when necessary. When movement of money becomes constrained or surveilled, that freedom shrinks.

Instead of reacting with panic, I encourage you to be proactive. Understand the shifts in our financial system, keep part of your assets tangible and independent, and stay informed. The world is changing, yes—but with calm preparation, you can ensure that money remains a tool of empowerment, not a chain of limitation.

Your money should help you live your life, not control it.

—

Claire West