When Trust Breaks: How Crises Reshape the Way We Protect What Matters

It's a Saturday afternoon. The pharmacy line stretches longer than usual. People clutch prescriptions, glance at their phones, murmur quietly to one another. There's no panic—not yet—but there's something in the air. A low hum of uncertainty. The kind that settles in when trust begins to fray.

I've felt this before. Not the crisis itself, but the moment just before—when official narratives begin to diverge from lived experience, when people start questioning what they're told, and when the instinct to protect becomes more urgent than the instinct to comply.

This isn't about choosing sides. It's about recognizing a pattern: when institutional trust erodes during a crisis, financial behavior changes in ways that ripple for years. And those who prepare quietly—without hysteria, without ideology—are the ones who weather the storm with their security intact.

A Shifting Landscape

Misinformation is a word we hear constantly now. But what does it actually mean when both sides of an argument claim the other is lying? When senators invoke science to support contradictory positions? When the same data generates opposite conclusions depending on who's interpreting it?

The result isn't clarity. It's information paralysis. People freeze, unsure what to believe, unsure whom to trust. And in that paralysis, secondary risks grow—unnoticed, unaddressed, and often more dangerous than the primary threat.

During Covid, the dominant narrative shifted weekly. Masks worked, then didn't, then did again. Treatments were banned, then quietly approved. Mortality rates varied wildly depending on which source you consulted. For most people, the confusion wasn't about the virus itself—it was about who was telling the truth, and why it seemed to keep changing.

That confusion didn't just affect health decisions. It affected financial ones.

What People Felt vs. What We Learned

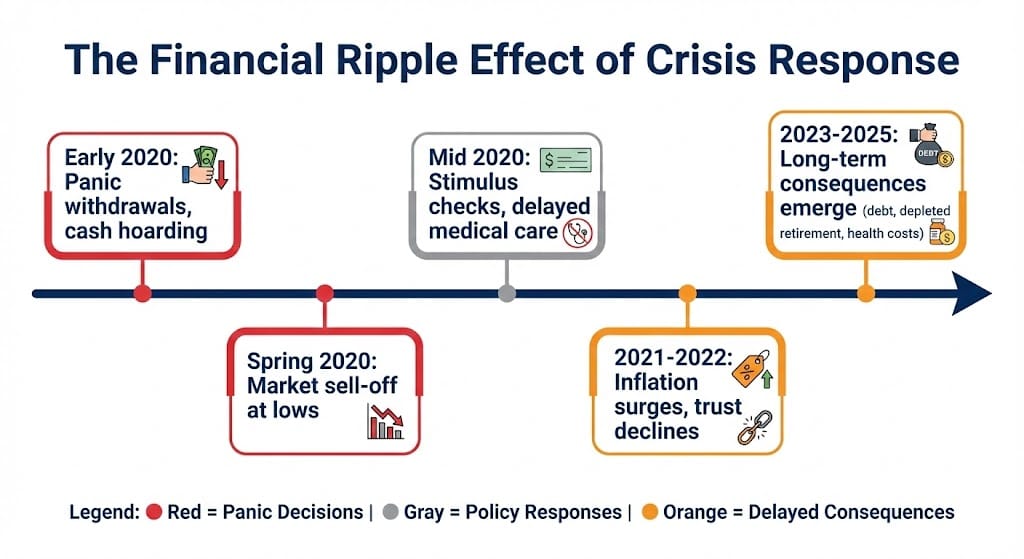

In early 2020, millions of Americans made rapid financial decisions based on incomplete information:

They withdrew cash, fearing bank closures that never came.

They panic-bought assets, fearing supply chain collapse that mostly stabilized.

They delayed medical care, fearing infection, only to face worsened chronic conditions later.

They trusted institutional guidance that later proved incomplete—or wrong.

The financial fallout wasn't immediate. It compounded quietly:

Retirement accounts liquidated at market lows.

Emergency funds depleted on precautions that didn't matter.

Medical bills surged from delayed diagnoses.

Trust in public health institutions—and by extension, government financial guidance—cratered.

What we learned afterward: the crisis wasn't just the virus. It was the erosion of trust in systems people had relied on to tell them the truth. And once that trust breaks, it doesn't return quickly.

In a new message, RFK Jr. warned Americans:

Vaccine Propaganda is EVERYWHERE.

Democratic Senators are even using it to dupe American citizens.

But THIS CONTROVERSIAL NEW VIDEO sheds light on what REALLY happened during Covid and most importantly—

What is happening right now with a terrifying “Second Pandemic.”

One that’s killing 60 TIMES more people a day than Covid.

