When the Grid Goes Down — My Financial & Survival Playbook

The Night Everything Went Dark

It was just past 10 p.m. on a muggy August night when the hum of my neighborhood faded into silence. The ceiling fan slowed, then stopped. My phone, blinking at 22%, became my only flashlight. Minutes stretched as reports trickled in—an unexpected grid outage, affecting thousands. I found myself staring at a darkened ATM, wondering how long this would last and what else might follow.

For hours, every plan depended on the return of a single, invisible system: the electrical grid. But as the night wore on, vulnerability seeped in. Not just in the heat and darkness, but in the sudden limits—no access to my online banking, no working card terminals, no digital safety net.

That night, I realized my real security wasn’t just financial or technical—it was a blend of the two, dependent on how well I’d prepared for moments when digital life staggered to a halt.

Why Energy Security Is Also Financial Security

We rarely think about how tightly our finances rely on running power—until it’s gone. In a grid-down scenario, the domino effect is swift and sobering:

- ATMs go offline. The reassuring glow of a machine offers nothing but an error message. Your digital balances exist, but are suddenly unreachable.

- POS terminals stop accepting cards. Local stores move to “cash only,” if they’re open at all. Swiping or tapping is out of the question.

- Broker accounts and online banking are inaccessible. Can’t move funds, pay bills, or manage investments. Even emergency money feels theoretical, locked behind screens you can’t power up.

- Supply chain chaos can trigger sudden price spikes. With deliveries stalled and shops shuttered, the few essentials left on shelves can double or triple overnight.

These disruptions aren’t just inconvenient—they reveal how fragile our money systems are in a moment of crisis. Preparation isn’t paranoia. It’s a practical expression of self-care and financial stewardship.

The 4-Part Grid-Down Playbook

Over years of tinkering with personal finance and disaster readiness, I’ve built a simple playbook for confidence when systems go dark. Here’s what I focus on—and how you can, too:

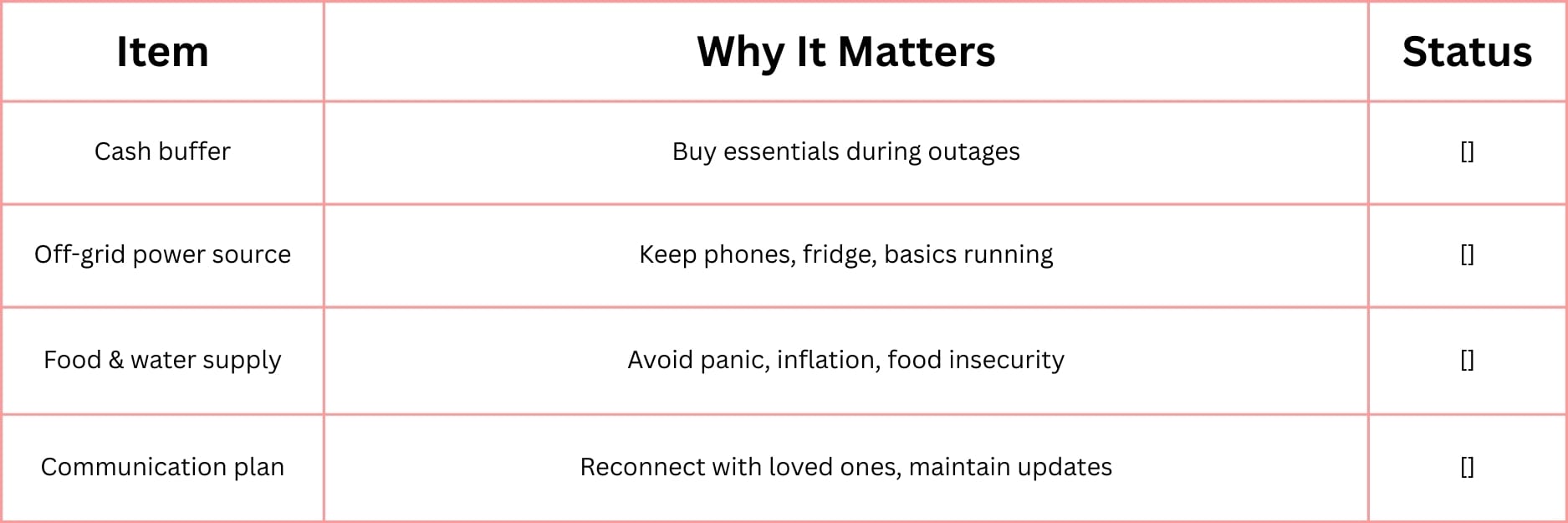

1. Cash Buffer

Keep 2–4 weeks’ worth of living expenses in cash, at home and easily accessible.

Why? When cards and accounts are inaccessible, cash is still king for essential purchases—groceries, gas, medicine—even if prices spike. Store it in a safe, divide it into usable denominations, and rotate bills periodically.

2. Food & Water

Stock 2–4 weeks of shelf-stable food and water for every person in your household.

It isn’t just about comfort—it’s about avoiding panic buying and price gouges. Buy what you actually eat. Rotate supplies with each season. Be mindful: inflation often peaks during crisis windows, making smart stockpiling a quietly savvy financial move.

3. Energy Backup

Invest in a reliable off-grid power source.

Even a few hours of backup can make the difference between safety and discomfort. After years of trial and error, I rely on one tool above all:

Patriot Power Generator 2500X

War’s brewing. The grid is fragile. Are you ready?

The Patriot Power Generator 2500X keeps your lights on when the world goes dark.

✅ Solar-powered

✅ No gas or fumes

✅ Runs indoors

✅ Ships free — while supplies last

4. Communication Plan

Know how to reach loved ones and financial partners—without relying on Wi-Fi or cell service.

- Write down key phone numbers and addresses.

- Keep a charged backup battery or power source for your devices.

- Make sure everyone in your household knows the plan (where to meet, who to call).

Sometimes, a local text or note can solve more problems than an elaborate app.

Embedded Financial Prep Checklist

Here’s the core readiness card I use myself—print it, save it, or copy these for your own dashboard:

Review monthly with your other financial metrics. If a box isn’t checked, make it a priority for the coming month.

Clarity Over Panic

We can’t predict grid failures or global events. Sometimes, control slips willingly from our grasp—politics, weather, and markets all dancing well above our paygrade. But preparedness isn’t about controlling the world—it’s about creating a personal boundary against chaos. What matters most is clarity: knowing you’ve done what you can, and feeling ready to adapt when surprises come.

Being prepared doesn’t mean living in fear—it means walking through each month with a little more control, no matter what flickers or fails outside your front door.

—

Claire West