When Taxes Feel Like a Second Rent

I still remember the moment it clicked for me—like a sudden realization creeping up on a quiet afternoon. There I was, looking at my monthly budget, tallying up the rent, utilities, groceries... and then the taxes. It hit me hard: the amount I pay in taxes every year is roughly the same as my rent or mortgage. Not just some small line item, but a weighty, regular expense that eats into the household budget just as much as having a roof over my head. For many families across America, this reality isn’t a rare burden; it’s an ongoing challenge. Taxes can really feel like a second rent. It’s a quiet stress, felt deeply but not often talked about.

The Hidden Weight Beneath Every Paycheck

The U.S. tax system is complex and layered, and for many middle-class households, it can be a source of financial anxiety. Beyond just federal income taxes, there are state and local taxes, payroll taxes, and a web of "hidden" taxes baked into everyday expenses—the sales taxes on groceries and goods, property taxes on homes, and even costs related to healthcare that function like taxes. These elements combine to make it easy for hardworking Americans to feel squeezed, watching their paycheck shrink before their eyes.

It’s not just numbers on a page—there is an emotional impact in witnessing money earned through long hours and sacrifice quietly slip away. That stress compounds, especially for those trying to balance immediate household needs with long-term plans like saving for retirement. Feeling trapped between living costs and tax obligations can lead to a sense of financial vulnerability.

Did you know that most hardworking Americans are overpaying on their taxes? Meanwhile, the wealthy use little-known legal strategies to keep more of their money.

With the Patriot Tax Loophole, you could reduce your tax burden, protect your wealth, and secure a better financial future—all legally and ethically.

Our FREE 2025 Wealth Protection Guide reveals exactly how this works and how you can take advantage before the government closes this loophole.

⚠️ This information won’t be available forever—claim your free copy now!

The Numbers Tell a Stark Story

So, how much are middle-class American families paying in taxes today, in 2025? The numbers reveal a layered story.

According to recent IRS data and analysis from the Tax Policy Center, the average U.S. household sees roughly 25-30% of gross income going to taxes when federal, state, payroll, and other hidden taxes are considered. The effective federal income tax rate for the average taxpayer hovers around 14.5%, but this only captures part of the picture. Adding payroll taxes (Social Security, Medicare) pushes the percentage higher, with states adding sales and property taxes that further chip away at take-home pay.

Hidden taxes have been growing—sales taxes now impact more everyday purchases than ever, and healthcare-related costs that function like a tax have risen sharply due to inflation and policy shifts. These hidden costs disproportionately affect middle-income families who spend a larger share of their incomes on consumption.

Contrast this with wealthier households who, thanks to access to tax planning strategies, can often reduce their effective tax rates significantly through legal means such as tax-exempt investments, estate planning, and leveraging business deductions. This disparity means the middle class often bears a heavier effective tax burden relative to their income compared to the wealthy, who can legally minimize what they owe.

Making the Math Simple

To make the tax burden clearer, here’s a simple way to think about it:

Tax Burden = Gross Income − Net Income (after taxes)

In other words, your tax burden is the portion of your earnings that doesn’t make it to your wallet, covering all the taxes and related costs. The higher this number, the less disposable income you have for daily living and future planning.

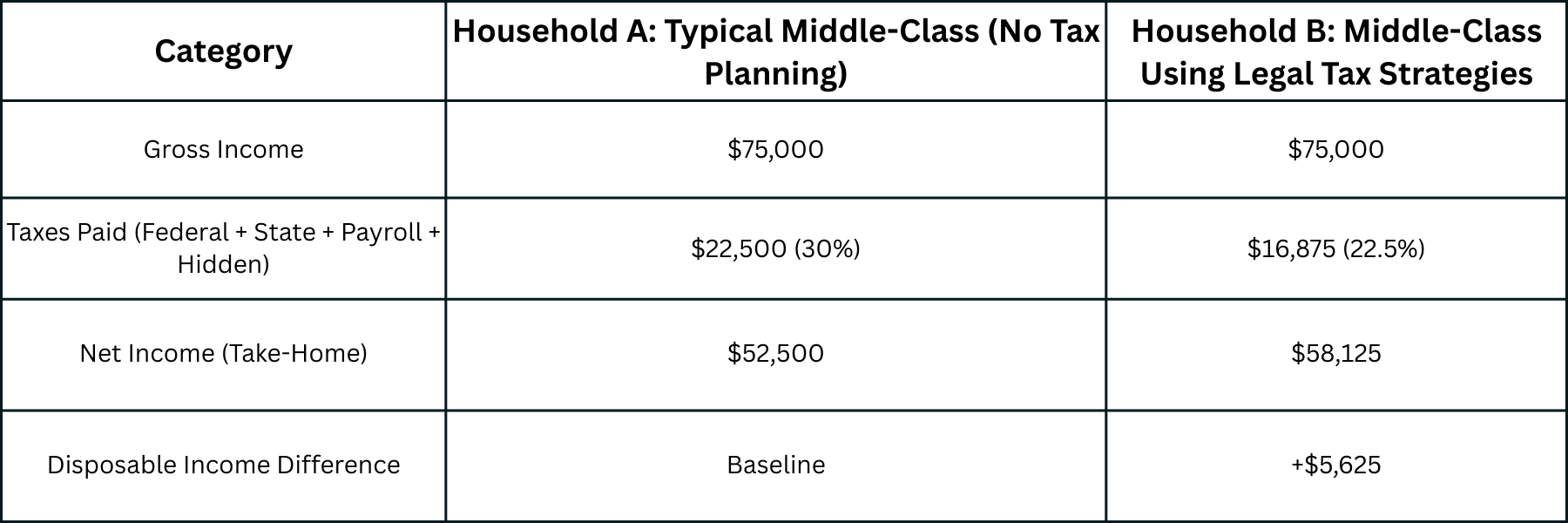

Two Households, Two Outcomes

This illustration shows how strategic tax planning can create meaningful breathing room in take-home pay. Even a few percentage points shaved off a tax burden can translate into several thousands of dollars annually, funds that can instead boost savings or retirements accounts.

Practical Steps to Lighten the Load

- Maximize Retirement Accounts

Contribute to 401(k)s or IRAs to reduce taxable income now and build savings for the future. - Track All Possible Deductions and Credits

Education costs, medical expenses, and charitable donations can lower your taxable income. - Review Your Filing Status Annually

Adjust if your life situation changes—sometimes 'head of household' or filing jointly offers better tax treatment. - Use Health Savings Accounts (HSAs)

If eligible, HSAs offer triple tax benefits: contributions reduce taxes, earnings grow tax-free, and withdrawals for medical expenses are tax-free. - Explore Legal Tax Strategies

Consult with tax professionals about tax credits, deductions, or deferral tactics suited to your situation. - Conduct Annual Tax Reviews

Don’t wait until tax season—review your tax picture yearly and adjust strategies as needed.

Finding Room to Breathe

Taxes will likely never disappear, and they may always feel like a weight on the household budget. But the goal is not to escape them entirely; it’s to create space—breathing room within that tax-heavy reality. This comes through knowledge, preparation, and the thoughtful use of every available tool. Like rent, taxes are regular and unavoidable, but unlike rent, there is potential in your hands to manage and even reduce their impact. By understanding the system and planning accordingly, everyday Americans can protect their budgets and approach retirement with greater confidence and calm.

—

Claire West