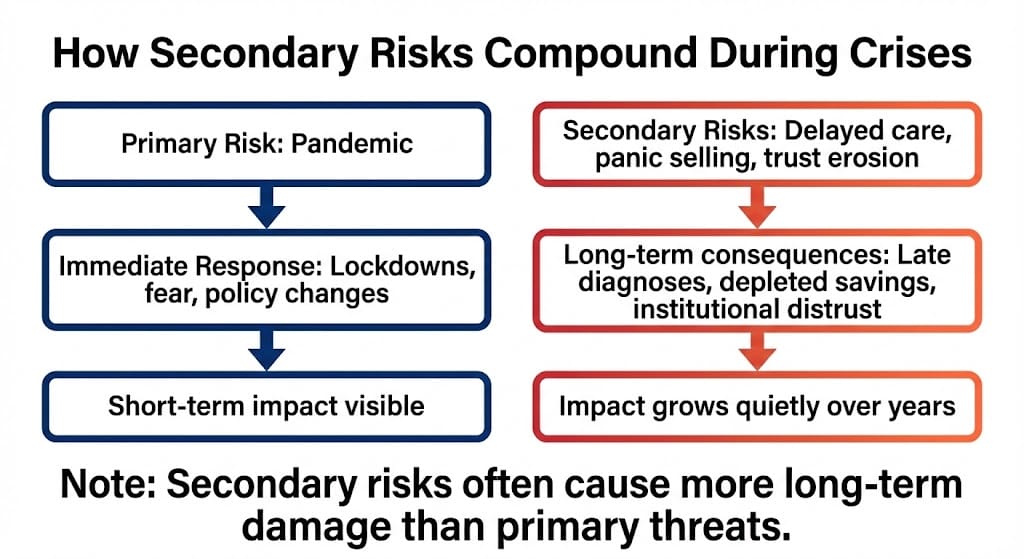

The Concept of Secondary Risks

Primary risk: the obvious threat. A pandemic. A market crash. A policy change.

Secondary risk: the consequences of reacting to the primary risk without full information. The health decisions made in fear. The financial moves made in panic. The trust broken that can't be easily repaired.

Secondary risks grow in the shadows of primary ones. They're harder to measure, harder to predict, and often more damaging in the long term.

Consider:

Health secondary risks: Delayed cancer screenings during lockdowns led to later-stage diagnoses and higher mortality. Heart disease, diabetes, mental health crises—all worsened by prolonged isolation and fear-driven avoidance of care.

Financial secondary risks: Stimulus checks and extended unemployment created short-term relief but long-term inflation. Supply chain disruptions caused by panic buying created scarcity that lasted years. Trust in government financial management declined, driving shifts toward alternative stores of value—gold, crypto, physical assets.

Institutional secondary risks: When people feel lied to—whether they were or not—they stop listening. They seek alternative sources. Some of those sources are better. Many are worse. And the fragmentation of trust creates a landscape where no single narrative holds authority anymore.

Institutional Trust vs. Personal Safety Nets

| Institutional Systems | Personal Safety Nets |

|---|---|

| Rely on government guidance | Diversify information sources |

| Trust official health agencies | Maintain independent medical records |

| Assume banks/markets stay stable | Hold physical cash reserves |

| Expect supply chains to function | Keep essential supplies on hand |

| Believe media narratives | Verify through multiple channels |

| Depend on single employer/income | Build multiple income streams |

| Trust retirement accounts | Diversify into physical assets |

This isn't about paranoia. It's about redundancy. Systems fail. Not always. Not forever. But when they do, those with personal safety nets stay functional while others scramble.

Why People Chase Alternative Sources

When institutional trust breaks, people don't stop seeking truth. They just stop seeking it from institutions.

This is how alternative media explodes during crises. Not because people suddenly become conspiracy theorists, but because they feel gaslit by conflicting official narratives and start looking elsewhere for coherence.

Some find better information. Independent researchers. Data analysts. Doctors speaking off the record. Others find worse—grifters, fearmongers, opportunists who monetize confusion.

The financial implication: trust migration changes behavior. People who lose faith in federal guidance start moving assets into self-custody. They buy gold, hold cash, stockpile essentials. They stop trusting 401(k)s managed by institutions they no longer believe in. They diversify not just for returns, but for autonomy.

This shift—from centralized trust to decentralized verification—is one of the lasting financial consequences of pandemic-era institutional failure.

The Role of Financial Preparedness in Health Crises

Here's the uncomfortable truth: health crises become financial crises for those without reserves.

Medical emergencies drain savings.

Job losses during lockdowns compound quickly.

Inflation erodes fixed incomes.

And those who entered the crisis with no buffer left it with debt, depleted retirement accounts, and years of recovery ahead.

Financial preparedness isn't just about wealth—it's about time and options. Time to evaluate information before making reactive decisions. Options to seek second opinions, delay treatments, or pivot income sources when systems fail.

Those who had cash reserves didn't panic-sell portfolios at the bottom. Those who had diversified income didn't depend solely on unemployment benefits. Those who held physical assets didn't watch their purchasing power evaporate overnight.

Preparedness isn't pessimism. It's the difference between reacting and responding.

Who We're Really Protecting

I think often about the conversations I had during Covid—not with analysts or policymakers, but with regular people. Parents worried about their kids' education. Retirees watching their fixed incomes shrink. Small business owners deciding whether to stay open or comply with mandates that would bankrupt them.

No one was thinking in partisan terms. They were thinking in protection terms. Who depends on me? What happens if I can't work? How do I keep my family safe without bankrupting us?

That instinct—to protect what matters—is neither liberal nor conservative. It's human. And it's the reason financial preparedness resonates so deeply during crises: because money isn't the goal. Security is.

A Warning Worth Considering

There are voices raising concerns about what comes next. RFK Jr. warns that vaccine propaganda remains pervasive, that senators continue using it for political leverage, and that a controversial video reveals what really happened during Covid—while detailing a "second pandemic" killing 60× more people per day. Full details are available in the video linked.

I don't offer this as endorsement or dismissal. I offer it as signal: when prominent figures raise alarms, whether proven right or wrong later, their warnings shift behavior. People prepare. Capital moves. And those who dismissed the concerns entirely often find themselves unprepared when secondary risks materialize.

The question isn't whether the warning is right. It's whether you've built enough redundancy into your financial and health systems to weather uncertainty regardless of who's proven correct.

Crises reveal fragility. Not just in systems, but in our own assumptions about what's stable and what's not.

The lesson from pandemic-era chaos isn't to distrust everything—it's to trust selectively, verify independently, and build buffers that don't depend on institutions functioning perfectly.

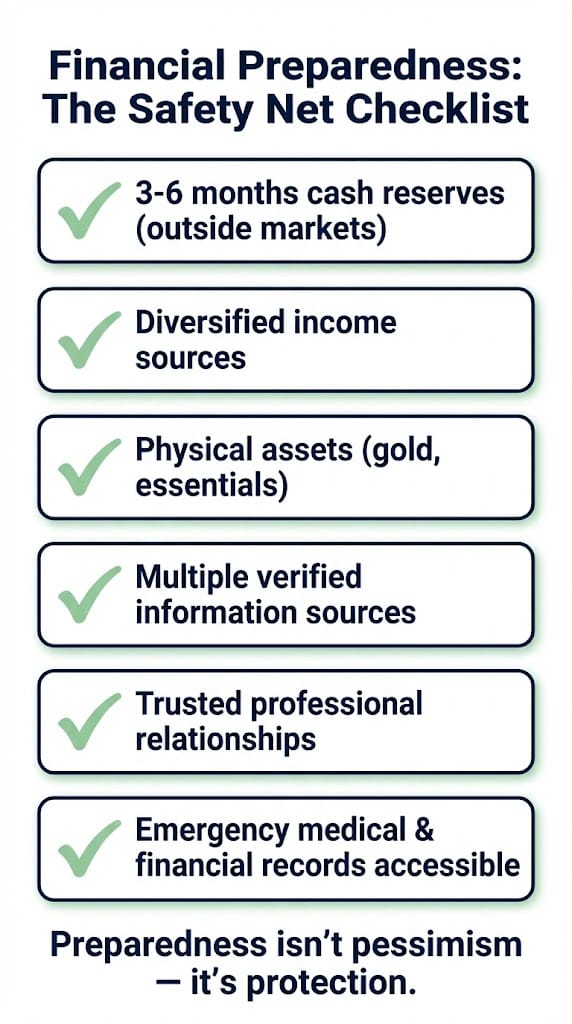

Actionable steps aren't dramatic:

Hold 3-6 months of expenses in cash—outside of markets, outside of digital systems.

Diversify income sources so no single disruption collapses your financial life.

Maintain physical assets—gold, essentials, supplies—that hold value when trust in paper systems wavers.

Verify health information through multiple sources before making irreversible decisions.

Build relationships with professionals you trust personally, not just institutionally.

This isn't about preparing for apocalypse. It's about preparing for the inevitable moments when systems don't work as promised—and ensuring that when trust breaks, your security doesn't.

The pharmacy line still stretches. People still wait. But those who prepared aren't scrambling. They're steady. And that steadiness—more than wealth, more than certainty—is what carries you through the moments when everything else feels unsteady.

—

Claire West